About James Cotto

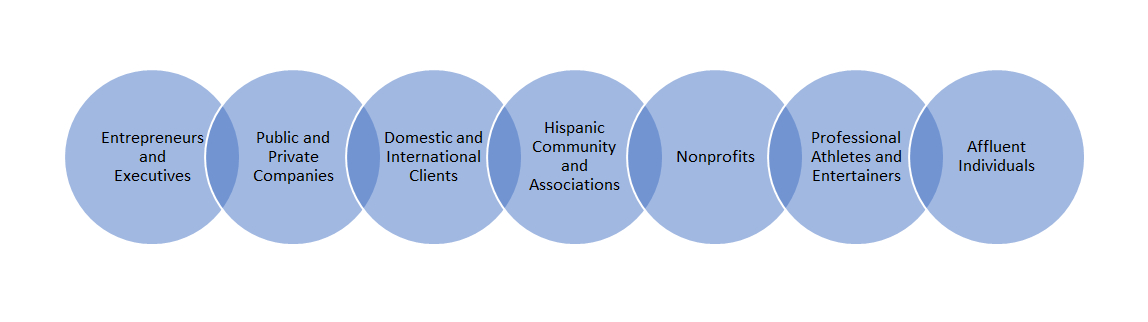

James Cotto is a Managing Director – Wealth Management, Wealth Advisor at The Cotto Wealth Management Group at Morgan Stanley Global Headquarters in Purchase, New York. He built his practice by providing entrepreneurs and other clients with the guidance they need to pursue financial independence for themselves and financial sustainability for the philanthropic organizations most important to them. James’ growing, diverse team of next gen Latinos and women collaboratively work together to serve clients of unique segments such as high-net-worth individuals, families, business owners, professional athletes and entertainers, special purpose acquisition companies, endowments, foundations, and more.

James began his career in the financial services industry in 1988 and joined Morgan Stanley in 2009. Throughout his time at Morgan Stanley, James received various designations and titles, including Family Wealth Director, Global Sports and Entertainment Director, Corporate Client Director, Portfolio Management Director, International Client Advisor, Workplace Advisor - Equity Compensation, and Lending Specialist – these are a direct reflection of his knowledge and offerings to better serve clients with a suite of tailor-made solutions. His mission is to help clients design, scale, and deliver on their business and personal goals while giving back to their community.

James has developed a global understanding and approach to assisting his domestic and international clientele in navigating the financial markets by offering key insights to achieve financial success. He provides a comprehensive approach to reviewing his client’s current finances, future objectives, and potential barriers to develop a holistic plan that encompasses every aspect of one financial well-being, including investment and lending strategies, estate planning, philanthropy management, and more.

James’ clients value his honest and integrity-based approach. At the Cotto Wealth Management Group, he and his team pridefully take a thoughtful approach in all manners concerning their clients and educating them on their financial journey. He built his practice based on long-standing relationships and kind referrals, which indicates his clients’ appreciation of his unique skill set, global perspective, and overall experience.

James is recognized for his commitment to various causes, whether it’s helping clients achieve their purposeful endeavors or being on the ground giving back to his community directly. He is a distinguished member of the Advisory Council for Maestro Cares Foundation, Corporate Board of Governors (CBOG), Member for The National Association of Hispanic Real Estate Professionals (NAHREP), Hispanic Association on Corporate Responsibility (HACR), The Latino U Scholars Program, The Hispanic Scholarship Fund (HSF), The Hispanic National Bar Association (HNBA), Latino Donor Collaborative (LDC), The Gilbert and Jacki Cisneros Foundation, and more.

James received his bachelor’s degree from Rutgers University in New Brunswick, NJ, and resides in Cross River, New York. He enjoys spending quality time with his family in Nantucket, MA, with his three adult children, Carol, Ray, and Lucy, and his three dogs.

Securities Agent: RI, NY, NE, DE, AK, OR, MN, MD, ID, CA, WV, PR, NH, MT, IN, CO, AR, NJ, IA, VT, SD, PA, NV, FL, AL, HI, WA, TN, OH, MS, MI, LA, KS, IL, AZ, VI, VA, SC, CT, TX, ND, ME, MA, DC, OK, NC, MO, WY, WI, UT, NM, KY, GA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 74944