The Veritas Group at Morgan Stanley

Daniel Maniscalco, CIMA®Jason ManiscalcoJustin Maniscalco, CFP®, CFA®, CAIAKimberly CasperDanielle Jackson

Direct:

(516) 336-0856(516) 336-0856

Toll-Free:

(833) 367-5302(833) 367-5302

Our Mission Statement

To have a positive impact on the lives of our clients. To support their endeavors. To be deemed a trusted advisor.

Our Mission

To have a positive impact on the lives of our clients - In an increasingly complex and ever-changing financial system, our team provides a level of professionalism and white glove service to offer peace of mind to our clients throughout all life events.

To support their endeavors - Whether a client’s goal is a comfortable and secure retirement, estate and legacy planning, or philanthropic efforts, we utilize the deep infrastructure of Morgan Stanley to provide them with creative solutions.

To be deemed a trusted advisor - Our appreciation for and fascination with the financial markets have driven us to attain designations and certifications focusing on some of the most salient features of wealth management and financial planning. But our ability to utilize these features and skillsets are only doable by developing a deep level of mutual respect and confidence with our clients.

To support their endeavors - Whether a client’s goal is a comfortable and secure retirement, estate and legacy planning, or philanthropic efforts, we utilize the deep infrastructure of Morgan Stanley to provide them with creative solutions.

To be deemed a trusted advisor - Our appreciation for and fascination with the financial markets have driven us to attain designations and certifications focusing on some of the most salient features of wealth management and financial planning. But our ability to utilize these features and skillsets are only doable by developing a deep level of mutual respect and confidence with our clients.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

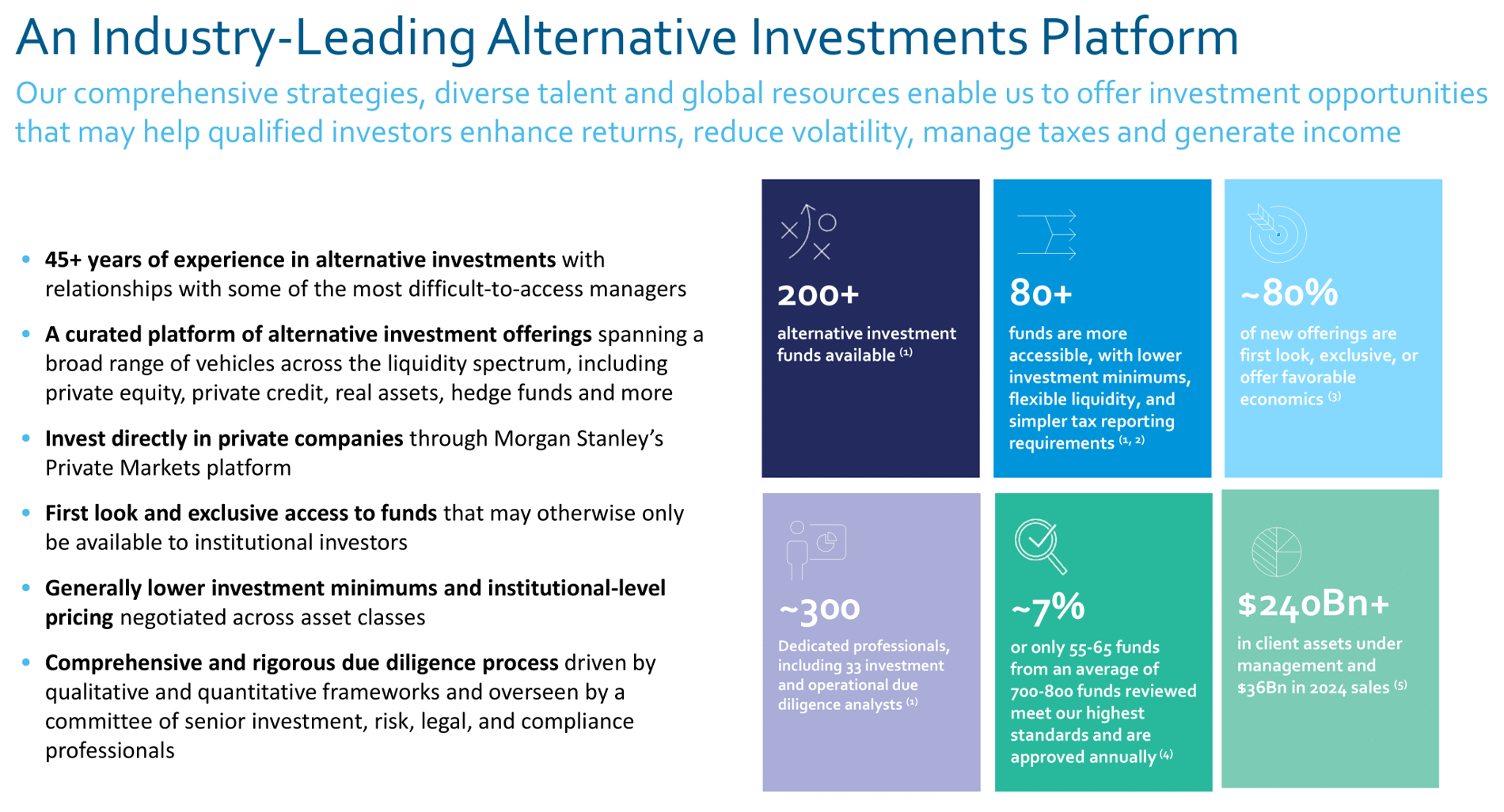

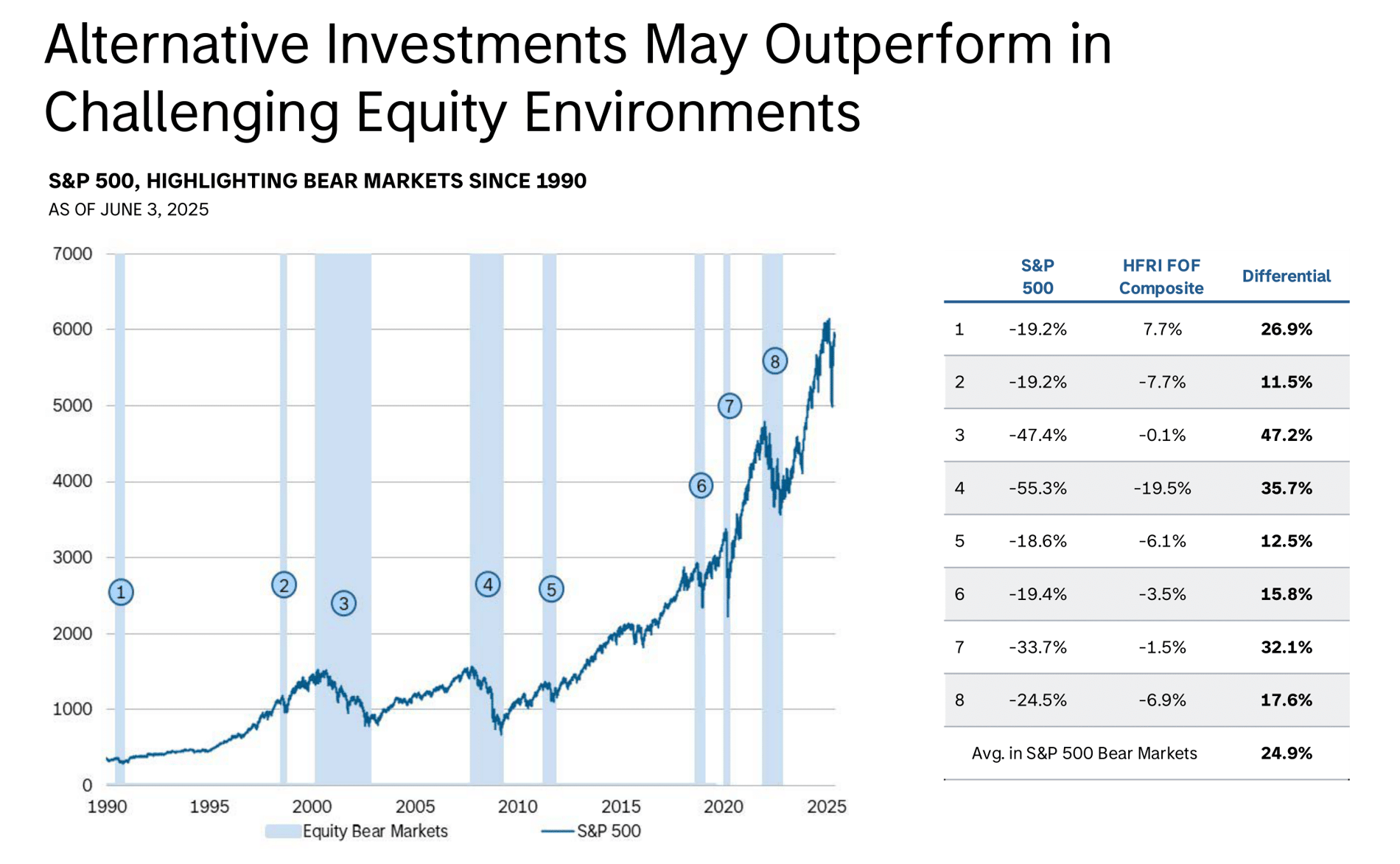

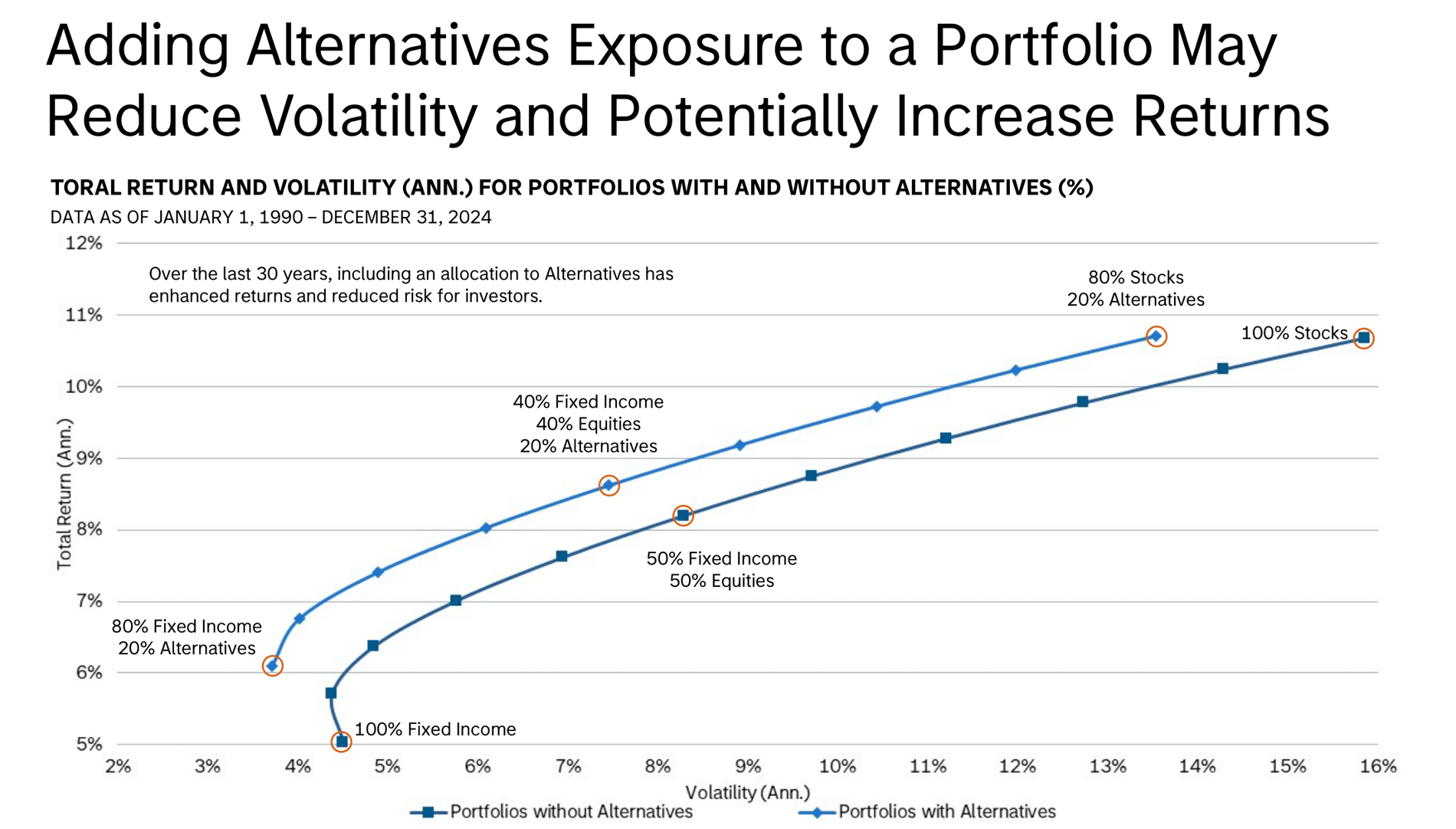

Expanding Possibilities Beyond Public Markets

We believe alternative investments can play a powerful role in a modern portfolio. From private equity and private credit to real estate and hedge funds, these strategies aim to enhance diversification, reduce exposure to public market volatility, and unlock new sources of return.

📎For a breakdown of the key trends tracked in this space, click the link below.

Our approach focuses on sourcing and curating high-conviction opportunities across private markets—giving clients access to strategies once limited to institutions and endowments.

Why Consider Alternatives?

- Diversification beyond traditional stocks and bonds

- Low correlation to public markets, offering balance during volatility

- Return potential from illiquidity premiums and active strategies

- Access to high-barrier strategies in sectors like energy transition, sports ownership, and technology

We Leverage Access To:

- Private Equity

Growth capital, buyouts, and sector-specific strategies with long-term return potential - Private Credit

Direct lending and specialty finance offering yield and downside resilience - Real Estate & Infrastructure

Institutional-grade property and energy assets offering income and diversification - Hedge Funds

Multi-strategy and opportunistic approaches aimed at generating risk-adjusted alpha - Thematic Alternatives

Blockchain, sports media rights, and impact-oriented infrastructure

📎For a more comprehensive looks at Alternative Investments, click the link below.

Location

Two Jericho Plaza

First Floor, Wing A

Jericho, NY 11753

US

Direct:

(516) 336-0856(516) 336-0856

Toll-Free:

(833) 367-5302(833) 367-5302

Fax:

(516) 256-8527(516) 256-8527

Meet The Veritas Group

About Daniel Maniscalco

Un-conflicted. Un-biased. Accountable. The principles that have defined my practice for nearly 30 years still hold true to this day. One might argue that they are even more powerful given the evolution and increased complexities of today’s ever-changing financial climate.

My goal as an advisor is to develop a solid understanding of each client’s unique needs. That starts with listening.

Something that clients appreciate is my ability to think outside the box and create a roadmap that is a departure from the norm. That ability has led me to come up with innovative ways to address each client’s desired outcomes.

What gives me great fulfillment is the journey that I and that client - that person, that human - embark on. Along the way, we’ll share both joy and tribulation as we work together toward a common goal.

The CIMA designation I received from the Wharton School of Business transformed me as an advisor. I saw and understood risk differently. Risk and loss in the financial markets can’t be avoided but understanding them and trying to mitigate them is my goal. My approach to portfolio construction developed from understanding how institutional investors, such as Pensions and Endowments, manage their pools of money, bringing those strategies to my clients and custom tailoring them to their needs.

The most important part of a financial relationship is trust. Trust can only be achieved through truth. Being open and honest in all dealings, with clients, but also with counterparties and regulators, is critical. Truth. It’s why our team is called Veritas.

I started the Veritas Group five years ago. It is supported by a team of administrators and investment product specialists offering a full complement of services from asset-based loans to mortgages, from conventional stock and bond portfolios to Alternative Investments such as Private Equity and Private Real Estate, from estate planning to tax minimization strategies. Teamwork, professionalism, and top-notch customer service have helped me build long-term, multi-generational relationships with a growing client base.

Our team is multi-generational by design. Youth added to experience is very powerful. Our industry is always changing, and youth can bring energy and new ways of tackling such changes. At the same time, youth needs experience and perspective to temper that enthusiasm and channel it to the greatest benefit. Such a structure allows the team to better serve our clients, their children, and the causes most important to them. But overall, I believe that what makes our team truly stand out is our commitment to our industry, each other, and most importantly our clients. We are driven toward constant improvement and providing service that is second-to-none.

I marvel at the beauty and efficiency of the capital markets, but I am most passionate about having a positive impact on human beings. I truly appreciate when clients acknowledge my hard work, passion, and ethics.

Outside of work, I enjoy spending time with my wife of 35 years, Rita, and our two sons and their families, including two grandbabies and four granddogs! I also enjoy playing guitar, observing nature, and traveling.

Rita and I are long-time supporters of St. Jude’s Children’s Research Hospital, Shriners Hospitals for Children, Villalobos Rescue Center and the ASPCA.

My goal as an advisor is to develop a solid understanding of each client’s unique needs. That starts with listening.

Something that clients appreciate is my ability to think outside the box and create a roadmap that is a departure from the norm. That ability has led me to come up with innovative ways to address each client’s desired outcomes.

What gives me great fulfillment is the journey that I and that client - that person, that human - embark on. Along the way, we’ll share both joy and tribulation as we work together toward a common goal.

The CIMA designation I received from the Wharton School of Business transformed me as an advisor. I saw and understood risk differently. Risk and loss in the financial markets can’t be avoided but understanding them and trying to mitigate them is my goal. My approach to portfolio construction developed from understanding how institutional investors, such as Pensions and Endowments, manage their pools of money, bringing those strategies to my clients and custom tailoring them to their needs.

The most important part of a financial relationship is trust. Trust can only be achieved through truth. Being open and honest in all dealings, with clients, but also with counterparties and regulators, is critical. Truth. It’s why our team is called Veritas.

I started the Veritas Group five years ago. It is supported by a team of administrators and investment product specialists offering a full complement of services from asset-based loans to mortgages, from conventional stock and bond portfolios to Alternative Investments such as Private Equity and Private Real Estate, from estate planning to tax minimization strategies. Teamwork, professionalism, and top-notch customer service have helped me build long-term, multi-generational relationships with a growing client base.

Our team is multi-generational by design. Youth added to experience is very powerful. Our industry is always changing, and youth can bring energy and new ways of tackling such changes. At the same time, youth needs experience and perspective to temper that enthusiasm and channel it to the greatest benefit. Such a structure allows the team to better serve our clients, their children, and the causes most important to them. But overall, I believe that what makes our team truly stand out is our commitment to our industry, each other, and most importantly our clients. We are driven toward constant improvement and providing service that is second-to-none.

I marvel at the beauty and efficiency of the capital markets, but I am most passionate about having a positive impact on human beings. I truly appreciate when clients acknowledge my hard work, passion, and ethics.

Outside of work, I enjoy spending time with my wife of 35 years, Rita, and our two sons and their families, including two grandbabies and four granddogs! I also enjoy playing guitar, observing nature, and traveling.

Rita and I are long-time supporters of St. Jude’s Children’s Research Hospital, Shriners Hospitals for Children, Villalobos Rescue Center and the ASPCA.

Securities Agent: TX, PA, TN, SC, NC, MA, VT, MI, ME, FL, AZ, KS, CT, RI, OH, NY, NJ, IL, MN, MD, IA, OR, CA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1278954

NMLS#: 1278954

About Jason Maniscalco

As a founding member of the Veritas Group, I cover all areas of wealth management for our clients, from portfolio management to financial planning. The majority of the team is based out of Jericho, New York and in 2020, my family and I moved down to Florida, and I personally am based in Winter Park.

I’m proud to be part of a multi-generational team and appreciate how our values are passed on from one generation to the next. The value of learning from people within your circle can not be understated. The diversity of our skillsets allows us to explore different opportunities to benefit our clients.

Every relationship is unique. Every day, month, and year of a client’s financial journey is important and I will always be accessible for our clients. It is truly amazing how many deep-rooted relationships we have built over the years.

I am very proud to have come up with the team name Veritas, which means “truth” in Latin. Nothing is more important in a relationship between a client and an advisor than truth and honesty.

I graduated from Adelphi University in 2011 with a Bachelor’s Degree in Finance and started working in the industry the day after I graduated. I also hold a designation of Financial Planning Specialist.

In my spare time, I enjoy spending time with my beautiful wife Nichole, and our two amazing children, Harper and Luke. I love playing golf and hockey, and riding my Harley-Davidson.

I’m proud to be part of a multi-generational team and appreciate how our values are passed on from one generation to the next. The value of learning from people within your circle can not be understated. The diversity of our skillsets allows us to explore different opportunities to benefit our clients.

Every relationship is unique. Every day, month, and year of a client’s financial journey is important and I will always be accessible for our clients. It is truly amazing how many deep-rooted relationships we have built over the years.

I am very proud to have come up with the team name Veritas, which means “truth” in Latin. Nothing is more important in a relationship between a client and an advisor than truth and honesty.

I graduated from Adelphi University in 2011 with a Bachelor’s Degree in Finance and started working in the industry the day after I graduated. I also hold a designation of Financial Planning Specialist.

In my spare time, I enjoy spending time with my beautiful wife Nichole, and our two amazing children, Harper and Luke. I love playing golf and hockey, and riding my Harley-Davidson.

Securities Agent: IL, KS, FL, TN, UT, RI, OH, MA, GA, SC, ME, AZ, NH, NC, OR, MN, VT, TX, IA, NY, MI, CT, PA, CA, NJ, MD; General Securities Representative; Investment Advisor Representative

NMLS#: 2013537

NMLS#: 2013537

About Justin Maniscalco

As a Financial Advisor with the Veritas Group, I specialize in the team’s portfolio management, investment due diligence, and financial planning initiatives. Given my background in private markets, a key focus is integrating alternative investments such as private equity, private credit, private real estate, and private infrastructure, where suitable, to enhance our clients' traditional asset allocation strategies.

Before joining the Veritas Group in 2022, I accumulated 8 years of experience in the financial services sector. I started my career with a Wealth Management team at Fidelity Investments. Later, I joined Morgan Stanley's Alternative Investments team, collaborating with financial advisors on the West Coast to develop and expand alternative investment allocations within client portfolios.

The Veritas Group is multi-generational by design. Recognizing the impending wealth transfer between generations on an unprecedented scaled, our team collaborates closely with clients and their families, ensuring a seamless and efficient transition. Leveraging the extensive infrastructure and resources of Morgan Stanley, we offer comprehensive solutions such as tax-efficient investing and gifting strategies, alternative investments, and private banking services. Personally, I am on the relentless pursuit of the truth, both within the investment realm and the authentic needs and aspirations of our clients. This is why our team’s name resonates with me so strongly. I find immense satisfaction in alleviating one of life's most significant concerns - financial security.

I am a graduate of Bentley University, where I earned a Bachelor’s of Science in Finance with a minor in Mandarin. During my time at Bentley, I had the privilege of spending approximately six months studying in Shanghai. I am a CFP® professional, a Chartered Financial Analyst (CFA®) charter holder, and a Chartered Alternative Investment Analyst (CAIA®) charter holder.

My wife and I recently welcomed our daughter, Rosemary, who was born in May 2025. We live in Huntington, NY with our two King Charles Cavaliers, Cooper and Molly. In my spare time, I like to stay physically active and mentally stimulated. I enjoy spending time outdoors with my family, golf, reading, playing chess, studying languages, playing guitar, and rooting for the New York Rangers.

Jackie Robinson once said, “A life is not important except in the impact it has on other lives.” Keeping this sentiment close, I am honored to volunteer with Patrol Base Abbate, a non-profit organization run by and for current service members and veterans.

Before joining the Veritas Group in 2022, I accumulated 8 years of experience in the financial services sector. I started my career with a Wealth Management team at Fidelity Investments. Later, I joined Morgan Stanley's Alternative Investments team, collaborating with financial advisors on the West Coast to develop and expand alternative investment allocations within client portfolios.

The Veritas Group is multi-generational by design. Recognizing the impending wealth transfer between generations on an unprecedented scaled, our team collaborates closely with clients and their families, ensuring a seamless and efficient transition. Leveraging the extensive infrastructure and resources of Morgan Stanley, we offer comprehensive solutions such as tax-efficient investing and gifting strategies, alternative investments, and private banking services. Personally, I am on the relentless pursuit of the truth, both within the investment realm and the authentic needs and aspirations of our clients. This is why our team’s name resonates with me so strongly. I find immense satisfaction in alleviating one of life's most significant concerns - financial security.

I am a graduate of Bentley University, where I earned a Bachelor’s of Science in Finance with a minor in Mandarin. During my time at Bentley, I had the privilege of spending approximately six months studying in Shanghai. I am a CFP® professional, a Chartered Financial Analyst (CFA®) charter holder, and a Chartered Alternative Investment Analyst (CAIA®) charter holder.

My wife and I recently welcomed our daughter, Rosemary, who was born in May 2025. We live in Huntington, NY with our two King Charles Cavaliers, Cooper and Molly. In my spare time, I like to stay physically active and mentally stimulated. I enjoy spending time outdoors with my family, golf, reading, playing chess, studying languages, playing guitar, and rooting for the New York Rangers.

Jackie Robinson once said, “A life is not important except in the impact it has on other lives.” Keeping this sentiment close, I am honored to volunteer with Patrol Base Abbate, a non-profit organization run by and for current service members and veterans.

Securities Agent: AL, OR, WY, DC, SD, VA, MS, NJ, NV, CO, OK, CT, OH, SC, TN, UT, VI, WA, WI, WV, IA, ID, GA, NY, HI, MA, MI, MN, NC, MT, NH, NE, FL, AR, AZ, VT, TX, RI, PR, PA, NM, ND, MO, ME, MD, LA, KY, KS, IN, IL, DE, CA, AK; General Securities Representative; Investment Advisor Representative

NMLS#: 2413426

NMLS#: 2413426

About Kimberly Casper

Originally from Bel Air, Maryland, I bring over 30 years of financial experience to the Veritas Group. Having worked for such firms as Prudential Securities, Wachovia Securities, and Wells Fargo Advisors before joining Morgan Stanley in 2013, provides me with the expertise to anticipate the needs of our clients and introduce them to the services that will best fulfill their needs. I currently hold Series 7 and 63 securities registrations.

As an original member of the Veritas Group, I’m so proud of the team we’ve built and the client relationships we’ve developed. Veritas is more than a team name, it’s an experience. From our in-depth onboarding procedure to our financial planning strategies, we differentiate ourselves from other financial service organizations because we bring to the table a level of client service that is truly exceptional. Building the best team of financial specialists is a task not to be taken lightly. Therefore, we take our time to find the most talented and qualified candidates, so our clients have the best overall financial journey.

Whether onboarding clients, researching a wide variety of requests, or entering orders for alternative investments, helping clients navigate during unpredictable markets while assisting them in reaching their financial goals gives me great satisfaction. I take pride in the fact that I’m extremely detail-oriented, conscientious, and enjoy collaborating with my team on finding new and creative ways to identify financial opportunities.

I live in East Northport with my husband, Kevin, and we have one son, Nicholas. During my free time, I enjoy spending time with Kevin, Nick and his wife Nicolette. I love to read, spend time at the beach, and visit with my family in Maryland. Kevin and I also love to travel to remote areas of the globe. I am a loyal Baltimore Ravens fan, so my family and I try to head back to Charm City at least once each year to catch a Baltimore Ravens home game. I proudly served as an executive committee member for the American Cancer Society’s Relay for Life - Northport/East Northport Chapter from 2009-2014, which raised over $2mm in cancer research. Our family also proudly supports Tunnel to Towers Foundation and St Jude Children’s Research Hospital.

As an original member of the Veritas Group, I’m so proud of the team we’ve built and the client relationships we’ve developed. Veritas is more than a team name, it’s an experience. From our in-depth onboarding procedure to our financial planning strategies, we differentiate ourselves from other financial service organizations because we bring to the table a level of client service that is truly exceptional. Building the best team of financial specialists is a task not to be taken lightly. Therefore, we take our time to find the most talented and qualified candidates, so our clients have the best overall financial journey.

Whether onboarding clients, researching a wide variety of requests, or entering orders for alternative investments, helping clients navigate during unpredictable markets while assisting them in reaching their financial goals gives me great satisfaction. I take pride in the fact that I’m extremely detail-oriented, conscientious, and enjoy collaborating with my team on finding new and creative ways to identify financial opportunities.

I live in East Northport with my husband, Kevin, and we have one son, Nicholas. During my free time, I enjoy spending time with Kevin, Nick and his wife Nicolette. I love to read, spend time at the beach, and visit with my family in Maryland. Kevin and I also love to travel to remote areas of the globe. I am a loyal Baltimore Ravens fan, so my family and I try to head back to Charm City at least once each year to catch a Baltimore Ravens home game. I proudly served as an executive committee member for the American Cancer Society’s Relay for Life - Northport/East Northport Chapter from 2009-2014, which raised over $2mm in cancer research. Our family also proudly supports Tunnel to Towers Foundation and St Jude Children’s Research Hospital.

About Danielle Jackson

I am a dedicated support professional with over 18 years of experience in wealth management, project management, and marketing. Since 2018, I have been serving as a Portfolio Associate at Morgan Stanley Wealth Management, where I play a key role in supporting client portfolios and delivering exceptional service. I am also fully registered and hold Series 7 and 66 licenses, which enable me to effectively support our financial services and operations.

Prior to joining Morgan Stanley, I spent 11 years at MetLife. During my tenure there, I rotated through various integral roles, gaining diverse expertise in project management, marketing initiatives, and support functions. This broad background has equipped me with a versatile skill set, blending strategic planning with client-facing relationship management.

Outside of my professional commitments, I am passionate about maintaining an active and healthy lifestyle. I enjoy dance, health, and fitness activities, and I cherish the time spent with my family, including my husband, Dave, our son, Robbie, and daughter, Gaby.

Prior to joining Morgan Stanley, I spent 11 years at MetLife. During my tenure there, I rotated through various integral roles, gaining diverse expertise in project management, marketing initiatives, and support functions. This broad background has equipped me with a versatile skill set, blending strategic planning with client-facing relationship management.

Outside of my professional commitments, I am passionate about maintaining an active and healthy lifestyle. I enjoy dance, health, and fitness activities, and I cherish the time spent with my family, including my husband, Dave, our son, Robbie, and daughter, Gaby.

Contact Daniel Maniscalco

Contact Jason Maniscalco

Contact Justin Maniscalco

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Dana Jordan

Dana Jordan is a Private Banker serving Morgan Stanley Wealth Management offices in New York.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Dana began her career in financial services in 2017 when she joined Morgan Stanley as a Lending Analyst in Private Banking Operations. She most recently returned to the firm in 2022. Prior to joining the firm, she was a Mortgage Professional at JP Morgan Private Bank.

Dana is a graduate of Loyola University Maryland, where she received a Bachelor of Business Administration in Finance She lives in Long Island, New York. Outside of the office, Dana donates her time to the American Legion Auxiliary Unit 1006. She is a Senior Gold Medalist and USFSA (U.S. Figure Skating Association) member, and enjoys partaking in CrossFit.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Dana began her career in financial services in 2017 when she joined Morgan Stanley as a Lending Analyst in Private Banking Operations. She most recently returned to the firm in 2022. Prior to joining the firm, she was a Mortgage Professional at JP Morgan Private Bank.

Dana is a graduate of Loyola University Maryland, where she received a Bachelor of Business Administration in Finance She lives in Long Island, New York. Outside of the office, Dana donates her time to the American Legion Auxiliary Unit 1006. She is a Senior Gold Medalist and USFSA (U.S. Figure Skating Association) member, and enjoys partaking in CrossFit.

NMLS#: 1974422

About Angelo Loumbas

Angelo is the Family Office Resources Generalist in the Northeast Region. Angelo provides in depth knowledge to ultra-high net worth (UHNW) clients and Financial Advisors across a broad range of family wealth and family office management matters. His area of focus includes family governance, wealth education,, strategic estate and financial planning, philanthropy management, lifestyle advisory, and customized asset allocation and portfolio construction. Angelo has over 25 years’ experience advising wealthy families, business owners, and philanthropic organizations.

Originally from Chicago and now residing in Westchester County, New York, , Angelo practiced law for 15 years and represented UHNW clients, closely held businesses, and major philanthropic organizations. He is admitted to the Society of Trust and Estate Practitioners and has been asked to speak over the years before tax, trust and estate committees of estate planning councils and other organizations. Angelo has also contributed thought leadership through Morgan Stanley’s Family Legacy and Governance Institute leadership series and authored an article for Barrons.com, “Should I Invest in My Kid’s Start-Up? Financial Advisors Can Help Clients Decide” (2023).

Angelo has been advising UHNW clients in the financial services industry for over 17 years, with 13 of those years at Morgan Stanley in Chicago and New York. He earned his J.D. from Indiana University at Bloomington, his M.B.A. from the University of Notre Dame, and B.A. from DePaul University. He also holds his Series 7, 66 and 24 licenses. In addition, Angelo served as President of the Rotary Club of Chicago (“ROTARY/One”), the world’s first Rotary club (2009-2010).

Originally from Chicago and now residing in Westchester County, New York, , Angelo practiced law for 15 years and represented UHNW clients, closely held businesses, and major philanthropic organizations. He is admitted to the Society of Trust and Estate Practitioners and has been asked to speak over the years before tax, trust and estate committees of estate planning councils and other organizations. Angelo has also contributed thought leadership through Morgan Stanley’s Family Legacy and Governance Institute leadership series and authored an article for Barrons.com, “Should I Invest in My Kid’s Start-Up? Financial Advisors Can Help Clients Decide” (2023).

Angelo has been advising UHNW clients in the financial services industry for over 17 years, with 13 of those years at Morgan Stanley in Chicago and New York. He earned his J.D. from Indiana University at Bloomington, his M.B.A. from the University of Notre Dame, and B.A. from DePaul University. He also holds his Series 7, 66 and 24 licenses. In addition, Angelo served as President of the Rotary Club of Chicago (“ROTARY/One”), the world’s first Rotary club (2009-2010).

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Wealth Management Financial Advisors can conduct their business in several ways: individually, as a member of a team of Financial Advisors, or through the formation of a Strategic Partnership with another Financial Advisor or team of Financial Advisors. A Strategic Partnership is an arrangement between a Financial Advisor or a team of Financial Advisors with another Financial Advisor or team of Financial Advisors that has a unique focus or knowledge regarding a specific business concentration, product area, and/or client type. If your account is with an individual Financial Advisor, that Financial Advisor services all facets of your account. If your account is with a Financial Advisor who is a member of a team, any Financial Advisor on the team can service your account. If your Financial Advisor is part of a Strategic Partnership, his or her role in that Strategic Partnership may be limited to a specific business and/or product area and may not cover all facets of your account. The use of the terms “Partner” or “Strategic Partner” and/or “Partnership” or “Strategic Partnership” are used as terms of art and not used to imply or connote any legal relationship.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Wealth Management Financial Advisors can conduct their business in several ways: individually, as a member of a team of Financial Advisors, or through the formation of a Strategic Partnership with another Financial Advisor or team of Financial Advisors. A Strategic Partnership is an arrangement between a Financial Advisor or a team of Financial Advisors with another Financial Advisor or team of Financial Advisors that has a unique focus or knowledge regarding a specific business concentration, product area, and/or client type. If your account is with an individual Financial Advisor, that Financial Advisor services all facets of your account. If your account is with a Financial Advisor who is a member of a team, any Financial Advisor on the team can service your account. If your Financial Advisor is part of a Strategic Partnership, his or her role in that Strategic Partnership may be limited to a specific business and/or product area and may not cover all facets of your account. The use of the terms “Partner” or “Strategic Partner” and/or “Partnership” or “Strategic Partnership” are used as terms of art and not used to imply or connote any legal relationship.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Veritas Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)