Industry Award Winner

Industry Award WinnerOur Mission Statement

Welcome

The Sean Yu Group at Morgan Stanley Private Wealth Management received the #8 ranking by Forbes Magazine as the Los Angeles Best-In-State Wealth Advisor in 2025. Our team has extensive knowledge and strengths in US Planning and International Planning.

USA Planning

Financial Planning:

Our domestic planning is driven by our strong technical skills. Our team specializes in solving the most complicated domestic financial & estate planning issues for our multi-generational clients. We focus on USA person trust planning (revocable and irrevocable), charitable planning (Donor-Advised Funds, Public and Private Foundations), and concentrated stock planning (both liquidation & holding a concentrated position).

Portfolio Management:

By understanding our clients' needs, we are able to craft highly tailored portfolios that address their needs, and implement strategies with detailed execution and prudent decision-making. When creating our portfolios, we utilize the full suite of Morgan Stanley capabilities and tools, such as leveraging our award-winning research team for investment ideas, monitoring our portfolio risk, and running statistical analysis for our various portfolios.

International Planning

On our team, we have 3 International Client Advisors (ICA's), exclusively selected by Morgan Stanley based on our unique skills and background, to open Non-Resident Alien (NRA) accounts from China, Taiwan, Hong Kong, and Singapore. Our team understands the cross border non-USA rules and regulations for foreign accounts. We have experience with Non-Resident Alien (NRA) estate & financial planning, gifting to USA persons, and working with various trust structures (foreign grantor trusts, foreign non-grantor trust, domestic non-grantor trust). We have considerable experience incorporating both International and US Planning into the client's comprehensive financial plan. We work well with CPAs & Trust attorneys to execute on the client's overall plan.

Should you decide to work with us, we will work hard on your behalf, go the extra mile to fulfill your needs and hold ourselves to the highest ethical standards. We are here to help you achieve your goals.

- Comprehensive Wealth Planning

- Investment Management

- International Investing

- Risk Management

- Tax, Trust & Estate AdvisoryFootnote1

- Philanthropy Management

- Retirement & Pension Plans

- 10b5-(1) Programs

- Corporate Services

- Pre-Liquidity Planning

- Sustainable & Responsible InvestingFootnote2

- Cash Management & LendingFootnote3

- Investment Strategies for Family Offices

- Family Governance & Wealth Education

- Open-Architecture Platform

About PWM

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

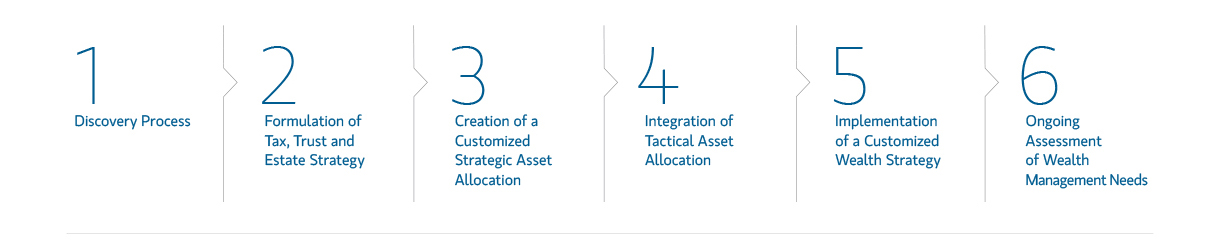

Approach

Philosophy

We help our clients protect and enhance these assets by taking a comprehensive approach to providing customized advice, investment solutions, and other financial services. We strive to gain a strong sense of their personalities and an in-depth understanding of their goals. With a clear understanding of our clients as people and investors, we are able to craft highly tailored portfolios that address their needs, and implement strategies with detailed execution and prudent decision-making. We are here to help you achieve your goals.

• Comprehensive Financial Advisory

• Asset Management

• Goals Oriented Approach

• International Wealth Management

• Customized Portfolio Tailored Towards Your Needs

Location

Meet The Sean Yu Group

About Sean Yu

Sean received his Master of Arts in international relations from the University of Chicago in 2002, and he received an Honorary Doctorate Degree from California State Polytechnic University-Pomona in 2023. He holds Series 3, 7, 31, and 66 licenses from FINRA, and holds the Certified Financial Planner® (CFP®), Certified Private Wealth Advisor® (CPWA®), and Chartered Advisor in Philanthropy (CAP®) certifications.

Sean leads in numerous philanthropic and social leadership activities. In 2012, he established the Sean Yu International Relations Fellowship at the University of Chicago to help underprivileged students at the university and has committed over $2 million to University of Chicago. In 2020, Sean established the Sean Yu Travel Fund at the University of Chicago for students and faculty to conduct research and study in Taiwan and China. In 2014, he created the Taiwanese American Scholarship Fund to alleviate college tuitions of underprivileged students of Taiwanese descent. He has committed $1 million personally and raised over $4 million in pledges to support 100+ students. In 2015, he was awarded the Philanthropy Leadership Award by the Asian Pacific Community Fund for helping them create their donor-advised fund program and raise over $20 million in donations. In the same year, he co-founded the Los Angeles Chapter of The Chinese Finance Association with over 150 active members from various areas of the financial services industry.

For his professional achievements and community contributions, Sean was awarded the Asian Business Award from Los Angeles Business Journal for the public company category in 2014. He was also listed among Los Angeles Business Journal’s 40 In Their 40's in Accounting & Financial Services Professionals in 2020. He has served on the Advisory Council of the Division of the Social Sciences at the University of Chicago since 2017. Additionally, he has been on the board of directors at Cal Poly Pomona University Philanthropic Foundation since 2016, having formerly chaired the Investment Committee for 3 years, and chaired the Audit Committee for a year.

In his spare time, Sean enjoys playing tennis and basketball. He has been to more than 100 Michelin starred restaurants, and his favorite restaurants include Providence in Los Angeles, Joel Robuchon in Las Vegas, Raw in Taipei, Bo Innovation in Hong Kong, Xin Rong Ji (新榮記) in Beijing, and Kikunoi Honten in Kyoto.

Sean is fluent in English, Mandarin Chinese, and Taiwanese.

NMLS#: 1398728

CA Insurance License #: 0E12405

About Davin Chen

Additionally, Davin works closely with Sean Yu and leverages Morgan Stanley resources to customize Equity, Fixed Income and Private Equity portfolios tailored for both U.S. domestic and non-US resident clients, when appropriate. By providing a patient and educational approach, Davin works with clients in determining risk level, proper asset allocation and structure. Davin closely monitors and adjusts portfolios to help ensure investment strategies keep pace with changes in clients’ lives.

Davin also helps non-US resident clients with the complexities of cross-border planning and investing. He is also an International Client Advisor, one of a selected few at Morgan Stanley who are designated to open non-US resident accounts and address the wealth-planning needs of non-US resident clients. He works with non-US resident clients seeking global diversification, U.S. preimmigration planning, and those who wish to plan for the transfer of wealth to their US heirs. Davin has extensive experience in opening, investing, and working with foreign accounts, ranging from individuals to complex structures, such as offshore holding companies, irrevocable trusts, and foreign trusts.

Davin has been working in the finance industry since 2008 and joined Morgan Stanley in 2013. He is an advisory board member of Pacific Academy, a private preparatory school. Prior to joining Morgan Stanley, Davin worked at BancWest Investment Services and Smith Barney for several years. He graduated from the University of California, San Diego, and holds B.A. degrees in Economics and Psychology. He is a Certified Financial Planner® ( CFP® ) and holds Series 7 and 66 licenses from FINRA. In Davin’s free time, he likes to travel, golf, play tennis, and explore new dining experiences, having dined at 79 Michelin-starred restaurants around the world.

Davin speaks English, Mandarin Chinese, and Taiwanese.

NMLS#: 1272883

CA Insurance License #: 0G51439

About Kevin Yu

Kevin primarily works with clients with Chinese and Taiwanese backgrounds (both US domiciled and NRC). Kevin works with Sean & the team to cultivate a deeper understanding of each client’s unique set of goals. From there, Kevin helps execute the financial planning, providing strategies on retirement planning, estate planning, risk management, philanthropy planning, wealth transfer and tax planning. After conducting thorough analysis and risk assessment, Kevin determines an optimal portfolio asset allocation for each client. He collaborates with Sean Yu in creating, managing, and monitoring customized investment strategies. Utilizing Morgan Stanley’s wide range of investment product offerings, Kevin is able to customize strategies for clients. Kevin provides ongoing communication and periodic reviews to ensure the client’s financial plan and investment strategies adapt to life changes. Furthermore, Kevin directly works with the team’s investment analysts and Morgan Stanley’s trading desk in the execution of the client’s portfolio. Through his process and concierge service, he is able to develop and maintain strong client relationships.

Kevin can open both US domiciled and non-US resident accounts. He works with both US domestic and foreign individuals, corporations, personal holding companies and trusts (revocable and irrevocable).

Kevin attended the University of California, Los Angeles, and studied Psychology. He has been working in the finance industry with Morgan Stanley since 2006. He holds the Series 7, 31 and 66 licenses from FINRA. Kevin is passionate about his local community. He is a member of the Asian Pacific CPA Association, created by experienced CPAs and Non-CPA Allied Professionals from various Asian American communities to collaborate on professional matters and build lifetime friendships. Kevin is an active member of the City of Industry Royal Lions Club and has served as the President and a board member in previous years. He is also a pet lover and a proud supporter for his local humane societies. On his spare time, Kevin enjoys playing basketball and playing with his three cats.

Kevin speaks English, Mandarin Chinese, and Taiwanese.

NMLS#: 1272765

About Patty Chao

With 14 years of experience, Patty leads the onboarding process of complex accounts, such as foreign individuals, offshore corporations, personal holding companies, foreign grantor trusts and irrevocable trust accounts established by a foreign person. She also has vast experience in opening domestic accounts, such as trusts, foundations, 401K plans, and retirement accounts.

Additionally, Patty facilitates strategic partnerships with other teams and helps with opening both domestic and international accounts for these clients. She is also highly experienced in restricted and controlled stock positions that require trading through Rule 144 and 10b5-1. She helps with the sale of restricted, control, and large concentrated positions, and the transfer of shares/certificates. Additionally, she helps with 10b5-1 planning by offering strategies for concentrated liquidity events.

Patty joined Morgan Stanley in 2009 and holds Series 7 and 66 licenses from FINRA. She graduated from the University of California, Los Angeles, and holds a B.A. degree in Psychology. In her free time, Patty likes to play basketball and golf. She also enjoys exploring new restaurants and wine tasting.

Patty speaks English, Mandarin Chinese, and conversational Cantonese.

About Pearl Huang

Pearl works closely with the team in monitoring the Sean Yu Group’s equity & fixed Income portfolios and conducts due diligence on alternate investments for both U.S. & international clients. In addition, she oversees the team’s reporting and performance metrics. Her contributions help the Financial Advisor Partners in delivering the team’s investment philosophy—including asset allocation, investment products and strategies. Pearl also helps the Financial Advisors educate clients about financial planning in future life situations, such as long-term investing and saving for retirement, planning around life milestones, navigating family dynamics, and philanthropy and legacy goals.

Pearl has been working in the finance industry since 2001. Before joining Morgan Stanley, she was Senior Private Banker at Wells Fargo Private Bank, where she helped with successful families to fulfill their complex financial needs and to manage life’s big transitions. She has also worked in commercial banking as an Executive Director with JPMorgan Chase’s Middle Market Banking Group and as Senior Vice President with Bank of America Commercial Banking, where she delivered tailormade financing solutions to mid-size companies on products and services. She also has experience in supervision as a branch office manager in HSBC Securities.

Pearl grew up in Taipei, Taiwan, where she earned her BA in economics from National Tsinghua University. She also earned her MBA from Yale University. After Yale, she and her family experienced living internationally in Hong Kong, Boston, New York, London, and Singapore. Pearl holds the Series 9/10, 24, 31 and 66 licenses from FINRA along with her California Insurance license. In her free time, she enjoys practicing yoga and Pilates.

Pearl is fluent in English, Mandarin Chinese, and Taiwanese.

About Nicole Victoria

Nicole is a graduate of the University of Southern California with a B.A. in Public Relations and a minor in Cultural

Anthropology. She has been working in the financial services industry since 2007, having had several roles in both Service and Risk leadership at Morgan Stanley, Merrill and UBS Financial Services. She is a dedicated mentor who is passionate about developing talent and creating a culture of excellence and accountability. She holds the Series 3, Series 7, Series 9, Series 10 and Series 66 licenses from FINRA.

Nicole was born in the Philippines and primarily raised in Southern California. In her leisure time she enjoys traveling, learning new languages and spending time with her dog Dwight.

Nicole speaks English, Tagalog and conversational Korean.

About Jenny Lee

Jenny assists Sean Yu with the execution, implementation, and monitoring of long-term, often multigenerational financial plans for clients based on a deep understanding regarding their needs, goals and preferences. Additionally, she takes care of all service-related questions for her clients, such as wires, transfers, internal journals, updating account information and helping clients log into Morgan Stanley Online (MSO).

Jenny has been working in the financial services industry since 2003, and joined Morgan Stanley in 2013. She holds Series 3, 4, 6, 7, 24, 53, and 66 licenses from FINRA. Prior to her career at Morgan Stanley, she worked at Merrill Lynch for six years and Chase Investment Services for two years. She used to serve as a Vice President of the Asian Pacific Certified Public Accountants Association.

Jenny graduated from Oklahoma City University with a B.A. degree in Business Management. She also holds an MBA from the University of Dallas. In her leisure time, Jenny likes to travel and play golf. She is also passionate about fine dining and wine tasting.

Jenny speaks English, Mandarin Chinese, and Taiwanese.

About Julie Liu

Julie has been working in the wealth management industry since 2007, and joined Morgan Stanley in 2014, and holds Series 7 and 66 licenses from FINRA. Prior to joining Morgan Stanley, she gained 7 years of industry experience working for UBS and LPL Financial.

During Julie’s free time, she enjoys taking group exercise classes for running and loves to explore new hiking trails, completing more than 50 trails to date. She is a PADI Certified Open Water Diver.

Julie speaks English and Mandarin Chinese.

About Jen Wu

Jen received her B.A. degree in Accounting in 2012 and an MBA in Finance in 2013, both from Indiana University. Jen holds the Series 7 and 66 licenses from FINRA, and Certified Financial Planner® certification (CFP®). She also holds her Certified Public Accountant license (currently not practicing). Prior to joining Morgan Stanley in 2019, Jen worked at PricewaterhouseCoopers and has five years of industry-related experience.

In her free time, Jen enjoys playing golf, equestrian sports (dressage and showjumping), and playing the piano. She enjoys wine and has obtained the WSET Level 1 Award in Wines. Jen is also passionate about gemology and holds a Graduate Diamonds Diploma from the GIA Institute.

Jen speaks English and Mandarin Chinese.

About Winnie Cao

In 2024, Winnie Cao graduated from the University of California, Los Angeles with a B.A. degree in Chinese literature and language. Prior to joining Morgan Stanley in 2024, she worked as a certified pharmacy technician where she was able to improve her customer service, time management, and organization skills. She is currently studying for her Series 7 & 66 licenses.

In her leisure time, Winnie likes to catch sunsets at the beach, go café-hopping, and play badminton. She also likes to unwind by cooking newly found recipes with friends, reading Chinese fantasy novels, and practicing Pilates.

Winnie is fluent in English, Cantonese, and Mandarin Chinese.

About Asha Chen

Asha has been working in the financial industry since 2014. Prior to joining Morgan Stanley in 2025, she worked in the Taipei branch of BNP Paribas Wealth Management on the Private Banking team for 9 years. She served as a Forex product specialist cooperating with Relationship Managers to service UHNW clients on product strategy and trading. She recently obtained her Series 7 and 66 licenses from FINRA.

Asha was born in Taiwan and graduated from National Chiao Tung University with a B.A. degree in Management Science. She holds a Master of Arts in English-Applied Linguistics from University of Colorado Denver. In her free time, she enjoys spending time hiking and traveling with her family.

Asha speaks Mandarin Chinese, English, and conversational Taiwanese.

About Brian Hioe

Brian worked in the wealth management industry since 2004, and joined Morgan Stanley in 2021. Prior to joining Morgan Stanley, Brian worked for LPL Financial and Western International Securities Inc. He graduated from the University of California, San Diego, with a B.S. degree in Management Science / Economics. Brian holds his Series 7 and 66 licenses, and Certified Financial Planner® certification (CFP®).

Brian enjoys spending time with friends, watching movies, and playing tennis and football. Brian practices Shaolin Kung Fu and won second place in the broad sword event and third place in the bare fist event at the 2000 Shaolin Kung Fu competition.

Brian is fluent in English and Mandarin Chinese.

About Roger Li

Roger Li graduated from University of California, Santa Barbara with a B.S. in Statistics and Data Science in 2019. Prior to joining Morgan Stanley in 2024, he worked at First Republic and JP Morgan Chase for 3 years, mainly on new accounts and alternative investment operations. He currently holds Series 7, 24, 63, and 65 licenses from FINRA, and Certified Financial Planner® certification (CFP®).

Roger was born in Shanghai, China, and attended high school in California. In his leisure time, Roger enjoys playing tennis, cooking, photography, karaoke, history, and hiking. In 2023, Roger completed a 14-miles hike with 3800 ft of elevation gained.

Roger is fluent in English, Mandarin Chinese, Shanghainese, and conversational Cantonese.

About Maddie Lin

Before joining Morgan Stanley, Maddie spent 7 years working in startup fundraising, and assisted in developing growth strategies for multi-national brands in Taiwan. She holds a B.A. in History from National Taiwan University and earned her Business Fundamentals Certificate with a focus in Finance from the University of California, Los Angeles. She holds her Series 7 and 66 licenses from FINRA.

Maddie was born and raised in Taipei, Taiwan. Outside of work, she enjoys baseball and Formula 1 racing. She also has a passion for whisky tasting, exploring renowned distilleries and appreciating the artistry behind fine spirits.

Maddie is fluent in English, Mandarin Chinese, and Taiwanese.

About Karen Lyn Manuharan

Karen received her B.S. degree in Actuarial Science from University of Nebraska-Lincoln in 2015 and MBA from International American University in 2017. Karen holds her FINRA Series 7 and 66 licenses.

Prior to joining Morgan Stanley in 2023, Karen worked in the financial industry since 2015, including UBS Financial Services for 4 years. In her leisure time, Karen enjoys spending time with family and friends, travelling, exploring new restaurants, water sports, and skiing.

Karen is fluent in English, Mandarin, Cantonese, and Malay.

About Maggie Wang

maintenance. A versatile team member, Maggie helps with the team’s business administration, serves as the team’s tech trainer, and is also cross trained in executing trades for clients across Equities, Fixed Income, and Mutual Funds.

Maggie graduated from University of California, Irvine in 2019 with a B.A. in Business Economics and minor in Management in 2019. Prior joining Morgan Stanley in 2023, Maggie worked at UBS for 2 years. Maggie holds Series 7 and Series 66 license from FINRA.

Maggie was born and raised in mainland China. She was educated in mainland China until middle school before attending high school in the U.S. During her leisure time, Maggie enjoys traveling, watching movies, playing badminton, baking, and spending time with her friends and family.

Maggie is fluent in English, Mandarin Chinese, and Cantonese.

About Jennifer Wu

Taiwan backgrounds (U.S. passport holders, Green Card holders, and non-US resident). Jennifer communicates

effectively with clients and assists Sean Yu with the implementation, execution, and monitoring of clients’ financial plans. Additionally, she takes care of all service-related questions for her clients, such as wires, transfers, internal journals, updating account information and helping clients log into Morgan Stanley Online (MSO).

Jennifer helps with opening domestic and foreign accounts such as individuals, corporations, retirement plans, personal holding companies, foreign grantor trusts, and irrevocable trust accounts established by foreign persons. Furthermore, she interprets Chinese documents and conducts research and analysis on non-resident client backgrounds to facilitate the account opening process.

Jennifer graduated from the University of California, Berkeley with a B.A. degree in Economics in 2019. She holds her Series 7 and 66 licenses from FINRA.

Jennifer was born in the U.S. and attended high school in Taiwan. Outside of work, music has a substantial influence on her life as she spent 10 years as the principal saxophonist and student conductor in her school's orchestra. In addition, she enjoys playing the piano and guitar in her spare time.

Jennifer is fluent in English, Mandarin Chinese, and Taiwanese.

About Yuki Zhang

Yuki graduated from University of Massachusetts, Amherst with a Bachelor of Science in Resource Economic and a minor in Psychology & Brain science in 2018 . She then completed her Master of Science in Real Estate and Infrastructure with a concentration in finance from Johns Hopkins University in 2020. Yuki holds Series 7 licenses from FINRA. Prior to joining Morgan Stanley in 2024, Yuki worked in the real estate industry.

Yuki was born in Hangzhou, China, and attended high school in Cambridge, Massachusetts. In her leisure time, Yuki likes attending open houses, nurturing her passion for interior design and home improvement. She also finds relaxation and enjoyment in playing lacrosse, golf, practicing yoga, ice skating and hiking.

Yuki is fluent in English and Mandarin Chinese.

About Cindy Zhou

Cindy holds the Series 7 and 66 licenses from FINRA and the Chartered Financial Analyst (CFA) designation. She is an actively contributing as a member of the CFA LA Society. She earned her M.S. in Financial Engineering from the University of Southern California in 2014 and B.S in Insurance from Nankai University in 2012. Prior to her tenure at Morgan Stanley, Cindy accumulated 6 years of experience in financial analysis, planning, and advisory roles with East West Bank and Intercontinental Exchange.

Beyond her professional endeavors, Cindy finds fulfillment in spending quality time with her family, exploring National Parks, and capturing picturesque moments through photography. She is a PADI Certified Open Water Diver.

Cindy is fluent in English and Mandarin Chinese.

About Emma Hsu

Prior to joining Morgan Stanley, Emma worked in the financial industry since 2013, including 7 years at J.P. Morgan and 3 years at Cathay Private Equity Co. She obtained her undergraduate degree from National Central University in Business Administration. She is currently studying for her SIE license.

Emma was born and raised in Taiwan. Outside of work, she enjoys traveling, playing golf, photography, and practicing Pilates. She also has a passion for wine tasting.

Emma is fluent in English, Mandarin Chinese, and Taiwanese.

Contact Sean Yu

Contact Davin Chen

Contact Kevin Yu

Awards and Recognition

Portfolio Insights

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

Insights and Outcomes

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Private Wealth Management Podcast

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

1Morgan Stanley Smith Barney LLC and its affiliates and their employees (including Financial Advisors and Private Wealth Advisors) are not in the business of providing tax or legal advice. These materials and any statements contained herein should not be construed as tax or legal advice. Individuals should consult their personal tax advisor or attorney for matters involving taxation and tax planning and their attorney for matters involving personal trusts and estate planning.

2Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

3Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley