The Bargetto Ingesson Evans Group at Morgan Stanley

Our Mission Statement

solutions

Our Story and Services

As Morgan Stanley Financial Advisors, we have access to a superior platform, up-to-date research, and a wide range of investment options. We will always put our clients’ needs first and deliver exceptional ideas and advice. We are committed to winning your business and putting our vast resources to work for you.

- Retirement PlanningFootnote1

- 401(k) Rollovers

- Corporate Pension Plans

- Business PlanningFootnote2

- Wealth ManagementFootnote3

- Sustainable InvestingFootnote4

- Professional Portfolio ManagementFootnote5

- Endowments and FoundationsFootnote6

- Financial PlanningFootnote7

- Planning for Education FundingFootnote8

- Cash Management and Lending ProductsFootnote9

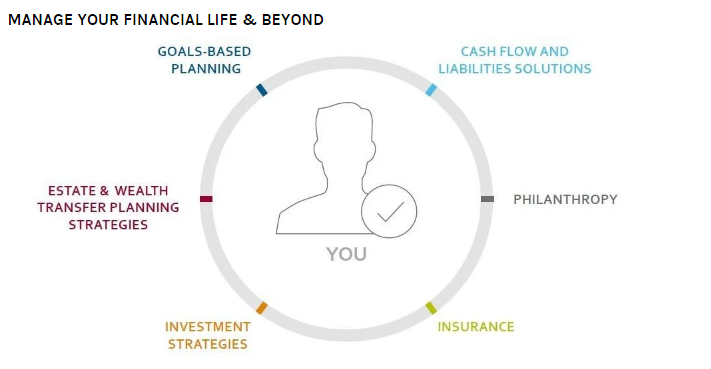

Manage Your Financial Life & Beyond

Reaching your goals often involves going beyond investment advice—we provide a wide array of offerings and services centered on you and customized to help meet your needs, and provide access to specialists to help pursue specific goals

Start with a conversation to gain a thorough understanding of your needs, lifestyle and family – and your goals for the future.

We work with you to develop portfolio strategies to help you achieve and protect the outcomes you envision.

Look across multiple accounts and products to help you implement solutions that are an appropriate fit for your strategy.

We help you track your progress as well as spending and savings to help ensure you remain on track toward your goals.

INSIGHTS & INFORMATION

Here at Morgan Stanley, we strive to make complex financial ideas more digestible so that our clients understand what is being done on their behalf to plan for their financial future. I am a firm believer of giving my clients as many resources as possible so they can stay informed about the latest market trends, outlooks, and breakdowns. The links below provide detailed analysis on interesting topics that are affecting the finance and business worlds.

Whether it is panic selling, hiding out in cash, or trading frantically during volatile markets, investors tend to make several mistakes that can hurt them long-term. Know how to spot—and avoid—the most common bad behaviors.

Global growth should stay steady at just over 3% in 2024 and 2025, though volatility will remain as a pickup in growth around the world contrasts with a slowdown in the U.S.

While investors have more data at their disposal than ever before, making the right investment decision takes more than just crunching numbers. Investors must also understand the psychology of the market—as well as their own impulses—to help sharpen their rational decision-making process. This is especially during periods of market volatility, when emotions often get in the way.

Location

Meet The Bargetto Ingesson Evans Group

About James Bargetto

Jim joined Morgan Stanley in 1984 as a Financial Advisor, where he continues to work primarily with high net worth families, foundations, endowments and corporate retirement plans. His areas of investment experience are well mixed between equity, fixed income, and cash and wealth management. He taught investment classes at the college level for over 20 years and has served as an elected board member of his local water agency for 19 years. Jim has been active in key organizations within the community such as the Dominican Hospital Foundation and the Santa Cruz Rotary Club.

Jim has been married to Suzie since 1983. He is a proud father of three beautiful daughters, Allison, Sarah, and Emma, and grandfather to William and George.

Named to Forbes’ Best-In-State Wealth Management Teams ranking for 2026

Source: Forbes.com (Awarded Jan 2026) Data compiled by SHOOK Research LLC based on time period from 3/31/24–3/31/25.

Awards Disclosures

NMLS#: 1380677

CA Insurance License #: 0A76328

About Roger Evans

Roger grew up in the Santa Cruz area and has remained here since. He graduated from University of California, Santa Barbara with a BA in Economics and Accounting, which lit a passion for all things capital markets and finances. Over the last 10 years at Morgan Stanley, he has earned the Senior Vice President title, building his expertise in developing nuanced planning solutions for high-net worth families, especially families with large private or illiquid equity holdings.

Roger lives in Scotts Valley with his wife and son. He enjoys spending time as much of his free time as possible enjoying the beautiful area, whether mountain biking with friends or hiking with family.

NMLS#: 1282646

CA Insurance License #: 0I23690

About Christine E. Ingesson

Originally from the Santa Cruz area, Christine graduated from the University of California, Santa Cruz with a BA in Global Economics and an emphasis in Latin American Economics. During her time at UCSC, she spent a semester at the Universidad de Costa Rica, studying economics as applied to Latin America in Spanish. Upon graduation in 2003, she began working with Morgan Stanley Wealth Management. She has since become a Senior Vice President and also holds the Certified Financial Planner™ designation, awarded by the Certified Financial Planner™ Board of Standards, Inc. in 2011. As Senior Vice President, her primary responsibilities include investment research, risk and liability management and general financial planning.

Christine enjoys playing an active role in her community. She is a member of the Scotts Valley Middle School and Vine Hill Elementary PTAs. Christine enjoys spending time outdoors, whether it is hiking, camping, skiing in Lake Tahoe, or kayaking on the Russian River. She and her husband live with their two young boys in the Santa Cruz Mountains.

Named to Forbes Top Women Wealth Advisors Best-In-State 2023

Source: Forbes.com (Awarded February 2023)

Data compiled by SHOOK Research LLC based on time period from 9/30/21 - 9/30/22.

Awards Disclosures

Named to Forbes’ Top Women Wealth Advisor ranking for 2021

Source: Forbes.com (Awarded Mar 2021) Data compiled by SHOOK Research LLC based on time period from 9/30/19 - 9/30/20.

Awards Disclosures

Named to Working Mother & SHOOK Research's Top Wealth Advisor Moms ranking for 2020 and 2021

Source: Workingmother.com (Awarded October 2020 and 2021)

Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

Awards Disclosures

Named to Forbes’ Best-In-State Wealth Management Teams ranking for 2026

Source: Forbes.com (Awarded Jan 2026) Data compiled by SHOOK Research LLC based on time period from 3/31/24–3/31/25.

Awards Disclosures

Named to Forbes' Top Women Wealth Advisors Best-In-State 2026

Source: Forbes.com (2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

NMLS#: 1282578

CA Insurance License #: 0F60364

About Matthew Zepeda

Clients enjoy working with Matt because he is generous with his time and embarks on the journey hand in hand with his clients. He has a caring demeanor that helps him most when working with families. For continuity of care, Matt especially enjoys working with younger generations and professionals helping them understand financial principles and the benefits of long-term investing.

Matt earned his Bachelor's degree from Loyola Marymount University in Los Angeles with a focus in Finance. Outside of work, Matt enjoys the outdoors and can be found in his free time playing pickleball or taking weekend trips with his friends. Matt was born and raised in Los Altos, in the heart of Silicon Valley, and has always been fond of the fast paced & innovative area that surrounds him.

Named to Forbes’ Best-In-State Wealth Management Teams ranking for 2026

Source: Forbes.com (Awarded Jan 2026) Data compiled by SHOOK Research LLC based on time period from 3/31/24–3/31/25.

Awards Disclosures

NMLS#: 2319518

About Maggie Martin

Contact James Bargetto

Contact Roger Evans

Contact Christine E. Ingesson

Contact Matthew Zepeda

The Power of Partnerships

About Lina Li

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Lina began her career in financial services in 2005 and joined Morgan Stanley in 2016 as an Associate Private Banker. Prior to joining the firm, she was a Banking Advisor at Merrill Lynch. She also served as a Preferred Banking Office Manager at the First Republic Bank and a Banking Center Manager at Bank of America.

Lina is a graduate of the San Jose State University, where she received a Bachelor of Science in Business Administration with a Concentration in Accounting. She lives in San Jose, California with her family. Outside of the office, she enjoys reading, travelling, and spending time with family and friends. Lina dedicates her time to SCRITCH Kittens as Secretary, Adoption Counselor, and foster.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

9Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley