About Kathleen Thompson

Kathleen “Katie” Thompson is a Financial Advisor at Morgan Stanley with nearly two decades of experience in the financial services industry. A CERTIFIED FINANCIAL PLANNER® professional, Katie brings a thoughtful, client-centered approach to wealth management, helping individuals and families navigate life’s complexities and milestones with confidence. Her passion lies in uncovering each client’s unique story and crafting strategies that align with their values, goals, and long-term vision.

Katie’s path into finance began with a foundation in education and family support. After earning a B.A. in Sociology from the University of Richmond, she started her career in K-12 education. This experience instilled in her deep understanding of family dynamics, patience, and the importance of clear communication, skills that seamlessly translated to her transition into financial services in 2007. Since then, she has worked across multiple roles, from compliance to advisor support, eventually joining Morgan Stanley in 2022. Her practice blends technical expertise with emotional intelligence always grounded in empathy and purpose.

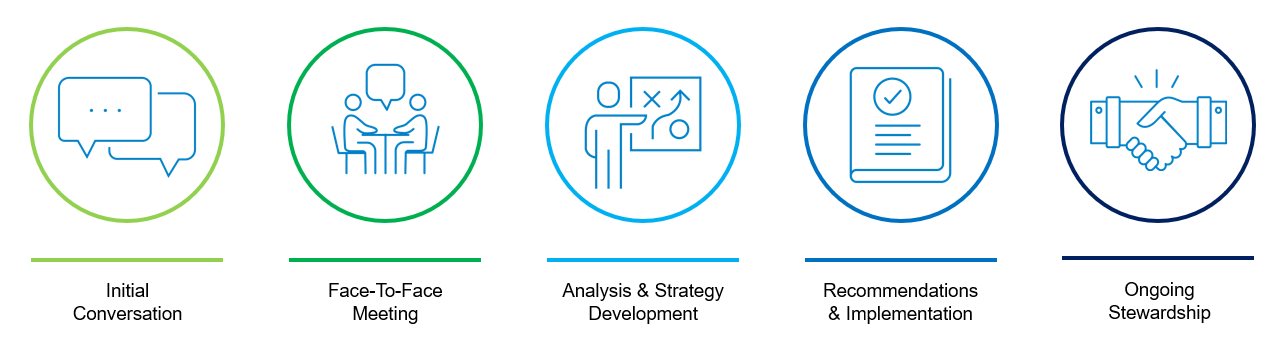

Katie is known for taking a holistic planning approach with her clients focusing not just on investments but on aligning their wealth with their lives and priorities. She believes in building long term relationships rooted in trust, education, and ongoing collaboration. Whether guiding a family through a major life event or helping a business owner plan for the future, Katie is committed to providing personalized, meaningful advice every step of the way.

Outside of the office, Katie enjoys spending time with her family, gardening, cooking, and creating a welcoming home environment. She loves music, walks in nature and working with her hands especially in the garden, where she finds lessons in patience and resilience. If she weren’t in financial services, she imagines she would be an interior designer, still focused on building spaces where people can thrive.

Securities Agent: FL, AK, UT, TN, SD, WY, SC, PA, NJ, MO, MI, IN, CT, WI, KY, IL, CO, RI, MS, ID, GA, CA, VA, NH, NC, MD, HI, WV, WA, OR, NV, OH, DE, DC, AZ, AL, NY, ME, MT, MA, TX; General Securities Representative; Investment Advisor Representative

NMLS#: 2741474

Industry Award Winner

Industry Award Winner