The Ament Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Approach

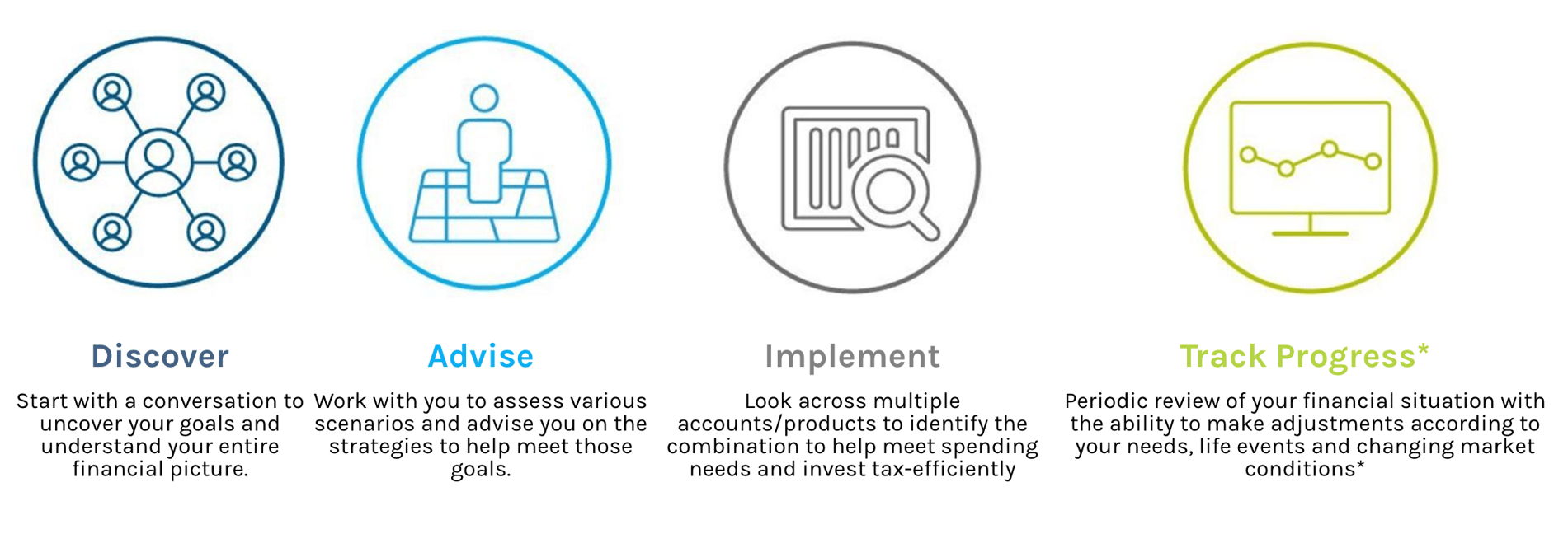

Success in achieving our clients' financial goals starts with creating a comprehensive wealth strategy. We take the time to listen intently to you, gaining a clear understanding of what is most important to you and your family. We'll then recommend thoughtful strategies that are aligned with your unique needs, whether you are accumulating wealth, investing for income, solidifying your plans for retirement or devising a distribution approach that meets your current lifestyle and legacy goals.

Depending on your needs and investment objectives, we may assist you with brokerage services, investment advisory services or both.

We work closely with our clients' CPA's and estate planning attorneys to help our clients efficiently oversee their comprehensive wealth management strategy, including investments, tax planning and legacy planning.

Understanding progress is important to our clients. In addition to in-person meetings during normal times, we provide our clients with concise investment summary reports and a robust client website and client app, allowing them to quickly ascertain how they are doing, wherever they are.

Morgan Stanley serves many of the world's most sophisticated investors, and our firm is one of the nation's leading firms to help clients with their personal wealth. No matter your wealth management needs, we have strategies that can help you achieve your most important financial goals. Give us a call or send us an email - we can start helping you today!

Sincerely,

The Ament Group at Morgan Stanley

Dan Ament

Jeff Ament

Jason Ripple

Brooke Ament

Jennifer Carroll

Addy Salzer

Disclaimer: Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

- Wealth ManagementFootnote1

- 401(k) Rollovers

- Corporate Retirement PlansFootnote2

- Corporate Trust Services

- Endowments and FoundationsFootnote3

- Estate Planning StrategiesFootnote4

- Exchange Traded FundsFootnote5

- Financial PlanningFootnote6

- Lending Products

- Philanthropic Services

- Professional Portfolio ManagementFootnote7

- Qualified Retirement PlansFootnote8

- Retirement PlanningFootnote9

- Sustainable InvestingFootnote10

- Trust AccountsFootnote11

- Trust Services*

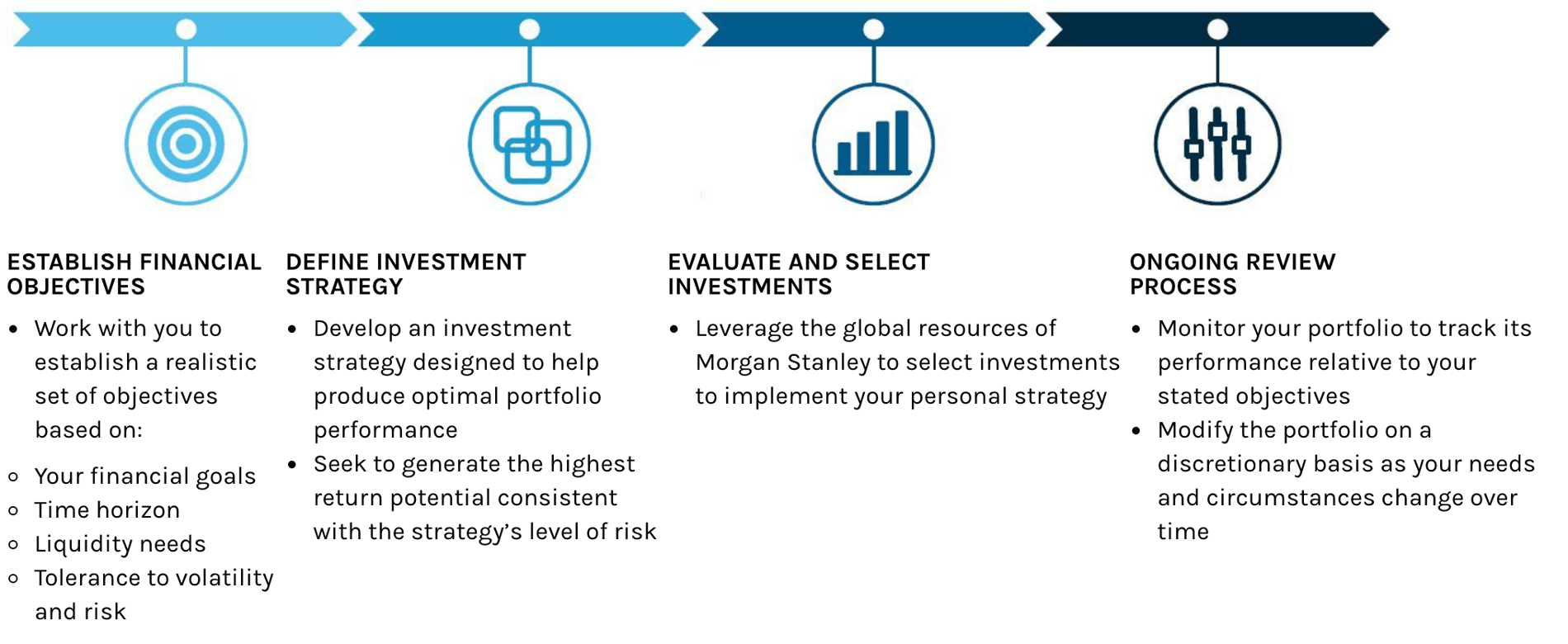

4 Step Process

Our integrated platform ties goals to implementation, leveraging the intellectual capital and sophisticated institutional capabilities of Morgan Stanley

Location

Meet The Ament Group

About Dan Ament

As a member of the Ament Group at Morgan Stanley, Dan leverages his extensive knowledge, experience, and commitment to excellence to help clients in realizing their financial objectives. He is a true asset to the firm and embodies professionalism in every aspect of his work.

In addition to his professional responsibilities, Dan is deeply committed to giving back to his community and served on the board for NPH – Fr. Wasson Legacy Endowment, an organization dedicated to transforming the lives of vulnerable children.

With over 18 years of experience as a recurring guest on KARE-11, the local NBC affiliate, Dan is a well-respected voice in the financial industry. He has provided insightful commentary on financial matters, becoming a valuable source of information for viewers.

When Dan isn't working, he really enjoys spending time in the beautiful Minnesota outdoors, hunting, fishing and cycling. Dan is dedicated to his family – his wife Linda and their three children, Paige, Brooke, and Blake. He is also a loving owner of two Siberian huskies, Aspen and Moka.

BA Finance from St. Thomas University

Series 7, 31 63 and 66 licenses

NMLS#: 1406550

About Jeff Ament

Jeff has accumulated over 30 years of invaluable industry experience that he wants to share with you. He believes that investment experience is earned the hard way, by living through positive and negative market periods and making sound choices along the way - especially at the inflection points. “The fool doth think he is wise, but the wise man knows he is a fool”. William Shakespeare – As You Like It

Success is driven by clearly understanding the needs of their clients and then aligning the deep resources Morgan Stanley to each, unique situation.

Jeff and his team believe in always putting their clients' interests first, helping them make intelligent decisions regarding their financial affairs and carefully managing their investments.

When not at work, Jeff is a family man! He and his entrepreneurial wife Kari and have two kids, Lucia Henri and Murphy, the amazing Pomeranian! Life can be busy, but busy can be fun!

Jeff also enjoys cooking, biking, working out and when time permits, making something fun out of wood. He is sentimental and very loyal!

Career Experience

33 year industry veteran (1991-present)

Education

St. John's University with majors in Accounting and Management

NMLS#: 1282548

About Jason Ripple

Jason's deep understanding of the financial industry, gained through navigating diverse market conditions and making sound decisions, allows him to provide personalized investment strategies and financial planning that align with his clients' unique goals and needs. He takes pride in staying up to date on the latest industry trends and developments, and is committed to providing his clients with the highest level of service and attention.

The Ament Group's success is grounded in a thorough understanding of their clients' needs and the strategic alignment of Morgan Stanley's resources to each unique situation. Jason and his team consistently prioritize their clients' interests, guiding them in making informed decisions about their financial affairs and managing their investments with the utmost care.

When not at work, Jason is a busy with his family! He and his wife Anne have three children, Ellie, LJ and Charlie and their dog Harley.

During his free time, Jason also enjoys jogging, biking, skiing and fishing.

Career Experience

23 years of industry experience (2000-present)

Education

University of St. Thomas– Major in Entrepreneurship

NMLS#: 1380617

CA Insurance License #: 0H86514

About Brooke Ament

NMLS#: 2704434

About Jennifer Carroll

Before joining Morgan Stanley, Jenny got her start in the industry at UBS, working as a summer and holiday employee starting at the young age of 16. She later transitioned to a full-time role in 2002, before joining Morgan Stanley in 2008 as an Assistant Operations Manager. After a year and a half in this role, she moved to her current position as a Portfolio Associate in 2009.

Jenny is an outdoor enthusiast, with a passion for activities such as walking, hiking, biking, paddleboarding, fishing, and cooking. She holds several licenses, including the Series 7, 9, 10 & 63, and is insurance/annuity licensed. Jenny and her husband Eric live in St. Michael with their children Nicole and Devon.

Contact Dan Ament

Contact Jeff Ament

Contact Jason Ripple

Contact Brooke Ament

Awards and Recognition

Portfolio Insights

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Retirement for Plan Sponsors

We can provide the tools and guidance to help you manage a retirement plan.

- Plan Evaluation

- Investment Management

- Plan Management Support

- Plan Participant Education

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

8When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

11Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley