The Schultz Group

Our Mission Statement

Welcome

At the Schultz Group, we pride ourselves on providing personalized wealth and estate management services to the exceptional people that we are privileged to serve. Functioning as an extended family, our primary responsibility is to work alongside our clients and their loved ones to understand their goals and objectives.

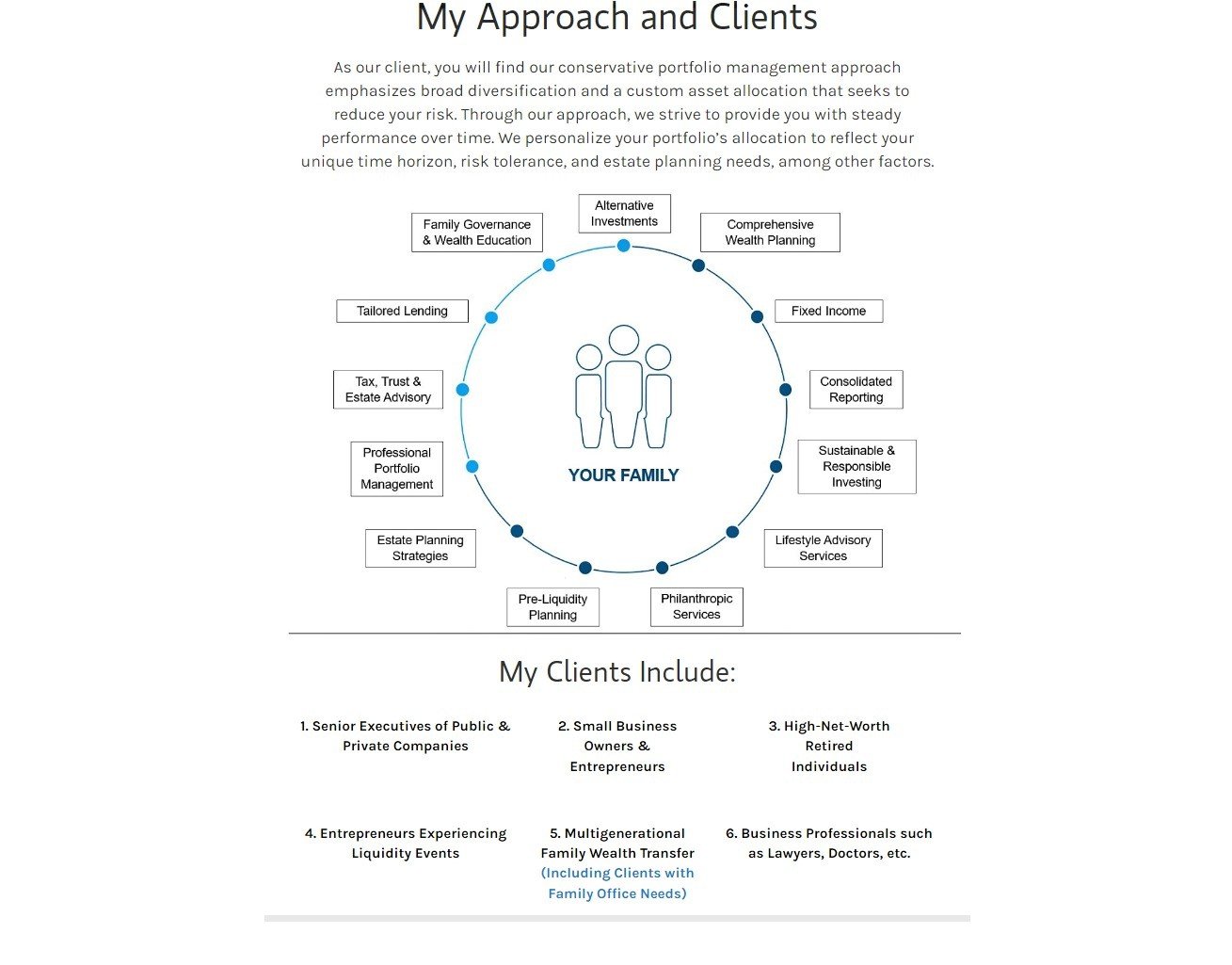

As our client, you will find our conservative portfolio management approach emphasizes broad diversification and a custom asset allocation that seeks to reduce your risk. Through our approach, we strive to provide you with steady performance over time. We personalize your portfolio's allocation to reflect your unique time horizon, risk tolerance, and estate planning needs, among other factors. With Andrew Schultz leading our team, we use his 34 years of investment experience, along with our resources at Morgan Stanley and across Wall Street, to help you preserve and grow your wealth.

Nothing is more personal than your wealth, and we believe there is no substitute for the sort of financial and personal partnership you can expect from the Schultz Group. As your extended family, it's our job to hold your hand along the way to make sure achieving your goals is a fulfilling experience. Our vigilance will free you to focus on the more enjoyable business of life – your family, friends, and leisure time.

We look forward to meeting you and learning more about the needs and aspirations of you and your future generations.

- Alternative InvestmentsFootnote1

- Comprehensive Wealth Planning

- Family Governance & Wealth Education

- Fixed IncomeFootnote2

- Consolidated Reporting

- Tailored LendingFootnote3

- Sustainable & Responsible InvestingFootnote4

- Tax, Trust & Estate AdvisoryFootnote5

- Lifestyle Advisory ServicesFootnote6

- Philanthropic Services

- Pre-Liquidity Planning

About PWM

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

Investing the time to learn more about you and your family, your assets and liabilities, and the risk exposures, enables us to formulate strategies and customize the relationship to your needs.

Working with your tax and legal advisors, we help analyze your income and estate tax circumstance to identify and tailor planning techniques that may be used to address your objectives.

Your customized asset allocation reflects risk, opportunities, and taxation across multiple entities, while integrating your investing and estate plans.

Short-term adjustments seek to capitalize on temporary market distortions. Before making adjustments, we analyze the impact of taxes and trading costs on potential returns.

After comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform.

In coordination with your other advisors, we can conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs.

Location

Meet The Schultz Group

About Andrew Schultz

Andrew Schultz joined Morgan Stanley in 1991. Since 2002, he has been a member of Morgan Stanley’s Chairman’s Club, an exclusive group of the firm’s top-producing Financial Advisors. Andrew has been recognized yearly as one of Forbes’ Top 250 Financial Advisors in the US from 2017-2025. He has also been recognized on the Forbes Best-in-State Wealth Advisor list from 2018-2025. Additionally, Andrew has been named on the Barron’s Top 1,200 Financial Advisors list from 2014-2025 and the Barron's Top 1,000 Financial Advisors list from 2009-2013.

Andrew graduated from the University of Florida with a degree in Economics and continued his professional education at the University of Pennsylvania’s Wharton School, completing the Senior Financial Advisor’s Program and Investment Consultant’s Program. Now, Andrew delivers lectures at his Alma Mater on sustainability and entrepreneurship, as well as sitting on the Alumni Association and helping sponsor the Young Entrepreneurs for Leadership and Sustainability (YELS) program.

Within the community, Andrew sits on the United Way of Miami Dade Professional Advisors Council and the Herbert Wertheim College of Medicine Dean’s Advisory Council. Andrew also hosts an annual charity wine auction and dinner for Broward Children’s Diagnostic & Treatment Center. Andrew and his wife Diana live with their two daughters in Miami Beach, Florida.

2017-2025 Forbes America's Top Wealth Advisors

Source: Forbes.com (Awarded 2017-2024). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of the year the award was issued. https://www.morganstanley.com/disclosures/awards-disclosure.html

2018-2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2014-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2014-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2009-2013 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2009-2013). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

NMLS#: 2133771

About Jonathan Faber

Beyond his professional focus, Jon is known for his integrity, empathy, and exceptional sense of detail. One of the main reasons he became a financial advisor is to utilize his skills and knowledge of the capital markets towards helpings families and individuals achieve their financial goals and avoid stress through the growth cycle into full retirement. He sticks to a very structured service model and closely works with every individual to create a customized strategy that aligns with their financial objectives.

Jon is an active member of his community in Parkland, Florida. He currently sits on the City of Parkland Charter Review board and is a past member of the City of Parkland School Advisory Board. Jon is very involved with the Chabad of Parkland and is an Honorary Member. Family is one of the utmost important things in Jon’s life and is embedded in his core values. He resides in Parkland, Florida with his wife of 26 years, Stacey, and two sons Ethan and Jordan. Outside of work, Jon enjoys reading, fine dining, biking, and spending time with family and friends.

NMLS#: 1279582

About Kemar Bennett

About Peter Collazo

In his current capacity, Peter goes beyond conventional expectations, actively fortifying client relationships with an arsenal of market insights and product knowledge to tailor financial solutions for High- and Ultra-High-Net-Worth clients. His commitment to staying ahead in an ever-evolving financial environment is evident as he navigates its complexities for his clients.

Working directly alongside Andrew Schultz, Peter stands at the forefront of initiatives to streamline service models, demonstrating a keen understanding of the nuanced needs and concerns of High-Net-Worth clients. He is an avid WW1 and WW2 historian.

Peter graduated from Florida International University with a bachelor’s degree in interdisciplinary studies and holds his Series 7, Series 63, and Series 65 licenses.

About Salomon Lapco

Salomon holds the Series 7 and the Series 66.

About Anthony Potestad

Originally from Miami, Florida, Anthony's roots trace back to Cuba, imbuing him with a profound appreciation for his heritage and community. When he's not immersed in the world of finance, Anthony enjoys pursuing his passions for golf, exercise and music. With a diverse educational background, including a Psychology degree from Florida International University and an MBA, coupled with his series of professional certifications, Anthony stands as a trusted member of the team.

Beyond his professional endeavors, Anthony is deeply engaged in community initiatives. He actively participates in the American Cancer Society's "Relay for Life." Additionally, he is a member of Kappa Gamma Pi, the Honor's Society at St. Thomas University, where he continues to contribute to his alma mater's legacy of excellence.

About Kasey Carlson

After graduation, Kasey moved to South Florida to begin her career in the financial services industry, where she has been dedicated to helping clients achieve their financial goals with personal care.

In her free time, Kasey enjoys staying active with outdoor activities, traveling, and spending quality time with family and friends.

Kasey holds both her Series 7 and her Series 66.

About Sebastian Partridge

About Angely Anuel

About Rylee Aden

Rylee creates lasting client relationships through her commitment to personalized care and attention to detail. In her free time, she enjoys cooking, spending time with friends and family, and supporting the local Miami community.

About Vittoria von Blommestein

She earned her Bachelor of Arts in International Affairs with a double major in Peace Studies from The George Washington University. Vittoria blends her governmental affairs background with a strong focus on client engagement and organizational strategy.

In her free time, Vittoria enjoys staying active with her dog Romeo, traveling, and spending quality time with family and friends.

She earned her Bachelor of Arts in International Affairs with a double major in Peace Studies from The George Washington University. Her background in governmental affairs and organizational strategy allows her to provide seamless, high-level support with an emphasis on precision, discretion, and proactive execution. Vittoria blends her governmental affairs background with a strong focus on client engagement and organizational strategy.

In her free time, Vittoria enjoys staying active with her dog Romeo, traveling, and spending quality time with family and friends.

Contact Andrew Schultz

Contact Jonathan Faber

My Thoughts - Go All In or Go Back to Fundamentals

Portfolio Insights

Insights and Outcomes

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Private Wealth Management Podcast

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

3Tailored Lending is a loan/line of credit product offered by Morgan Stanley Private Bank, National Association, an affiliate of Morgan Stanley Smith Barney LLC. A Tailored Lending credit facility may be a committed or demand loan/line of credit. All Tailored Lending loans/lines of credit are subject to the underwriting standards and independent approval of Morgan Stanley Private Bank, National Association. Tailored Lending loans/lines of credit may not be available in all locations. Rates, terms, and programs are subject to change without notice. Other restrictions may apply. The information contained herein should not be construed as a commitment to lend. Morgan Stanley Private Bank, National Association is a Member FDIC that is primarily regulated by the Office of the Comptroller of the Currency. The proceeds from a Tailored Lending loan/line of credit (including draws and other advances) may not be used to purchase, trade, or carry margin stock; repay margin debt that was used to purchase, trade, or carry margin stock; and cannot be deposited into a Morgan Stanley Smith Barney LLC or other brokerage account.

4Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

5Morgan Stanley Smith Barney LLC and its affiliates and their employees (including Financial Advisors and Private Wealth Advisors) are not in the business of providing tax or legal advice. These materials and any statements contained herein should not be construed as tax or legal advice. Individuals should consult their personal tax advisor or attorney for matters involving taxation and tax planning and their attorney for matters involving personal trusts and estate planning.

6Morgan Stanley Smith Barney LLC (the “Firm”) and its affiliates do not currently offer the services provided by this Service Provider(s). The Service Provider(s) is not an affiliate of the Firm. Any review of the Service Provider(s) performed by the Firm was based on information from sources that we believe are reliable but we cannot guarantee its accuracy or completeness. This referral should in no way be considered to be a solicitation by the Firm for business on behalf of the Service Provider(s). The Firm makes no representations regarding the appropriate or otherwise of the products or services provided by the Service Provider(s). There may be additional service providers for comparative purposes. If you choose to contact the Service Provider(s), do thorough due diligence, and make your own independent decision.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley