Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Services

With over 70 years of combined investment experience, we believe wealth management transcends mere transactions. We are steadfast in our commitment to understanding each client’s unique journey, crafting personalized financial strategies that not only secure but elevate their legacy. By seamlessly blending sophistication with genuine care, we endeavor to redefine the gold standard of financial stewardship. The team has navigated a multitude of market cycles, allowing us to better understand the risks that investors face.

As a client of The Newtown Legacy Group, you will be able to benefit from the attention and personalized care of a boutique office, coupled with the strength and resources of a leading global financial institution that will help you meet your lifestyle and legacy goals. We offer customized solutions and comprehensive wealth planning services, which include portfolio management, retirement planning, estate and tax planning strategies, wealth transfer, and cash management and lending solutions.

- SyndicateFootnote1

- Wealth ManagementFootnote2

- Business PlanningFootnote3

- Endowments and FoundationsFootnote4

- Estate Planning StrategiesFootnote5

- Executive Financial ServicesFootnote6

- Executive Benefit ServicesFootnote7

- Municipal BondsFootnote8

- Professional Portfolio ManagementFootnote9

- Qualified Retirement PlansFootnote10

- Retirement PlanningFootnote11

- Sustainable InvestingFootnote12

- Stock Option PlansFootnote13

- Stock Plan ServicesFootnote14

- Structured ProductsFootnote15

- Trust AccountsFootnote16

- Trust ServicesFootnote17

- 401(k) Rollovers

- Alternative InvestmentsFootnote18

- Business Succession PlanningFootnote19

- Financial PlanningFootnote20

- Cash Management and Lending ProductsFootnote21

OUR CAPABILITIES FOR BUSINESS OWNERS

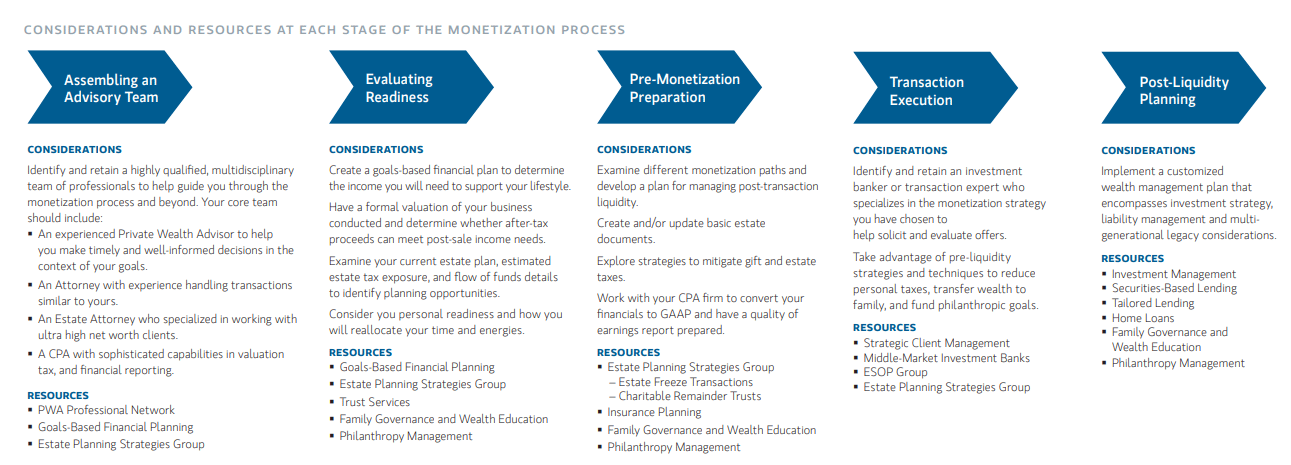

As an entrepreneur or business owner, you know the value of hard work and your time is at a premium. You've invested years-or perhaps decades- into your enterprise, and your personal wealth is intertwined with your company. Whether you are focused on accelerating your growth, preparing to transition or exit, or somewhere in between, we are intimately familiar with the complexities and considerations of your situation.

Through our years of service to business owners and their multi-generational families, we have learned that there is no substitute for thoughtful and proactive advice. This starts with a comprehensive plan encompassing every facet of your life, your business and your family. From there, we are able to leverage the resources of a global firm to coordinate solutions for nearly every area of your life and business, in concert with your other professional advisors.

As your Financial Advisors, we view our role as the quarterback of your advisory team, helping you to coordinate a cohesive group of professionals encompassing legal, tax/accounting, and investment banking advice. A coordinated and responsive team will allow you to focus on the business while providing guidance to help you maximize your personal and entrepreneurial potential.

The early stage of a company's growth phase is a productive time for you to conduct in-depth estate planning. In our experience, the demands of growing a business often relegate an estate plan to the back burner until an impending exit or untimely passing. Performing planning in the early stages can help to mitigate risk, maximize tax efficiency, and secure the future of both your family and your business.

As your business matures, the resources of Morgan Stanley prove valuable in helping you raise debt or equity for growth, establish corporate retirement and financial wellness plans, update your personal and business insurance lines as appropriate, introduce philanthropic initiatives, and more. At this point, more in depth business and estate planning is warranted, along with a valuation of the business. With the rest of your advisory team, we can help you assess growth drivers and weigh exit planning options as desired.

It is important to consider and implement income tax and wealth transfer strategies prior to a potential liquidity event. In addition to strategic tax planning, a liquidity event often raises greater issues for you: fundamental questions regarding family goals or "mission," wealth stewardship and your next step either into retirement or a new venture.

The post liquidity stage brings various considerations such as continuing to build out a family "mission statement," family governance and wealth education, philanthropic planning, and lifestyle advisory. Should the company now be public, the conversation centers around liquidity planning and programs for the exercise of stock.

Location

Meet Newtown Legacy Group

About Alicja (Allie) Plonska

Alicja's team develops personalized strategic advice to address complex needs of individuals, business owners and executives who have unique planning and wealth management needs. Her team combines the true intimacy and personal attention of a boutique style practice and the global resources of one of the world’s largest financial services firms.

As a first-generation emigrant she has a special appreciation and curiosity for the financial systems and structures in the USA. Her unwavering commitment is evident in consistently refining her team's ability to assist clients in structuring an optimal financial strategy tailored to their specific needs.

The footprint of Alicja's approach is a tailored financial strategy, along with a comprehensive cash flow and risk analysis. This multi-fold personalized strategy helps to address many of the core needs of individuals and families with substantial wealth. Moreover, her team, comprised of former business owners, employs distinctive methods to help guide business owners through exit planning (Selling or transitioning out of business), leveraging the strength of Morgan Stanley while working very closely with client’s legal, accounting, and valuation experts to ensure a successful transaction.

Alicja is a magna cum laude Temple University graduate. She received her Bachelors and Masters simultaneously graduating with 2 majors, a minor and a specialization. Alicja has also earned the Certified Divorce Financial Analyst ™ designation, awarded by The Institute of Divorce Financial Analysts™.*

Outside of work Alicja enjoys spending time with her three sons and being involved with Bucks County community, especially Newtown, PA and engaged with the Polish and emigrant community.

Alicja has been awarded America's Top Women Wealth Advisors ranking by Forbes in 2022, 2023, 2024. In addition, she has been awarded Forbes Top Women Wealth Advisors Best-In-State in 2024.

Disclosures

2022, 2023, & 2024 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors)

Source: Forbes.com (2022, 2023, & 2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2024 Forbes Top Women Wealth Advisors Best-In-State Source: Forbes.com (2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

NMLS#: 21054

About Victor Kurtz

NMLS#: 1288300

About Michael Johnson

NMLS#: 2347026

About Michal Plonski

My professional journey has always been rooted in supporting people. In previous client-facing roles, I collaborated closely with individuals to solve problems, overcome challenges, and ensure they felt understood. These experiences shaped my empathetic approach to financial advising: one that prioritizes listening, understanding, and building trust.

While I bring two years of experience to the financial services industry, I work alongside a team of seasoned advisors, drawing on decades of combined insight to deliver well-rounded strategic support. This collaborative environment allows me to provide clients with both personalized attention and institutional strength.

With an Eastern European background and fluency in multiple languages, I deeply value cultural awareness and the role it plays in financial decision-making. I understand that every client brings a unique story, perspective, and set of goals. I take pride in crafting tailored strategies that reflect that individuality.

Education and empowerment are central to my practice. I strive not only to give sound advice, but to ensure clients understand the “why” behind every recommendation. I also embrace innovation, staying open to new tools and technologies that can enhance portfolio management and drive client outcomes.

At the heart of everything I do is a commitment to transparency, trust, and long-term partnership. My goal is to help clients move forward with confidence; knowing they have a dedicated advisor who truly understands their needs and is invested in their success.

NMLS#: 2710567

Contact Alicja (Allie) Plonska

Contact Victor Kurtz

Contact Michael Johnson

Contact Michal Plonski

Awards and Recognition

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

1Participating in a new issue/syndicate is subject to availability. IPOs are highly speculative and may not be appropriate for all investors because they lack a stock-trading history and usually involve smaller and newer companies that tend to have limited operating histories, less-experienced management teams, and fewer products or customers. Also, the offering price of an IPO reflects a negotiated estimate as to the value of the company, which may bear little relationship to the trading price of the securities, and it is not uncommon for the closing price of the shares shortly after the IPO to be well above or below the offering price.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

9Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

12Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

13Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

14Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

15Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

16Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

17Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

18Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

19Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

20Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

21Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley