About Jenna Muscarella

Jenna Muscarella, CFP®

Financial Advisor

NMLS # 2373421

Jenna Muscarella is a Financial Advisor and Certified Financial Planner at Morgan Stanley. She holds her Series 7,66 and Life and Health Insurance Licenses.

She’s been working in the financial field for over 6 years. Prior to joining Morgan Stanley in 2022, Jenna was an advisor at AXA/Equitable Advisors. There, she specialized in working with educators, helping them plan for retirement and various other needs such as asset management and insurance.

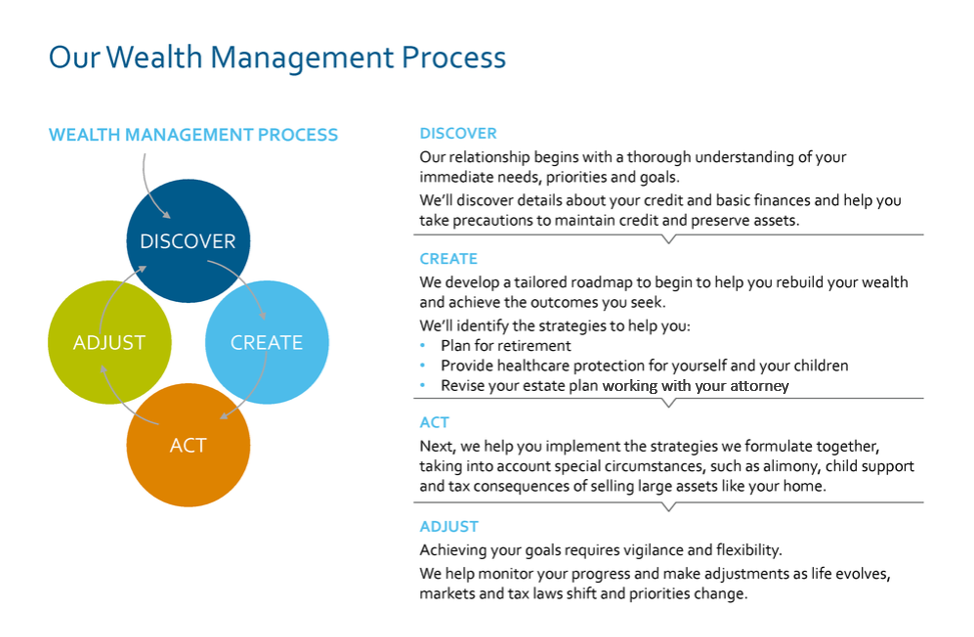

Jenna and her team, BGS Group, have extensive experience working with entertainers, professional athletes, business owners, high net worth families and individuals. She takes a holistic planning approach, first taking the time to understand her clients, what their future goals are such as, a comfortable retirement, sending their children to school, or buying a vacation home. Then, she creates a plan and puts together the proper investment portfolio to get them to their future goals from where they are today.

Jenna graduated with honors from Quinnipiac University where she graduated early to receive both her Bachelor’s Degree in Finance and Master’s in Business Administration in 4 years. She grew up in Garden City and currently lives in Massapequa. She enjoys watching professional sports, traveling, cooking, and making people laugh.

Securities Agent: MN, MA, OH, PR, NJ, VI, WV, DC, IN, WY, WI, WA, VT, VA, UT, TX, TN, SD, SC, RI, PA, OR, OK, NY, NV, NM, NH, NE, ND, NC, MT, MS, MO, MI, ME, MD, LA, KY, KS, IL, ID, IA, HI, GA, FL, DE, CT, CO, CA, AZ, AR, AL, AK; General Securities Representative; Investment Advisor Representative

NMLS#: 2373421

Industry Award Winner

Industry Award Winner