Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story

Integrity. Exceptional Service. Commitment to Improvement.

At Pinnacle View Wealth Management our journey began with a singular vision: to provide high-net worth families unparalleled wealth management services rooted in integrity, exceptional service, and a steadfast commitment to continuous improvement.

Integrity is the cornerstone of our practice. From day one, we have been dedicated to building trust with our clients through transparency and honesty. We believe that strong, enduring relationships are built on trust, and we strive to earn and uphold that trust every day.

Our commitment to exceptional service drives everything we do. We understand that each family's financial situation is unique, and we take pride in offering personalized solutions that reflect your individual goals and aspirations. Our team of seasoned professionals is always ready to go the extra mile, ensuring that every interaction is marked by attentiveness, responsiveness, and care.

We are unwavering in our commitment to improvement. In the ever-evolving world of finance, staying ahead means continually seeking knowledge and refining our strategies. We invest in ongoing education and leverage the latest tools and technology to provide innovative solutions that keep your financial plan aligned with your goals.

From comprehensive financial planning and strategic investment management to proactive tax and estate planning, we offer a holistic approach to wealth management. Our goal is to simplify the complexities of your financial life, allowing you to focus on what matters most: enjoying your wealth and securing your legacy for future generations.

At Pinnacle View Wealth Management, we are more than just financial advisors; we are dedicated in helping navigate your path to your goals. We would very much like to hear your story and help provide you with a solution. Contact us today.

- Professional Portfolio ManagementFootnote1

- Estate Planning StrategiesFootnote2

- Business Succession PlanningFootnote3

- Financial PlanningFootnote4

- Wealth ManagementFootnote5

- Alternative InvestmentsFootnote6

- Sustainable InvestingFootnote7

- Philanthropic ManagementFootnote8

- Cash Management and Lending ProductsFootnote9

- Stock Plan ServicesFootnote10

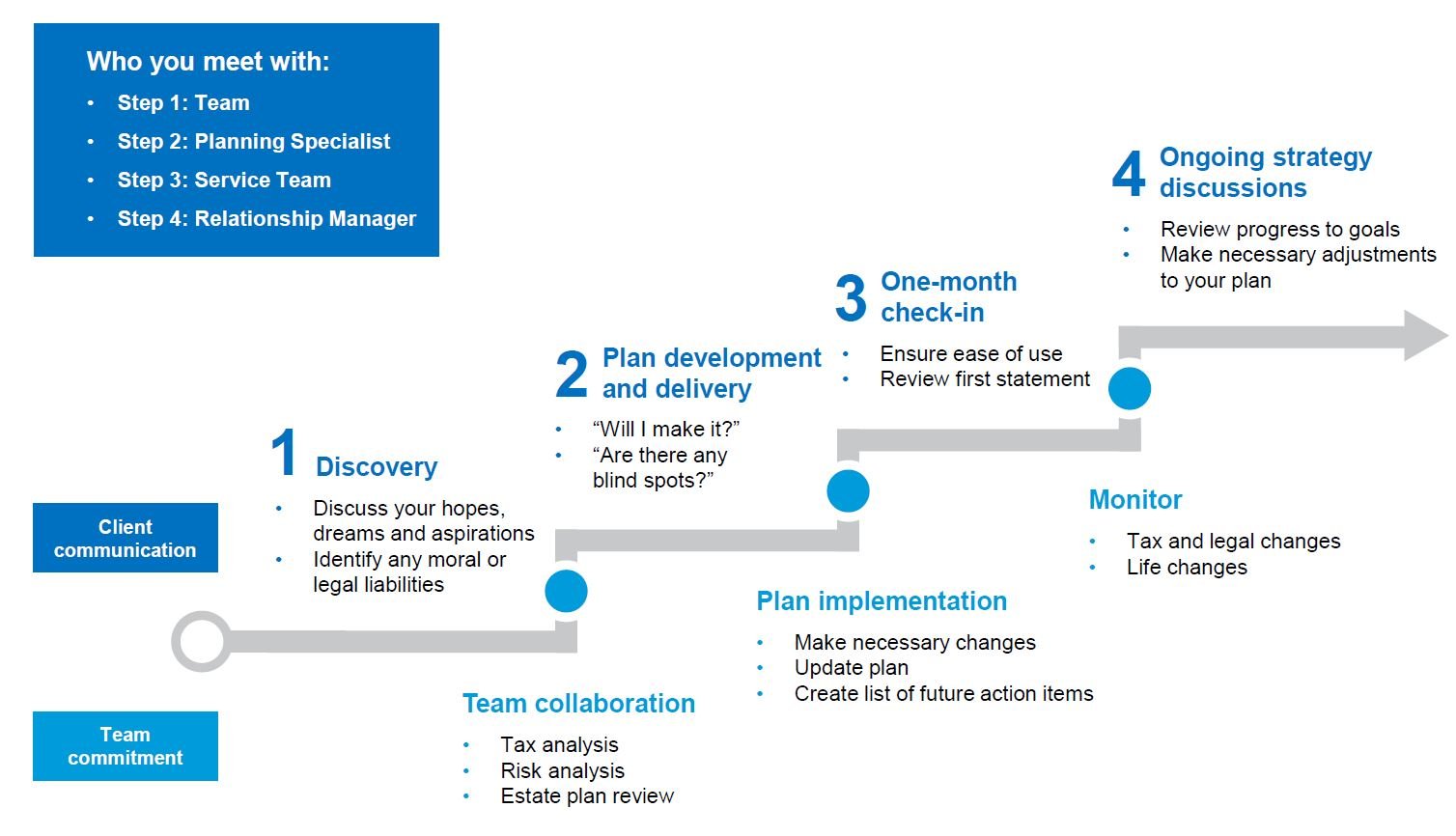

The Pinnacle View Process

"Our process is designed to help you plan for life's challenges and support you through difficult times. We want you to have confidence that you have a guide beside you every step of the way."

-Tim Metcalf

Our Comprehensive Wealth Management Process

Step 1: Discovery

We take the time to understand your unique hopes, dreams, and goals. We conduct an in-depth analysis of your assets, entities, and the progress you have already made toward achieving your objectives. This holistic approach ensures we have a complete picture of your financial landscape.

Step 2: Plan Development and Delivery

We meticulously process all gathered data to formulate a customized recommendation tailored to your specific needs and aspirations. Our comprehensive plan addresses all facets of your financial life, ensuring a strategic and cohesive approach to wealth management.

Step 3: Plan Implementation

We put our recommendations into action. Our team of specialists execute the plan with precision, coordinating all aspects to ensure seamless integration with your existing financial structure and optimizing for efficiency and effectiveness.

Step 4: Ongoing Strategy Conversations

We believe that wealth management is an ongoing process. Through regular Strategy Conversations, we continuously monitor and adjust your plan to reflect changes in your life and the financial landscape. Our proactive approach helps ensure that your strategies remain aligned with your evolving goals, providing you with financial confidence.

This formalized process highlights our dedication to thorough, personalized, and dynamic wealth management services.

Location

Meet Pinnacle View Wealth Management Group

About Tim Metcalf

Tim brings over 15 years of experience in the Financial Services industry. Prior to joining Morgan Stanley, Tim worked at J.P. Morgan as a Financial Advisor.

Tim is very active in his community, supporting Veteran’s causes around the valley and state. He is involved in Blue Blazer for Fighter Country Foundation, which supports the airmen at Luke AFB, Alzheimer’s Foundation Arizona Helping Hands, and Team Bradley Bear.

When Tim isn’t working, he enjoys spending time with his family. He enjoys being outdoors and is often hiking, golfing, scuba diving, or snowboarding. Tim lives in Paradise Valley, Arizona, with his wife Ashley, daughter Finley, son Silas, and their golden retriever, Brutus.

NMLS#: 1993708

About Jack Regier

Prior to joining Morgan Stanley in 2022, Jack was a Senior Financial Consultant at E*TRADE, where he provided stock plan education, concentrated position analysis, financial planning, and investment advice. He also worked at Lincoln Financial as a Paraplanner and in Investment Relationships where he built financial plans, assisted with client reviews, and performed due diligence on investment relationships for his group.

Jack received his B.S in Finance from Santa Clara University in 2010. In 2015, Jack earned his CERTIFIED FINANCIAL PLANNER™ (CFP®) designation from the Certified Financial Planner® Board of Standards, an independent regulatory organization.

Originally from California, Jack recently moved to Arizona with his wife, Kelsey, his two daughters, Charlotte and Molly, and their dog, Teddy. In his free time, Jack loves to travel. He has been to Hawaii a few times with his family, which he thoroughly enjoyed! He also loves to play golf and is an avid Dodgers fan.

NMLS#: 2434248

About Stacy M. Morton

Stacy is a Chartered Retirement Planning Counselor® (CRPC®), as well as a Financial Planning Associate. She has earned her FINRA Series 7 and 66 licenses and holds a B.S in Management from Western International University.

A Phoenix native, Stacy currently lives in Scottsdale, Arizona with her husband Paul and their rescue dog Guinness. In her free time, Stacy enjoys spending time with her 8 nieces and nephews, traveling around Arizona, and visiting national parks. She is also very involved in her community, and enjoys volunteering with food organizations and foster care.

About Maddie Alcorn

Maddie is a CERTIFIED FINANCIAL PLANNER™ who has spent the past decade mastering her knowledge of the financial services industry. With experience in client service and the employer plan space, Maddie has a diverse background and understanding of our clients’ needs. She graduated from Northern Arizona University’s Franke College of Business with degrees in management and marketing.

A proud fifth-generation Arizonan, Maddie embraces all that her home state has to offer- from hiking, to golf, to spring training. She is a Northern Arizona University alumni alongside her husband, Nate who were both tour guides on campus while students. Together, they are passionate sports fans who love cheering on the Clemson Tigers and Colorado Avalanche. At home, life is full of laughter and snuggles with their two daughters, Callie and Alannah, and sweet rescue dog, Abbey.

NMLS#: 1923268

About David Seay, CRPC®

David is a local native of Scottsdale and currently resides in Mesa, Arizona with his black lab, Tyson. Outside of the office, David loves to spend time working out, playing poker, watching mixed martial arts, and enjoying time spent with family and friends. He loves to be involved in the community and has done lots of work with local organizations including "Valley of Sun United Way" and "Feed My Starving Children".

About Alison Smith, CFP®

Alison graduated from Grand Canyon University with a B.S in Finance and Economics and currently holds her FINRA Series 7 and Series 66 licenses as well as her Arizona Life, Accident & Health Insurance licenses.

After growing up in Tucson, Arizona, Alison now calls Phoenix home. In her free time, she enjoys spending time with friends and family, trying different workout classes, and rooting for Arizona sports teams. Most recently, Alison has taken up golf and pickleball!

About Jera Cain

Jera earned her Bachelor of Science in Psychology from Arizona State University and holds her FINRA Series 7 and 63 licenses.

Originally from San Diego, California, Jera currently resides in Phoenix, Arizona, with her husband Rob and their three cats. In her free time, she enjoys reading, traveling and exploring new places. She also enjoys giving back to her community. Her ‘adopted’ charity organization is HALO – Helping Animals Live On. HALO provides a no-kill safe-haven where extraordinary measures are taken to save homeless pets and protect them from abuse and neglect. HALO engages their community by providing resources, education and programs to do the same. She has been a long supporter of their cause, having helped through charitable contributions, by organizing multiple collection drives and by spearheading and participating in hands-on volunteer events.

About Jayden Parkinson

Prior to joining the team, Jayden graduated from Utah State University with a B.S. in Finance and Economics and currently holds his FINRA Series 7 and Series 66 licenses. He began his career with Morgan Stanley at the Virtual Advisory Center.

Jayden is originally from Utah and currently resides in Gilbert, Arizona. In his free time, Jayden loves to play golf and read.

About Max Dunlap

Max earned his Bachelor of Science in Finance from Arizona State University and holds his FINRA Series 7 and 66 licensees.

Originally from Waimanalo, Hawaii, Max currently resides in Tempe, Arizona. In his free time, Max enjoys golfing, swimming, traveling, cooking and watching sports. Max also enjoys getting involved with the community and regularly volunteers with the “Boys and Girls Club” and beach cleanups in Hawaii.

Contact Tim Metcalf

Contact Jack Regier

Contact Stacy M. Morton

Contact Maddie Alcorn

Awards and Recognition

Winter Newsletter 2026

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

5Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

8Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley