Morgan Stanley Private Wealth Management

Sean Yu, CFP®, CPWA®, CAP®, ChSNC®

Managing Director, Private Wealth Management,

Private Wealth Advisor,

International Client Advisor,

Senior Portfolio Management Director,

Alternative Investments Director,

Family Wealth Director,

Global Sports and Entertainment Director,

Senior Investment Management Consultant,

Workplace Advisor – Equity Compensation

Direct:

(626) 405-9393(626) 405-9393

Industry Award Winner

Industry Award WinnerMy Mission Statement

To empower diverse high-net-worth individuals and families to preserve and grow their wealth through experienced, culturally attuned guidance. With best-in class, multi-faceted capabilities, our team navigates complex multi-generational planning with precision and care—helping clients create a legacy that uplifts their families, communities, and causes they care about.

My Story and Services

Sean Yu, CFP®, CPWA®, CAP®, ChSNC®, is Founder and lead FA of the Sean Yu Group. He ensures that his team delivers an outstanding overall wealth management experience to their ultra-high net worth clients, who originate from the Greater China Region—with a focus on mainland China, Hong Kong & Taiwan territories. The team’s clientele ranges from those born domestically in the USA, those that have been living in the US for a significant time, to recently immigrated and non-resident aliens. He prides himself on his multi-cultural team’s ability to successfully provide clients with Best-in-Class service.

Sean has consecutively ranked on Forbes America’s Top Wealth Advisors for 2016 to 2025 and #8 of Best-In-State Wealth Advisors in Los Angeles in 2025. He was ranked by On Wall Street in its Top 40 Financial Advisors Under 40 for four consecutive years— #7 in 2014, #6 in 2015, #4 in 2016, and #3 in 2017. Also, from 2016 through 2025, he was listed among Barron’s Top 1200 Financial Advisors in California.

Sean received his Master of Arts in international relations from the University of Chicago in 2002, and he received an Honorary Doctorate Degree from California State Polytechnic University-Pomona in 2023. He holds Series 3, 7, 31, and 66 licenses from FINRA, Certified Financial Planner® (CFP®), Certified Private Wealth Advisor® (CPWA®), and Chartered Advisor in Philanthropy (CAP®) certifications.

Sean leads in numerous philanthropic and social leadership activities. In 2012, he established the Sean Yu International Relations Fellowship at the University of Chicago to help underprivileged students at the university and has committed a total of $1.75 million to University of Chicago. In 2020, Sean established the Sean Yu Travel Fund at the University of Chicago for students and faculty to conduct research and study in Taiwan and China. In 2014, he created the Taiwanese American Scholarship Fund to alleviate college tuitions of underprivileged students of Taiwanese descent. He has committed $1 million personally and raised over $4 million in pledges to support around 100+ students. In 2015, he was awarded the Philanthropy Leadership Award by the Asian Pacific Community Fund for helping them create their donor-advised fund program and raise over $10 million in donations. In the same year, he co-founded the Los Angeles Chapter of The Chinese Finance Association with over 150 active members from various areas of the financial services industry.

For his professional achievements and community contributions, Sean was awarded the Asian Business Award from Los Angeles Business Journal for the public company category in 2014. He was also listed among Los Angeles Business Journal’s 40 In Their 40's in Accounting & Financial Services Professionals in 2020. He currently serves on the Advisory Council of the Division of the Social Sciences at the University of Chicago. Additionally, he currently sits on the Investment Committee of the board of directors at Cal Poly Pomona University Philanthropic Foundation, having formerly chaired the Investment Committee for 3 years, and chaired the Audit Committee for a year.

In his spare time, Sean enjoys playing tennis and basketball. He has been to more than 100 Michelin starred restaurants, and his favorite restaurants include Providence in Los Angeles, Joel Robuchon in Las Vegas, Raw in Taipei, Bo Innovation in Hong Kong, Xin Rong Ji (新榮記) in Beijing, and Kikunoi Honten in Kyoto.

Sean is fluent in English, Mandarin Chinese, and Taiwanese.

Sean has consecutively ranked on Forbes America’s Top Wealth Advisors for 2016 to 2025 and #8 of Best-In-State Wealth Advisors in Los Angeles in 2025. He was ranked by On Wall Street in its Top 40 Financial Advisors Under 40 for four consecutive years— #7 in 2014, #6 in 2015, #4 in 2016, and #3 in 2017. Also, from 2016 through 2025, he was listed among Barron’s Top 1200 Financial Advisors in California.

Sean received his Master of Arts in international relations from the University of Chicago in 2002, and he received an Honorary Doctorate Degree from California State Polytechnic University-Pomona in 2023. He holds Series 3, 7, 31, and 66 licenses from FINRA, Certified Financial Planner® (CFP®), Certified Private Wealth Advisor® (CPWA®), and Chartered Advisor in Philanthropy (CAP®) certifications.

Sean leads in numerous philanthropic and social leadership activities. In 2012, he established the Sean Yu International Relations Fellowship at the University of Chicago to help underprivileged students at the university and has committed a total of $1.75 million to University of Chicago. In 2020, Sean established the Sean Yu Travel Fund at the University of Chicago for students and faculty to conduct research and study in Taiwan and China. In 2014, he created the Taiwanese American Scholarship Fund to alleviate college tuitions of underprivileged students of Taiwanese descent. He has committed $1 million personally and raised over $4 million in pledges to support around 100+ students. In 2015, he was awarded the Philanthropy Leadership Award by the Asian Pacific Community Fund for helping them create their donor-advised fund program and raise over $10 million in donations. In the same year, he co-founded the Los Angeles Chapter of The Chinese Finance Association with over 150 active members from various areas of the financial services industry.

For his professional achievements and community contributions, Sean was awarded the Asian Business Award from Los Angeles Business Journal for the public company category in 2014. He was also listed among Los Angeles Business Journal’s 40 In Their 40's in Accounting & Financial Services Professionals in 2020. He currently serves on the Advisory Council of the Division of the Social Sciences at the University of Chicago. Additionally, he currently sits on the Investment Committee of the board of directors at Cal Poly Pomona University Philanthropic Foundation, having formerly chaired the Investment Committee for 3 years, and chaired the Audit Committee for a year.

In his spare time, Sean enjoys playing tennis and basketball. He has been to more than 100 Michelin starred restaurants, and his favorite restaurants include Providence in Los Angeles, Joel Robuchon in Las Vegas, Raw in Taipei, Bo Innovation in Hong Kong, Xin Rong Ji (新榮記) in Beijing, and Kikunoi Honten in Kyoto.

Sean is fluent in English, Mandarin Chinese, and Taiwanese.

Securities Agent: CO, DE, FL, GA, HI, IL, IN, MA, MD, MI, MN, MO, NC, ND, NJ, NV, NY, OH, OR, TX, UT, VA, WA, CT, AZ, CA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1398728

CA Insurance License #: 0E12405

NMLS#: 1398728

CA Insurance License #: 0E12405

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

About PWM

Founded in 1977, Private Wealth Management is the division of Morgan Stanley Wealth Management that is dedicated to serving the firm’s most affluent clients, including some of the world’s most accomplished entrepreneurs, executives and stewards of multigenerational wealth. Functioning as an exclusive investment boutique within a global financial firm, we deliver sophisticated solutions that leverage the intellectual capital and insight of Morgan Stanley’s substantial global resources. Drawing on a deep understanding of your financial life, our goal is to help you:

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

Private Wealth Management Highlights

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

1 Morgan Stanley Wealth Management, September 2025

Source: Barron's (Awarded March 2025) This ranking was determined based on an evaluation process conducted by Barron's for the period Oct 2023-Sept 2024. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to Barron's to obtain or use the ranking. This ranking is based on an algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the assessment of Barron's and may not be representative of any one client’s experience. This ranking is not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with Barron's. Barron’s is a registered trademark of Dow Jones & Company, L.P. All rights reserved.

Approach

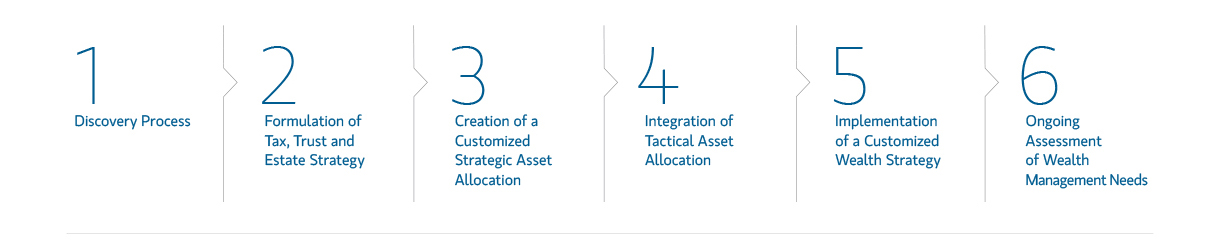

Discovery Process

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

55 South Lake Ave

Ste 700

Pasadena, CA 91101

US

Direct:

(626) 405-9393(626) 405-9393

Fax:

(626) 405-9339(626) 405-9339

Awards and Recognition

Barron's Top 1,200 Financial Advisors: State-by-State

2014-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2014-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Barron's Top 250 Private Wealth Management Teams

Barron's Top 250 Private Wealth Management Teams Source: barrons.com (Awarded May 2024) Data compiled by Barron's for the period Jan 2023-Dec 2023.

Forbes Best-In-State Wealth Advisors

2019-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2019-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Forbes America's Top Wealth Advisors

2016-2025 Forbes America's Top Wealth Advisors Source: Forbes.com (Awarded 2016-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of the year the award was issued.

Forbes Best-In-State Wealth Management Teams

2024-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2024-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

5

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Private Wealth Management Podcast

Bringing you engaging stories and key insights surrounding the complexities associated with significant wealth, including:

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

LISTEN | Passion Assets: Investing in Art

Article Image

Insights and Outcomes

Thought Leadership for our ultra high net worth clients, which contains thought-provoking articles, authored by leading experts from Morgan Stanley Family Office Resources.

Wealth Management for Athletes and Entertainers

Understanding the unique financial challenges of athletes and entertainers and how they differ from one profession to the next, we deliver the experience and resources you need to help create and implement a comprehensive, multigenerational wealth management plan based on your needs, values and aspirations.

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

We look forward to discussing your needs and goals, and the exceptional resources we can place at your disposal.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley

CRC 4237142 (02/2025)