Envision Legacy Group at Morgan Stanley

Direct:

(310) 205-4939(310) 205-4939

Toll-Free:

(800) 458-9838(800) 458-9838

Industry Award Winner

Industry Award WinnerOur Mission Statement

We strengthen your family’s financial security through tailored advice and customized solutions, empowering you to preserve and enjoy the wealth you’ve worked so hard to achieve and leave the legacy you envision.

Financial Strategies for Your Life & Legacy

At The Envision Legacy Group, we focus on what is most important to you, your family and your future. We provide the personalized service, problem-solving skills and world-class resources needed to help you make more informed and confident decisions about your wealth.

Above all, we commit to making a meaningful difference in your life through the delivery of five core values that have become the hallmark of our practice:

• Deep and caring relationships that span generations

• Competence through extensive experience

• Proven processes that drive results

• A focus on education for ourselves and our clients

• A pledge to ongoing, proactive service

With or passion and perseverance, we deliver a standard of care that puts you in the center of every decision. We are dedicated to earning your trust every day through a powerful combination of wisdom, knowledge and experience. Above all, we strive to ensure every client feels like our only client.

Getting started is easy. It begins with a conversation. As our name implies, we look forward to discussing how we can support and enhance the lifestyle and legacy you envision for you, your children and your grandchildren now and for years to come.

We look forward to hearing from you soon.

Above all, we commit to making a meaningful difference in your life through the delivery of five core values that have become the hallmark of our practice:

• Deep and caring relationships that span generations

• Competence through extensive experience

• Proven processes that drive results

• A focus on education for ourselves and our clients

• A pledge to ongoing, proactive service

With or passion and perseverance, we deliver a standard of care that puts you in the center of every decision. We are dedicated to earning your trust every day through a powerful combination of wisdom, knowledge and experience. Above all, we strive to ensure every client feels like our only client.

Getting started is easy. It begins with a conversation. As our name implies, we look forward to discussing how we can support and enhance the lifestyle and legacy you envision for you, your children and your grandchildren now and for years to come.

We look forward to hearing from you soon.

Services Include

- Retirement PlanningFootnote1

- Wealth ManagementFootnote2

- Alternative InvestmentsFootnote3

- 401(k) Rollovers

- Cash Management and Lending ProductsFootnote4

- Estate Planning StrategiesFootnote5

- Planning for Education FundingFootnote6

- Endowments and FoundationsFootnote7

- Sustainable InvestingFootnote8

- Business Succession PlanningFootnote9

- Life InsuranceFootnote10

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

9665 Wilshire Boulevard

Suite 600

Beverly Hills, CA 90212

US

Direct:

(310) 205-4939(310) 205-4939

Toll-Free:

(800) 458-9838(800) 458-9838

Fax:

(310) 878-9254(310) 878-9254

Meet Envision Legacy Group

About Leor Tzour

Leor is a Senior Vice President, Portfolio Manager and founding partner of The Envision Legacy Group, a highly skilled advisory team located in Beverly Hills. Since 1999, he has enjoyed working with individuals and families with a higher level of wealth, providing personalized advice through a disciplined approach. His in-depth knowledge of tax and business planning helps clients navigate the ever-changing financial landscape. Leor’s comprehensive approach includes a thorough planning process, a diversified investment portfolio, and a commitment to outstanding service.

Born in Israel and emigrating to the U.S. in 1980, Leor and his family settled in Northridge, California. Ever since he can remember, he has always enjoyed helping others. If he could help someone solve a problem, he received great satisfaction. Leor was also drawn to the world of finance, which led him to study Economics at California State University. Upon graduation, Leor’s uncle (Michael Monatlik) invited him to join his practice and they have been partners ever since.

Today, more than 20 years later, Leor has built a successful career that allows him to not only solve complex problems for others, but help them manage their total financial picture more effectively and efficiently. It is extremely rewarding for Leor to see the impact a comprehensive strategy can have on his clients’ lives. Helping them develop and implement a financial plan and reap the rewards of a customized portfolio gives him great satisfaction that he is making their lives better and easier.

Leor’s desire to help others is equaled only by his dedication to his family and his community. He is an active member of Temple Aliyah in Woodland Hills. Leor and his wife, Leah, currently live in Calabasas with their son, Gavin, and twin daughters, Ellie and Ava. Leor loves coaching his kid’s soccer team. Other favorite activities include tennis, skiing, grilling and rooting on the Los Angeles sports teams.

Born in Israel and emigrating to the U.S. in 1980, Leor and his family settled in Northridge, California. Ever since he can remember, he has always enjoyed helping others. If he could help someone solve a problem, he received great satisfaction. Leor was also drawn to the world of finance, which led him to study Economics at California State University. Upon graduation, Leor’s uncle (Michael Monatlik) invited him to join his practice and they have been partners ever since.

Today, more than 20 years later, Leor has built a successful career that allows him to not only solve complex problems for others, but help them manage their total financial picture more effectively and efficiently. It is extremely rewarding for Leor to see the impact a comprehensive strategy can have on his clients’ lives. Helping them develop and implement a financial plan and reap the rewards of a customized portfolio gives him great satisfaction that he is making their lives better and easier.

Leor’s desire to help others is equaled only by his dedication to his family and his community. He is an active member of Temple Aliyah in Woodland Hills. Leor and his wife, Leah, currently live in Calabasas with their son, Gavin, and twin daughters, Ellie and Ava. Leor loves coaching his kid’s soccer team. Other favorite activities include tennis, skiing, grilling and rooting on the Los Angeles sports teams.

Securities Agent: OK, OH, NY, NE, WI, NM, MN, IN, DE, CO, WY, TN, SC, MD, FL, SD, NV, HI, PA, KS, AZ, VA, UT, TX, MT, KY, ID, DC, WA, VI, NC, MI, LA, IA, GA, CA, PR, NJ, IL, CT, MA, OR; General Securities Representative; Investment Advisor Representative

NMLS#: 1935364

CA Insurance License #: 0C79689

NMLS#: 1935364

CA Insurance License #: 0C79689

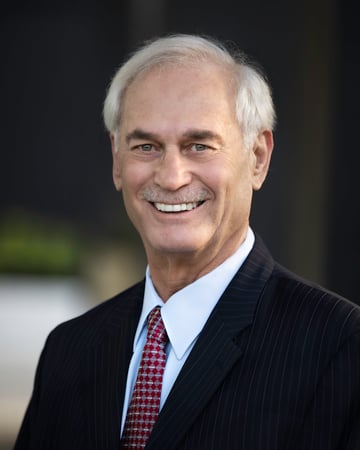

About Michael Monatlik

Michael is a Senior Vice President, Senior Financial Advisor and founding partner of The Envision Legacy Group. For more than 40 years, he has enjoyed helping successful individuals, generational families and business owners build and preserve their wealth. He couples his extensive background in fixed income and municipal bonds with his deep experience in the stock market to help clients better position their portfolios for today’s complexities and market opportunities. For Michael, professional success is measured in terms of client well-being and goal achievement.

Michael was born in Israel and moved to New York at the age of 10. Always intrigued by the world of finance, he attended Hofstra University to earn his degree in Economics. Upon graduation, he began his career as an economist at the Department of Labor. This led to new opportunities as he joined Smith Barney.

Over the years, Michael has worked at large financial firms, including Prudential, Merrill Lynch and UBS. In 1999, he joined forces with his nephew, Leor Tzour, and they have been partners ever since. Michael’s favorite part of being a Financial Advisor is educating his clients on how to leverage the markets to positively impact their overall investment plans.

Michael believes balance is vital to a happy life. He now lives in Encino with Rose, his wife of 47 years. They have two grown children and four grandchildren. An avid bird watcher, Michael enjoys studying nature and spending time with his family. He also loves to read, with a focus on historical books.

Michael was born in Israel and moved to New York at the age of 10. Always intrigued by the world of finance, he attended Hofstra University to earn his degree in Economics. Upon graduation, he began his career as an economist at the Department of Labor. This led to new opportunities as he joined Smith Barney.

Over the years, Michael has worked at large financial firms, including Prudential, Merrill Lynch and UBS. In 1999, he joined forces with his nephew, Leor Tzour, and they have been partners ever since. Michael’s favorite part of being a Financial Advisor is educating his clients on how to leverage the markets to positively impact their overall investment plans.

Michael believes balance is vital to a happy life. He now lives in Encino with Rose, his wife of 47 years. They have two grown children and four grandchildren. An avid bird watcher, Michael enjoys studying nature and spending time with his family. He also loves to read, with a focus on historical books.

Securities Agent: MN, GA, WI, OK, NV, ID, IA, CT, VI, OH, PR, NE, MD, KY, HI, VA, TN, SD, OR, NJ, CA, AZ, MT, MA, UT, TX, NM, NC, MI, IN, IL, DE, WA, NY, LA, FL, DC, CO, PA, SC, KS; General Securities Representative; Investment Advisor Representative

NMLS#: 1954250

CA Insurance License #: 0I40059

NMLS#: 1954250

CA Insurance License #: 0I40059

About Kit Mac Nee

The Envision Legacy Group focuses on what is most important to you, your family, and your future. We provide personal problem-solving skills and world-class resources needed to help you make more informed and confident decisions about your wealth. With our passion and perseverance, we deliver a service model that puts you in the center of every decision. The Envision Legacy Group has a combined over 100 years of experience with six members of our team, Leor Tzour, Michael Monatlik, Kit Mac Nee, Sean Dhila, Brendon Terry, and Matthew Ameling. Together we manage over $750 million in assets (as of 8/2024).

Kit’s clients trust her for two main reasons: They know she cares. And they value her experience. Kit joined Morgan Stanley as a Financial Advisor in 2013 and the Envision Legacy Group in 2023. Prior to joining Morgan Stanley, Kit was with Merrill Lynch Wealth Management for nearly 12 years.

On her way to becoming a CERTIFIED FINANCIAL PLANNER™, Kit served a community foundation in Southern California as its Director of Gift Planning. She worked with donors and local charitable organizations to gain philanthropic assets that would provide a legacy of financial resources. Today, she uses her financial-planning proficiency to serve as a volunteer, Board Member, and consultant to guide families and charities toward more secure financial futures.

Kit raised three children, all now grown and leading fulfilling lives in different parts of the United States. She loves traveling to visit family, including trips to Detroit, my original hometown. She lives in Santa Monica, California and travels throughout Southern California and the U.S. to support clients as well as the community groups she works with. Her volunteer work continues as the 2024 President for the National Association of Estate Planners and Councils, Inland Empire Planned Giving Seminar, Empowering Ugandans, and St. Barnabas Senior Services. Kit is a graduate of the University of Minnesota, Carlson School of Management, earned the Certified Specialist in Planned Giving ® from California State University Long Beach, American Institute of Philanthropy in 2001, became a CERTIFIED FINANCIAL PLANNER™ and Accredited Estate Planner® in 2013, and in 2023 became a Qualified Plan Financial Consultant.

Kit’s clients trust her for two main reasons: They know she cares. And they value her experience. Kit joined Morgan Stanley as a Financial Advisor in 2013 and the Envision Legacy Group in 2023. Prior to joining Morgan Stanley, Kit was with Merrill Lynch Wealth Management for nearly 12 years.

On her way to becoming a CERTIFIED FINANCIAL PLANNER™, Kit served a community foundation in Southern California as its Director of Gift Planning. She worked with donors and local charitable organizations to gain philanthropic assets that would provide a legacy of financial resources. Today, she uses her financial-planning proficiency to serve as a volunteer, Board Member, and consultant to guide families and charities toward more secure financial futures.

Kit raised three children, all now grown and leading fulfilling lives in different parts of the United States. She loves traveling to visit family, including trips to Detroit, my original hometown. She lives in Santa Monica, California and travels throughout Southern California and the U.S. to support clients as well as the community groups she works with. Her volunteer work continues as the 2024 President for the National Association of Estate Planners and Councils, Inland Empire Planned Giving Seminar, Empowering Ugandans, and St. Barnabas Senior Services. Kit is a graduate of the University of Minnesota, Carlson School of Management, earned the Certified Specialist in Planned Giving ® from California State University Long Beach, American Institute of Philanthropy in 2001, became a CERTIFIED FINANCIAL PLANNER™ and Accredited Estate Planner® in 2013, and in 2023 became a Qualified Plan Financial Consultant.

Securities Agent: NC, AZ, OH, MA, FL, OR, NV, KS, ID, HI, PR, MI, MD, LA, CT, CO, NJ, KY, IL, PA, NM, NE, MT, VI, UT, CA, GA, DC, SD, WA, VA, TN, NY, MN, DE, SC, AK, MO, WI, VT, AR, WY, ME, ND, NH, AL, WV, MS, RI, TX, OK, IN, IA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 633395

CA Insurance License #: Insurance Lic. CA 0E87426

NMLS#: 633395

CA Insurance License #: Insurance Lic. CA 0E87426

About Dante Gudino

Dante began his investment career as a Financial Representative in 2013 at MassMutual, where he focused on helping families develop and implement financial strategies. After building a strong foundation in insurance planning, he transitioned to Merrill Lynch Beverly Hills in 2015, serving as a Financial Advisor for five years. There, he specialized in corporate retirement solutions and worked with recent retirees and young professionals to define and purse their financial goals.

In 2020, Dante joined Morgan Stanley as a Financial Advisor, where he focuses on servicing institutional retirement plans and supporting clients through key life transitions, particularly in retirement. He is a graduate of UC Santa Barbara with a degree in Political Science with an emphasis in International relations.

Outside of work, Dante enjoys traveling, volunteering for the Pasadena Tournament of Roses, and working on his classic 1976 Datsun 280z.

In 2020, Dante joined Morgan Stanley as a Financial Advisor, where he focuses on servicing institutional retirement plans and supporting clients through key life transitions, particularly in retirement. He is a graduate of UC Santa Barbara with a degree in Political Science with an emphasis in International relations.

Outside of work, Dante enjoys traveling, volunteering for the Pasadena Tournament of Roses, and working on his classic 1976 Datsun 280z.

About Brendon Terry

Drawing on nearly 10 years of industry experience, Brendon is often the first line of contact on a broad array of client services. A consummate professional, he is committed to providing every client with the highest level of personal service. Brendon joined Morgan Stanley in 2011 and is an important member of The Envision Legacy Group.

From the largest task to the smaller request, Brendon works diligently to exceed client expectations. He serves as the administrative arm of the team, handing many of the day-to-day responsibilities of the team. He interfaces with various departments across the firm to help ensure issues are resolved quickly and efficiently. Brendon also holds his Series 7 and 66 FINRA licenses and insurance licenses so is available to assist with any trading activity if needed.

Prior to his financial services career, Brendon served in the U.S. Marine Corps for four years. Upon returning home, he joined Morgan Stanley as an Operations Associate. This position has led to new opportunities and responsibilities over the years, including Financial Planning Specialist, Financial Advisor, and Group Director. Brendon enjoys his current role as a Wealth Management Associate, often assisting with options trading and financial planning activities.

Originally from Missouri, Brendon now calls Simi Valley his home, where he lives with his wife, Samantha, and their children, Bryce, Jacob and Rilyn. He is an avid outdoorsman with interests that are wide and vast – from being a competitive archer who shot qualifiers for the U.S. Olympic team to being a regular guest on TV’s Fox Sports West to coaching youth football and basketball. Brendon also loves gardening, with an affinity for growing super-hot peppers, building furniture, and giving back. He is a member of Morgan Stanley’s Veterans Employee Network, and every other summer, he and his wife travel to Guatemala to build schools and homes for local orphanages there.

From the largest task to the smaller request, Brendon works diligently to exceed client expectations. He serves as the administrative arm of the team, handing many of the day-to-day responsibilities of the team. He interfaces with various departments across the firm to help ensure issues are resolved quickly and efficiently. Brendon also holds his Series 7 and 66 FINRA licenses and insurance licenses so is available to assist with any trading activity if needed.

Prior to his financial services career, Brendon served in the U.S. Marine Corps for four years. Upon returning home, he joined Morgan Stanley as an Operations Associate. This position has led to new opportunities and responsibilities over the years, including Financial Planning Specialist, Financial Advisor, and Group Director. Brendon enjoys his current role as a Wealth Management Associate, often assisting with options trading and financial planning activities.

Originally from Missouri, Brendon now calls Simi Valley his home, where he lives with his wife, Samantha, and their children, Bryce, Jacob and Rilyn. He is an avid outdoorsman with interests that are wide and vast – from being a competitive archer who shot qualifiers for the U.S. Olympic team to being a regular guest on TV’s Fox Sports West to coaching youth football and basketball. Brendon also loves gardening, with an affinity for growing super-hot peppers, building furniture, and giving back. He is a member of Morgan Stanley’s Veterans Employee Network, and every other summer, he and his wife travel to Guatemala to build schools and homes for local orphanages there.

Contact Leor Tzour

Contact Michael Monatlik

Contact Kit Mac Nee

Awards and Recognition

Forbes Best-In-State Wealth Advisors

Forbes Best-In-State Wealth Advisors Source: Forbes.com (Awarded April 2025) Data compiled by SHOOK Research LLC for the period 6/30/23 - 6/30/24.

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Wealth Management for Athletes and Entertainers

Understanding the unique financial challenges of athletes and entertainers and how they differ from one profession to the next, we deliver the experience and resources you need to help create and implement a comprehensive, multigenerational wealth management plan based on your needs, values and aspirations.

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact Envision Legacy Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)