Stoneridge West Wealth Management Group at Morgan Stanley

Our Mission Statement

Our Story

For over 35 years, the Stoneridge West Wealth Management Group at Morgan Stanley has pioneered a proactive, high-service model that is uniquely tailored to provide our clients with exceptional, personalized service.

Our innovative approach constantly seeks out new opportunities for our clients, while our retirement planning strategies remain grounded in time-tested principles.

Our practice holds the distinctive credentials of Family Wealth Director, Equity Compensation Specialist, Alternative Investments Director, and Corporate Retirement Director. These designations provide our team with exclusive access to advanced Wealth Advisory Services and Corporate Retirement solutions. Leveraging relationships built over decades, we are equipped to help maximize retirement readiness and navigate the complexities of today's marketplace.

As a multigenerational team serving multigenerational families, we are deeply rooted in our communities and committed to inclusivity. We proudly serve clients who are deaf and hard of hearing, utilizing sign language and the latest communication technologies. Our dedication to investment excellence, coupled with rigorous due diligence, enables us to deliver exceptional service, objective guidance, and results-driven strategies.

Whether your mission is philanthropic, social, or family-focused, we are honored to help lay the foundation that empowers our clients to confidently pursue their dreams and aspirations.

- 401(k) Rollovers

- Alternative InvestmentsFootnote1

- Asset Management

- Corporate Investment SolutionsFootnote2

- Corporate Retirement PlansFootnote3

- Estate Planning StrategiesFootnote4

- Executive Financial ServicesFootnote5

- Financial PlanningFootnote6

- Lending Products

- Long Term Care InsuranceFootnote7

- Philanthropic Services

- Planning for Education FundingFootnote8

FINANCIAL STRATEGIES FOR LIFE

As we unravel and fully understand your goals and aspirations, we will begin developing a comprehensive financial plan that is designed to meet your objectives. We will then conduct onsite due diligence meetings with you to clarify the inherent risks associated with those returns. If you agree with the recommendations, the plan is implemented and continuously monitored to provide periodic feedback and advice.

Through our unique combination of resources and capabilities, we have exclusive access to investments and products that are otherwise only available to institutional investors. As a result, we are able to provide our clients with distinctive investment opportunities and superior advice. Through each custom tailored plan, we work to provide you with unbiased investment planning and monitoring that replicates a boutique-like experience from a global financial leader in Morgan Stanley.

- Our clients are much than a portfolio of assets – they are sophisticated, prosperous individuals, families, and business owners who seek impartial and prudent guidance with respects to a full range of financial topics. They have grown to depend on our extraordinary service model that is specially designed to ensure every client feels like our only client. When choosing to work with us, you will be treated with the respect and an unwavering commitment to you and your family.

- High Net Worth and Ultra-High Net Worth Individuals and Families

- Retirees and Individuals Planning for Retirement

- Foundations and Non-Profit Organizations

- Corporate Executives, Professionals, and Small to Midsize Companies

- Self-Made Entrepreneurs and Business Owners

- Referrals from Existing Clients and Industry Professionals

Ways to Prepare for Your Retirement

Please contact either Michael Teague (Mike.Teague@morganstanley.com) or Connor McGuire (Connor.McGuire@morganstanley.com) for more information on upcoming events

Time: 12:00 PM PT

Each month, the team hosts a webcast focusing on relevant topics catered to what's going on in the markets at that time. Be sure to check out this month's webcast titled, "Morgan Stanley Total Tax 365 for 2026: Tax-Aware Investing and Financial Planning".

Location

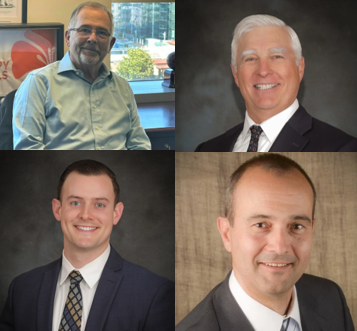

Meet Stoneridge West Wealth Management Group

About Michael J Teague

Mike holds a BA and MA in Education, with a focus on Deaf Education. Before transitioning to financial services, he taught English and coached sports at the California School for the Deaf, where he also pioneered the use of computers to enhance composition skills for students.

In 1985, Mike founded Teague Financial, which he sold to Smith Barney in 1994. Following Smith Barney's integration into Morgan Stanley, Mike expanded his focus to include comprehensive wealth management and equity compensation strategies that align with his clients' broader financial goals.

Mike is a Certified Financial Planner and Certified Retirement Plan Specialist. He also completed the Certified Private Wealth Advisor Program at the University of Chicago, which emphasizes Family Office services for ultra-high-net-worth clients, including business owners and corporate executives.

Mike has been married for over 30 years to his wife, Joni. They have four children and reside in Pleasanton. Mike volunteers for the St. Michael’s Patrol annual summer camp and serves in the choir at St. Michael’s Catholic Church in Livermore, CA.

NMLS#: 1255673

CA Insurance License #: 0686670

About Connor J McGuire

Connor plays a pivotal role on the team, focusing on portfolio analysis, building comprehensive financial plans, and delivering investment-related services tailored to each client's unique needs. His commitment to excellence has significantly enhanced the client experience and the overall effectiveness of our team's strategies.

A native of Pleasanton, Connor earned his B.S. in Business Administration with an emphasis in Finance from San Diego State University. He holds multiple securities and insurance licenses. Outside of work, Connor enjoys hiking, mountain biking, snowboarding, and staying active at the gym.

NMLS#: 1703209

CA Insurance License #: 0K99404

About Brian T Franklin

Prior to joining Morgan Stanley in 2000, Brian worked with Silicon Valley Capital Management, as well as Bottom Line Investments. He holds his BS in Finance from San Jose State University. Brian is an active member of his community, working with associations such as CREW, Rotary Downtown San Jose, and FARE GC.

NMLS#: 1265099

CA Insurance License #: 0D06974

Contact Michael J Teague

Contact Connor J McGuire

Contact Brian T Franklin

Rational Investing in an Age of Uncertainty

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Retirement for Plan Sponsors

We can provide the tools and guidance to help you manage a retirement plan.

- Plan Evaluation

- Investment Management

- Plan Management Support

- Plan Participant Education

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley