Ron Basu

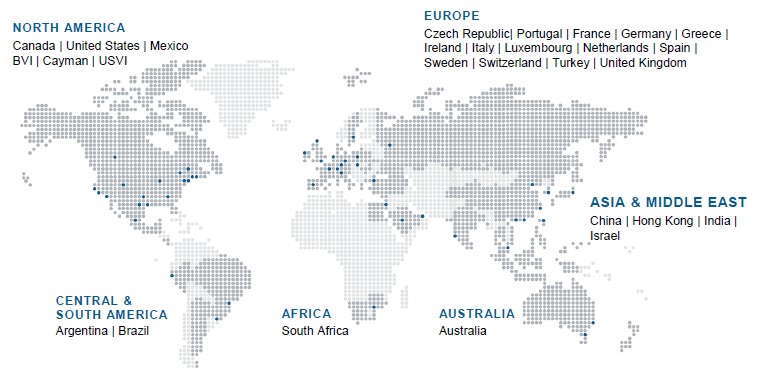

International Wealth Management is a specialized area within Morgan Stanley Wealth Management that is dedicated to serving individuals, families, family offices, entrepreneurs, corporate executives and corporate stock plan managers who live outside the United States. We also serve US citizens living and working abroad as well as those who are relocating to the United States or otherwise changing domicile.

We are based in offices throughout the United States, but often specialize in a specific country or region, and typically speak the client's language, understand the culture and have a deep knowledge of the markets we serve. Combining our investment knowledge with the resources and intellectual capital of Morgan Stanley, we deliver targeted solutions that help our clients pursue their goals and address their unique financial needs.

We may be able to provide you access to:

Not all products and services are available to clients outside of the United States.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be suitable for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Morgan Stanley Smith Barney LLC ("Morgan Stanley") is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.