Scott J. Hesekiel, CFP®

Industry Award Winner

Industry Award WinnerOur mission is to provide individuals, families, and institutions with comprehensive, customized financial strategies designed to help address their unique goals and evolving needs. Through a disciplined, planning-based approach and access to the full capabilities of Morgan Stanley—including investment management, fiduciary guidance, estate and succession planning strategies, and institutional resources—we aim to deliver clarity amidst complexity. Our team is committed to providing an exceptional level of professional service, intellectual capital, and strategic insight, helping clients preserve and grow their wealth while pursuing long-term financial success with confidence.

The Tufton Group has been recognized for their commitment to excellence:

Shawn Halsey and Scott Hesekiel both being named Best in State Wealth Advisors in 2025.

Forbes Best-In-State Wealth Advisors (2025)

Source: Forbes.com (Awarded April 2025) Data compiled by SHOOK Research LLC for the period 6/30/23 - 6/30/24.

morganstanley.com/disclosures/awards-disclosure.html

Forbes Best-In-State Wealth Management Teams (2026)

Source: Forbes (Awarded Jan 2026) Data compiled by SHOOK Research LLC for the period 3/31/24-3/31/25

morganstanley.com/disclosures/awards-disclosure.html

We are proud to introduce our dynamic team of young financial advisors: Ray, Katherine & Ryan. Each brings a fresh perspective and a deep commitment to helping guide the next generation toward financial success. With a keen understanding of modern financial challenges and potential opportunities, they are dedicated to crafting personalized strategies that can help align with your unique goals.

Whether you're navigating student loans, planning for your first home, or exploring digital investment platforms, Ryan, Ray, and Katherine are here to help provide the insights and support you need to help you thrive in today's ever-evolving financial landscape. Discover how the Tufton Group can help you achieve your financial aspirations with confidence and clarity.

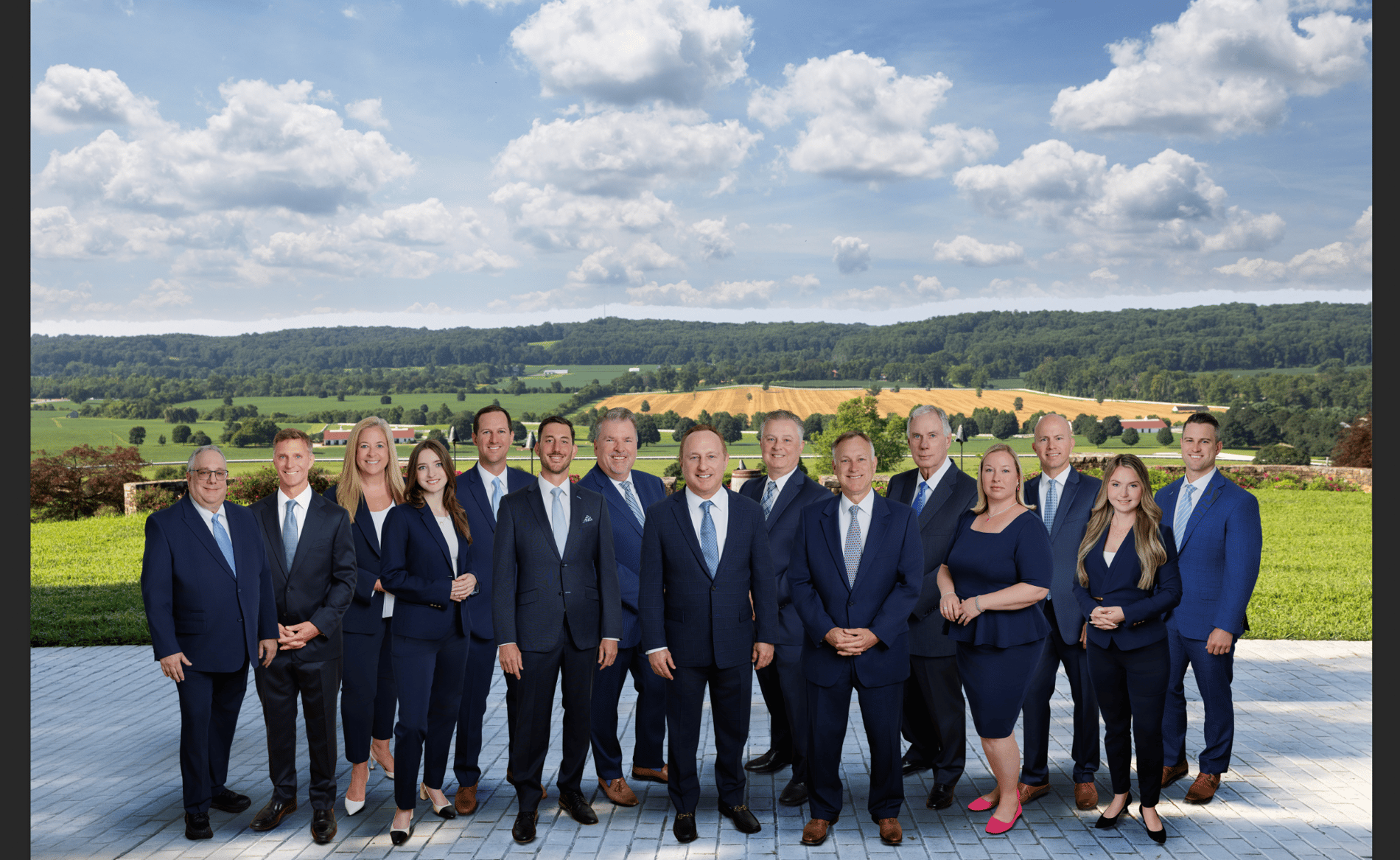

About the Team

The Tufton Group at Morgan Stanley is led by Scott Hesekiel, Shawn Halsey, and Steve Young, who collectively bring over 96 years of experience in the financial industry. Scott, the founder of the Tufton Group, emphasizes understanding client needs and building long-lasting relationships. Shawn, with over 24 years of experience, focuses in working with institutional clients and high-net-worth families. Steve, with more than 32 years of experience, focuses on providing tailored financial planning and investment strategies.

The History Behind The Tufton Group Name

Many years ago, we chose this name not only because Tufton Avenue is a well-known thoroughfare with historical relevance here in Northern Baltimore County, but also because this road runs through many of the beautiful horse farms very close to our Hunt Valley office, where now all three of our teams are located together.

Our Support Team

Our support team includes Nikki Middlestadt, Sarah Singh, Madison Smith, and Andy Heyman, who are dedicated to providing comprehensive services to help meet clients' needs.

The Tufton Group is one of the largest teams in the Hunt Valley branch and one of the most experienced within the Morgan Stanley Greater Chesapeake Complex.

2024 Five Star Wealth Manager Award Source: fivestarprofessional.com (Awarded 2024) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2024 Award - 4/10/23-10/31/23