Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Philosophy

Our team is committed to providing clients with personalized, one-on-one service. We believe the client-advisor relationship is the most important factor for wealth management. Our knowledgeable and experienced financial advisors and service associates gain a detailed understanding of our clients' goals and expectations. We recognize each client has different objectives and priorities; therefore, we tailor our wealth strategies to fit each client's specific needs.

Our aim is to help our clients live the lifestyle they desire while reaching their financial goals. The 1987 Group at Morgan Stanley will always act in the best interest of the client, and that is reflected in our product choices, asset allocations, and holistic financial plans. We resist industry fads and focus on wealth management strategies proven over the long-term.

The 1987 Group combines over 150 years of investment experience, unparalleled service, and the industry-leading power of Morgan Stanley to provide best-in-class guidance for every client's financial journey.

Awards and Recognition

Forbes Magazine named The 1987 Group at Morgan Stanley one of the Best-In-State Wealth Management Teams for 2023, 2024 and 2025! It is an honor to be recognized amongst this group of outstanding professionals who consistently work to raise the standards in our industry.

Forbes Best-In-State Wealth Management Teams 2025

Source: Forbes.com (Awarded Jan 2025) Data compiled by SHOOK Research LLC based on time period from 3/31/23-3/31/24.

Forbes Best-In-State Wealth Management Teams 2024

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/22-3/31/23.

Forbes Best-In-State Wealth Management Teams 2023

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

https://www.morganstanley.com/disclosures/awards-disclosure.html

The Tools To Guide You To Success

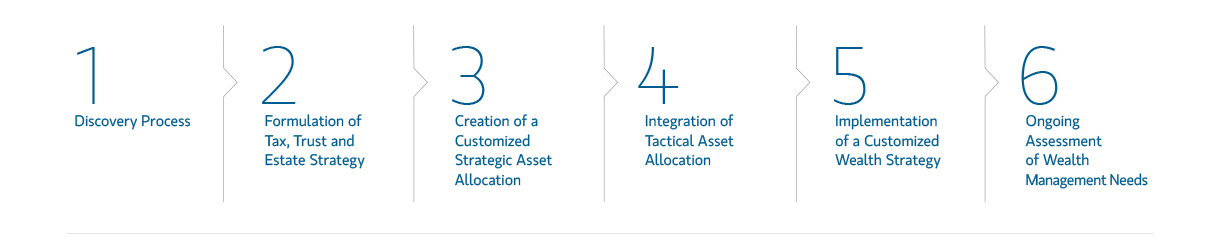

As a valued client of The 1987 Group, we begin with a comprehensive view of your investment objectives and your financial goals. Holistic in its approach, it may encompass all the elements of your financial life - your investments and your cash management needs - making sure they align with your goals and wealth management plan. In such circumstances, it makes sense to work with an experienced professional who understands your financial needs and can dedicate time and resources to help you meet them.

- Lifeview - Intelligent Planning

- Goals Planning System - Calculated Planning

- Aladdin - Intelligent Risk Management

- 401(K) and IRA

- Mortgage

- House Value

- Brokerage Accounts

- Credit Cards

- Checking Accounts

- Savings Accounts

- Insurance and Annuity Accounts

ARE YOU PREPARED FOR THE FUTURE?

Do you want to purchase a vacation home, fund your children's or grandchildren's education, spend your retirement as you've dreamed, or all of the above? Together, you and The 1987 Group can create a personalized and dynamic wealth management strategy to help you prepare for a successful financial future.

Financial planning is never a static process. Your concerns and life priorities are constantly changing which requires constantly evolving your plan. We engage in a holistic planning process that helps you identify what matters most whether that is buying a new home, funding higher education, financially protecting your family or planning a dream retirement. Planning for dream retirement means addressing common fears and concerns such as health care costs, outliving your money and determining the best time to file for Social Security benefits. With a personalized financial plan specifically tailored for you and your family, we help you chart a path forward and remain your dedicated advisor along the way.

- Having a defined financial plan can help increase confidence

- Identifying your goals and having a plan can increase the chances of success

- You have a roadmap and we can help keep you accountable

- Having a financial plan can lead to better financial habits

- The 1987 Group can focus on helping you reach your goals so you can worry less and live more

Location

Meet The 1987 Group

About Mark S Ryan

Mark is also a Portfolio Management Director at Morgan Stanley. This designation, along with over 35 years of experience, has proven helpful in providing objective investment guidance for his clients. Recognizing that there is no silver bullet, or one size fits all solution, Mark’s focus is on understanding each client’s unique vision, goals, and preferences. He then tailors advice and portfolio structure in a custom manner to help his clients maximize their financial potential.

