The Eckert Group at Morgan Stanley

Our Mission Statement

We assist our clients in defining and pursuing their financial goals by integrating a personalized and simplified wealth management approach with clear communication.

Our Story and Services

As your Financial Advisors, we partner with you to define your objectives and implement a strategy aligned to your investment profile, time horizon, and long-term priorities. We deliver a comprehensive suite of capabilities and advice—tailored to how you invest and what you seek to achieve—designed to help preserve and grow your wealth across market cycles.

You will have access to a global network of experienced investment professionals, a premier trading and execution platform, and a broad, diversified set of investment solutions across public markets and alternative investments—including opportunities in private markets, where appropriate.

You will have access to a global network of experienced investment professionals, a premier trading and execution platform, and a broad, diversified set of investment solutions across public markets and alternative investments—including opportunities in private markets, where appropriate.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Approach

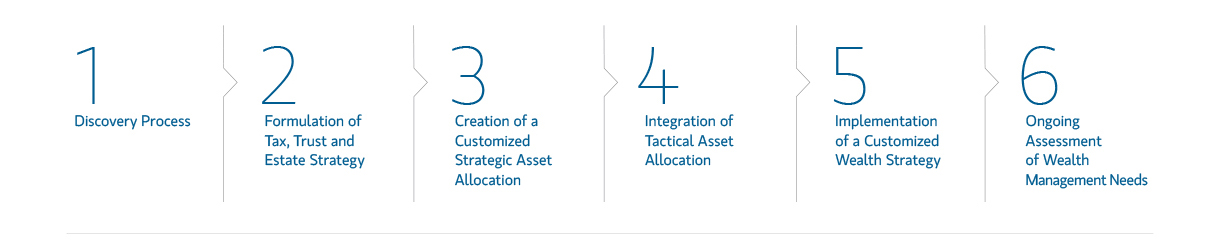

Discovery Process

Investing the time to learn about you and your family; your assets and liabilities and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Formulation of Tax, Trust and Estate Strategy

Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that may be used to address your objectives.

Creation of Customized Strategic Asset Allocation

Your customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans.

Integration of Tactical Asset Allocation

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

Implementation of a Customized Wealth Strategy

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

Ongoing Assessment

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

800 East 96 St

Ste 400

Indianapolis, IN 46240

US

Direct:

(317) 818-7371(317) 818-7371

Meet The Eckert Group

About Elizabeth English Eckert, MBA, CFP®

Elizabeth Eckert is a Senior Vice President, Investment Management Consultant, and Financial Advisor. She has over twenty five years of experience in wealth management and she began her financial services career at Morgan Stanley. Elizabeth has been recognized as an Indianapolis Five Star Wealth Manager from 2012-2020 and named a 2020 Top Wealth Advisor Mom by Working Mother and SHOOK Research.

Elizabeth holds a Bachelor’s in Communications from DePauw University and a MBA from The University of Notre Dame. She has added numerous professional credentials to help better serve her clients including: Certified Financial Planner (CFP®), Certified Divorce Financial Analyst (CDFA®) Investment Management Consultant, Indiana Insurance and LTC license.

Outside of the office, Elizabeth is active in the Indianapolis community. She is involved with Women For Riley, Gleaners Food Bank and volunteers at her church. Elizabeth likes to read, run and enjoys Orange Theory workouts. She and her husband, Kevin, like to stay very active with their two young children by biking, cooking and playing games.

Other awards:

2020 - Forbes American's Top Women Advisors

Source: Forbes.com (Awarded Apr 2020) Data compiled by SHOOK Research LLC based on time period from 9/30/18 - 9/30/19.

2025 - Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded Apr 2025) Data compiled by SHOOK Research LLC based on time period from 6/30/23 - 6/30/24.

2026 - Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2026) Data Compiled By Shook Research LLC Based On Time Period From 3/31/24-3/31/25.

2026 - Forbes Top Women Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Feb 2026) Data compiled by SHOOK Research LLC based on time period from 6/30/24 - 6/30/25.

Elizabeth holds a Bachelor’s in Communications from DePauw University and a MBA from The University of Notre Dame. She has added numerous professional credentials to help better serve her clients including: Certified Financial Planner (CFP®), Certified Divorce Financial Analyst (CDFA®) Investment Management Consultant, Indiana Insurance and LTC license.

Outside of the office, Elizabeth is active in the Indianapolis community. She is involved with Women For Riley, Gleaners Food Bank and volunteers at her church. Elizabeth likes to read, run and enjoys Orange Theory workouts. She and her husband, Kevin, like to stay very active with their two young children by biking, cooking and playing games.

Other awards:

2020 - Forbes American's Top Women Advisors

Source: Forbes.com (Awarded Apr 2020) Data compiled by SHOOK Research LLC based on time period from 9/30/18 - 9/30/19.

2025 - Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded Apr 2025) Data compiled by SHOOK Research LLC based on time period from 6/30/23 - 6/30/24.

2026 - Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2026) Data Compiled By Shook Research LLC Based On Time Period From 3/31/24-3/31/25.

2026 - Forbes Top Women Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Feb 2026) Data compiled by SHOOK Research LLC based on time period from 6/30/24 - 6/30/25.

Securities Agent: MA, FL, MI, OR, MN, IN, DC, AZ, WY, OH, VA, SC, MO, KS, LA, GA, CT, CO, NC, IL, MD, KY, CA, AL, WI, WA, TN, PA, NY, NJ, IA, TX; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1321539

NMLS#: 1321539

About Nathalie Mastouri

Nathalie joined Morgan Stanley in 2017, after working for over a decade in different corporate finance roles across multiple geographies.

She is committed to providing a holistic financial planning approach to successful executives, young professionals, business owners and affluent families living across the country. Her approach is focused on seeking to add value to different aspects of clients' financial lives by understanding her clients’ personal and financial goals, family dynamics, balance sheet needs and philanthropic activities.

Nathalie has a passion for architecture and design. She draws parallels between the way an architect combines form and function to enhance people's lives - both aesthetically and functionally - and the way a robust and carefully structured financial plan aims to help her clients navigate ever-changing market conditions while allowing them to (1) enjoy a comfortable retirement, (2) approach major life transitions with confidence, and (3) leave a lasting legacy for future generations.

She prides herself in acting as her clients’ best advocate, promptly responding, helping identify opportunities, and working to help clients stay on track to help them grow, preserve, and optimize their wealth.

When appropriate, Nathalie utilizes a multitude of investment vehicles including but not limited to, mutual funds, ETFs, separately managed accounts, individual stocks, direct indexing, private placements, and tax optimization strategies.

She holds a bachelor’s degree in Economics and a Masters in Finance from ESCP Business School. She holds Series 7, and 66 FINRA registrations, and Life, Health, and Long-Term Care Insurance licenses. She is a Certified Financial Planner (CFP®) and a Qualified Plan Financial Consultant (QPFC®). Nathalie has been earned a Five Star Wealth Manager Award in 2022, 2023, 2024, and 2025.

She lives in Indianapolis with her husband, and two kids. She has served on the board of Women for Riley, supports the local chapter of her Alma Mater, and Gleaners Food Bank.

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Source: fivestarprofessional.com Awarded 2022-2024. There awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2022 Award: 12/27/21 through 6/24/22

2023 Award: 11/14/22 through 5/31/23

2024 Award: 11/14/23 through 5/31/24

2025 Award: 11/14/24 through 5/31/25

She is committed to providing a holistic financial planning approach to successful executives, young professionals, business owners and affluent families living across the country. Her approach is focused on seeking to add value to different aspects of clients' financial lives by understanding her clients’ personal and financial goals, family dynamics, balance sheet needs and philanthropic activities.

Nathalie has a passion for architecture and design. She draws parallels between the way an architect combines form and function to enhance people's lives - both aesthetically and functionally - and the way a robust and carefully structured financial plan aims to help her clients navigate ever-changing market conditions while allowing them to (1) enjoy a comfortable retirement, (2) approach major life transitions with confidence, and (3) leave a lasting legacy for future generations.

She prides herself in acting as her clients’ best advocate, promptly responding, helping identify opportunities, and working to help clients stay on track to help them grow, preserve, and optimize their wealth.

When appropriate, Nathalie utilizes a multitude of investment vehicles including but not limited to, mutual funds, ETFs, separately managed accounts, individual stocks, direct indexing, private placements, and tax optimization strategies.

She holds a bachelor’s degree in Economics and a Masters in Finance from ESCP Business School. She holds Series 7, and 66 FINRA registrations, and Life, Health, and Long-Term Care Insurance licenses. She is a Certified Financial Planner (CFP®) and a Qualified Plan Financial Consultant (QPFC®). Nathalie has been earned a Five Star Wealth Manager Award in 2022, 2023, 2024, and 2025.

She lives in Indianapolis with her husband, and two kids. She has served on the board of Women for Riley, supports the local chapter of her Alma Mater, and Gleaners Food Bank.

The investments listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Source: fivestarprofessional.com Awarded 2022-2024. There awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2022 Award: 12/27/21 through 6/24/22

2023 Award: 11/14/22 through 5/31/23

2024 Award: 11/14/23 through 5/31/24

2025 Award: 11/14/24 through 5/31/25

Securities Agent: WI, SC, NJ, MD, GA, AZ, AL, FL, MO, MI, LA, IA, CT, MA, CO, KY, WA, PA, KS, DC, VA, TX, NC, IL, WY, TN, OH, NY, MN, IN, OR, CA; General Securities Representative; Investment Advisor Representative

NMLS#: 1898523

CA Insurance License #: California Insurance License # 4266971

NMLS#: 1898523

CA Insurance License #: California Insurance License # 4266971

About Lisa Caputo

Lisa began her career in the financial services industry in 1996, joining Morgan Stanley in 2011. With over 30 years of experience, Lisa brings a wealth of knowledge and experience to our organization. She has enjoyed a variety of roles which include client service and administrative responsibilities. Lisa holds her Series 7, 63, 66 and 9,10 FINRA licenses and has earned a Financial Planning Specialist Designation* with Morgan Stanley

A native of Michigan, Lisa moved to Indianapolis in 1999. She graduated from Davenport University with an Associate of Science in Sales and Marketing. In her free time, Lisa enjoys running, biking, hiking and travel.

*Disclaimer: This role cannot solicit or provide investment advice.

A native of Michigan, Lisa moved to Indianapolis in 1999. She graduated from Davenport University with an Associate of Science in Sales and Marketing. In her free time, Lisa enjoys running, biking, hiking and travel.

*Disclaimer: This role cannot solicit or provide investment advice.

Contact Elizabeth English Eckert, MBA, CFP®

Contact Nathalie Mastouri

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Eckert Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)