The Cornerstone Capital Group at Morgan Stanley

Our Mission Statement

Partnering with clients to provide objective, high quality advice and services to simplify their life and provide peace of mind.

Welcome

The Cornerstone Capital Group has an extensive financial team working across the country, servicing clients in over 40 states. For us, wealth planning means more than providing our clients with investment advice – it means helping them maintain the financial independence that they have worked their whole lives to achieve. Our team strives to ensure that our clients have the means to pursue what is most important to them. We do this by understanding them as people with unique goals, values, and circumstances, which ultimately determine the strategies that we develop on their behalf. In times of transition, our team of trusted professionals provides advice that can help our clients make sound investment decisions that will help them reach their financial goals.

Our consultative process begins with an in-depth discussion of your current finances and future objectives. We will address some issues that you might have overlooked that could have a significant impact on your ability to accomplish your goals and retire as planned. Finally, we will determine how we can help you adjust your investment strategy as necessary to accommodate changing economic and personal conditions that may arise during retirement.

Our consultative process begins with an in-depth discussion of your current finances and future objectives. We will address some issues that you might have overlooked that could have a significant impact on your ability to accomplish your goals and retire as planned. Finally, we will determine how we can help you adjust your investment strategy as necessary to accommodate changing economic and personal conditions that may arise during retirement.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

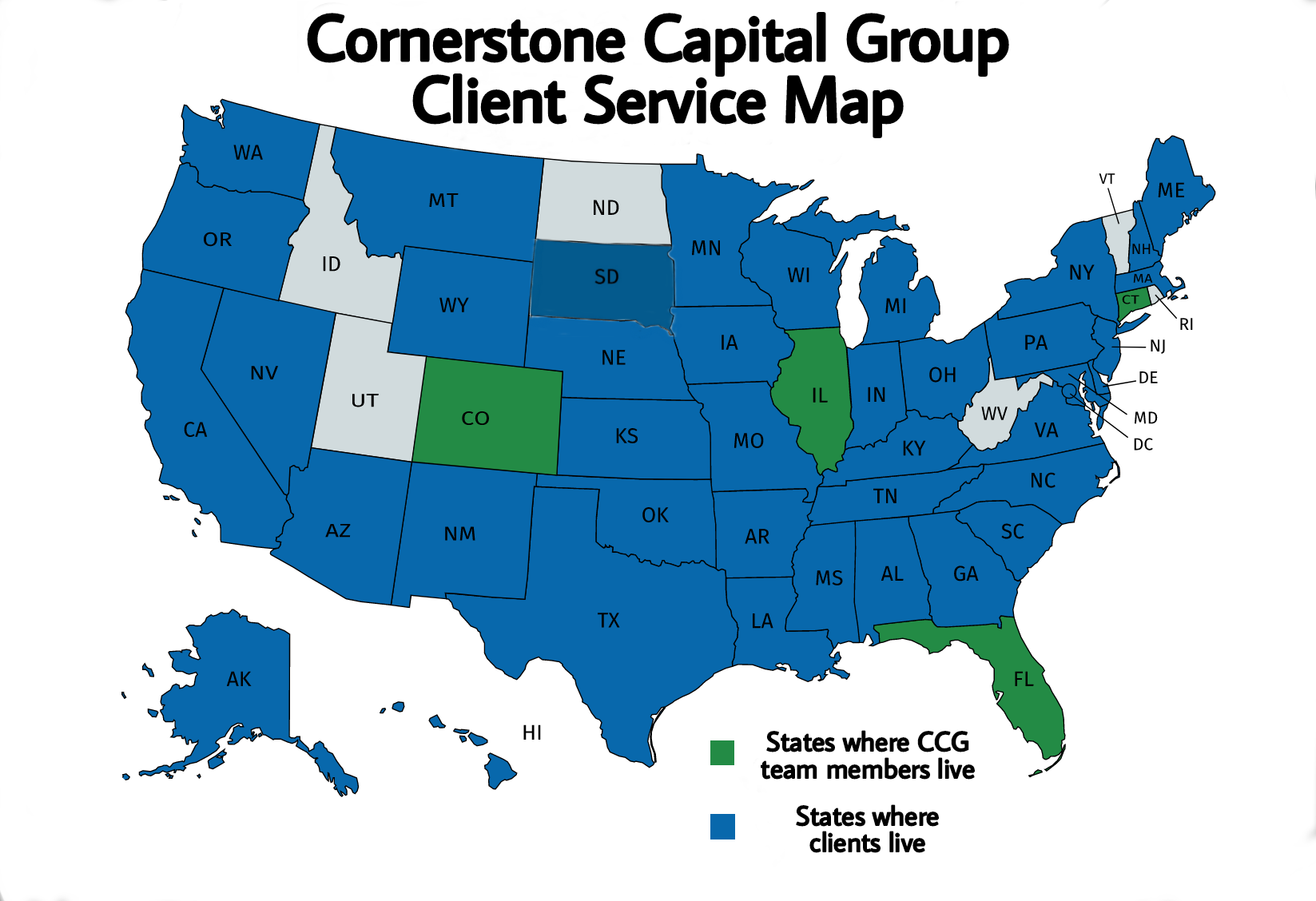

We serve clients across the U.S.

We know that everyone today is on the move, and we aim to serve you wherever you live within the U.S, using all of the virtual and digital tools that Morgan Stanley has to offer. Our financial advisors currently live or spend time living in four different states, and our clients live in over 40 states. If you are looking for a financial advisor relationship with a personal touch and state-of-the-art digital experience, we are here to help.

Our geographic diversity stretches from coast to coast, so whether you find yourself in the Rust Belt, the Sun Belt, or anywhere in between, the Cornerstone Capital Group is eager to help you manage your financial portfolio and make sound investment decisions.

Our geographic diversity stretches from coast to coast, so whether you find yourself in the Rust Belt, the Sun Belt, or anywhere in between, the Cornerstone Capital Group is eager to help you manage your financial portfolio and make sound investment decisions.

Location

211 Fulton Street

Suite 500A

Peoria, IL 61401

US

Direct:

(800) 527-3579(800) 527-3579

2 North Tamiami Trail

Sarasota, FL 34236

US

Meet The Cornerstone Capital Group

About Carolyn Kroupa Weaver

Carolyn Weaver has spent 20 years as a Financial Advisor at Morgan Stanley, helping clients navigate complex financial decisions and develop clear, adaptable roadmaps for their financial futures. She brings a thoughtful, client-centered approach to her work, guiding individuals and families through evolving circumstances with clarity and confidence. In addition to holding a full spectrum of financial licenses, Carolyn is a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional and a member of the firm’s Master’s Club.

Carolyn resides in Evergreen, Colorado, and is a native of Peoria, Illinois, where she has remained deeply connected to the community. An avid runner, she has participated in numerous intercity and interstate fundraising runs supporting St. Jude Children’s Research Hospital. Carolyn has also served on the Board of Directors for the Heart of Illinois Big Brothers Big Sisters and continues to give back through volunteer work with the Peoria Public School System, Junior Achievement of Central Illinois, the Salvation Army, and the Heart of Illinois United Way’s Tocqueville Society.

Carolyn resides in Evergreen, Colorado, and is a native of Peoria, Illinois, where she has remained deeply connected to the community. An avid runner, she has participated in numerous intercity and interstate fundraising runs supporting St. Jude Children’s Research Hospital. Carolyn has also served on the Board of Directors for the Heart of Illinois Big Brothers Big Sisters and continues to give back through volunteer work with the Peoria Public School System, Junior Achievement of Central Illinois, the Salvation Army, and the Heart of Illinois United Way’s Tocqueville Society.

Securities Agent: PA, MO, LA, CO, SD, NJ, TX, SC, RI, OH, NH, MN, MA, IA, GA, DE, DC, CT, AL, OR, NY, MS, IN, WI, VA, UT, OK, ME, MD, AZ, NV, MT, KY, HI, TN, NM, NC, MI, AR, AK, WA, KS, IL, FL, CA; General Securities Representative; Investment Advisor Representative; Managed Futures

About Eric Schlipf

Eric Schlipf, a Financial Advisor located in Central Illinois, has been in the financial services industry since 2000. Eric started his journey at the University of Illinois, Champaign-Urbana where he completed a Bachelor of Science in Finance with high honors. He then earned his MBA, also with honors, from the prestigious University of Chicago. Eric is a Certified Financial Planner™ as well as a Chartered Financial Analyst (CFA®), both of which require rigorous coursework and testing in investment knowledge, analytics, long term financial planning including estate and retirement planning, ethical and professional standards.

Eric grew up working on his family farm, learning the value of hard work. Eric started his financial career at State Farm Insurance as a member of a 13-person investment team managing over $50 billion. After State Farm, he took his talents to a regional investment banking firm as an Equity Research Analyst, where he spent his days advising a multitude of global institutional clients.

In 2007, Eric brought his talents to Morgan Stanley to realize his ultimate goal and become a Financial Advisor. He now uses his passion for finance to help individual and institutional investors. With his breadth of knowledge and deep understanding of complex investors, investments, finance and planning, Eric has been providing elite client service for almost two decades now.

Eric resides in Bloomington-Normal with his wife, Chris, and their two children, Blake and Layne. He enjoys coaching baseball, scuba diving, golfing, and spending time on the family farm. He is active in his church and with his children’s schools.

Eric grew up working on his family farm, learning the value of hard work. Eric started his financial career at State Farm Insurance as a member of a 13-person investment team managing over $50 billion. After State Farm, he took his talents to a regional investment banking firm as an Equity Research Analyst, where he spent his days advising a multitude of global institutional clients.

In 2007, Eric brought his talents to Morgan Stanley to realize his ultimate goal and become a Financial Advisor. He now uses his passion for finance to help individual and institutional investors. With his breadth of knowledge and deep understanding of complex investors, investments, finance and planning, Eric has been providing elite client service for almost two decades now.

Eric resides in Bloomington-Normal with his wife, Chris, and their two children, Blake and Layne. He enjoys coaching baseball, scuba diving, golfing, and spending time on the family farm. He is active in his church and with his children’s schools.

Securities Agent: FL, AK, MN, AL, TN, PA, NH, MT, AR, WY, VT, VA, IL, WA, MS, IA, DC, TX, SC, NV, MI, DE, CT, CA, WI, KS, CO, GA, RI, OR, OH, ME, IN, UT, OK, NJ, NC, MO, AZ, KY, HI, SD, NY, NM, LA, MD, MA; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1268416

NMLS#: 1268416

About Tom Bardwell

Tom Bardwell has been in the financial services industry since 1999, serving affluent individuals, families, and institutional clients. He began his career at Van Kampen Investments, where he was able to develop a deep understanding of portfolio management and asset allocation strategies. Before joining the Cornerstone Capital Group, Tom served as the Manager of the Central Illinois Complex for Morgan Stanley from late 2005 until 2008.* Tom joined the Cornerstone Capital Group at Morgan Stanley in 2008 to work with both individuals and institutions, where he utilized his background to help optimize investment portfolios and implement appropriate planning strategies for clients. Tom was also involved in a variety of community organizations while living in Central Illinois and served in numerous leadership roles, in which he was a member of the Board of Directors for the Peoria Riverfront Museum Foundation, a member of the Campaign Cabinet for the Heart of Illinois United Way Drive, and a Board Member for the Central Illinois Estate Planning Council.

In 2014, Tom and his family moved to Sarasota, Florida, to start a new office for the Cornerstone Capital Group. He still lives here today, and continues to serve clients all over the country. Tom and his wife, Courtney, have four children. In Sarasota, Tom is member of Bayside Community Church, and enjoys local outreach events to help the community.

In 2014, Tom and his family moved to Sarasota, Florida, to start a new office for the Cornerstone Capital Group. He still lives here today, and continues to serve clients all over the country. Tom and his wife, Courtney, have four children. In Sarasota, Tom is member of Bayside Community Church, and enjoys local outreach events to help the community.

Securities Agent: OR, MT, UT, TX, SC, NH, ME, KS, AK, NC, MN, LA, GA, WY, RI, NY, NE, MO, HI, CA, PA, KY, IN, IA, CT, CO, AR, OK, NM, MA, DE, DC, WA, NJ, IL, AL, WI, VA, TN, OH, MS, MI, MD, FL, SD, NV, AZ; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1272770

NMLS#: 1272770

About T. Michael Osterman

Michael Osterman brings over 30 years of Wealth Management experience to every client he advises.

As a Senior Vice President and Financial Planning Specialist, Michael was based in Chicago for 22 years before he relocated to Sarasota in 2015.

Michael’s primary responsibilities include client relationships, investment strategies, liability management and coordinating with accountants and estate attorneys to help secure client’s financial goals.

He holds a Bachelor of Science in Finance from Arizona State University, and is actively involved with various organizations, including Easter Seals and SPARCC.

Michael lives with his wife Charlotte, his son Oliver and their dog Piper. He enjoys most sports, especially skiing and surfing. He is also an active traveler and avid reader.

As a Senior Vice President and Financial Planning Specialist, Michael was based in Chicago for 22 years before he relocated to Sarasota in 2015.

Michael’s primary responsibilities include client relationships, investment strategies, liability management and coordinating with accountants and estate attorneys to help secure client’s financial goals.

He holds a Bachelor of Science in Finance from Arizona State University, and is actively involved with various organizations, including Easter Seals and SPARCC.

Michael lives with his wife Charlotte, his son Oliver and their dog Piper. He enjoys most sports, especially skiing and surfing. He is also an active traveler and avid reader.

Securities Agent: CT, OH, MA, IA, WA, VA, NM, IN, WY, RI, OK, MT, GA, FL, AK, OR, LA, HI, DE, TX, TN, AZ, NY, NJ, MO, KS, CO, SD, NC, MS, IL, PA, MN, CA, AL, VT, UT, NV, MI, MD, KY, DC, AR, WI, SC, NH, ME; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1270077

CA Insurance License #: 0D94200

NMLS#: 1270077

CA Insurance License #: 0D94200

About Susan Wilson

As an Executive Director and Financial Advisor, Susan Wilson has been helping clients build generational wealth for over four decades. She and her partners, Financial Advisors Tom Bardwell and Mike Osterman, manage the Sarasota branch of Cornerstone Capital Group at Morgan Stanley.

“Our wealth management team of six is recognized as a 2025 Forbes Best-In-State Wealth Management Team,” says Susan, who was also recognized by Forbes as one of the Top Women Wealth Advisors from 2020 through 2025, as well as a Best in State Wealth Advisor for 2022, 2023, 2024, and 2025. “It is a great honor to be surrounded by a great team of professionals who put clients first.”

Complementing a long-held career in finance, Susan and her husband, Charlie, are very involved with local organizations where they are both active supporters of the local performing arts scene and notable nonprofits in Sarasota.

One of their main focuses includes youth education at The Sarasota Ballet through Dance – The Next Generation, and Sarasota Orchestra’s Youth Orchestra Program, where children and young adults develop their skills and appreciation for music through performance opportunities with the full orchestra in their Side-by-Side program. Susan and her husband are also Ambassadors for the Westcoast Black Theatre Group where they support the summer camp Stage of Discovery for young aspiring performers. Past volunteer work included serving ten years on the Gala Committee of the Safe Place and Rape Crisis Center (SPARCC) where much-needed funds are raised for victims of sexual and domestic abuse in our community.

In her free time, Susan enjoys traveling, playing golf, socializing with friends at Bird Key Yacht Club and caring for her Toy Aussie Shepherd, Storm.

“Our wealth management team of six is recognized as a 2025 Forbes Best-In-State Wealth Management Team,” says Susan, who was also recognized by Forbes as one of the Top Women Wealth Advisors from 2020 through 2025, as well as a Best in State Wealth Advisor for 2022, 2023, 2024, and 2025. “It is a great honor to be surrounded by a great team of professionals who put clients first.”

Complementing a long-held career in finance, Susan and her husband, Charlie, are very involved with local organizations where they are both active supporters of the local performing arts scene and notable nonprofits in Sarasota.

One of their main focuses includes youth education at The Sarasota Ballet through Dance – The Next Generation, and Sarasota Orchestra’s Youth Orchestra Program, where children and young adults develop their skills and appreciation for music through performance opportunities with the full orchestra in their Side-by-Side program. Susan and her husband are also Ambassadors for the Westcoast Black Theatre Group where they support the summer camp Stage of Discovery for young aspiring performers. Past volunteer work included serving ten years on the Gala Committee of the Safe Place and Rape Crisis Center (SPARCC) where much-needed funds are raised for victims of sexual and domestic abuse in our community.

In her free time, Susan enjoys traveling, playing golf, socializing with friends at Bird Key Yacht Club and caring for her Toy Aussie Shepherd, Storm.

Securities Agent: VI, CO, TN, OR, OK, OH, MO, CA, AK, WY, NY, NM, NJ, ND, MN, MA, LA, AL, WI, NH, MI, ME, AZ, AR, MT, CT, UT, TX, NC, DC, WA, MS, GA, PA, KS, IN, FL, SC, IA, MD, KY, IL, HI, DE, VA, SD, RI, NV; General Securities Representative; Investment Advisor Representative

NMLS#: 1255614

NMLS#: 1255614

About Rylan K. Lanham

Rylan K. Lanham is a financial advisor in Sarasota, Florida. After a successful professional golfing career Rylan transitioned to the financial services industry December 9th 2014. Upon obtaining his series 7, 66, and insurance licenses, Rylan began his career with a boutique independent firm in Sarasota FL. He acted as the financial planning coordinator for the southeastern United States and partnered with over 120 advisors to deliver tailored financial planning solutions to their clients. In analyzing thousands of clients’ portfolios and financial positions Rylan quickly acquired conceptual intelligence of market dynamics and comprehensive financial planning. Morgan Stanley recognized his passion and vision of the financial services industry and recruited Rylan in April of 2017. Rylan has played an integral role in launching Morgan Stanley’s modern wealth management platform and takes pride in being the face of modern wealth management. Rylan strategically leverages the entire ecosystem of Morgan Stanley to deliver a business model that represents the future of what the financial services industry will bring; best in class technology, regulatory framework, and world class thought leadership.

Rylan was born at Sarasota Memorial Hospital September 30th 1988. Soon after birth his parents Alan and Lisa relocated to the Appalachian Mountains of Murphy, NC to raise him. Rylan was the first and only male member of his family to attend college and not go the traditional family route, The United States Marine Corps 3rd battalion. His mother is a cancer specialist and father went on to become a physical therapy assistant after an honorable discharge from 6 years in the Marine Corps. Growing up Rylan was an avid student athlete and went on to obtain a full golfing scholarship at both Young Harris College in GA, and Western Carolina University in Cullowhee, NC. After graduating from Western Carolina in 2010 with a bachelor degree in Business Science & Administration, and minor in Science Concentration Rylan went on to travel the world and play professional golf. Professional golf taught Rylan much more about perseverance, patience, & how to properly manage expectations. Through his travels and competition Rylan found an equal passion, finance. Looking for a career where he could have equal challenge and a transfer of acquired assets, he successfully transitioned into the financial services industry. Rylan is married to the love of his life Heather Lanham, and they live in Sarasota with their cockapoo, golden doodle, maine coon, and tabby cat. Heather is a radiation therapist at Moffitt and delivers radiation treatment to cancer patients. Their hobbies include golf, offshore fishing, cooking, and spending time with family and friends.

Rylan was born at Sarasota Memorial Hospital September 30th 1988. Soon after birth his parents Alan and Lisa relocated to the Appalachian Mountains of Murphy, NC to raise him. Rylan was the first and only male member of his family to attend college and not go the traditional family route, The United States Marine Corps 3rd battalion. His mother is a cancer specialist and father went on to become a physical therapy assistant after an honorable discharge from 6 years in the Marine Corps. Growing up Rylan was an avid student athlete and went on to obtain a full golfing scholarship at both Young Harris College in GA, and Western Carolina University in Cullowhee, NC. After graduating from Western Carolina in 2010 with a bachelor degree in Business Science & Administration, and minor in Science Concentration Rylan went on to travel the world and play professional golf. Professional golf taught Rylan much more about perseverance, patience, & how to properly manage expectations. Through his travels and competition Rylan found an equal passion, finance. Looking for a career where he could have equal challenge and a transfer of acquired assets, he successfully transitioned into the financial services industry. Rylan is married to the love of his life Heather Lanham, and they live in Sarasota with their cockapoo, golden doodle, maine coon, and tabby cat. Heather is a radiation therapist at Moffitt and delivers radiation treatment to cancer patients. Their hobbies include golf, offshore fishing, cooking, and spending time with family and friends.

Securities Agent: TN, AL, WI, WA, NC, CO, SC, RI, NY, SD, OR, MI, AZ, AK, PA, LA, FL, WY, UT, OK, NJ, ME, NH, MA, KY, IL, CA, NM, MO, MD, KS, HI, CT, VA, OH, MT, MN, IN, GA, AR, TX, NV, MS, IA, DE, DC; General Securities Representative; Investment Advisor Representative

NMLS#: 1832949

NMLS#: 1832949

About Zack Weaver

Zack Weaver is a CERTIFIED FINANCIAL PLANNER ™ practitioner who was first introduced to investing at the age of twelve with money that he had saved up from mowing lawns, which served as the springboard for his professional career, where he has focused on designed and creating customized investment strategies for his clients' portfolios for the past 19 years. A graduate of the University of Illinois, he began his career as an equity investment analyst for State Farm Insurance, where he managed over $50 billion in assets. His areas of focus included the analysis of financial services companies and researching tactical investment opportunities. In 2003, he relocated to his hometown of Peoria, Illinois, where he worked at A.G. Edwards and Sons until coming to Morgan Stanley in 2007.

Zack became a Chartered Financial Analyst (CFA®) in 2004, a widely regarded designation in the global financial industry, certifying a broad range of current investment knowledge, analytical skill, and ethical and professional standards. He currently resides in Evergreen, Colorado, with his wonderful wife, Carolyn; their son, Hudson; and their twin daughters, Campbell and Emerson.

Zack became a Chartered Financial Analyst (CFA®) in 2004, a widely regarded designation in the global financial industry, certifying a broad range of current investment knowledge, analytical skill, and ethical and professional standards. He currently resides in Evergreen, Colorado, with his wonderful wife, Carolyn; their son, Hudson; and their twin daughters, Campbell and Emerson.

Securities Agent: TX, NM, NJ, MA, IL, AZ, WA, MT, ME, WY, VA, RI, PA, OK, MS, MN, ID, HI, WI, VT, MI, DC, AL, SC, OR, OH, NH, KY, NE, IN, SD, NV, KS, DE, CT, CA, GA, FL, AK, TN, NY, MD, LA, IA, AR, UT, NC, MO, CO; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

About Sarah Freeman

Sarah Freeman joined Cornerstone Capital Group in 2021, bringing with her more than 17 years of experience from Morgan Stanley, where she began her career in 2004. Throughout her tenure, Sarah has held roles including Client Service Associate, Operations Associate, and Consulting Group Analyst. Her diverse background provides her with a deep understanding of the industry and enables her to deliver highly personalized service to each client.

Sarah is known for her strong focus on the client experience and her commitment to building meaningful, long-term relationships. She holds both her Series 7 and Series 66 licenses, further underscoring her expertise and dedication to professional excellence.

Sarah resides in Canton, Illinois, with her husband, Brent, and their beloved dog, Dexter. As a recent empty nester and budding DIY enthusiast, she enjoys staying active in her community while supporting local initiatives throughout the greater Peoria area, including Habitat for Humanity and local food banks. In her free time, Sarah is an avid reader, a sports enthusiast, and a past participant in the St. Jude Memphis to Peoria Run.

Securities Agent: AR, IN, CO, OR, AZ, DC, VA, NC, GA, KY, LA, MA, AL, MO, AK, FL, IA, IL, MI, MN, MS, MI, NE, CT, DE, OK, NJ, NM, NY, OH, PA, SC, SD, TN, TX, WA, WI, KS, WY, CA, MD, ME, NV; General Securities Representative; Investment Advisor Representative

Sarah is known for her strong focus on the client experience and her commitment to building meaningful, long-term relationships. She holds both her Series 7 and Series 66 licenses, further underscoring her expertise and dedication to professional excellence.

Sarah resides in Canton, Illinois, with her husband, Brent, and their beloved dog, Dexter. As a recent empty nester and budding DIY enthusiast, she enjoys staying active in her community while supporting local initiatives throughout the greater Peoria area, including Habitat for Humanity and local food banks. In her free time, Sarah is an avid reader, a sports enthusiast, and a past participant in the St. Jude Memphis to Peoria Run.

Securities Agent: AR, IN, CO, OR, AZ, DC, VA, NC, GA, KY, LA, MA, AL, MO, AK, FL, IA, IL, MI, MN, MS, MI, NE, CT, DE, OK, NJ, NM, NY, OH, PA, SC, SD, TN, TX, WA, WI, KS, WY, CA, MD, ME, NV; General Securities Representative; Investment Advisor Representative

About Meggie Pretorius

Meggie Pretorius has worked in the financial services industry since 2012, building her career in client service, primarily with Morgan Stanley. She is dedicated to delivering a high-quality client experience and believes her success is rooted in understanding each client’s unique needs and providing thoughtful, personalized support. Meggie also remains highly engaged in staying current with regulatory changes and firm initiatives that enhance the overall client experience.

Meggie holds two bachelor’s degrees: one in English from the University of Illinois at Urbana-Champaign and another in Nursing from the OSF St. Francis Medical Center College of Nursing. She resides in Peoria with her husband, Blake, and their three children, Jude, Levi, and Penelope. Meggie is an active member of St. Philomena Parish and is involved in her community through volunteer efforts supported by both her parish and her workplace.

Securities Agent: AR, IN, CO, OR, AZ, DC, VA, NC, GA, KY, LA, MA, AL, MO, AK, FL, IA, IL, MI, MN, MS, MI, NE, CT, DE, OK, NJ, NM, NY, OH, PA, SC, SD, TN, TX, WA, WI, KS, WY, CA, MD, ME, NV; General Securities Representative; Investment Advisor Representative

Meggie holds two bachelor’s degrees: one in English from the University of Illinois at Urbana-Champaign and another in Nursing from the OSF St. Francis Medical Center College of Nursing. She resides in Peoria with her husband, Blake, and their three children, Jude, Levi, and Penelope. Meggie is an active member of St. Philomena Parish and is involved in her community through volunteer efforts supported by both her parish and her workplace.

Securities Agent: AR, IN, CO, OR, AZ, DC, VA, NC, GA, KY, LA, MA, AL, MO, AK, FL, IA, IL, MI, MN, MS, MI, NE, CT, DE, OK, NJ, NM, NY, OH, PA, SC, SD, TN, TX, WA, WI, KS, WY, CA, MD, ME, NV; General Securities Representative; Investment Advisor Representative

About Susan Knight

Susan joined Morgan Stanley and its predecessors in 1984 as she was achieving her Associate Degree in Business Management. Born in Mesquite, Texas, Susan’s family moved to Long Island, NY when she was 5 years old. She ended up in Sarasota in 2018 to aid her aging parents.

Susan brings extensive knowledge and experience to the Cornerstone Capital Group. She is a Senior Registered Associate and has her Series 7, 63, 66, 9 and 10 licenses. Susan is passionate about people and works diligently in building long lasting client relationships and providing excellent client service. She provides administrative and operational support for the team’s private clients along with working closely with the Financial Advisors.

Susan enjoys the sunshine, time at the beach and outdoor activities like biking, kayaking, swimming, and walking trails. She loves to spend time with her grown kids, family, and friends. She is a member with New Day Christian Church and enjoys volunteering her time there.

Susan brings extensive knowledge and experience to the Cornerstone Capital Group. She is a Senior Registered Associate and has her Series 7, 63, 66, 9 and 10 licenses. Susan is passionate about people and works diligently in building long lasting client relationships and providing excellent client service. She provides administrative and operational support for the team’s private clients along with working closely with the Financial Advisors.

Susan enjoys the sunshine, time at the beach and outdoor activities like biking, kayaking, swimming, and walking trails. She loves to spend time with her grown kids, family, and friends. She is a member with New Day Christian Church and enjoys volunteering her time there.

About Adrienne Lambers

Adrienne began her career with Morgan Stanley in 2019 and joined the Cornerstone Capital Group in 2022. As a Senior Registered Client Service Associate, Adrienne is passionate about delivering great service. She enjoys solving problems for clients and making their lives a little simpler. She holds her Series 7 and 66 licenses, as well as her Life, Accident, Health, and Variable Annuity insurance licenses.

Adrienne graduated in 2018 from Calvin College in Grand Rapids, Michigan, where she then began her career with Morgan Stanley. She moved to Sarasota, Florida to join the Cornerstone Capital Group and to be closer to her family in her hometown of Tampa. Adrienne is happy to be back in Florida and enjoys biking, running, and spending time at the beach.

Adrienne graduated in 2018 from Calvin College in Grand Rapids, Michigan, where she then began her career with Morgan Stanley. She moved to Sarasota, Florida to join the Cornerstone Capital Group and to be closer to her family in her hometown of Tampa. Adrienne is happy to be back in Florida and enjoys biking, running, and spending time at the beach.

Contact Carolyn Kroupa Weaver

Contact Eric Schlipf

Contact Tom Bardwell

Contact T. Michael Osterman

Contact Susan Wilson

Contact Rylan K. Lanham

Contact Zack Weaver

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Cornerstone Capital Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)