Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story

We strive to provide financial confidence for our clients so they can focus their time on what matter most to them. Our core six-person team has over 75 years of combined investment management experience and we provide high touch service that exceeds expectations. Execution is paramount – we do what we say will do.

We combine our own experience and network, the global resources of Morgan Stanley and the lessons learned from working with many successful families to provide holistic wealth management services for a small group of individuals, families, and institutions. We help structure, implement, and manage wealth for sophisticated investors, their families, and their philanthropic entities.

Our clients are individuals and families, corporate executives, private equity and venture capital professionals, entrepreneurs, and family offices. We focus on tax efficient investing and our strategies always begin with a financial plan.

We help our clients manage their concentrated equity positions, equity compensation, tax and estate planning strategies, philanthropic goals, and their risk management needs.

Awards & Recognition:

SV Palo Alto Group: 2021-2026 Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Last Awarded Jan 2026) Data compiled by SHOOK Research LLC based on time period from 3/31/20 - 3/31/25.

Jesse Zimmer: 2021-2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Last Awarded Apr 2025) Data compiled by SHOOK Research LLC based on time period from 6/30/20 - 6/30/24.

Diclosure: https://www.morganstanley.com/disclosures/awards-disclosure.html

Location

Meet SV Palo Alto Group

About Jesse Zimmer

Jesse earned a BA in economics from Occidental College and an MBA in finance from the University of Texas at Austin. He is a Chartered Financial Analyst and member of the CFA Society of San Francisco as well as a CPWA. Jesse spent many years volunteering his time coaching Little League baseball and AYSO soccer. He was on the Board of Hillsborough Little League, the Finance Committee for the Burlingame Community Education Foundation and the Investment Committee for Peninsula Temple Shalom.

Jesse has been married for over twenty years and has two children. He enjoys golf, traveling and enjoying good food and wine with family and friends.

Awards Disclosures:

2021-2024 Forbes Americas Top Wealth Management Teams

Source: Forbes.com (Last Awarded Jan 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/20 – 3/31/23.

2021-2023 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Last Awarded Feb 2023) Data compiled by SHOOK Research LLC based on time period from 6/30/20 - 6/30/22.

NMLS#: 1288176

CA Insurance License #: 0C50804

About Neil O'Connor

NMLS#: 1588783

About Zizi Potoukian

NMLS#: 1045571

About Jake Kamine

About Ricardo Santamaria

About Irene Carter

Contact Jesse Zimmer

Contact Neil O'Connor

Contact Zizi Potoukian

Awards and Recognition

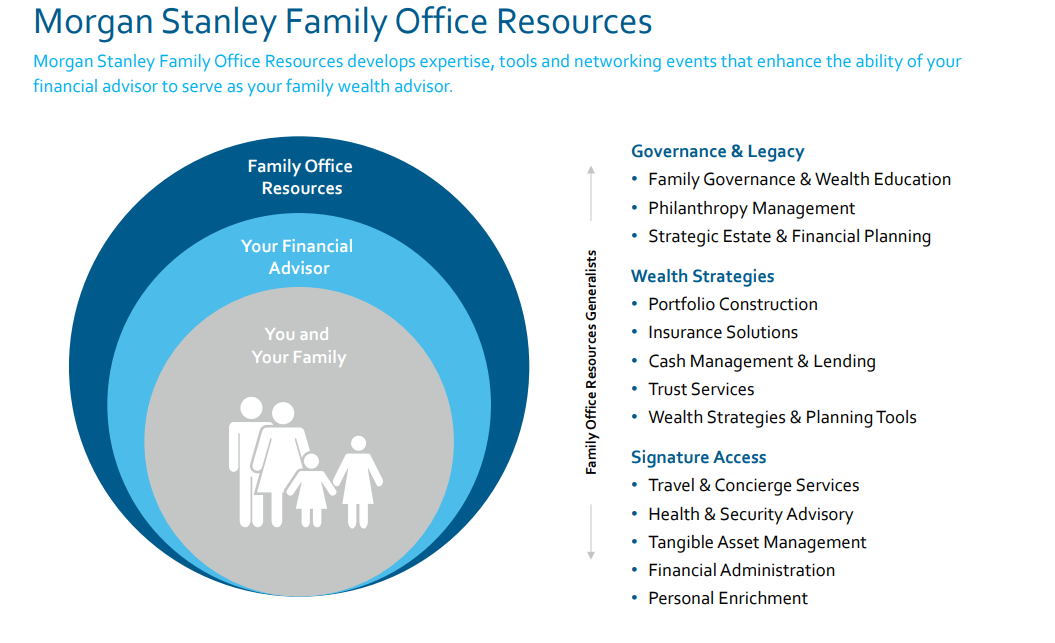

The Power of Partnerships

About Ryan Brown

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity, and financing needs, while leveraging our comprehensive suite of cash management and lending

solutions.

Ryan began his career in financial services in 2006 and joined Morgan Stanley in 2011 as an Associate Private Banker. Prior to joining the firm, he was a Licensed Premier Banker at Wells Fargo Bank, N.A.

Ryan is a graduate of the University of California at Irvine, where he received a Bachelor of Arts in International Studies and a minor in Management. He lives in Half Moon Bay, California with his family. Outside of the office, Ryan enjoys playing golf, road and mountain biking, and spending time with friends and family. He also volunteers his time as a youth sports coach and at several non-profit organizations.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley