About Bareq A. Peshtaz

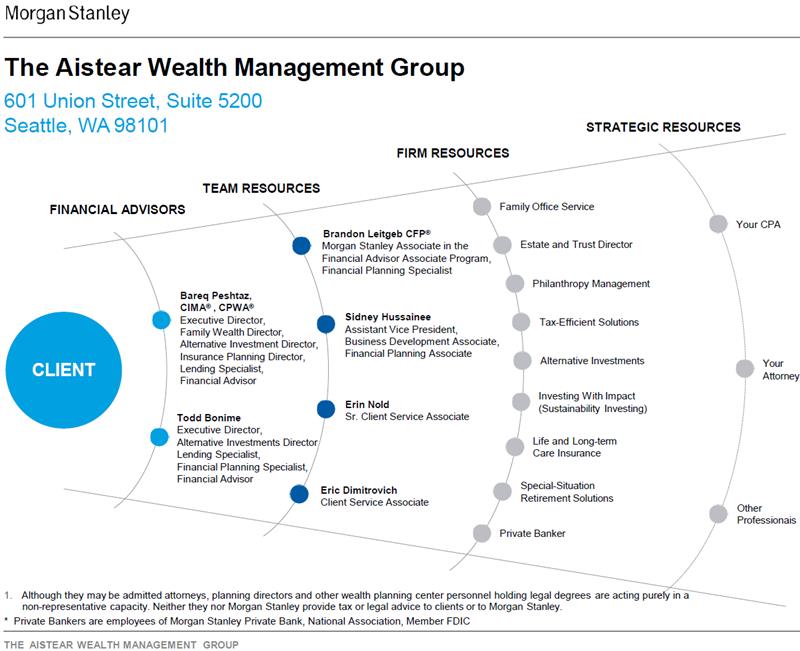

Bareq serves as an Executive Director and Family Wealth Director with the Aistear Wealth Management Group. He focuses on helping successful individuals and families navigate the complexities of multigenerational wealth—bringing together investment management and highly personalized planning. He leads a team of six professionals, and the group oversees $1.5 billion in client assets as of February 2026, serving as trusted advisors and “personal CFOs” to clients.

Bareq brings a distinctive, multidisciplinary perspective to wealth management. He earned a B.S. in Cell and Molecular Biology from the University of Washington and began his career in chemical distribution and franchising before transitioning into financial services.

In 2011, he entered the wealth management industry at Bernstein Private Wealth Management in Seattle as a Vice President and Financial Advisor. He joined Morgan Stanley in 2013, drawn by the firm’s breadth of capabilities and integrated wealth management platform. Today, Bareq holds the Family Wealth Director title, reflecting his focus on the needs of ultra-high-net-worth families. He is a Certified Investment Management Analyst® (CIMA®), CERTIFIED PRIVATE WEALTH ADVISOR® (CPWA®), and Qualified Plan Financial Consultant (QPFC), and has completed advanced training at the Yale School of Management. He also holds several Morgan Stanley internal designations, including Insurance Planning Director, Alternative Investment Director, Workplace Advisor (Equity Compensation), and Lending Specialist.

Bareq has been recognized by Forbes/SHOOK as a Best-In-State Wealth Advisor in 2024 and 2025, and the Aistear Wealth Management Group was named a Best-In-State Wealth Management Team in 2024, 2025, and 2026. He was also named to Firm's prestigious Master's Club, an elite group composed of the Firm's top financial Advisors, every year since 2023 and was invited to join the firm’s West Coast Financial Advisor Council in 2026.

Outside of his practice, Bareq is active in philanthropic and community leadership. He serves on the Board of Directors and Executive Committee of Akin (formerly Childhaven & Children’s Home Society of Washington) and is President of the Akin Foundation Board. He also supports a number of local organizations, including the Seattle Children’s Hospital Legacy Advisor Council, Northwest Family Business Advisors, East King County Estate Planning Council, Seattle Philanthropic Advisor Network, and the Seattle Fifth Avenue Theatre Corporate Council. He is an active member of the Investment & Wealth Institute (IWI) and the Association of Professional Investment Consultants (APIC).

Bareq lives in Bellevue, Washington, with his family. In his free time, he enjoys golf, skiing, boating, and traveling, and is a member of Overlake Golf & Country Club.

2024 - 2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded 2024 - 2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

2024 - 2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2024 - 2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Morgan Stanley Wealth Management Master's Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance

Securities Agent: NC, MO, MA, IL, MT, MI, HI, OK, NV, MN, DE, DC, CA, ID, FL, AZ, WI, OH, GA, VA, NJ, NH, CT, CO, TX, TN, PA, OR, NM, IN, AK, UT, SD, NY, KS, AR, WA, WY, SC, RI; General Securities Representative; Investment Advisor Representative

NMLS#: 1255566

Industry Award Winner

Industry Award Winner