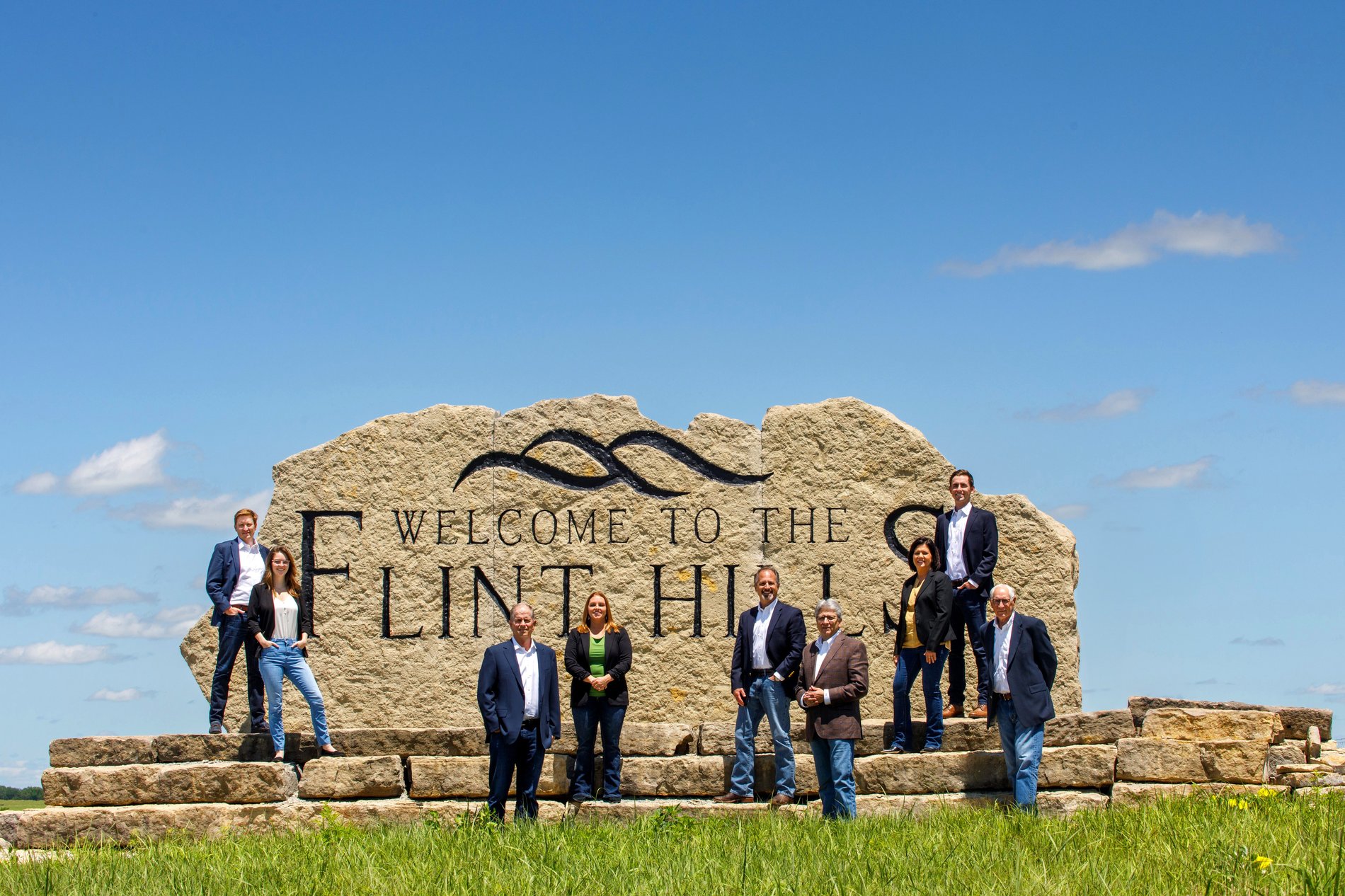

The Flint Hills Group at Morgan Stanley

Direct:

(316) 630-4416(316) 630-4416

Toll-Free:

(800) 365-4888(800) 365-4888

Industry Award Winner

Industry Award WinnerOur Mission Statement

Inspired by the strength of the Flint Hills, we leverage the power of a global firm to provide comprehensive financial guidance for you and your family.

Our Story

Our name is inspired by the strength and integrity of the Flint Hills in Kansas.

Like the Flint Hills, our team's strengths are rooted in history. The origins of The Flint Hills Group date back to 1966 when Paul Attwater's father started our financial advisor practice. More than half a century later, we proudly serve clients who have been with us since the beginning. We now work with the 4th and 5th generations of some of the families we serve.

With over 100 years of combined experience in the industry, many families have entrusted us with building, protecting, and preserving their wealth. Why? Because we offer professional financial guidance and dedicated client care. We bring the experience of all of our clients to each of our clients. This means that we apply the deep insight acquired from decades of experience to your unique needs and concerns.

Whether you're facing challenges around planning for retirement, tax mitigation, philanthropy, saving for education, or establishing a family legacy, we offer tailored guidance geared toward you and your family. And like the Flint Hills, you can trust that we are here for the long term.

Like the Flint Hills, our team's strengths are rooted in history. The origins of The Flint Hills Group date back to 1966 when Paul Attwater's father started our financial advisor practice. More than half a century later, we proudly serve clients who have been with us since the beginning. We now work with the 4th and 5th generations of some of the families we serve.

With over 100 years of combined experience in the industry, many families have entrusted us with building, protecting, and preserving their wealth. Why? Because we offer professional financial guidance and dedicated client care. We bring the experience of all of our clients to each of our clients. This means that we apply the deep insight acquired from decades of experience to your unique needs and concerns.

Whether you're facing challenges around planning for retirement, tax mitigation, philanthropy, saving for education, or establishing a family legacy, we offer tailored guidance geared toward you and your family. And like the Flint Hills, you can trust that we are here for the long term.

Services Include

- Wealth ManagementFootnote1

- Professional Portfolio ManagementFootnote2

- Financial PlanningFootnote3

- Retirement PlanningFootnote4

- Estate Planning StrategiesFootnote5

- Alternative InvestmentsFootnote6

- Structured ProductsFootnote7

- 401(k) Rollovers

- 529 PlansFootnote8

- AnnuitiesFootnote9

- Municipal BondsFootnote10

- Life InsuranceFootnote11

- Long Term Care InsuranceFootnote12

- Cash ManagementFootnote13

- Lending Products

- Philanthropic Services

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Working With Us

We advise individuals, families, executives and business owners who have often accumulated significant wealth, but need help managing and ultimately transferring their assets.

We treasure the long-term relationships formed with our clients and take pride in guiding multi-generational families through life’s financial challenges, while preserving their family values and legacy.

Often times, big life changes accompany financial decisions—birth, marriage, divorce, retirement, or a death. These can be emotional experiences, but with careful guidance, we help our clients ensure that with everything else they have to worry about, their financial strategy is being well managed.

We are humbled by the opportunity to make a difference in our clients' lives. Sometimes our impact is measured by returns on an investment, or securing the funds to send a child to college. Other times it is less tangible, like the comfort we provide while helping a client implement estate planning strategies after the death of a loved one.

Our clients have worked hard to build meaningful lives. That’s why we believe they deserve an exceptional team who is just as invested as they are in their future.

We treasure the long-term relationships formed with our clients and take pride in guiding multi-generational families through life’s financial challenges, while preserving their family values and legacy.

Often times, big life changes accompany financial decisions—birth, marriage, divorce, retirement, or a death. These can be emotional experiences, but with careful guidance, we help our clients ensure that with everything else they have to worry about, their financial strategy is being well managed.

We are humbled by the opportunity to make a difference in our clients' lives. Sometimes our impact is measured by returns on an investment, or securing the funds to send a child to college. Other times it is less tangible, like the comfort we provide while helping a client implement estate planning strategies after the death of a loved one.

Our clients have worked hard to build meaningful lives. That’s why we believe they deserve an exceptional team who is just as invested as they are in their future.

Our Beliefs

- We believe in delivering first-class service in a first-class way – with time-honored skills, top-tier professionalism, and responsive care.

- We believe in personal accountability and doing the right thing.

- We believe in regular communication and an attentive eye. We keep in touch consistently and adjust financial solutions when your needs or objectives change.

- We believe in personalized investment portfolios to best suit your goals. That’s why we don’t use cookie-cutter investment solutions for our clients.

- We believe that investment decisions should not be driven by emotion. That’s why we strive to create plans that are proactive, rather than reactive.

- We believe in leveraging the global resources of a world-class financial firm to help you build and preserve your wealth.

- We believe in collaborating with your other trusted advisors; including attorneys and CPAs. This way your financial strategy is both coordinated and comprehensive.

- We believe in giving back. We donate our time, talent and resources to support the community in which we live and work.

Location

1617 N Waterfront Pkwy

Ste 200

Wichita, KS 67206

US

Direct:

(316) 630-4416(316) 630-4416

Toll-Free:

(800) 365-4888(800) 365-4888

Meet The Flint Hills Group

About Paul R Attwater

As the founder of the Flint Hills Group, Paul advises high net worth families and small foundations. He is a 30-year veteran of the financial services industry and holds a Bachelor of Science in Economics from Kansas State University. Paul has been recognized as a Wichita Collegiate Outstanding Alumni, Wichita Business Journal 40 Under 40 (1999) and an Outstanding Board Member for Youth Entrepreneurs. Paul serves on the Kansas State University Economics Department Advisory Council and is a member of Wichita Rotary Club, Wichita Executives Association and Wichita Crime Commission. He continues to serve on the board of the Boy Scouts of America, Quivira Council.

Paul and his wife, Kim, enjoy traveling and spending time with family and friends. Paul and his four sons are Eagle Scouts.

Paul and his wife, Kim, enjoy traveling and spending time with family and friends. Paul and his four sons are Eagle Scouts.

Securities Agent: MT, ND, NE, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV, WY, NH, NC, AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

About Gregory S Brown

Greg began his professional career with his family’s construction company in 1991. He helped guide the business to significant growth as a pioneer in its industry before selling the firm in January of 2008. With seventeen years of owning and operating a successful business, Greg has a thorough understanding of financial concerns of business owners and individuals. He is committed to helping his clients with business strategies, risk management and financial planning.

A licensed financial advisor, he enjoys using his education and work experience to help clients build comprehensive financial plans and execute them using consistent and disciplined strategies. Greg earned his B.S. in Business Administration in 1988 and his Master’s in Business Administration in 1990 from the University of Kansas.

Outside of work, Greg has served on numerous committees for a variety of church and construction industry trade groups. He has served on the board of directors of the Salina Country Club and the Asphalt Recycling and Reclaiming Association (ARRA). Greg ultimately became the ARRA president in 2007. Greg and his wife Margaret have two boys, Brooks and Stratton.

A licensed financial advisor, he enjoys using his education and work experience to help clients build comprehensive financial plans and execute them using consistent and disciplined strategies. Greg earned his B.S. in Business Administration in 1988 and his Master’s in Business Administration in 1990 from the University of Kansas.

Outside of work, Greg has served on numerous committees for a variety of church and construction industry trade groups. He has served on the board of directors of the Salina Country Club and the Asphalt Recycling and Reclaiming Association (ARRA). Greg ultimately became the ARRA president in 2007. Greg and his wife Margaret have two boys, Brooks and Stratton.

Securities Agent: UT, AL, AR, AZ, CA, CO, DC, FL, GA, IA, IL, IN, KS, MA, MD, MO, NC, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, SC, SD, TN, TX, VA, WA, WY, AK, CT, ID, MN; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1406616

NMLS#: 1406616

About Gregory E. Ek

In these uncertain and volatile times, experience counts. With over fifty years in the financial services industry, including over twenty-six years as a financial advisor, I am dedicated to the long term financial success of my clients. My ultimate goal is to deliver to my clients high quality financial products, services, and advice backed by the vast global resources of Morgan Stanley.

I am a 1976 graduate of the University of Kansas with a degree in Business Administration. My wife, Debby and I have been married for over 45 years blessed with two adult children and five grandchildren.

I am currently a member and past president of the East Wichita Rotary Club. I have also been quite active in support of my alma mater, the University of Kansas, serving as a national board member of the KU Alumni Association, a member of the 2017 Chancellor Search Committee, and board member of the Wichita Area and Kansas City Area KU Alumni Chapters.

In addition, I currently serve as a Trustee of the Emporia State University Foundation and a member of the School of Business and Technology Dean’s Advisory Council providing me the opportunity to “give back” to my hometown university.

I am a 1976 graduate of the University of Kansas with a degree in Business Administration. My wife, Debby and I have been married for over 45 years blessed with two adult children and five grandchildren.

I am currently a member and past president of the East Wichita Rotary Club. I have also been quite active in support of my alma mater, the University of Kansas, serving as a national board member of the KU Alumni Association, a member of the 2017 Chancellor Search Committee, and board member of the Wichita Area and Kansas City Area KU Alumni Chapters.

In addition, I currently serve as a Trustee of the Emporia State University Foundation and a member of the School of Business and Technology Dean’s Advisory Council providing me the opportunity to “give back” to my hometown university.

Securities Agent: VA, UT, NC, IL, ID, CA, NJ, MA, LA, WA, IN, NE, GA, CT, TN, SC, NV, MO, AZ, NH, OK, KS, AL, OR, OH, NY, NM, IA, DC, CO, AR, AK, TX, PA, MN, FL, MD; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Transactional Futures/Commodities; Managed Futures

NMLS#: 1052542

NMLS#: 1052542

About Robert Ralston

Rob joined Morgan Stanley in 2015 and the Flint Hills Group in 2017. As a Family Wealth Advisor, Rob is keenly aware of the multi-generational needs of families and works with clients to establish a plan and strategy that encompasses their unique needs.

Before joining Morgan Stanley, Rob worked for Mission Peak Capital in Kansas City where he advised institutions and high net worth individuals that owned distressed fixed income securities and real estate. Rob began his career in New York City as an Equity Research Analyst covering health care stocks at Bank of America Securities. Rob earned his Bachelor of Science in Finance from the University of Kansas.

Outside of the office, Rob and his wife, Lindsey, are the proud parents of two daughters.

Before joining Morgan Stanley, Rob worked for Mission Peak Capital in Kansas City where he advised institutions and high net worth individuals that owned distressed fixed income securities and real estate. Rob began his career in New York City as an Equity Research Analyst covering health care stocks at Bank of America Securities. Rob earned his Bachelor of Science in Finance from the University of Kansas.

Outside of the office, Rob and his wife, Lindsey, are the proud parents of two daughters.

Securities Agent: KS, CA, KY, NV, MO, UT, NY, ME, HI, GA, VA, TN, NJ, NE, MD, MA, FL, CT, AL, NH, NC, IL, CO, AZ, OR, OK, NM, MN, IN, IA, DC, AK, PA, OH, ID, AR, WA, TX, DE; General Securities Representative; Investment Advisor Representative

NMLS#: 1475808

NMLS#: 1475808

About Jim Roman

Jim Roman is a Vice President, Financial Advisor with The Flint Hills Group at Morgan Stanley. With over 30 years of experience in the financial services industry, Jim has built his career by staying focused on providing clients and their families with an exceptional level of personal service working together to grow, preserve and distribute their wealth. Morgan Stanley allows him to couple that level of service with the resources and insight of a global investment firm, allowing him to better assist clients to live well, retire well and spend time on the good things in life.

A graduate of Wichita State University, Jim earned a bachelor’s degree in marketing and began his career in Banking with an emphasis on Private Banking and Family Wealth Management.

Outside of the office, Jim has served on numerous community Boards and is currently an active board member with the Central & Western Kansas Chapter of the Alzheimer’s Association. Jim and his wife Jennifer have been married for 35 years and enjoy traveling as well as spending time with their three daughter’s & their husbands.

A graduate of Wichita State University, Jim earned a bachelor’s degree in marketing and began his career in Banking with an emphasis on Private Banking and Family Wealth Management.

Outside of the office, Jim has served on numerous community Boards and is currently an active board member with the Central & Western Kansas Chapter of the Alzheimer’s Association. Jim and his wife Jennifer have been married for 35 years and enjoy traveling as well as spending time with their three daughter’s & their husbands.

Securities Agent: NC, AK, AL, AR, AZ, CA, CO, CT, DC, FL, GA, IA, ID, IL, IN, KS, MA, MD, MN, MO, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, SD, TN, TX, UT, VA, WA, WY; General Securities Representative; Investment Advisor Representative

NMLS#: 743070

NMLS#: 743070

About Brooks Brown

In March of 2024, Brooks joined the Flint Hills Group at Morgan Stanley, following in the footsteps of his father, Greg Brown, and grandfather, David Fancher. With a passion for financial stewardship and client success, Brooks is poised to help make significant impact on both current and future generations of clients.

Graduating from Washburn University, Brooks earned a BBA in Finance and Marketing, distinguishing himself within the top 10% of his business school class. While at Washburn, Brooks was a member of the golf team, served on the Student Athlete Advisory Committee, and was a member of the Washburn Finance Society.

Post graduation, Brooks served as a sales representative/customer development leader at Georgia Pacific in Green Bay, WI, and then Dallas, TX. Ultimately, managing $50 Million of distribution relationships across Texas, Oklahoma, and Arkansas.

He then relocated to Chicago, IL, where Brooks was responsible for revitalizing a grocery distribution branch, employing his experience to help stabilize financial operations, foster lasting customer relationships, and facilitate the growth of client businesses. His hands-on and relationship-based approach were instrumental in turning profits from negative to positive for the branch.

Now, at Morgan Stanley, Brooks eagerly anticipates leveraging his experiences and the capabilities of Morgan Stanley to help highly successful businesses and families develop a financial plan designed to help attain their goals and manage their wealth over generations.

Graduating from Washburn University, Brooks earned a BBA in Finance and Marketing, distinguishing himself within the top 10% of his business school class. While at Washburn, Brooks was a member of the golf team, served on the Student Athlete Advisory Committee, and was a member of the Washburn Finance Society.

Post graduation, Brooks served as a sales representative/customer development leader at Georgia Pacific in Green Bay, WI, and then Dallas, TX. Ultimately, managing $50 Million of distribution relationships across Texas, Oklahoma, and Arkansas.

He then relocated to Chicago, IL, where Brooks was responsible for revitalizing a grocery distribution branch, employing his experience to help stabilize financial operations, foster lasting customer relationships, and facilitate the growth of client businesses. His hands-on and relationship-based approach were instrumental in turning profits from negative to positive for the branch.

Now, at Morgan Stanley, Brooks eagerly anticipates leveraging his experiences and the capabilities of Morgan Stanley to help highly successful businesses and families develop a financial plan designed to help attain their goals and manage their wealth over generations.

Securities Agent: AL, TX, TN, PA, NJ, MN, IL, ID, VA, UT, NM, NH, MD, CT, AZ, AR, NY, NC, MA, WY, OK, OH, NE, KS, IA, CO, OR, IN, AK, WI, MO, SC, GA, FL, DC, WA, SD, NV, CA; General Securities Representative; Investment Advisor Representative

NMLS#: 2629884

NMLS#: 2629884

About Danielle Schreck

With more than 17 years of securities industry experience, Danielle serves as the team’s chief operations officer and registered portfolio associate. Her responsibilities include exceptional client service and organizational oversight of team operations. Prior to joining The Flint Hills Group, Danielle spent several years as the Operations Manager for Wells Fargo Advisors. Danielle received her bachelor’s degree in Business Management from Friends University. Danielle and her husband, Patrick, have four kids. They enjoy watching their kids’ various activities and traveling.

About Kay Koehler

Kay is a Senior Registered Associate with nearly 30 years experience in the financial services industry. She has established herself as a dedicated and knowledgeable asset to the Flint Hills Group. Kay excels in building strong client relationships and seeks to ensure that each client receives first-class service. Kay is a lifelong Kansan and is married with four kids and nine grandkids. She enjoys living in the country, traveling, and cooking.

About Emily Harris

Emily began her career with Morgan Stanley and the Flint Hills Group in 2021. Emily comes to us with exceptional credentials having graduated summa cum laude with a bachelor's degree from Newman University. Emily’s primary responsibilities include providing excellent client service and team and client support for the firm’s digital capabilities. She is a lifelong Wichitan and enjoys reading, traveling, and spending time with friends and family.

Contact Paul R Attwater

Contact Gregory S Brown

Contact Gregory E. Ek

Contact Robert Ralston

Contact Jim Roman

Contact Brooks Brown

Awards and Recognition

Forbes Best-In-State Wealth Management Teams

2025-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2025-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Greg Cole

Greg Cole is a Private Banker serving Morgan Stanley Wealth Management offices in Missouri.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Greg began his career in financial services in 1999 and joined Morgan Stanley in 2011. Prior to joining the firm, he was a Regional Banking Consultant at Wells Fargo Advisors. Greg has also served as an Area Manager with JP Morgan Chase and was a Senior Mortgage Consultant in the Smith Barney division at CitiMortgage.

Greg is a graduate of Rockhurst University, where he received a Bachelor of Arts in Psychology. He and his family currently reside in O’Fallon, Missouri. Outside of the office, Greg enjoys spending time with his family and friends.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Greg began his career in financial services in 1999 and joined Morgan Stanley in 2011. Prior to joining the firm, he was a Regional Banking Consultant at Wells Fargo Advisors. Greg has also served as an Area Manager with JP Morgan Chase and was a Senior Mortgage Consultant in the Smith Barney division at CitiMortgage.

Greg is a graduate of Rockhurst University, where he received a Bachelor of Arts in Psychology. He and his family currently reside in O’Fallon, Missouri. Outside of the office, Greg enjoys spending time with his family and friends.

NMLS#: 801927

About Jerry Luckett Jr.

Jerry Luckett Jr. is a Private Banker serving Morgan Stanley Wealth Management offices in Oklahoma, Missouri, and Kansas.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jerry began his career in financial services in 2020 and joined Morgan Stanley in 2022. Prior to joining the firm, he was a Senior District Consumer Banker at Webster Bank.

Jerry is a graduate of the Southern Connecticut State University, where he received a Bachelor of Arts in Interdisciplinary Studies and a Master of Science in Sports and Entertainment Management. He currently lives in Tulsa, Oklahoma with his wife Gabriela and their dog Zoe.

Jerry was a former professional basketball player in Europe, and an All-Conference basketball player for Southern Connecticut State University. Outside of the office, he enjoys playing basketball, lifting weights, and making music.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jerry began his career in financial services in 2020 and joined Morgan Stanley in 2022. Prior to joining the firm, he was a Senior District Consumer Banker at Webster Bank.

Jerry is a graduate of the Southern Connecticut State University, where he received a Bachelor of Arts in Interdisciplinary Studies and a Master of Science in Sports and Entertainment Management. He currently lives in Tulsa, Oklahoma with his wife Gabriela and their dog Zoe.

Jerry was a former professional basketball player in Europe, and an All-Conference basketball player for Southern Connecticut State University. Outside of the office, he enjoys playing basketball, lifting weights, and making music.

NMLS#: 2109945

About Andrew Ghimpeteanu

Andrew Ghimpeteanu is a Planning Associate at Morgan Stanley providing dedicated financial planning support to Financial Advisors and their teams. Operating as an extension of the FA/Team, he collaborates with clients to discover and define goals that matter most to them. Leveraging state of the art technology, he will evaluate various options and their potential outcomes to help clients confidently choose the appropriate course of action. Andrew provides expertise across a wide suite of Morgan Stanley planning tools designed to assist in the areas of investment accumulation, retirement, education, major purchase, cash flow, risk management, tax efficiency, and wealth transfer planning.

He earned his undergraduate degree from Bentley University and received the Financial Planning Specialist® designation from the College for Financial Planning. Andrew is originally from Atlanta, GA and currently resides in Alpharetta, GA.

He earned his undergraduate degree from Bentley University and received the Financial Planning Specialist® designation from the College for Financial Planning. Andrew is originally from Atlanta, GA and currently resides in Alpharetta, GA.

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Flint Hills Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

13Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

12Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

13Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)