Ellie Ivancich, CFP®

Vice President, Wealth Management,

Financial Advisor,

Financial Planning Specialist,

Senior Portfolio Manager

Direct:

(615) 665-4740(615) 665-4740

My Mission Statement

Experience, intellectual capital and dedicated personal service to help you meet your life goals

My Story

Ellie Ivancich, CFP®, works with individuals and families to map out a comprehensive financial plan to help them reach their goals. She joined the Nashville Legacy Group as a Financial Advisor in 2018 after previously serving as the team’s intern. As a CERTIFIED FINANCIAL PLANNER™, Ellie, works to advise clients on issues involving financial planning, cash flow management as well as retirement, education, and legacy planning strategies.

Originally from Chicago, Ellie graduated cum laude with a Bachelor of Business Administration in Finance from Belmont University where she competed as a Volleyball Student-Athlete, earning academic honors all 4 seasons.

Ellie is the 103rd elected President of the Nashville Jr. Chamber, Nashville’s oldest young professional’s organization that brings together like-minded individuals seeking to give back to the community both professionally and philanthropically. Ellie was admitted to Nashville’s Young Leader’s Council (YLC), where she refined her skills in servant-leadership as it relates to board service. She was also appointed to the Board of Stars Nashville, a non-profit committed to helping the next generation unlock their full potential, primarily regarding mental health, through partnerships with the Metro Nashville public school system. Ellie was named a Top 30 Under 30 Honoree in Nashville by the Cystic Fibrosis Foundation (2023). As an alumna, she continues to be an active supporter of Belmont Athletics, often appearing as color commentator for the Lady Bruin Volleyball matches. Ellie is passionate about volleyball, which is evident through her coaching at Tennessee Performance Volleyball Club in Franklin, TN. In her free time, Ellie enjoys traveling with friends and family, and hiking. She attends Cross Point Church in Nashville.

Originally from Chicago, Ellie graduated cum laude with a Bachelor of Business Administration in Finance from Belmont University where she competed as a Volleyball Student-Athlete, earning academic honors all 4 seasons.

Ellie is the 103rd elected President of the Nashville Jr. Chamber, Nashville’s oldest young professional’s organization that brings together like-minded individuals seeking to give back to the community both professionally and philanthropically. Ellie was admitted to Nashville’s Young Leader’s Council (YLC), where she refined her skills in servant-leadership as it relates to board service. She was also appointed to the Board of Stars Nashville, a non-profit committed to helping the next generation unlock their full potential, primarily regarding mental health, through partnerships with the Metro Nashville public school system. Ellie was named a Top 30 Under 30 Honoree in Nashville by the Cystic Fibrosis Foundation (2023). As an alumna, she continues to be an active supporter of Belmont Athletics, often appearing as color commentator for the Lady Bruin Volleyball matches. Ellie is passionate about volleyball, which is evident through her coaching at Tennessee Performance Volleyball Club in Franklin, TN. In her free time, Ellie enjoys traveling with friends and family, and hiking. She attends Cross Point Church in Nashville.

Securities Agent: CA, MI, IN, FL, AZ, NY, IL, CO, SC, KY, TX, MN, WI, OK, OH, MS, AR, TN, NC, VA, MD, ME, GA, MT, AL; General Securities Representative; Investment Advisor Representative

NMLS#: 1794803

NMLS#: 1794803

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

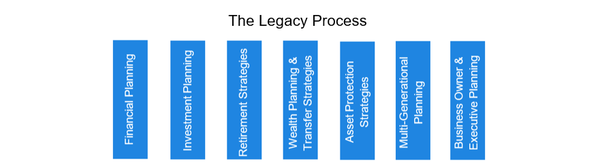

Thorough, thoughtful planning – planning that analyzes where you are as well as where you want to go – is the most important step in establishing a path to your goals.

Our team works with you as we navigate through the Seven Pillars of Planning to explore and help define your objectives and needs, and then structure a wealth plan that is uniquely your own.

We believe our Legacy Process allows us to establish deep and lasting relationships, to deliver hands-on, high-end service in an effort to generate consistently reliable outcomes that are uniquely tailored to you. We draw on our three decades of experience working with clients and their advisors to provide perspective and help solve problems that may seem unusual or unique. Some of the issues we address include helping minimize tax obligations, ensuring portfolios are aligned with estate plans, and providing key investment advice during times of change and transition. To set the tone for our working relationship, you can expect that we will execute the services outlined below.

Our team works with you as we navigate through the Seven Pillars of Planning to explore and help define your objectives and needs, and then structure a wealth plan that is uniquely your own.

We believe our Legacy Process allows us to establish deep and lasting relationships, to deliver hands-on, high-end service in an effort to generate consistently reliable outcomes that are uniquely tailored to you. We draw on our three decades of experience working with clients and their advisors to provide perspective and help solve problems that may seem unusual or unique. Some of the issues we address include helping minimize tax obligations, ensuring portfolios are aligned with estate plans, and providing key investment advice during times of change and transition. To set the tone for our working relationship, you can expect that we will execute the services outlined below.

Our Relationship

We will:

• Ask the right questions to maintain a thorough understanding of your financial goals

• Update your financial information as your situation changes and your needs evolve

• Communicate with you regularly regarding changes to your portfolio and economic conditions

• Understand and monitor your investment risk and its alignment to your investment time frame

• Carefully explain all recommended financial strategies and solutions

• Meet with you regularly to discuss next steps in the Legacy Process as your life unfolds

• Act as your primary financial advisor

• Work hand-in-hand with your trusted advisors when situations warrant

• Treat you with the utmost respect and professionalism

• Ask the right questions to maintain a thorough understanding of your financial goals

• Update your financial information as your situation changes and your needs evolve

• Communicate with you regularly regarding changes to your portfolio and economic conditions

• Understand and monitor your investment risk and its alignment to your investment time frame

• Carefully explain all recommended financial strategies and solutions

• Meet with you regularly to discuss next steps in the Legacy Process as your life unfolds

• Act as your primary financial advisor

• Work hand-in-hand with your trusted advisors when situations warrant

• Treat you with the utmost respect and professionalism

Finding A Plan That Works For You

The financial life of a woman is multi-faceted and nuanced. I am here to help you navigate through all of the milestones you may face. Contact me today and let’s get started.

Women and Wealth Brochure

- Securing your financial future starts with a well-defined financial plan based on the things you value most. Let's work together to build a strong foundation that supports your goals and aspirations.

IN THE PRESS

Awards

Caren Williams has been recognized in numerous financial publications.

- Forbes Magazine's Top Women Wealth Advisor 2020

- Forbes Magazine’s Best in State Advisors 2019, 2020, and 2021

- Working Mother Magazine’s Top Wealth Advisor Moms 2019 and 2020

- Forbes Magazine's Top Women Wealth Advisor 2020

- Forbes Magazine’s Best in State Advisors 2019, 2020, and 2021

- Working Mother Magazine’s Top Wealth Advisor Moms 2019 and 2020

Events

The events that we present to our clients are engaging and educational. By offering these periodic events, we hope to help facilitate greater financial understanding and promote ongoing, meaningful conversations.

Cybersecurity Webinar:

- Mastering the basics of cybersecurity

- Cyber safety for seniors and caregivers

- Cyber talk for parents and kids

- How to secure your remote workplace

Cybersecurity webinar series- Mastering the basics of cybersecurity

- Cyber safety for seniors and caregivers

- Cyber talk for parents and kids

- How to secure your remote workplace

4-part “Women & Wealth” Series:

- Saving & Budgeting 101

- Fixed Income Investing (Bonds)

- Equity Investing (Stocks)

- Putting It All Together & Planning For Your Future

- Saving & Budgeting 101

- Fixed Income Investing (Bonds)

- Equity Investing (Stocks)

- Putting It All Together & Planning For Your Future

Financial Wellness Series:

- Risk Tolerance & Investment Allocation

- Planning & Managing Retirement Income

- Debt Management

- Risk Management (disability, long-term care, life, health)

- Estate Planning Strategies & Directives

- Risk Tolerance & Investment Allocation

- Planning & Managing Retirement Income

- Debt Management

- Risk Management (disability, long-term care, life, health)

- Estate Planning Strategies & Directives

Women, Wealth & Wellness:

- Nutritional Wellness

- Physical Wellness

- Financial Wellness

Contact me at (615) 665-4740 or email ellie.ivancich@ms.com to learn about upcoming events.

- Nutritional Wellness

- Physical Wellness

- Financial Wellness

Contact me at (615) 665-4740 or email ellie.ivancich@ms.com to learn about upcoming events.

Disclosure(s):

2020 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2020). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2019, 2020, and 2021 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019, 2020, and 2021). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2019 and 2020 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October 2019 and 2020). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

2020 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (Awarded 2020). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2019, 2020, and 2021 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019, 2020, and 2021). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2019 and 2020 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms

Source: Workingmother.com (Awarded October 2019 and 2020). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

Location

3102 West End Ave

Ste 200

Nashville, TN 37203

US

Direct:

(615) 665-4740(615) 665-4740

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact Ellie Ivancich today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)