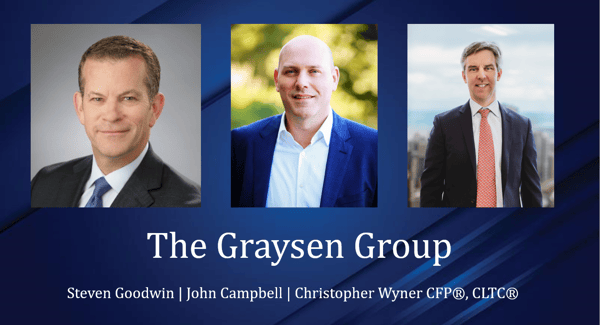

The Graysen Group at Morgan Stanley

Our Mission Statement

We pride ourselves on understanding the unique needs of high-net-worth clients like you and commit to delivering high quality service with a wide array of investment solutions.

Our Story and Services

As your Financial Advisors, we can help you define and strive to meet your goals by delivering a vast array of resources to you in the way that is most appropriate for how you invest and what you want to achieve. We have experience with the unique challenges, styles and strategies that distinguish wealthy investors. We will work with you to help you preserve and grow your wealth, relying on the insights of seasoned investment professionals, a premier trading and execution platform and a full spectrum of investment choices.

Morgan Stanley serves many of the world’s most sophisticated investors, and our firm is one of the nation’s leading firms to help clients with their personal wealth.

Morgan Stanley serves many of the world’s most sophisticated investors, and our firm is one of the nation’s leading firms to help clients with their personal wealth.

Services Include

- Wealth ManagementFootnote1

- Estate Planning StrategiesFootnote2

- Retirement PlanningFootnote3

- Professional Portfolio ManagementFootnote4

- Trust ServicesFootnote5

- Qualified Retirement PlansFootnote6

- Alternative InvestmentsFootnote7

- Business PlanningFootnote8

- Cash ManagementFootnote9

- Executive Benefit ServicesFootnote10

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Location

233 S Wacker Dr

Ste 8600

Chicago, IL 60606

US

Direct:

(312) 827-6500(312) 827-6500

Meet The Graysen Group

About Steven Goodwin

Steven Goodwin is a Sr. Vice President and Portfolio Management Director at Morgan Stanley in their Wealth Management Division since 2008 and originally joined the firm from Bear, Stearns & Co. in 2000.

Prior to his portfolio management duties at Bear Stearns, Goodwin worked as a financial advisor with UBS Paine Webber in Chicago, developing wealth management strategies for the firm’s high net-worth client group and establishing retirement plans for small and mid-sized companies. In his current position with Morgan Stanley, Goodwin is a portfolio management director and senior vice president, overseeing portfolios and the wealth management needs for private clients, foundations and family offices.

Mr. Goodwin is a past member on the Board of Directors of the Union League Club of Chicago. Formerly serving as the chair the House Committee.

Goodwin attended the University of Oregon, studying political science and history. He is also a veteran of the United States Army, having served in the Army from 1984 to 1988 with the 7th Infantry Division as a Recon Platoon, Sniper Team Leader with the Headquarters and Headquarters Company (HHC) of the 4th Battalion 17th Infantry Regiment.

Goodwin also attended numerous combat leadership and tactical training courses. He is also recognized by the Dept. of the Army and holds the honor of “Distinguished Member of the 17th Infantry Regiment” for displaying exemplary service and demonstrating a high level of “Esprit de Corps”.

Additionally, he has served as the founding chairman of the Veterans Advisory Council at National Louis University in Chicago. In 2016 he was awarded an honorary doctorate degree from National Louis for his work in advancing veteran education outcomes.

Goodwin was recognized by the National Infantry Association in 2013 and was selected as a recipient of the Order of Saint Maurice for his continued support of the Infantry and the U.S. Army.

Prior to his portfolio management duties at Bear Stearns, Goodwin worked as a financial advisor with UBS Paine Webber in Chicago, developing wealth management strategies for the firm’s high net-worth client group and establishing retirement plans for small and mid-sized companies. In his current position with Morgan Stanley, Goodwin is a portfolio management director and senior vice president, overseeing portfolios and the wealth management needs for private clients, foundations and family offices.

Mr. Goodwin is a past member on the Board of Directors of the Union League Club of Chicago. Formerly serving as the chair the House Committee.

Goodwin attended the University of Oregon, studying political science and history. He is also a veteran of the United States Army, having served in the Army from 1984 to 1988 with the 7th Infantry Division as a Recon Platoon, Sniper Team Leader with the Headquarters and Headquarters Company (HHC) of the 4th Battalion 17th Infantry Regiment.

Goodwin also attended numerous combat leadership and tactical training courses. He is also recognized by the Dept. of the Army and holds the honor of “Distinguished Member of the 17th Infantry Regiment” for displaying exemplary service and demonstrating a high level of “Esprit de Corps”.

Additionally, he has served as the founding chairman of the Veterans Advisory Council at National Louis University in Chicago. In 2016 he was awarded an honorary doctorate degree from National Louis for his work in advancing veteran education outcomes.

Goodwin was recognized by the National Infantry Association in 2013 and was selected as a recipient of the Order of Saint Maurice for his continued support of the Infantry and the U.S. Army.

Securities Agent: GA, OR, NY, MI, WY, NV, NM, AZ, NC, ME, CT, AK, PA, IL, MD, LA, FL, WA, TX, SC, OH, NH, IN, HI, MN, KY, DC, WI, NJ, MO, ID, CO, CA, AR, DE, MA; General Securities Representative; Investment Advisor Representative

NMLS#: 1312551

NMLS#: 1312551

About John Campbell

John Campbell is a Senior Vice President, Wealth Management, for Morgan Stanley. With over thirty years’ experience in the fixed income markets, John concentrates on evaluating opportunities across the credit spectrum in the global bond markets. He brings this experience and insight to serve private clients and domestic and international clients across industries including biotechnology, software as a service (SaaS) and big data among others.

John was previously with J.P. Morgan Securities, UBS and Lehman Brothers where he focused on treasury and corporate cash investments for public/private companies. His previous career experience in the fixed income markets was with Nomura International Plc. in London and Hong Kong, J.P. Morgan Securities in Singapore and Credit Suisse First Boston in Tokyo. During his 12 year tenure in the international markets, John traded European sovereign debt, corporate and supranational debt instruments and also acted as a sales/trader of investment grade and non-investment grade structured credit products.

John graduated from the University of California, Berkeley with a B. A. in Social Science, and an emphasis in Economics and History. John lives in Walnut Creek, CA and has four children, 21-year-old boy/girl twins, and two younger sons, ages 17 and 13. John spends his free time with his children coaching Little League and playing various sports. He also enjoys photography, travel and other outdoor activities.

The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Financial Advisor invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

John was previously with J.P. Morgan Securities, UBS and Lehman Brothers where he focused on treasury and corporate cash investments for public/private companies. His previous career experience in the fixed income markets was with Nomura International Plc. in London and Hong Kong, J.P. Morgan Securities in Singapore and Credit Suisse First Boston in Tokyo. During his 12 year tenure in the international markets, John traded European sovereign debt, corporate and supranational debt instruments and also acted as a sales/trader of investment grade and non-investment grade structured credit products.

John graduated from the University of California, Berkeley with a B. A. in Social Science, and an emphasis in Economics and History. John lives in Walnut Creek, CA and has four children, 21-year-old boy/girl twins, and two younger sons, ages 17 and 13. John spends his free time with his children coaching Little League and playing various sports. He also enjoys photography, travel and other outdoor activities.

The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Financial Advisor invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor.

Securities Agent: WA, DE, SC, PA, AZ, CT, OR, NC, KY, MD, GA, NM, MI, WY, WI, ME, NY, NJ, IN, DC, CO, NV, MO, MN, MA, LA, IL, AR, AK, OH, HI, CA, TX, NH, ID, FL; General Securities Representative; Investment Advisor Representative

NMLS#: 529932

NMLS#: 529932

About Christopher Wyner

Christopher B. Wyner is a CERTIFIED FINANCIAL PLANNER™ who provides comprehensive wealth management counseling with a focus on long-term investing, diversification, and tax efficiency. Chris prides himself on diligently building customized strategies designed to meet the unique financial goals and investment objectives of each client. His client relationships are founded on trust and communication. Chris is committed to helping his clients feel confident that they are making sound investment decisions during all types of market conditions. With more than nineteen years of experience in the financial services industry, sixteen of which have been with Morgan Stanley, Chris is equipped to deliver a full suite of wealth management resources to his clients including Private Banking, Insurance, Estate Planning Strategies, and Trust Services.

Prior to joining Morgan Stanley in 2008, Chris was part of the Bernstein Global Wealth Management team, servicing high-net-worth clients, and Putnam Investments in corporate marketing. He holds a B.S. in Business Administration from the University of Vermont. In his free time, Chris enjoys playing paddle tennis and spending time with his family – these days you will catch him on the weekends watching his daughter, Catherine, play field hockey, and his son, Will, play tennis.

Prior to joining Morgan Stanley in 2008, Chris was part of the Bernstein Global Wealth Management team, servicing high-net-worth clients, and Putnam Investments in corporate marketing. He holds a B.S. in Business Administration from the University of Vermont. In his free time, Chris enjoys playing paddle tennis and spending time with his family – these days you will catch him on the weekends watching his daughter, Catherine, play field hockey, and his son, Will, play tennis.

Securities Agent: LA, AR, TX, NY, MN, IN, DC, AZ, MD, IL, ID, CO, CA, AK, NM, NH, MO, FL, WA, NC, DE, OR, WY, OH, MA, KY, GA, NJ, ME, NV, MI, CT, WI, SC, PA, HI; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1265047

NMLS#: 1265047

About James B Johnson

James Johnson joined Morgan Stanley in 2024 and serves as a Registered Associate. He prides himself on developing personal relationships with clients to understand their aspirations and tailor his service to meet their goals. He enjoys thinking about clients’ finances in the broader context of their lives, helping them to feel secure in their long-term plan.

James recently moved to Chicago from Seattle, where he graduated from the Foster School of Business at the University of Washington with a BA in Business Administration. In his free time, he enjoys skiing, travel, and finding ways to practice French.

James recently moved to Chicago from Seattle, where he graduated from the Foster School of Business at the University of Washington with a BA in Business Administration. In his free time, he enjoys skiing, travel, and finding ways to practice French.

About Craig Yong

Craig Yong joined Morgan Stanley in 2024 as a Registered Associate, leaving his previous role as a chef in a Michelin starred restaurant. Craig leverages his previous experience in client facing roles as a tech consultant and as an entrepreneur, where he managed relationships with clients, business partners, and customers.

Craig moved to Chicago from Singapore to attend the University of Illinois at Chicago, where he graduated with a BA in Economics. In his free time, Craig enjoys cooking, aquarium keeping, and Brazilian jiu jitsu.

Craig moved to Chicago from Singapore to attend the University of Illinois at Chicago, where he graduated with a BA in Economics. In his free time, Craig enjoys cooking, aquarium keeping, and Brazilian jiu jitsu.

About David McColl

David McColl joined Morgan Stanley in 2025 and serves as a Registered Client Relationship Analyst. He is passionate about forming and developing client relationships in order to understand their goals to personalize his service to best meet their needs. David is dedicated to helping clients navigate their financial journeys with clarity, trust, and strategic insight.

David recently moved back to Chicago after graduating from the University of Dayton with a BA in Finance. In his free time, David enjoys running on Chicago’s lake front, traveling to new places, rooting for Chicago’s sports teams, and playing tennis or golf with his friends and family.

David recently moved back to Chicago after graduating from the University of Dayton with a BA in Finance. In his free time, David enjoys running on Chicago’s lake front, traveling to new places, rooting for Chicago’s sports teams, and playing tennis or golf with his friends and family.

About Claudia Herman

Claudia Herman joined Morgan Stanley in 2026 and serves as a Client Relationship Analyst. She values building meaningful client relationships and providing thoughtful, personalized support to help clients feel confident in their long-term financial plans. She brings prior client-facing experience as a Consulting Analyst Intern at an independent registered investment advisor and as a Legal Assistant.

Claudia graduated from the University of Texas at Austin with a Bachelors in Economics and is originally from Chicago. Outside of work, she enjoys marathon running, volunteering at dog shelters, exploring new cities, and trying new restaurants.

Claudia graduated from the University of Texas at Austin with a Bachelors in Economics and is originally from Chicago. Outside of work, she enjoys marathon running, volunteering at dog shelters, exploring new cities, and trying new restaurants.

Contact Steven Goodwin

Contact John Campbell

Contact Christopher Wyner

Wealth Management

From Our Team

6 Financially Smart Ways to Start 2025

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The Graysen Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

5Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

5Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

9Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)