About Daniel Morilak

Daniel Morilak

Senior Vice President, Financial Advisor

Family Wealth Director

Executive Financial Services Director

Work Place Advisor - Equity Compensation

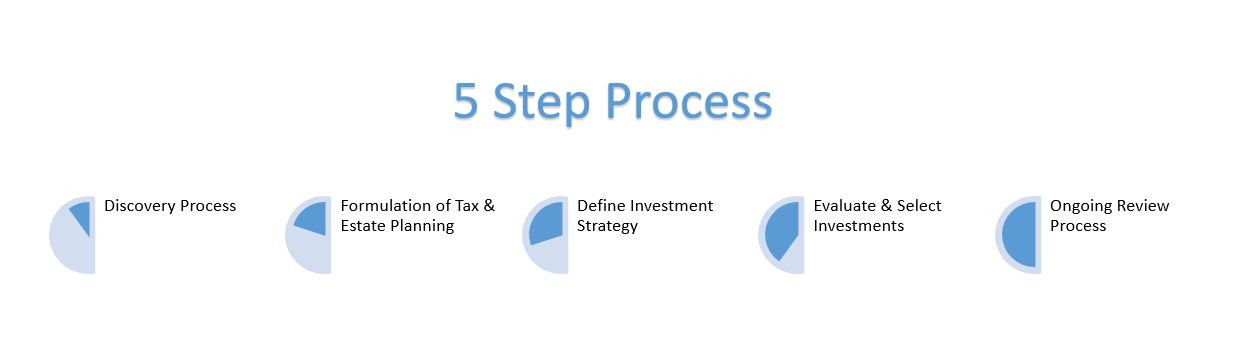

Daniel is a co-founder and member of The Pangaea Group at Morgan Stanley in Rancho Santa Fe, CA. The Pangaea Group is a Wealth Management and Advisory business focused on helping individuals and families achieve their financial goals through all market environments. This focus is achieved through a diligent wealth planning process and persistent implementation of the aspects of the plan which includes investment management, debt management, estate planning strategies, tax management strategies, insurance solutions, business planning and more.

Dan has enjoyed a career in financial services since 2001 and holds the Family Wealth Director designation, successfully completing a specialized, high-end professional development program, positioning himself as an alternative to a family office. His clients are entitled to a full suite of financial planning and investment services as well as access to a full breadth of family advisory-services-such as philanthropy, business monetization and succession planning, aggregated reporting and family governance & dynamics—all of which are tailored to meet their unique wealth management needs.

Daniel has also been quoted in articles in industry trade journals including Investment News, Bank Investment Consultant, and On Wall Street. He earned his Bachelors of Science Degree in Physics from Case Western Reserve University in Cleveland, OH and his Master of Science Degree in Industrial Engineering from Cleveland State University in Cleveland, OH. Dan resides in Scottsdale, AZ with his wife, Fran, and two children, Jessica and Jacob. He is active in his community, serving on the board of the non-profit organizations of The Magdalena Ecke YMCA in Encinitas.

He holds Series 7, 66 and 31 securities registrations, State of California Insurance license #0E19100, Family Wealth Director and CFM designations.

The Pangaea Group and Daniel Morilak are most effective when serving clients who have the need for complex financial solutions or whose net worth requires they are availed to a team with the experience to solve tax management, estate transfer, business succession or other unique financial situations. Through proper asset allocation, investment management, debt management, and wealth protection strategies the Pangaea Group works with our clients and their other trusted advisors (CPA, Attorney, etc.) to help ensure that most appropriate structures and strategies are in place and working towards their goals.

The Pangaea Group wealth planning includes investments, cash flow, stock options, restricted stock, life insurance, other pertinent insurance, real assets, liabilities.

Through Morgan Stanley our clients can also get access to corporate retirement plan services, corporate cash management, 10b(5)-1 plan establishment, and Endowment and Foundation management services.

The Pangaea Group is established in Rancho Santa Fe as a Family Wealth Office for Morgan Stanley providing a family office experience to their clients with the access and capabilities of the world's largest Broker Dealer.

Securities Agent: VA, DC, WI, PR, NV, IL, CA, CO, HI, AZ, TX, SC, ID, WY, OH, CT, NC, MI, LA, KY, WA, UT, TN, OK, NY, MA, PA, OR, MD, GA, MO, FL; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1265121

CA Insurance License #: 0E19100