The Gallun Group

My Mission Statement

About Barry

Barry S. Gallun is a Financial Advisor at Morgan Stanley with over 30 years of experience in the investment industry. Barry began his career as a Financial Advisor when he joined Legg Mason Wood Walker, Inc. in 1988 as Vice President of Investments. In February 2006, Legg Mason Wood Walker, Inc. became a subsidiary of Citigroup Global Markets, Inc. and thus began operating under the umbrella of Smith Barney. A joint venture between Citigroup Global Markets and Morgan Stanley created the new firm Morgan Stanley Smith Barney. In 2023, Barry was promoted to Managing Director -Wealth Management. This promotion is recognition of Barry's unwavering commitment to deliver consistently an exceptional level of quality service and support to his clients. Recently, Barry was named to Forbes Magazine's list of Best-in-State Wealth Advisor, an achievement that Barry has been awarded since 2018 through 2025.

Barry is a member of Morgan Stanley prestigious President's Club since 2009 through 2025. The club recognizes financial advisors for outstanding service and commitment to helping clients achieve their financial goals. Barry concentrates in growth and value investing, through a variety of investment vehicles, in naming a few, bonds, mutual funds, equities, annuities and insurance. He also provides customized financial plans and manages discretionary portfolios for those clients seeking an advisory relationship.

Barry graduated from the University of Maryland with a Bachelor of Science degree in Finance. He is currently a Managing Director, Family Wealth Advisor and Senior Portfolio Management Director at Morgan Stanley in the Park Potomac, Maryland office. A native of the Washington D.C. area, he currently resides with his wife in North Bethesda, Maryland.

Morgan Stanley

12505 Park Potomac Ave Suite 200

Potomac MD 20854

Phone: 301-279-6433

Toll Free: 1-844-222-6286

Fax: 301-279-6485

E-mail: barry.s.gallun@morganstanley.com

Website: https://advisor.morganstanley.com/barry.s.gallun

LinkedIn: www.linkedin.com/in/barrygallun

X / Formerly Twitter: @BarryGallunMS

The investments and services listed may not be appropriate for all investors. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates. Barry Gallun is a Financial Advisors with Morgan Stanley participating in the Morgan Stanley Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client's Financial Advisor invests the client's assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Morgan Stanley ADV Part 2, available at www.morganstanley.com/ADV or from your Financial Advisor. Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you.

Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences. This communication contains links to third party websites that are not affiliated with Morgan Stanley. These links are provided only as a convenience. The inclusion of any link is not and does not imply an affiliation, sponsorship, endorsement, approval, investigation, verification or monitoring by Morgan Stanley of any information contained in any third party website. In no event shall Morgan Stanley be responsible for the information contained on that site or your use of or inability to use such site. Furthermore, no information contained in the site constitutes a recommendation by Morgan Stanley to buy, sell, or hold any security, financial product, particular account or instrument discussed therein. You should also be aware that the terms and conditions of such site and the site's privacy policy may be different from those applicable to your use of any Morgan Stanley website Past performance of any security is not a guarantee of future performance. There is no guarantee that this investment strategy will work under all market conditions.

Source: Forbes.com (Awarded April 2025). This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period 6/30/23-6/30/24. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to SHOOK Research LLC for placement on its rankings. This ranking is based on in-person, virtual and telephone due diligence meetings to evaluate each Financial Advisor qualitatively, a major component of a ranking algorithm that includes client impact, industry experience, credentials, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the opinions of SHOOK Research LLC and may not be representative of any one client's experience; investors must carefully choose the right Financial Advisor or team for their own situation and perform their own due diligence. This ranking is not indicative of the Financial Advisor's future performance. Morgan Stanley Smith Barney LLC is not affiliated with SHOOK Research LLC, or Forbes. For more information, see www.SHOOKresearch.com.

© 2025 Morgan Stanley Smith Barney LLC. Member SIPC.

- Wealth Consulting

- Wealth ManagementFootnote1

- 401(k) Rollovers

- 529 PlansFootnote2

- Asset Management

- Business PlanningFootnote3

- Cash ManagementFootnote4

- Certificates of DepositFootnote5

- Corporate BondsFootnote6

- Estate Planning StrategiesFootnote7

- Exchange Traded FundsFootnote8

- Executive Financial ServicesFootnote9

- Financial PlanningFootnote10

- Fixed IncomeFootnote11

- Municipal BondsFootnote12

- Planning for Education FundingFootnote13

- Professional Portfolio ManagementFootnote14

- Qualified Retirement PlansFootnote15

- Retirement PlanningFootnote16

- Trust AccountsFootnote17

NMLS#: 1279190

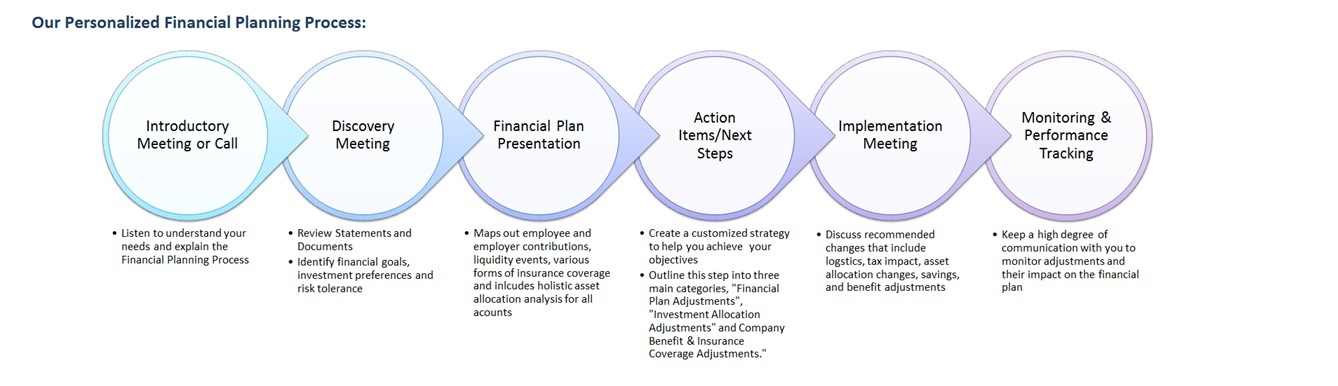

Working With You

We keep our focus on understanding what’s important to you, and we build strong relationships based on a deep understanding of what matters to you most. We are able to see the bigger picture of our clients in terms of how to not only accumulate, preserve, and distribute their wealth.

One of the most important decisions you can make is to seek the advice of a trusted, qualified advisor. For this important relationship, we want you to know we are 100% committed to helping you achieve your long-term financial and life goals.

In The Press

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

Source: Forbes.com (Awarded Jan 2023) Data compiled by SHOOK Research LLC based on time period from 3/31/21-3/31/22.

Financial Advisor in the Firm’s Park Potomac Wealth Management office, has been named to Forbes

Magazine’s 2025 list of Best-in-State Wealth Advisors.

Forbes’ Best-in-State Wealth Advisors list comprises a select group of individuals who have a minimum of

seven years of industry experience. The ranking, developed by Forbes’ partner SHOOK Research, is

based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors and

weighing factors like revenue trends, AUM, compliance records, industry experience and best practices

learned through telephone and in-person interviews.

“I am pleased that Barry Gallun is representing Morgan Stanley,” commented Michael Stadnik, Market

Manager of Morgan Stanley’s Central Maryland Market. “To be named to this list recognizes Barry’s

professionalism and dedication to the needs of his valued clients.”

Morgan Stanley Wealth Management, a global leader, provides access to a wide range of products and

services to individuals, businesses and institutions, including brokerage and investment advisory services,

financial and wealth planning, cash management and lending products and services, annuities and

insurance, retirement and trust services.

Location

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

2Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

5Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

6Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8An investment in an exchange-traded fund (ETF) involves risks similar to those of investing in a broadly based portfolio of equity securities traded on exchange in the relevant securities market, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. The investment return and principal value of ETF investments will fluctuate, so that an investor’s ETF shares, if or when sold, may be worth more or less than the original cost.

Investors should carefully consider the investment objectives, risks, charges and expenses of an exchange-traded fund (ETF) before investing. The prospectus contains this and other information about the ETF. To obtain a prospectus, contact your Financial Advisor or visit the ETF company’s website. Please read the prospectus carefully before investing.

9Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

10Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

11Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

12Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

13When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

14Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

15When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

16When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

17Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley