About Jonathan Wiener

Jonathan Wiener, is a Vice President, Portfolio Manager, Chartered Retirement Plans Specialist, Insurance Planning Director, Financial Planning Specialist, and Financial Advisor with Morgan Stanley, and a Partner of The 58 Group at Morgan Stanley.

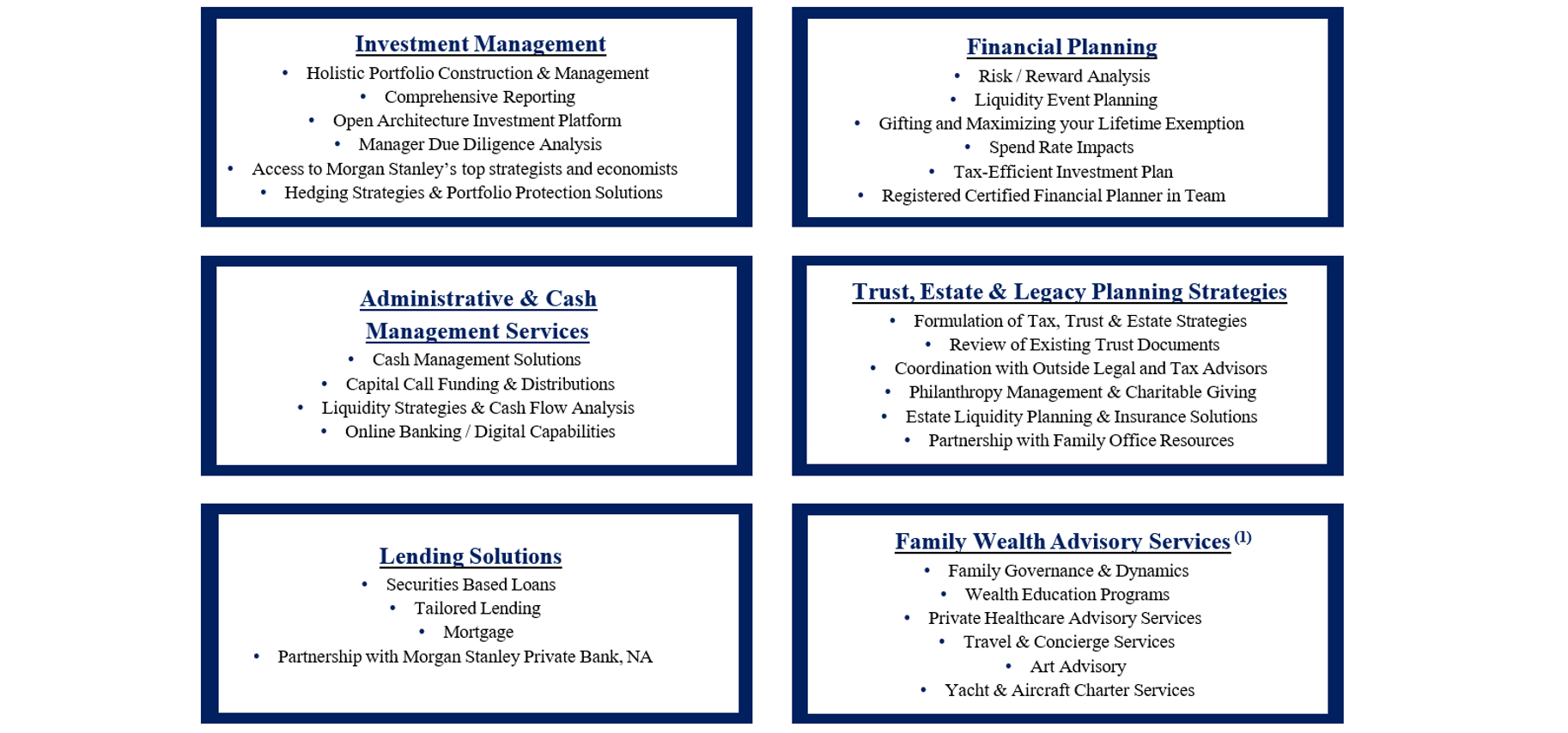

Jonathan began his career in institutional asset management most notably OppeneheimerFunds where he advised and counseled financial advisors, family offices, and institutions on portfolio construction. Later, he worked at a Private Family Office and at PitchBook, where he provided private market valuations to founders, venture capital firms, and Private Equity firms. He relies on his institutional asset management and portfolio construction experience to advise his clients. He oversees: (i) financial planning matters, including, but not limited to, comprehensive cash management and lending solutions, insurance, estate and tax planning strategies; (ii) macroeconomic and market research; (iii) investment selection for client portfolios; and (iv) relationship management.

Jonathan advises a diverse client base consisting of highly accomplished professionals and families ranging from Wall Street professionals, founders, attorneys, doctors, entrepreneurs, commercial real estate executives, property & casualty professionals to corporate executives. He has a particularly strong following among professionals at financial intuitions, real estate asset managers, founders and he and his team are very experienced advising these professionals while navigating the applicable regulatory and compliance restrictions they typically endure.

Outside of Morgan Stanley Jonathan is an advocate for charitable causes and most recently served as a Board Member for the Younger New Yorkers Chorus (YNYC) an arts & culture charity.

Jonathan earned his B.S. in Business Administration with a focus in Finance and Marketing and a minor in Financial Market Regulation, Cum laude, from the University at Albany, State University of New York. Jonathan resides in Cold Spring Harbor, NY with his wife Cara, their daughter Magnolia, son Hayes, and lively Cavapoo dog. He enjoys the peaceful charm of the harbor town and spending time outdoors with his family and staying active in the community.

Securities Agent: ME, CT, WI, SC, KY, RI, MD, DE, AR, TX, NY, NM, NH, DC, CO, OH, NV, KS, IL, IA, CA, AK, NJ, MS, AL, PA, LA, AZ, MI, MA, WA, NC, VA, TN, OR, MN, IN, GA, FL; General Securities Representative; Investment Advisor Representative

NMLS#: 2192352