John C Ayers, CFP®, CIMA®, CEPA®, CRD®, QPFC

Industry Award Winner

Industry Award WinnerEvery business will inevitably go through a transition at some point. What separates one transaction from the next lies in the question of who will initiate it: yourself or your heirs?

For most of us, this will be the first and only time we sell our business. It also means the end of the line for our primary career and losing a piece of our identity. Furthermore, the act of selling one's business necessitates giving up control, which, as you know, has been a key factor in your success. It is safe to say that this process is unnatural for entrepreneurs.

During these transitions, we often observed that business owners focus their attention to their business objectives while losing sight of their personal financial goals. Consequently, many fail to adequately consider their income requirements and retirement needs when preparing for succession planning; a costly mistake.

In light of this, we've tailored a process aimed at quantifying your cash flow needs in anticipation of your retirement. For example, if you were to exit your business at the age of 50 or 60, you would presumably need another 30 to 40 years' worth of similar, if not greater income needs. Having a clear vision for how you intend to spend that time and calculating what you will need to adequately satisfy those objectives is often misstated; our goal is to avoid this crucial pitfall. Developing a comprehensive exit plan that considers your business, financial, and personal needs is critical for a successful business transition.

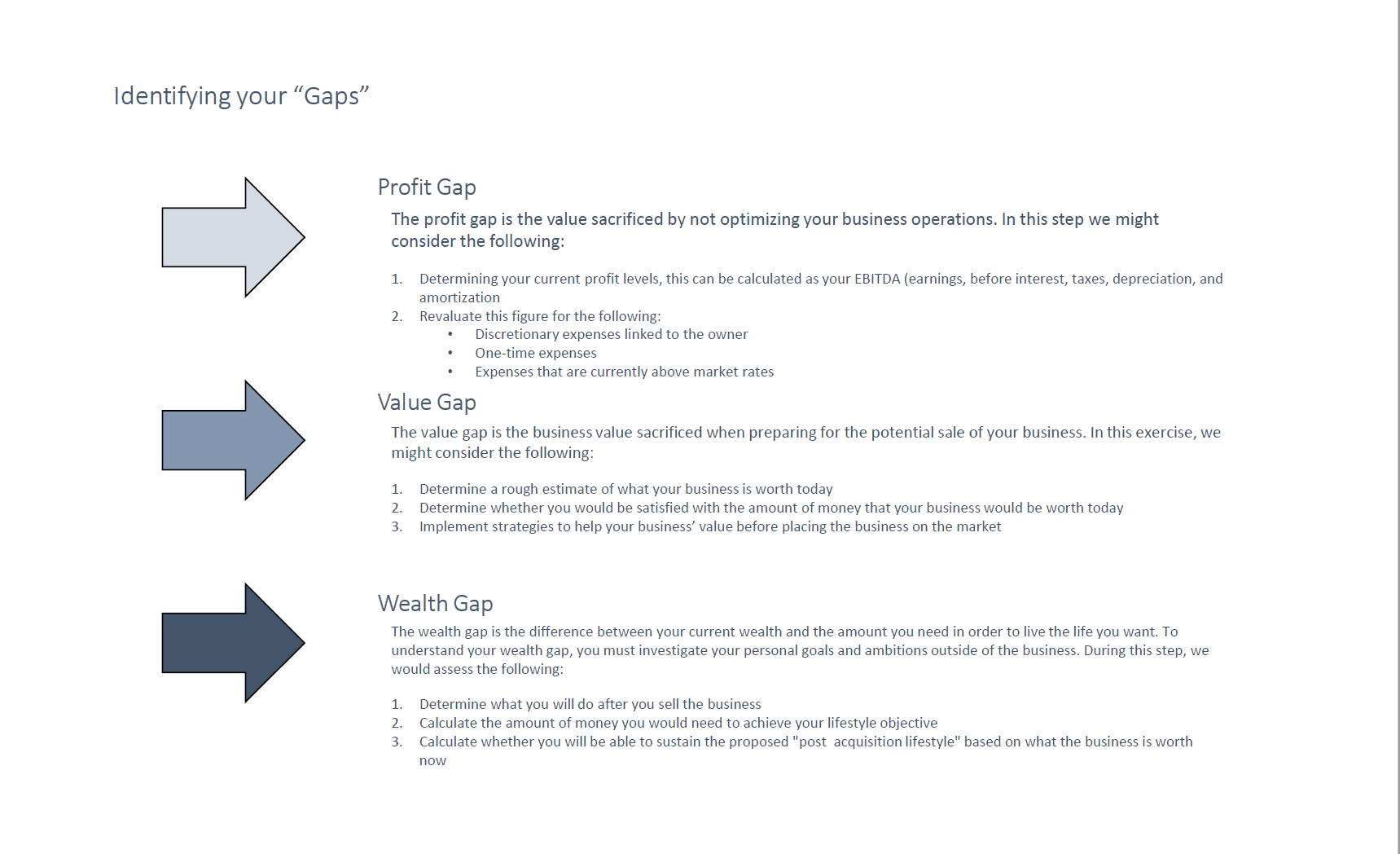

Our process begins by addressing your "gaps" as described above.

The proceeds obtained from the sale of your business or other appreciated assets such as stocks and real estate present an opportunity for extensive capital gains tax planning. This is particularly relevant given the substantial increase in wealth experienced by millions of Americans in the past decade. Fortunately, we can offer a range of strategies that can assist you in reducing taxes by effectively deferring, and in certain instances, eliminate tax liabilities. These strategies encompass various approaches, some of which are outlined below.

A taxpayer with a concentrated position characterized by a large capital gain embedded in one or two securities contributes their shares to a fund. In exchange, the taxpayer mitigates their risk by diversifying it across a basket of securities (i.e., S&P 500) while deferring gains.

A taxpayer invests in a portfolio that is designed to track the return of a specific index (i.e., S&P 500, EAFE, etc.) while intentionally producing capital tax losses that may be used to offset capital gains triggered from other areas.

A taxpayer with a realized gain invests in a fund that, when managed appropriately, defers the gain until 2026. Furthermore, if the fund is held for a period of 10 years or more, growth in the invested amount becomes tax-free.

For investors wishing to recognize the gain over a period of years (i.e., selling real estate), we can help structure this into an installment sale for tax purposes, stretching the gain out over several years.

Either through a donor advised fund, charitable remainder trust (CRT), charitable lead trust (CLT), or similar vehicle, a philanthropic investor can contribute appreciated securities to help in reducing taxes, and depending on the vehicle, receive an income stream.

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24

Joanne Daly

Source: fivestarprofessional.com (Awarded 2017-2025)

These awards were determined through an evaluation process conducted by Five-Star Professional, based on objective criteria, during the following periods:

2017 Award - 03/16/16 - 11/01/16; 2018 Award - 03/17/17 - 10/04/17; 2019 Award - 03/20/18 - 10/04/18; 2020 Award - 03/01/19 - 10/04/19; 2021 Award - 03/23/20 - 10/02/20; 2022 Award - 03/29/21 - 10/01/21; 2023 Award - 03/28/22 - 10/01/22; 2024 Award - 02/13/23 - 08/31/23; 2025 Award - 02/13/24 - 08/30/24

John Ayers

Source: fivestarprofessional.com (Awarded 2012-2025) These awards were determined through an evaluation process conducted by Five-Star Professional, based on objective criteria, during the following periods:

2012 Award - 05/06/11 - 09/30/11; 2013 Award - 05/06/12 - 09/30/12; 2014 Award - 05/06/13 - 09/30/13; 2015 Award - 05/06/15 - 09/30/15; 2016 Award - 05/19/15 - 10/12/16; 2017 Award - 03/16/16 - 11/01/16; 2018 Award - 03/17/17 - 10/04/17; 2019 Award - 03/20/18 - 10/04/18; 2020 Award - 03/01/19 - 10/04/19; 2021 Award - 03/23/20 - 10/02/20; 2022 Award - 03/29/21 - 10/01/21; 2023 Award - 03/28/22- 10/01/22; 2024 Award - 02/13/23 - 08/31/23; 2025 Award - 02/13/24 - 08/30/24