The Paclantic Group

Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Services

The Paclantic Group at Morgan Stanley is a comprehensive wealth management practice headquartered in Bellevue, WA. We have assembled a broad and experienced team of professionals with extensive knowledge across a wide range of asset classes and disciplines.

With over 100 years of combined experience our team is committed to helping clients with every aspect of their financial needs. As a client of The Paclantic Group you benefit from the attention and personalized care of our group coupled with the strength and resources of an industry leader.

Our goal is to ensure that even in times of uncertainty you have the confidence to know that your future is being managed by a group of professionals.

Our Clients

With greater wealth comes greater complexity. Our team is specifically designed to support successful individuals who have accumulated a significant amount of wealth. Our typical client needs more sophisticated solutions, security, and first-class service.

Our approach to client service is simple – we put you at the center of everything we do. We recognize that getting to know you is essential to success, so we are focused on active listening and collaboration. The more we know about you, the better we understand your needs and what you want to accomplish by working with us.

Individuals in Financial Transition

We strive to successfully lead our clients to transition smoothly through major life changes. We are loyal advocates and experienced wealth managers who do our best work during periods of change.

The complexity of a transitional event does not hinder our work; it actually drives us to uncover important issues as we create a holistic solution specific to your financial needs. With change comes opportunity, and indecision can be expensive. An informed decision is crucial. Whether you are selling a business, changing careers, or newly single, we will make sure you are effectively positioned to move forward with clarity and confidence.

International Clients

Morgan Stanley International Wealth Management (IWM) is the choice of exceptionally accomplished, globally minded Advisors. We focus on HNW/UHNW families, individuals and foundations located outside of United States. We provide the robust support, expansive platforms and specialized resources you need to help highly sophisticated families across the globe address the complex, multifaceted challenges of managing generational wealth.

International Wealth Management was founded on the promise of doing first-class business in a first-class way. We remain proud of our value proposition and are deeply committed to delivering a comprehensive wealth management offering to our clients.

Multigenerational Families

At The Paclantic Group, multi-generational wealth planning is integral to our practice.

Our financial planning process for multi-generational families is a rigorous analysis of your lifestyle, tax obligations, future gifting plans and portfolio objectives. This analysis drives our strategy as it pertains to financial and estate planning for wealth preservation, tax optimization, asset allocation and investment decisions. Throughout the entirety of the relationship, we can work closely with your attorneys and accountants.

Corporate Stock Plans, Entrepreneurs, Executives & Business Owners

We work with a select clientele of highly affluent professionals and entrepreneurs, helping them to create a comprehensive wealth management plan based on the goals they have for their businesses. We are uniquely positioned to work with corporate stock plan directors and individuals with concentrated stock positions.

About PWM

- Manage investments with an unwavering focus on your financial strategy and personal goals

- Create comprehensive, multigenerational wealth management plans based on your needs, challenges and the values that guide your life and legacy

- Simplify financial complexity to help you achieve clarity and control

- Approximately 300 teams specialized in assisting individuals and families with $20MM+ in investable assets

- Over $1.2 trillion in AUM

- Comprising 26% of the Barron’s Top 100 Financial Advisors list for 2025

- Direct access to ultra high net worth experts in philanthropy, family dynamics, wealth transfer, lifestyle advisory and other areas of interest to ultra high net worth families

Financial Planning with The Paclantic Group

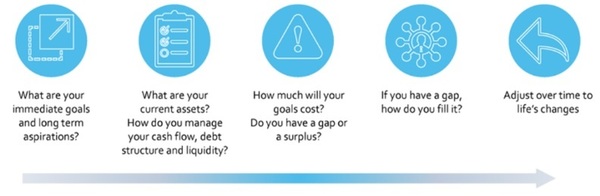

Our team of advisors has extensive experience in financial planning analysis. Bill Brooking holds the Certified Financial Planner certification, while Kerry Zimm and Pete Perry are Financial Planning Specialists at the firm. Using our suite of tools – our LifeView® platform – we can create your personal roadmap to help achieve and protect your goals – a framework that makes the connection between your life goals and your financial resources, and provides a baseline for future discussions.

• Identify circumstances unique to your personal situation

• Clearly establish your financial and personal goals

• Review the information collected to insure the data is accurate

• Analyze your current investment and cash management strategies

• Integrate any real estate and private investments into your overall strategy

• Incorporate insurance and estate planning strategies

• Present our recommendations along with key action steps

• Coordinate strategies with your CPA and estate attorney if applicable

• Set up tools to provide convenient access to your accounts

• Prepare and complete necessary paperwork

• Provide ongoing updates to ensure your plan is implemented as expected

• Apply a strict due diligence process to evaluate investment performance

• Determine if any adjustments are needed, since personal goals and market conditions can change over time

International Wealth Management

We are based in offices throughout the United States, but often specialize in a specific country or region, and typically speak the client’s language, understand the culture and have a deep knowledge of the markets we serve. Combining our investment knowledge with the resources and intellectual capital of Morgan Stanley, we deliver targeted solutions that help our clients pursue their goals and address their unique financial needs.

- An open architecture platform that includes leading asset management firms, giving you access to unaffiliated third party managers and their teams.

- Thematic investing ideas and asset allocation models from Morgan Stanley’s Global Investment Committee, guiding your overall portfolio allocation.

- Customized lending solutions from Morgan Stanley Private Bank, National Association, addressing your financing needs.

- Dedicated specialists in wealth transfer, philanthropy, family dynamics, concierge and lifestyle advisory services, and other family office capabilities, supporting the non-financial needs you may have.

Not all products and services are available to clients outside of the United States.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link: https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be suitable for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

CRC 3430115 05/22

Location

Meet The Paclantic Group

About Paul W Jackson

Today, I advise on the billion dollar wealth of my combined clients and I report to them on the progress they are making in achieving their life goals. Critical aspects of my former work were strong communication, situational awareness, and the ability to manage numerous complex ship ‘evolutions’ at the same time. These same capabilities are critically important when you seek an experienced advisor to trust, put your interests first and lead on complex wealth questions when working with their legal and tax experts.

As a Family Wealth Director, a Morgan Stanley designated financial professional, I believe that you - as one of our most important clients - are entitled to a different kind of working relationship with the firm. I bring the scope and influence of the additional resources Morgan Stanley provides to our most valued clients. This combination of personal attention and financial possibilities can help create unique opportunities for you. Your financial life requires the broadest possible scope of knowledge, and we are committed to helping you have an experience that is easier and rewarding.

Recognizing my commitment to my clients for over 28 years, Barron’s Magazine has recognized me as a top 1200 US advisor in 2017-2025, the Financial Times honored me as a top 400 US advisor in 2018, and Forbes Best in State 2018-2025.

Contact me today to discover how I help successful individuals and families navigate the challenges of wealth.

2017-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2017-2022). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2018-2025 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Financial Times 400 Top Financial Advisors

Source: ft.com (Awarded Mar 2018) Data compiled by the Financial Times based on time period from 6/30/15 - 6/30/17.

NMLS#: 1262194

About Kerry L Zimm

Based in Bellevue WA, I service high net worth individuals and families in the Puget Sound region, across the country, and around the world. I focus on comprehensive wealth planning to build an investment strategy that is tailored for each client to help meet their financial goals.

The backing and far reach of Morgan Stanley provides me with the resources to provide assistance in all areas of your financial life from retirement planning and investments to insurance, long-term care protection and cash management and lending solutions.

Outside of the office, I have worked as a volunteer tutor at the Seattle Public Library and raised money for the arts as an ArtsFund associate. I live in Seattle with my husband and two dogs and enjoy snowboarding, reading, attending theater productions and travel.

NMLS#: 1301159

About Bill Brooking, MBA

During and after graduate school, I worked in management for a local company with annual sales of about $100 million. That company was acquired by a much bigger company based in Minneapolis. When it became clear that my future depended on me moving to Minnesota to be near headquarters I knew it was time to change careers.

I began working at Smith Barney (later merged with Morgan Stanley) as a Financial Advisor in 2003. I joined a national stock plan services team based in Bellevue. I quickly found success working with executives of public companies and their families.

Since joining Morgan Stanley, I have completed courses in Financial Planning and received my Certified Financial Planner designation.

Being involved is one of my core values. Currently, I am a member of the Board of Trustees of Archbishop Thomas J. Murphy High School in Everett. I am also Past President and a current member of the Mill Creek Rotary. I have served on the School Commission for St Thomas School in Phoenix and for St. Brendan School in Bothell. I am a past Board member of the Imagine Children’s Museum and a past Board Member of the Alumni Board for Seattle Preparatory School.

I was lucky enough to marry my high school sweetheart and we have three children who keep us very busy on the weekends. When I’m not volunteering or coaching kid’s sports, I enjoy riding motorcycles.

NMLS#: 1253151

CA Insurance License #: 0F00977

About Leonard Hill

I joined The Paclantic Group at Morgan Stanley in July 2021, where I am now focused on tailoring customized financial plans, asset and liability management, investment manager selection, and handling the team’s relationships with professional partners which include legal, tax, and M&A. I currently hold the Certified Financial Planner® designation.

Outside the office, I reside in North Bend, WA and spend most of my time with my wife and young son. When I can find the time, you can typically find me on a golf course or hosting friends and family.

NMLS#: 2228405

About Marshall Friedman

Prior to joining Morgan Stanley, Mr. Friedman served as the CFO of a family office where he oversaw the financial operations of several operating businesses and performed diligence and analysis to drive overall investment strategy.

Previously, Mr. Friedman was an investment banker at Houlihan Lokey where he executed sell side and capital raise mandates for his clients. His responsibilities included all aspects of the deal process, including financial modeling, performing due diligence, creating marketing materials, and coordinating deal execution.

Before joining Houlihan Lokey, Mr. Friedman worked in Business Development and Marketing for Alibaba Group where he worked with international brands to reach Chinese consumers through China’s largest brands and retail platform, Tmall.com and attracted and educated international buyers to conduct business on the world’s largest wholesale trade platform, Alibaba.com.

Mr. Friedman is also a commercial real estate investor with a focus on multifamily and RV parks.

Mr. Friedman holds a B.S. in Business Administration and a minor in Chinese from the University of North Carolina at Chapel Hill and an MBA from Duke University’s Fuqua School of Business.

Outside of the office Mr. Friedman spends his time with his wife and two kids, loves cooking and entertaining friends and family, and is an avid snowboarder. Mr. Friedman is fluent in Mandarin Chinese.

NMLS#: 2677281

About Francine Griggs

NMLS#: 1465503

About Heather A Fleming

About Nalini Ramesh

About Daisy Zhu

Daisy is a graduate of University of Illinois at Chicago, where she earned a MBA degree, concentrate in Finance Market and Risk Management. She earned her bachelor’s degree in Hotel management from University of Houston.

She currently lives in Bellevue, Washington. She also enjoys reading, travelling, wine appreciation, swimming, playing violin, and social events.

About Janae Towery

To reach Janae, please call 425-436-2666 or email Janae.towery@morganstanley.com.

About Alex Luther-Gray

Originally from the south of France, Alex is bilingual and enjoys traveling back to Europe to visit her family and friends who reside there. She likes to go trail running on her days off as well as spend time with her rescue dog, Onessa.

About Emma M. Fritton

About Olivia Normand

Outside of her professional commitments, Olivia enjoys cooking, painting, traveling, and staying active, all of which fuel her creativity and enthusiasm. She also cherishes spending her free time with friends, family, and her dogs!

Contact Paul W Jackson

Contact Kerry L Zimm

Contact Bill Brooking, MBA

Contact Leonard Hill

Contact Marshall Friedman

Contact Francine Griggs

Awards and Recognition

Portfolio Insights

Managing Significant Wealth

- Investment Management

- Wealth Transfer & Philanthropy

- Cash Management & Lending

- Family Governance & Wealth Education

- Lifestyle Advisory

- Business Services

Insights and Outcomes

Private Wealth Management Podcast

- Intergenerational Planning

- Philanthropic Giving

- Non-Traditional Assets

- Managing Family Wealth

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

7Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

The securities/instruments, investments and investment strategies discussed on this website may not be suitable for all investors. The appropriateness of a particular investment or investment strategy will depend on an investor's individual circumstances and objectives. The views and opinions expressed on this website may not necessarily reflect those of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). This website and its associated content are intended for U.S. residents only.

Morgan Stanley and its Private Wealth Advisors do not provide tax or legal advice. Visitors to this website should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Private Wealth Advisers may only transact business in states where they are registered or excluded or exempted from registration. Transacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Morgan Stanley Private Wealth Advisers are not registered or excluded or exempt from registration.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

See the Financial Advisors Biographies for Registration and Licensing information.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

Investment Management Consultants Association, Inc. owns the marks CIMA®, Certified Investment Management Analyst® (with graph element)®, and Certified Investment Management Analyst® .

Morgan Stanley Smith Barney LLC offers insurance products in conjunction with its licensed insurance agency affiliates.

Life insurance, disability income insurance, and long-term care insurance are offered through Morgan Stanley Smith Barney LLC's licensed insurance agency affiliates.

Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Awards Disclosures | Morgan Stanley