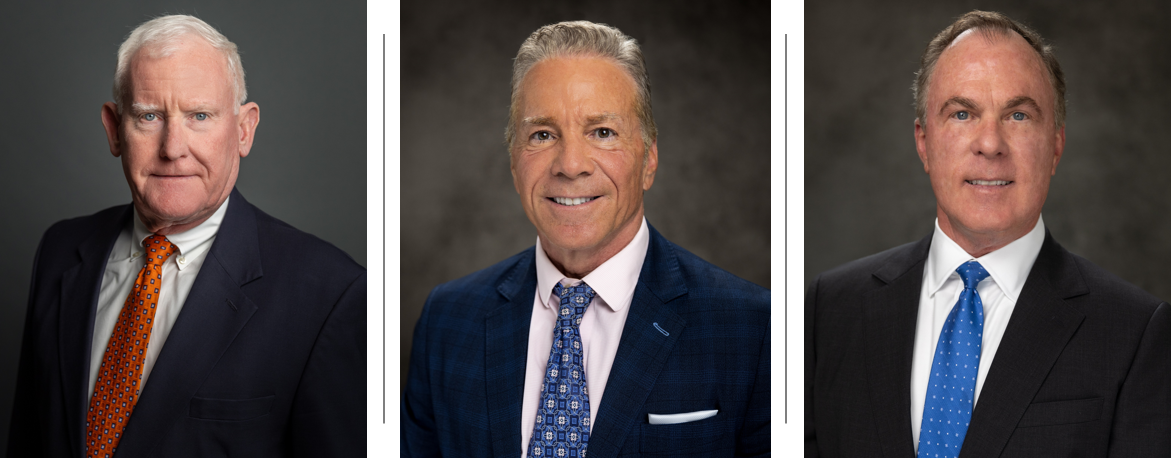

About James Valenti

With almost 40 years of financial services experience, Jim has helped clients through a wide variety of market and economic conditions. Clients have looked to him for the guidance they needed to retire in comfort, exit their successful businesses, and make decisions that would affect the financial well-being of not only themselves, but future generations.

Born and raised in Tampa, Jim graduated from Florida State University with a degree in Accounting but soon realized that he wanted to help clients with more than their tax returns. He joined a Morgan Stanley predecessor firm in 1985 and has been advising clients ever since. “I take great satisfaction in helping my clients avoid mistakes that can derail their plans for a fulfilling retirement,” he says. “That means providing them with advice that is always given with their interests first and foremost in mind.”

Jim has spent much of his career managing fixed income portfolios for clients seeking income and capital preservation. When not studying markets and advising clients, he has been an active member of the Tampa community. Specifically, Jim has served on the boards of Hillsboro Kids, Inc. and the Center for Women.

Securities Agent: WI, WV, AL, AZ, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, NC, NH, NJ, NV, NY, OH, PA, RI, SC, TN, TX, UT, VA, WA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1288331