After a 15-year career in retail, Mark decided that his attention to detail and numbers would be a perfect fit for a career as a financial advisor and took the necessary steps to obtain his securities licenses. He began his new career on October 19th, 1987, the infamous Black Monday.

Mark practices yoga on a regular basis and focuses on good nutrition. He is an RYT® 200 Registered Yoga Teacher and promotes a healthy lifestyle with many of his friends and clients that have similar interests. Mark lives in Boca Raton and is a lifelong Palm Beach County resident. His son Justin and his family reside in Houston.

NMLS#: 1279336

About Ryan A. Anderson

Prior to joining Morgan Stanley in 2021, Ryan spent 10 years as a financial advisor with J.P. Morgan. Before his wealth management career, he also served clients in the financial services field for Chase Bank, First Premier Bank, and Wells Fargo.

Ryan earned his Bachelor's Degree in Business Administration and Economics from Augustana University in Sioux Falls, South Dakota, where he also met his future wife Stephanie. After growing up and starting their careers in South Dakota, they decided to move to beautiful South Florida, where they now live in Boca Raton with their Italian Greyhound Augie. They also enjoy an occasional retreat to their mountain home in Western North Carolina. In Ryan’s free time, he can be found traveling, dining with friends and family, fly fishing, and homebrewing craft beer.

Forbes Magazine named The 1987 Group at Morgan Stanley one of the Best-In-State Wealth Management Teams for 2023, 2024, and 2025! It is an honor to be recognized amongst this group of outstanding

professionals who consistently work to raise the standards in our industry.

2023-2025 Forbes Best-In- State Wealth Management Teams

Source: Forbes.com (2023-2025) Forbes Best-In-State Wealth Management Teams ranking awarded in (2023- 2025). Each ranking was based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher). This evaluation process concluded in March of the previous year the award was issued, having commenced in March of the year before that. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to SHOOK Research LLC, for placement on its rankings. This ranking is based on in-person and telephone due diligence meetings to evaluate each Financial Advisor qualitatively, a major component of a ranking algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the opinions of SHOOK Research LLC and may not be representative of any one client’s experience; investors must carefully choose the right Financial Advisor or team for their own situation and perform their own due diligence. These rankings are not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with SHOOK Research LLC or Forbes.

For more information, see www.SHOOKresearch.com.

The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Morgan Stanley Smith Barney LLC. Member SIPC. CRC4712214 7/25

NMLS#: 602871

About David S. Gross

Over the years, David has developed a passion for retirement and estate planning strategies. He is dedicated to thoroughly understanding each client’s financial position, long and short-term goals, and risk tolerance in order to create a strategy designed to produce consistent investment returns while minimizing portfolio risk. He helps clients to understand the impacts of long term care and inflation as they prepare for retirement, and strives to bring consistent solutions and comfort in all aspects of a client’s financial plan. David is Series 7 Licensed and holds Life, Health, and Variable Insurance licenses.

Outside of work David enjoys watching hockey, practicing yoga, and golfing. He lives in Boca Raton, Florida with his wife and two daughters.

About Lisa Silver

After graduation from college and before becoming a mother, Lisa utilized her degree in Journalism by working for a South Florida advertising firm. She was responsible for handling executive planning, media buys and B2B advertising for major accounts. In 1989, Lisa transitioned to the radio industry, subsequently working for two of the market’s top radio stations as a sales executive.

After meeting her Canadian-born husband Jeff, Lisa worked for a worldwide leader in electronic component distribution in Montreal, where she was tasked with the multi-national responsibility of handling several major clients around the world, before moving back to South Florida in 1997.

Lisa was born in Fort Lauderdale, but raised in Cincinnati, Ohio. She graduated from the University of South Carolina with a Bachelor of Arts in Journalism and moved to Boca Raton where she has lived for over 30 years, with the exception of three years in Canada.

Lisa has been married for 28 years and has two sons, Matthew and Andrew. Now that Matthew is independent and a pilot for American Airlines and Andrew is in his senior year at FSU, she has more time to focus on her own career. In her free time, she enjoys exercising, cooking and socializing with who means the most to her.

Contact Mark S Ryan

Contact Ryan A. Anderson

Contact David S. Gross

Awards and Recognition

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

5Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

CFP Board owns the marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley