The Oaks Group at Morgan Stanley

Direct:

(805) 494-0215(805) 494-0215

Toll-Free:

(877) 494-0215(877) 494-0215

Industry Award Winner

Industry Award WinnerOur Mission Statement

Providing exceptional financial stewardship so you can spend your valuable time focused on what brings joy and meaning to your life.

The Oaks Group at Morgan Stanley

With more than 128 years of combined industry experience* and over $2.6 billion** in assets under management, our team takes tremendous pride in helping you use your wealth to achieve what is most important to you.

That may mean providing an education to children and grandchildren, buying a vacation home, meeting the special needs of a family member, retiring ten years early — the list is endless, and the decision is uniquely your own.

Together, we will explore your aspirations and the life you envision. We will work with you to translate your goals into a specific investment objective and personalized investment strategy. And then, drawing on the team’s experience and resources of one of the world’s largest financial firms, we will structure a portfolio for you to help bring you closer to your definition of investment success.

In short, your goals become our focus, and working towards them becomes a commitment that we share. We find tremendous joy in our daily work and with the people we are honored to serve.

Welcome to The Oaks Group at Morgan Stanley.

* Seth Haye - 21 years in industry

Katie DuBois - 7 years in industry

Duncan Hizzey - 6 years in industry

Elisa Decker - 39 years in industry

Clinton Spivey - 14 years in industry

Stephanie Hartmire - 22 years in industry

Griselda Hernandez - 11 years in industry

Adagio Cisneros - 4 years in industry

Brandon Fraye – 4 years in industry

** As of February 2026

That may mean providing an education to children and grandchildren, buying a vacation home, meeting the special needs of a family member, retiring ten years early — the list is endless, and the decision is uniquely your own.

Together, we will explore your aspirations and the life you envision. We will work with you to translate your goals into a specific investment objective and personalized investment strategy. And then, drawing on the team’s experience and resources of one of the world’s largest financial firms, we will structure a portfolio for you to help bring you closer to your definition of investment success.

In short, your goals become our focus, and working towards them becomes a commitment that we share. We find tremendous joy in our daily work and with the people we are honored to serve.

Welcome to The Oaks Group at Morgan Stanley.

* Seth Haye - 21 years in industry

Katie DuBois - 7 years in industry

Duncan Hizzey - 6 years in industry

Elisa Decker - 39 years in industry

Clinton Spivey - 14 years in industry

Stephanie Hartmire - 22 years in industry

Griselda Hernandez - 11 years in industry

Adagio Cisneros - 4 years in industry

Brandon Fraye – 4 years in industry

** As of February 2026

Services Include

- Wealth ManagementFootnote1

- Financial PlanningFootnote2

- Professional Portfolio ManagementFootnote3

- Trust AccountsFootnote4

- Lending Products

- Estate Planning StrategiesFootnote5

- 529 PlansFootnote6

- Retirement PlanningFootnote7

- Long Term Care InsuranceFootnote8

- AnnuitiesFootnote9

- Cash ManagementFootnote10

- Life InsuranceFootnote11

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

In The Press

"2016-2019 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors)

Source: Forbes.com (Awarded 2016-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued."

"2018-2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award."

"2020-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2020-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award."

Source: Forbes.com (Awarded 2016-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued."

"2018-2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award."

"2020-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2020-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award."

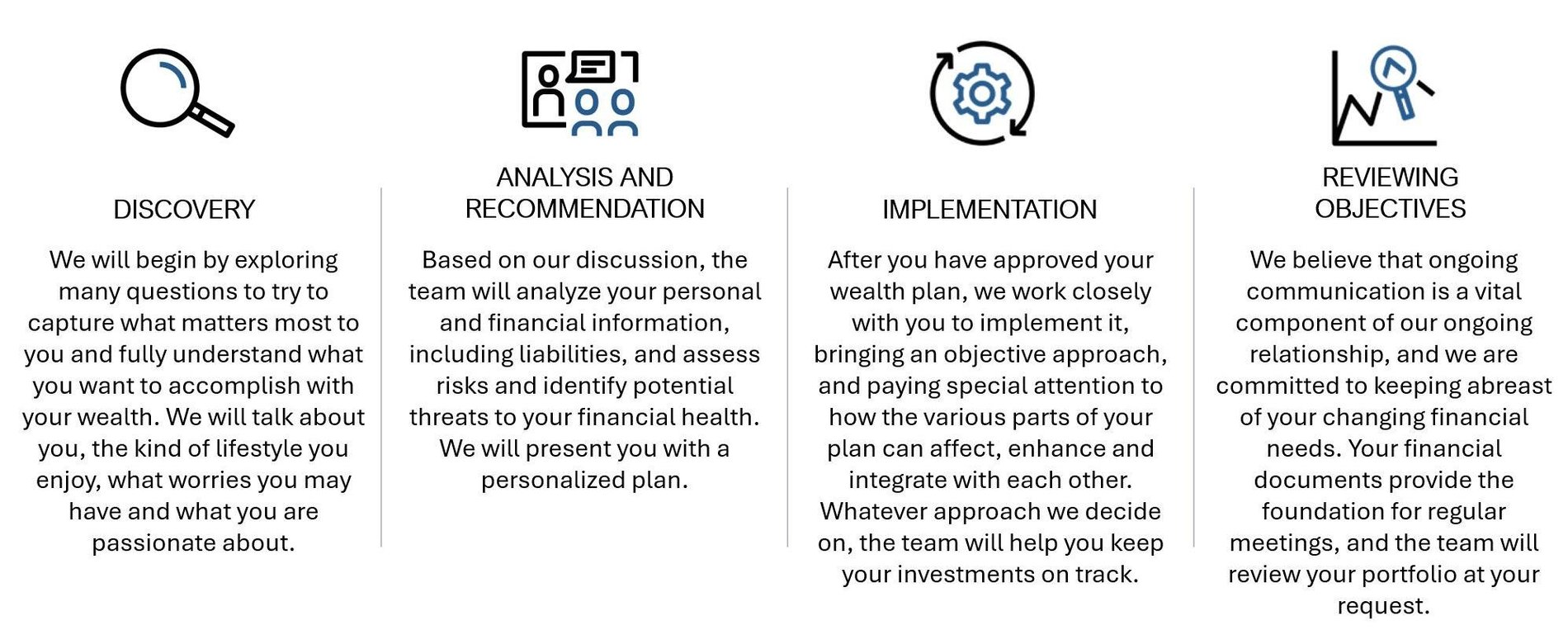

Working With You

Our Consultative Process

Charting a prudent course to financial independence requires a well-conceived, personalized plan with defined long-term goals. Our wealth advisory consultative process can help you design a cohesive plan for the future that includes:

Charting a prudent course to financial independence requires a well-conceived, personalized plan with defined long-term goals. Our wealth advisory consultative process can help you design a cohesive plan for the future that includes:

Location

2829 Townsgate Rd

Ste 200

Westlake Village, CA 91361

US

Direct:

(805) 494-0215(805) 494-0215

Toll-Free:

(877) 494-0215(877) 494-0215

Meet The Oaks Group

About Seth A Haye

Seth Haye is a Managing Director, Financial Advisor, and Senior Portfolio Management Director at Morgan Stanley. Within this capacity, Seth serves as the senior partner of The Oaks Group at Morgan Stanley. Since 2004, Seth has provided leadership and guidance regarding all financial matters that impact the lives of his clients.

Seth was ranked by Forbes as the #1 Next-Gen Wealth Advisor in America in 2019, and The Oaks Group is currently ranked #1 by Forbes on the Best-In-State Wealth Management Teams list for 2025. Additionally, Barron’s has named Seth to the list of Top 1200 Financial Advisors In America each consecutive year since 2020 and The Oaks Group has been named to the list of America’s Top Wealth Management Teams for 2024.

Seth has been married to his high school sweetheart, Jolyn, since 2001. The couple met in Seattle and both attended Pepperdine University. They were engaged while spending an academic year in Florence, Italy and now live with their two children and one dog in Westlake Village, California.

Seth and Jolyn have been involved with multiple boards and organizations both domestically and abroad. Seth currently serves on the Board of Regents at Pepperdine University, where the couple has endowed a student scholarship and supported multiple strategic priorities of the president. Seth and Jolyn also consult and provide funding for several non-profit organizations in the Conejo Valley that support underprivileged youth. The Haye family has been actively involved in their local church for more than twenty years.

2016-2019 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors)

Source: Forbes.com (Awarded 2016-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

2018-2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2020-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2020-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Award Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Seth was ranked by Forbes as the #1 Next-Gen Wealth Advisor in America in 2019, and The Oaks Group is currently ranked #1 by Forbes on the Best-In-State Wealth Management Teams list for 2025. Additionally, Barron’s has named Seth to the list of Top 1200 Financial Advisors In America each consecutive year since 2020 and The Oaks Group has been named to the list of America’s Top Wealth Management Teams for 2024.

Seth has been married to his high school sweetheart, Jolyn, since 2001. The couple met in Seattle and both attended Pepperdine University. They were engaged while spending an academic year in Florence, Italy and now live with their two children and one dog in Westlake Village, California.

Seth and Jolyn have been involved with multiple boards and organizations both domestically and abroad. Seth currently serves on the Board of Regents at Pepperdine University, where the couple has endowed a student scholarship and supported multiple strategic priorities of the president. Seth and Jolyn also consult and provide funding for several non-profit organizations in the Conejo Valley that support underprivileged youth. The Haye family has been actively involved in their local church for more than twenty years.

2016-2019 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors)

Source: Forbes.com (Awarded 2016-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

2018-2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2020-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2020-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Award Disclosures: https://www.morganstanley.com/disclosures/awards-disclosure.html

Securities Agent: PA, OR, MO, ID, CO, AZ, MT, MD, MA, DC, WY, NY, NH, MN, MI, SC, OK, NC, ME, FL, CT, WI, NV, IA, HI, VA, OH, CA, IN, DE, AR, UT, NM, WA, NJ, IL, GA, TX, TN; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1279368

CA Insurance License #: 0E71484

NMLS#: 1279368

CA Insurance License #: 0E71484

About Katie DuBois

Katie DuBois is a Vice President, Financial Advisor with The Oaks Group. Katie’s focus is ensuring that clients are able to define their financial and personal goals to develop a well-rounded financial strategy that is conducive to achieving those goals. She does so through comprehensive financial planning and partnering with clients to assist in the educational foundation of markets and the economy. Katie believes that feeling confident with your financial future comes from both understanding of investments and a well developed plan.

Katie joined Morgan Stanley in 2018 after working in the technology recruiting industry. She graduated from UCLA with a B.A. in Economics in 3 years. Her study focused on International Trade, Economic Growth & Development, and Econometrics. Katie's passion is helping individuals and families make prudent, goal-oriented financial choices, so they can feel confident about their future and spend more time on the things they love in life. This commitment has earned Katie firm recognition. She has been named a Pacesetter's Club Member in 2021 and 2022 at Morgan Stanley.

Katie was born and raised in the Santa Clarita Valley. She now lives in Moorpark with her husband, Spencer, their daughter, and their two Labrador Retrievers, Chief and Harley. Katie spends her free time with a good read, at the gym/running Spartan races, and cheering for the New England Patriots.

Katie joined Morgan Stanley in 2018 after working in the technology recruiting industry. She graduated from UCLA with a B.A. in Economics in 3 years. Her study focused on International Trade, Economic Growth & Development, and Econometrics. Katie's passion is helping individuals and families make prudent, goal-oriented financial choices, so they can feel confident about their future and spend more time on the things they love in life. This commitment has earned Katie firm recognition. She has been named a Pacesetter's Club Member in 2021 and 2022 at Morgan Stanley.

Katie was born and raised in the Santa Clarita Valley. She now lives in Moorpark with her husband, Spencer, their daughter, and their two Labrador Retrievers, Chief and Harley. Katie spends her free time with a good read, at the gym/running Spartan races, and cheering for the New England Patriots.

Securities Agent: IL, ME, UT, MI, IA, SC, OK, NY, HI, WA, OR, IN, ID, AR, WY, WI, TN, NJ, MD, MT, MN, GA, FL, CT, CA, VA, PA, MA, NC, MO, CO, AZ, TX, NV, DE, DC, OH, NM, NH; General Securities Representative; Investment Advisor Representative

NMLS#: 1894332

CA Insurance License #: 0M72710

NMLS#: 1894332

CA Insurance License #: 0M72710

About Duncan Hizzey

Duncan Hizzey is a Senior Vice President and Financial Advisor with The Oaks Group at Morgan Stanley in Westlake Village, CA. Deeply committed to building strong trusting relationships with his clients, he focuses primarily on creating and managing financial plans to help a wide range of investors achieve their unique goals.

Duncan’s process begins with a discovery meeting, which enables him to gather all relevant information of a client’s financial life and what he or she would like to accomplish. From there, he employs his analytical skills to create a comprehensive financial plan designed to help achieve specific goals within the individual’s time horizon.

As for his investment philosophy, Duncan places as much importance on mitigating undue risk as he does on accumulating wealth over time.

Duncan joined Morgan Stanley in 2019 following a highly successful 17-year career in the health care industry that required him, not only to be knowledgeable, but sensitive, compassionate and understanding. His current clients greatly value those character traits in him.

Duncan graduated from Pepperdine University with a B.S. in International Business & Finance. Born and raised in the Pacific Northwest, he now lives in Thousand Oaks with his wife, Maya, and their three daughters (Lily, Naomi, and Claire). In his free time, Duncan enjoys working in the yard, following current events, and golfing with his family.

Duncan’s process begins with a discovery meeting, which enables him to gather all relevant information of a client’s financial life and what he or she would like to accomplish. From there, he employs his analytical skills to create a comprehensive financial plan designed to help achieve specific goals within the individual’s time horizon.

As for his investment philosophy, Duncan places as much importance on mitigating undue risk as he does on accumulating wealth over time.

Duncan joined Morgan Stanley in 2019 following a highly successful 17-year career in the health care industry that required him, not only to be knowledgeable, but sensitive, compassionate and understanding. His current clients greatly value those character traits in him.

Duncan graduated from Pepperdine University with a B.S. in International Business & Finance. Born and raised in the Pacific Northwest, he now lives in Thousand Oaks with his wife, Maya, and their three daughters (Lily, Naomi, and Claire). In his free time, Duncan enjoys working in the yard, following current events, and golfing with his family.

Securities Agent: CA, AZ, AR, WA, VA, NC, IN, ID, DC, IL, OR, NM, NH, TX, OH, TN, PA, NV, NJ, MO, MN, ME, SC, IA, DE, CT, WY, WI, OK, NY, MI, MD, HI, GA, UT, MT, FL, CO, MA; General Securities Representative; Investment Advisor Representative

NMLS#: 1949120

NMLS#: 1949120

About Elisa Decker

Elisa is Vice President and Chief of Staff. She began her career with Morgan Stanley in 1986. She has responsibilities for client administration, client communications and trading. She has her BA - Liberal Studies from Cal State University in Northridge, California. She is Series 7, 63 and 65 licensed.

Elisa enjoys traveling, reading a good book, spending time with her adult children and dogs.

Elisa enjoys traveling, reading a good book, spending time with her adult children and dogs.

About Clint Spivey

Clint is a Consulting Group Analyst. His responsibilities include investment analysis, trading, retirement planning and project management. He earned his B.S. Business Economics degree from Saint Mary's College of California. He is Series 7, 63 and 65 licensed.

About Stephanie Hartmire

Stephanie is a Group Director. She began her career with Morgan Stanley in 2008. She is series 7 and 66 licensed. She earned her BA - Sociology Specialization in Business Administration from UCLA.

Stephanie enjoys hiking and the great outdoors with her husband, daughters and two dogs.

Stephanie enjoys hiking and the great outdoors with her husband, daughters and two dogs.

About Griselda Hernandez

Griselda is a Wealth Management Associate. She began her career with Morgan Stanley in 2014, and is series 7 and 66 licensed. Griselda has a BS in Business Administration from California State University, Northridge.

Griselda enjoys traveling, cooking, and spending time with her husband, children, and two dogs.

Griselda enjoys traveling, cooking, and spending time with her husband, children, and two dogs.

About Adagio Cisneros

Adagio Cisneros is a Business Development Director for The Oaks Group at Morgan Stanley. Adagio is involved with trading, financial planning, business development, and relationship management. Previously, Adagio served as a Senior Wealth Strategy Associate for an $8B team at UBS. While at UBS, he was responsible for investment research, portfolio management, and performance reporting. Before UBS, Adagio earned his B.S. in Business Administration from the Marshall School of Business at the University of Southern California.

Outside of work, Adagio enjoys cooking, sports, and spending time with family and friends. Adagio is passionate about the field of wealth management and enjoys helping others achieve their financial goals and helping high-net-worth families navigate complex financial issues.

Outside of work, Adagio enjoys cooking, sports, and spending time with family and friends. Adagio is passionate about the field of wealth management and enjoys helping others achieve their financial goals and helping high-net-worth families navigate complex financial issues.

About Brandon Fraye

Brandon Fraye is a Registered Client Service Associate who joined Morgan Stanley in 2021. He is Series 7 and Series 66 licensed and is committed to delivering client service at the highest level with a responsive, detail-oriented approach.

Brandon earned a B.A. in Economics from California State University, Northridge through the David Nazarian College of Business and Economics. He combines a strong business foundation with a service-first mindset.

Outside of the office, Brandon enjoys playing golf, going to the gym, and spending time with his wife, family, and friends.

Brandon earned a B.A. in Economics from California State University, Northridge through the David Nazarian College of Business and Economics. He combines a strong business foundation with a service-first mindset.

Outside of the office, Brandon enjoys playing golf, going to the gym, and spending time with his wife, family, and friends.

About Tyler Davis

Tyler Davis is a Financial Advisor with The Oaks Group at Morgan Stanley. Tyler is passionate about building authentic relationships and developing strategies to help others reach their life goals.

Tyler graduated with a B.S. in Business Management from Point Loma University and a M.S. in Business from Pepperdine University. Tyler played tennis at both Point Loma and Pepperdine. Being a college athlete at the highest level has made Tyler aware of the role trust and responsibility play in developing healthy relationships with others, which translates seamlessly to the wealth management industry. His experience, paired with his work ethic, grit, education, and natural interest in people, ultimately led him to pursue a career at Morgan Stanley, and specifically The Oaks Group.

Tyler lives in Malibu and is engaged to his college sweetheart, Kristia. The couple met during their time at Point Loma, and then pursued their master's degrees from Pepperdine together. Tyler spends his free time playing tennis, padel, basketball, and golf. He loves to travel, spend time with family and friends, and is a passionate Lakers fan.

Tyler graduated with a B.S. in Business Management from Point Loma University and a M.S. in Business from Pepperdine University. Tyler played tennis at both Point Loma and Pepperdine. Being a college athlete at the highest level has made Tyler aware of the role trust and responsibility play in developing healthy relationships with others, which translates seamlessly to the wealth management industry. His experience, paired with his work ethic, grit, education, and natural interest in people, ultimately led him to pursue a career at Morgan Stanley, and specifically The Oaks Group.

Tyler lives in Malibu and is engaged to his college sweetheart, Kristia. The couple met during their time at Point Loma, and then pursued their master's degrees from Pepperdine together. Tyler spends his free time playing tennis, padel, basketball, and golf. He loves to travel, spend time with family and friends, and is a passionate Lakers fan.

Securities Agent: ME, DC, AR, WI, PA, NV, MO, MD, ID, FL, CA, WA, SC, NJ, IN, IL, IA, CT, UT, NC, MI, MA, WY, MT, AZ, TN, OH, NY, NM, MN, HI, GA, DE, CO, NH, TX, OR, VA, OK; General Securities Representative; Investment Advisor Representative

Contact Seth A Haye

Contact Katie DuBois

Contact Duncan Hizzey

Awards and Recognition

Barron's Top 250 Private Wealth Management Teams

2024-2025 Barron's Top 100 Private Wealth Management Teams (formerly referred to as Barron's Top 100 Private Wealth Management Teams, Barron's Top 50 Private Wealth Management Teams, Barron's Top 50 Private Wealth Advisory Teams) Source: Barrons.com (Awarded April 2024-2025). Data compiled by Barron's based on 12-month period concluding in Dec of the year prior to the issuance of the award.

Forbes America's Top Wealth Management Teams

Forbes America’s Top Wealth Management Teams Source: Forbes.com (Awarded Nov 2024) Data compiled by SHOOK Research LLC for the period 3/31/23-3/31/24.

Forbes Best-In-State Wealth Management Teams

2020-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded 2020-2026). Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

Forbes America's Top Wealth Advisors

Forbes America's Top Wealth Advisors Source: Forbes.com (Awarded April 2025) Data compiled by SHOOK Research LLC for the period 6/30/23 - 6/30/24.

Forbes Best-In-State Wealth Advisors

2018-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2018-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Barron's Top 1,200 Financial Advisors: State-by-State

2020-2025 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2020-2025). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Forbes America's Top Next-Gen Wealth Advisors

2016-2019 Forbes America's Top Next-Gen Wealth Advisors (formerly referred to as Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors) Source: Forbes.com (Awarded 2016-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

7

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Wealth Management for Athletes and Entertainers

Understanding the unique financial challenges of athletes and entertainers and how they differ from one profession to the next, we deliver the experience and resources you need to help create and implement a comprehensive, multigenerational wealth management plan based on your needs, values and aspirations.

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Oaks Group today.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

7When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

11Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)