Solaria Perez-Stepanov

My Mission Statement

About Solaria

Solaria’s approach to wealth management is holistic and highly personalized. By helping her clients define the impact they want to have on the world, she creates custom financial plans tailored to their unique goals and priorities.

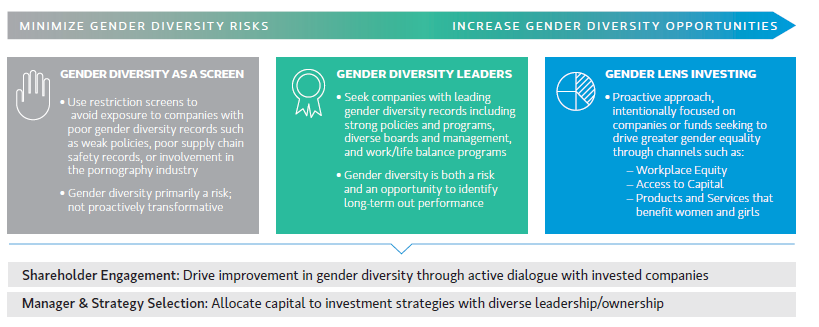

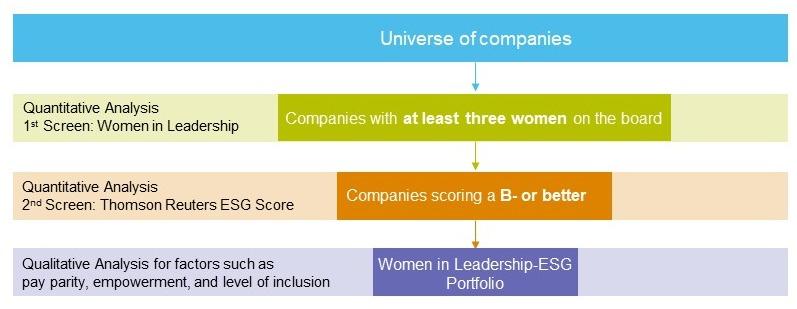

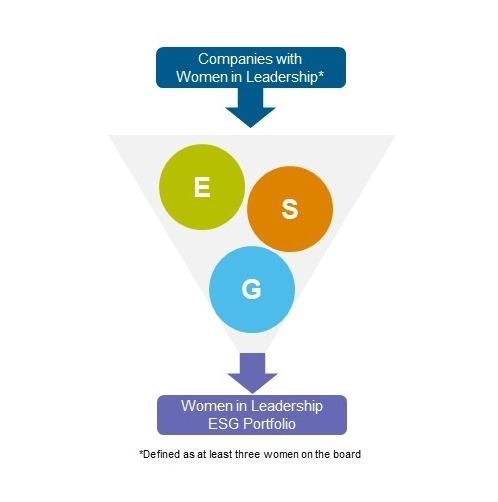

Many of Solaria’s clients are tech executives, women executives and entrepreneurs who share her drive to do well by doing good. Solaria draws on the resources of Morgan Stanley’s Institute for Sustainable Investing to provide her clients with a range of socially responsible and environmentally friendly investment options . She has also created a proprietary Women in Leadership-ESG portfolio , which reflects her passion for achieving gender equality while considering environmental, social and corporate governance impact.

As an International Client Advisor, Solaria has the ability to work with clients living outside of the U.S. She helps international clients navigate the challenges of managing significant wealth across borders and across generations. She is part of The Solaria Group at Morgan Stanley.

Prior to joining Morgan Stanley in 2010, Solaria worked in the investment banking divisions at JPMorgan and BNP Paribas. She is a regular guest on The Money Watch on KCBS, where she shares her market insights and perspectives. She also enjoys giving back to her community by providing financial literacy and financial planning seminars to promote long-term financial health.

Solaria has a BA in Economics from Brown University and an MBA from Harvard Business School.

Please visit our team website below:

NMLS#: 1264981

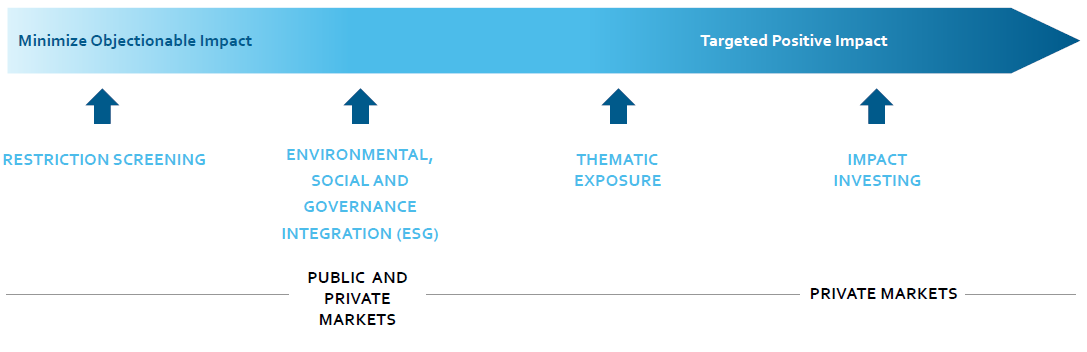

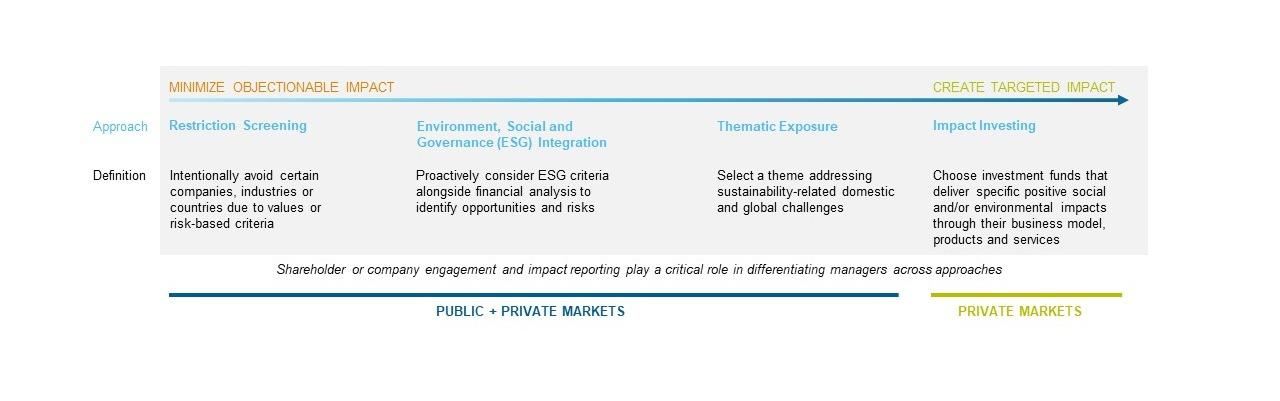

Investing strategies, portfolios, tools and resources can be used individually or in concert to activate portfolios designed to meet your impact goals, either in tailored asset allocations or across your entire portfolio

THE SOLARIA GROUP - OUR STORY

The Solaria Group at Morgan Stanley is a global team offering wealth management that has no borders and is mindful to our planet.

With offices in Menlo Park, CA, Scottsdale, AZ and New York, NY we offer our collective wisdom to serve a global clientele of highly accomplished entrepreneurs, executives, business owners and multi-generational families.

We understand that with substantial wealth comes unique challenges and significant complexity. We help simplify and bring balance to your financial life so that you may pursue the aspirations you have for your family, your business, your community and the world.

While our capabilities are sophisticated our mission is simple: to help you live the life you want to live.

We begin by listening to you to understand your vision of a fulfilling life. Once we understand what matters to you -- your hopes, dreams and values -- we develop and implement a roadmap to help achieve your goals and fulfill your legacy.

Our holistic approach includes:

- Investment strategy – as designated Portfolio Managers we can build and monitor custom discretionary portfolios. We tap into the vast resources of Morgan Stanley for a wide range of investment strategies including our Institute for Sustainable Investing as well as our Alternative Investments platform.

- Comprehensive financial planning – retirement roadmaps, lending solutions, business succession, pre-liquidity strategies.

- Family governance strategies - legacy wealth transfer, estate planning, philanthropic planning, family meetings to enable next generation involvement and value-based discussions.

We value our relationship with your trusted advisors including attorneys, accountants and other professionals to help ensure that we are all working in concert to help you achieve your objectives.

At the Solaria Group we believe in making our world a better place by:

- Offering you excellent service so that you are happy and in turn can have a positive impact in your circle

- Offering investment strategies that align with your values. We provide impact investing options ranging from addressing climate change to empowering women.

- Helping you fulfill your philanthropic objectives through charitable giving strategies or establishing a foundation

- Giving back to our communities -- we volunteer and give back to organizations that are dear to our heart and are making a positive impact in our world.

'We make a living out of what we get. We make a life out of what we give" - Winston Churchill

Please visit our team website below:

Location

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

4Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6GlobalCurrency is available to clients of Morgan Stanley Smith Barney LLC with an eligible brokerage account. Before undertaking foreign exchange transactions, clients should understand the associated risks.

Engaging in foreign currency transactions entails more varied risks than normally associated with transactions in the domestic securities markets. Attention should be paid to market, credit, sovereign, and liquidity risks. The foreign exchange transactions and deposits discussed in this material may not be appropriate for all clients. The appropriateness of a particular investment or strategy depends upon a client’s particular circumstances and objectives. This material does not provide individually tailored investment advice.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley