The Lindbrook Group at Morgan Stanley

Our Mission Statement

Helping individuals and entertainment clients meet their financial goals through experience, intellectual capital and dedicated personal service

Our Story and Services

The Lindbrook Group was formed in 2002, and our partners have a combined 175 years of industry experience. As of 2025 the team manages over $2.8 billion of client assets. We focus on working with high net-worth individuals, families, foundations, non-profits and partnerships.

The Lindbrook Group is proud to be a member of the Firm's elite Global Sports & Entertainment Group, chosen for our significant experience working with sports and entertainment professionals, plus our deep understanding of career and industry practices.

Services Include

- Wealth ManagementFootnote1

- Wealth PlanningFootnote2

- Retirement PlanningFootnote3

- Sustainable InvestingFootnote4

- Alternative InvestmentsFootnote5

- Trust AccountsFootnote6

- Structured ProductsFootnote7

- SyndicateFootnote8

- Qualified Retirement PlansFootnote9

- Professional Portfolio ManagementFootnote10

- Planning for Education FundingFootnote11

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

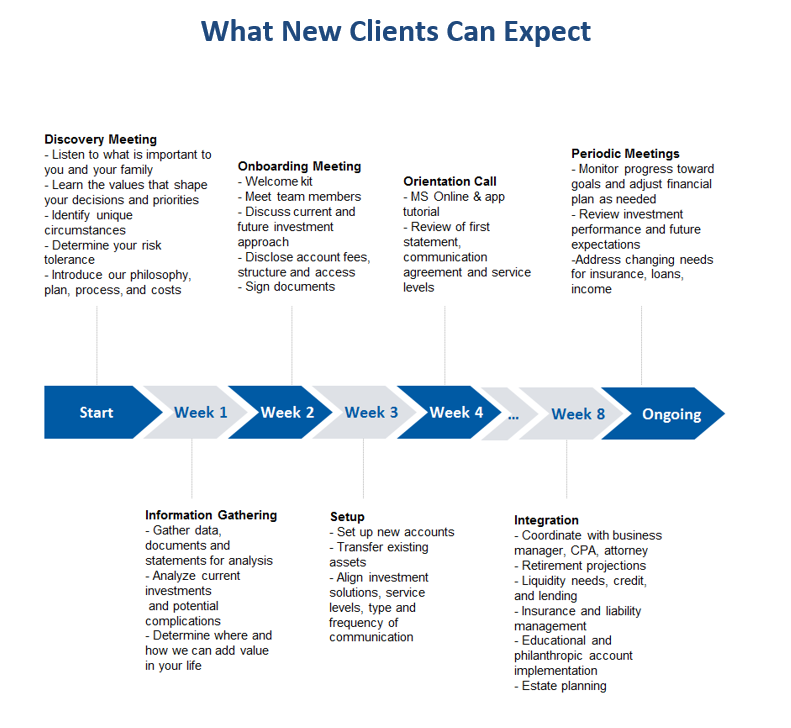

The Lindbrook Group at Morgan Stanley is devoted to delivering superior client service. This takes on many forms, from the handling and care of daily business, to the long term development of current clients and the generations behind them. Financial education is a priority. The Lindbrook Group helps clients make smart choices about the way they save, spend, invest, borrow and give during their lifetimes, and how they can pass their values and wealth to the generations that follow. The team's personal involvement in clients’ lives is what defines and differentiates them.

Credentials

Awards & Recognition

The Lindbrook Group has a depth of experience in multiple areas that differentiate us from the rest. We are proud to have been named one of the Forbes Best-In-State Wealth Management Teams from 2023 to 2025. Dan Klein of our team has also received the nomination for Forbes Best-In-State Wealth Advisors from 2021 to 2023. It’s an honor for our team to be recognized among this group of outstanding professionals who consistently work to raise the standards in our industry.

Learn More About Our Team AwardGlobal Sports and Entertainment Directors

Rob Mancini, Brittany Letto, Cassey Hubbard and Dan Klein are a Global Sports and Entertainment Directors. Morgan Stanley Global Sports & Entertainment is a highly specialized wealth management division, dedicated to serving the unique and complex needs of athletes, entertainers, creators and top professionals in the sports and entertainment industry.

Watch our new GSE Video, "What's Your Legacy?"Alternative Investment Directors

Dan Klein is an Alternative Investments Director. Dan has the relevant experience to present unique alternative investments to qualified investors. Morgan Stanley's comprehensive strategies, diverse talent and global resources help us to provide distinctive investment opportunities that may help qualified investors enhance returns, reduce volatility, manage taxes and generate income.

Learn More About Alternative InvestmentsImpact Investing Director

Investing with Impact delivers a comprehensive and holistic wealth solution for our clients that seek to generate market-rate financial returns alongside positive environmental and social impact. Dan Klein is an Investing with Impact Director.

The returns on a portfolio consisting primarily of Environmental, Social and Governance (“ESG”) aware investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

Learn More About Sustainability & Investing With ImpactThe returns on a portfolio consisting primarily of Environmental, Social and Governance (“ESG”) aware investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

Disclosures

Source: Forbes (Awarded Jan 2023). Data compiled by SHOOK Research LLC based on time period from 3/31/21 – 3/31/22. https://mgstn.ly/3wb7pSG

2021-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2021-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2021-2023 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2021-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

Disclosures

[Source: Forbes (Awarded Jan 2025). Data compiled by SHOOK Research LLC based for the period 3/31/23–3/31/24. https://www.morganstanley.com/what-we-do/wealth-management/forbes-top-wealth-advisors-lists-2025]

https://www.morganstanley.com/disclosures/awards-disclosure/

https://www.morganstanley.com/disclosures/awards-disclosure/

Giving Back

The Lindbrook Group gives back to the community in various ways. Some recent examples include:

UNICEF at 75 Fundraiser

Team member Brittany Letto is on the Board of UNICEF NextGen LA, most recently taking part in the Giving Tuesday event in Los Angeles.

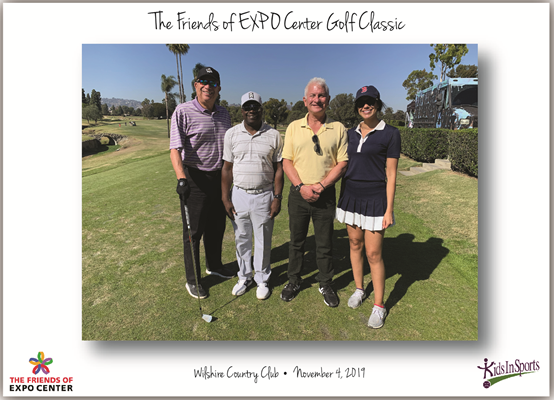

LA84 Foundation Invitational Golf Classic

This charity golf event benefits the Play Equity Fund, which has the mission to ensure the transformational power of sport and play is available to all children regardless of their race, gender, zip code, or economic status. The Lindbrook Group at Morgan Stanley is proud to be a Gold Medal Sponsor at the 24th Annual Golf Classic fundraising event, benefiting the LA84 Foundation. The event takes place Monday, October 11th, 2021 at the Riviera Country Club in Los Angeles.

Crossing the Channel for Kids Fundraiser

Team member Andrew Rayner swam 16 miles across the Catalina Channel on July 30, 2021 to benefit the USA Swimming Foundation and provide low-income kids with the life-saving skill of swimming. Andrew and the team raised $5,000 in total, which will provide 100 hours of swim instruction to children around the country.

KaBOOM! Playground Build

KaBOOM! is a national non-profit dedicated to giving all kids, especially those living in poverty, the childhood they deserve through great, safe places to play. The Lindbrook Group had the great pleasure of joining forces with Beverly Hills Complex colleagues for a KaBOOM! Playground Build on November 8th with Morgan Stanley Community Affairs.

Operation Gratitude: Battalion Buddies

Operation Gratitude works directly with military/family readiness groups across the country on military bases to provide the stuffed bears to the children of deployed service members. On November 19th we and our colleagues stuffed 30 teddy bears, and will ship the completed bears back to Operation Gratitude. The Lindbrook Group is proud to have been a part of Operation Gratitude, through the Morgan Stanley Veterans Employee Network.

Location

10960 Wilshire Blvd

Ste 2000

Los Angeles, CA 90024

US

Direct:

(310) 443-0537(310) 443-0537

Fax:

(323) 775-9929(323) 775-9929

Meet The Lindbrook Group

About Robert Mancini

Rob has been with Morgan Stanley since 2003, and in 2021 became a member of the prestigious Presidents Club. Prior to this, he was a Vice President with Sanford Bernstein. Rob’s experience includes the development, execution and maintenance of investment strategies for wealthy individuals and families, endowments, and foundations. He focuses on the research and evaluation of investment managers, including traditional money managers, hedge-fund-of-funds, managed futures and private equity investments. Rob has completed the Wharton School’s distinguished Investment Management Analyst and Investment Strategist Programs to become a Certified Investment Management Analyst™ (CIMA®).

Rob graduated from Villanova University, and earned a Masters of Science in Business Administration from Boston University. He also served four years in the United States Marine Corps. Rob is a member of the Investment Management Consultant’s Association (IMCA), and the Beverly Hills Estate Planning Council. He is on the board of US Lacrosse, the Southern California Chapter of the MS Society, and also serves on the board of Kids in Sports LA, which creates community led after school sports programs for youth in underserved areas of Los Angeles County. Rob is honored to be a member of the Villanova Career Advisory Council, providing thought leadership on matters that affect career development and the evolving job landscape. He also participates in the Villanova Athletics Student-Athlete Mentor Program. As one of a select few mentors, Rob works with his alma mater’s student-athletes on their short and long-term professional goals, their challenges and strategies for academic work-life balance, and preparation for post-graduate careers. He and his wife Christine live in Manhattan Beach with their children Michael, Reese and Charleston.

Rob graduated from Villanova University, and earned a Masters of Science in Business Administration from Boston University. He also served four years in the United States Marine Corps. Rob is a member of the Investment Management Consultant’s Association (IMCA), and the Beverly Hills Estate Planning Council. He is on the board of US Lacrosse, the Southern California Chapter of the MS Society, and also serves on the board of Kids in Sports LA, which creates community led after school sports programs for youth in underserved areas of Los Angeles County. Rob is honored to be a member of the Villanova Career Advisory Council, providing thought leadership on matters that affect career development and the evolving job landscape. He also participates in the Villanova Athletics Student-Athlete Mentor Program. As one of a select few mentors, Rob works with his alma mater’s student-athletes on their short and long-term professional goals, their challenges and strategies for academic work-life balance, and preparation for post-graduate careers. He and his wife Christine live in Manhattan Beach with their children Michael, Reese and Charleston.

Securities Agent: NC, AZ, WA, OH, IL, GA, SC, WY, VA, TX, HI, OR, MO, IA, MT, PA, NY, NV, NH, ID, IN, CO, UT, NM, MA, FL, DC, NJ, MI, MD, LA, KY, CT, CA, WI, TN, OK; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1896814

CA Insurance License #: 0K79217

NMLS#: 1896814

CA Insurance License #: 0K79217

About Daniel L Klein

Dan has been with Morgan Stanley since 2003. Before joining Morgan Stanley, Dan was an Executive Director and Asset Management Consultant with CIBC Oppenheimer since 1989 and entered the financial services industry in 1984, when he joined Drexel Burnham Lambert. Dan assists private investors, retirement plan sponsors and foundations develop and implement long-term investment strategies including asset/liability management. Dan has knowledge of fixed income markets, including asset-backed securities, mortgage-backed securities, municipal bonds and corporate bonds. Industry recognition includes having been named to the Forbes Best-in-State Wealth Advisors list from 2020-2022.

As a Family Wealth Director Dan has professional knowledge and experience in a range of wealth management solutions including estate planning strategies, alternative investments, control and restricted securities, lending, hedging and monetization, and business succession planning.

Dan graduated from the University of California, Los Angeles. Dan and his wife, Marla, regularly volunteer their time cooking for Project Angel Food, a nonprofit organization that prepares and delivers healthy meals to feed people impacted by serious illness. Dan and Marla live in Encino. They have two grown children, Kevin and Samantha, who also live in Los Angeles.

"2020-2023 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2020-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award."

As a Family Wealth Director Dan has professional knowledge and experience in a range of wealth management solutions including estate planning strategies, alternative investments, control and restricted securities, lending, hedging and monetization, and business succession planning.

Dan graduated from the University of California, Los Angeles. Dan and his wife, Marla, regularly volunteer their time cooking for Project Angel Food, a nonprofit organization that prepares and delivers healthy meals to feed people impacted by serious illness. Dan and Marla live in Encino. They have two grown children, Kevin and Samantha, who also live in Los Angeles.

"2020-2023 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2020-2022). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award."

Securities Agent: KY, LA, NV, NC, IL, GA, VA, WA, TN, PA, OK, NJ, IN, FL, WI, CA, SC, OR, MT, MO, MI, MD, HI, DC, CO, UT, TX, AZ, NH, WY, NM, MA, ID, IA, OH, NY, CT; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1255620

CA Insurance License #: 0A60978

NMLS#: 1255620

CA Insurance License #: 0A60978

About Brittany Letto

Brittany joined Morgan Stanley in 2019 and has been named to the firm's Pacesetter's Club in 2021, 2022, 2023, 2024 and most recently in 2025. She is a Financial Advisor, First Vice President, Senior Portfolio Manager, Global Sports and Entertainment Director and Workplace Advisor - Equity Compensation at The Lindbrook Group at Morgan Stanley. Brittany also sits on the Global Sports & Entertainment Advisory Council at Morgan Stanley. Prior to joining Morgan Stanley, Brittany was an investment professional at Doheny Asset Management, working in the financial services industry. She played an integral role in equity and fixed income trading, securities analysis and portfolio management for wealthy individuals, families, endowments and foundations.

Brittany is very active with UNICEF; she chaired the Next Generation Los Angeles Board of UNICEF and the Governance Committee. Brittany also sat on the Board of Directors for the Security Traders Association (STA), STA Women in Finance, Ellevate Network, and is a member of the CFA Society and Kappa Kappa Gamma Alumni Association. Brittany graduated from the University of California, Los Angeles with a Bachelor’s degree in Economics. Brittany currently resides in Los Angeles.

Brittany is very active with UNICEF; she chaired the Next Generation Los Angeles Board of UNICEF and the Governance Committee. Brittany also sat on the Board of Directors for the Security Traders Association (STA), STA Women in Finance, Ellevate Network, and is a member of the CFA Society and Kappa Kappa Gamma Alumni Association. Brittany graduated from the University of California, Los Angeles with a Bachelor’s degree in Economics. Brittany currently resides in Los Angeles.

Securities Agent: IN, FL, OR, MO, NY, NV, MI, NJ, IL, VA, SC, NM, MT, KY, GA, DC, TX, NC, HI, CA, TN, OK, NH, MA, LA, PA, MD, IA, WY, WA, CT, AZ, WI, OH, CO, UT; General Securities Representative; Investment Advisor Representative

NMLS#: 1853460

CA Insurance License #: 0N04133

NMLS#: 1853460

CA Insurance License #: 0N04133

About Casey Hubbard

Casey joined Morgan Stanley in 2015 as a Sales Associate. His responsibilities included trading and maintaining large institutional accounts and constructing client performance reports. Casey became a Financial Advisor in 2019. He has a passion for building and maintaining long lasting relationships. Casey also focuses on individual security selection and analysis as well as conducting research over a wide array of different investment managers. Casey was also named to the firm's Pacesetter's Club in 2023.

Casey is a Bay Area native and enjoys golfing. He also participates in various charity driven events. Casey earned his Bachelor of Science degree from Arizona State University in 2012. He is also a member of the Sigma Chi Alumni Association. Casey currently resides in Santa Monica.

Casey is a Bay Area native and enjoys golfing. He also participates in various charity driven events. Casey earned his Bachelor of Science degree from Arizona State University in 2012. He is also a member of the Sigma Chi Alumni Association. Casey currently resides in Santa Monica.

Securities Agent: MD, GA, AZ, TX, LA, KS, IN, ID, DE, CO, WY, WA, HI, WI, VA, OR, OH, OK, NJ, UT, PA, NH, MN, KY, IA, CT, TN, NC, MT, IL, MO, FL, DC, SC, NY, NV, MI, MA, CA, AK, NM; General Securities Representative; Investment Advisor Representative

NMLS#: 1884522

CA Insurance License #: 0N08413

NMLS#: 1884522

CA Insurance License #: 0N08413

About Andrew Rayner

Andrew joined Morgan Stanley in 2016. He has been helping individuals and small businesses achieve their financial goals since 2004. He is a Certified Financial Planner™, and in 2007 Andrew became a Certified Investment Management Analyst® after completing the IMCA program at the Wharton School of Management, University of Pennsylvania. He focuses on portfolio construction and comprehensive financial planning.

As part of his work with the CFP® Board, Andrew has volunteered as a panelist for the Disciplinary and Ethics Hearing Committee in Washington, D.C. He also volunteers at the Financial Planning Days in Los Angeles, part of a national initiative to provide financial planning to families of all incomes. He has been honored the last few years to work with students around Los Angeles, including at the Curtis School and Lang Ranch Elementary, as part of the SIFMA Foundation’s Invest It Forward™ program. Andrew graduated cum laude from Boston University with a B.A., majoring in psychology and minoring in economics.

Andrew is an avid triathlete, and is honored to have raced at the 2019 ITU World Championships in Switzerland as a member of Team USA. Andrew and his wife, Jessie, live in Culver City with their two dogs, Orzo and Leo.

As part of his work with the CFP® Board, Andrew has volunteered as a panelist for the Disciplinary and Ethics Hearing Committee in Washington, D.C. He also volunteers at the Financial Planning Days in Los Angeles, part of a national initiative to provide financial planning to families of all incomes. He has been honored the last few years to work with students around Los Angeles, including at the Curtis School and Lang Ranch Elementary, as part of the SIFMA Foundation’s Invest It Forward™ program. Andrew graduated cum laude from Boston University with a B.A., majoring in psychology and minoring in economics.

Andrew is an avid triathlete, and is honored to have raced at the 2019 ITU World Championships in Switzerland as a member of Team USA. Andrew and his wife, Jessie, live in Culver City with their two dogs, Orzo and Leo.

CA Insurance License #: 0F42897

About Amy Quinn

Amy has been providing financial service support to clients for over 25 years. As a fully registered Wealth Management Associate, Amy is the lead contact with clients for administrative problem resolution and complex life event navigation. While overseeing all operational aspects of The Lindbrook Group’s administrative processes, she also serves as a resource to other Associates throughout the firm and is frequently selected to participate in new service and technology pilot programs.

Amy’s professional passion is working directly with clients to identify and solve their needs and concerns. She is a published poet, a Volunteer Director for the Woodland Hills Children’s Theater and a Congressional District Leader for The ONE Campaign to Make Poverty History. Amy lives in West Hills with her husband, Grahm, and son, Jack.

Amy’s professional passion is working directly with clients to identify and solve their needs and concerns. She is a published poet, a Volunteer Director for the Woodland Hills Children’s Theater and a Congressional District Leader for The ONE Campaign to Make Poverty History. Amy lives in West Hills with her husband, Grahm, and son, Jack.

About Xzavier Howard

Xzavier joined Morgan Stanley in 2017 through the Wealth Management Operations Analyst Campus Recruiting Program. He spent the first 5 years of his career rotating through various roles in Wealth Management Ops including Private Banking Business Management, Mutual Funds Project Management and Operations Project Strategy. His responsibilities included managing financial reporting, forecasting and risk analysis for the Private Banking divisions, identifying and implementing strategic solutions across traditional & alternative investments and spearheading multi-year platform integration initiatives. Xzavier moved from New York to LA and joined the Lindbrook group in the middle of 2022. He is driven, focused and solution oriented with a passion for establishing and enhancing long lasting client relationships.

Xzavier is an east coast native that is looking forward to expanding his west coast network after relocating to Los Angeles. He received his bachelor’s degree in criminology and political science from West Virginia University before pivoting into the finance industry. He is a self-educated skincare enthusiast and all-around creative that participates in skincare and beauty branding, education and partnerships outside of the office.

Xzavier is an east coast native that is looking forward to expanding his west coast network after relocating to Los Angeles. He received his bachelor’s degree in criminology and political science from West Virginia University before pivoting into the finance industry. He is a self-educated skincare enthusiast and all-around creative that participates in skincare and beauty branding, education and partnerships outside of the office.

About Michael Midgette-Coleman

Michael has been in the Wealth Management industry for 6 years which his experience includes many aspects such as portfolio management and building client relationships. He also has been responsible for providing clientele with several options for retirement planning and mutual fund choice selection. Michael joined Morgan Stanley in 2022 as a Client Services Associate where he has taken on the responsibilities of handling the operational and administrative duties for The Lindbrook Group as well as assisting existing clients with their account needs. Michael is a self-driven individual who has the eagerness to learn and grow.

Michael was born and raised in Los Angeles, and he is a graduate of The University of Nevada, Reno with a degree in Business Management and Finance. Outside of work, Michael enjoys watching sports and enjoying quality time with his family.

Michael was born and raised in Los Angeles, and he is a graduate of The University of Nevada, Reno with a degree in Business Management and Finance. Outside of work, Michael enjoys watching sports and enjoying quality time with his family.

Contact Robert Mancini

Contact Daniel L Klein

Contact Brittany Letto

Contact Casey Hubbard

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Casey Morris

Casey Morris is a Private Banker serving Morgan Stanley Wealth Management offices in California.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Casey began his career in financial services in 2019 and joined Morgan Stanley in 2022 as an Associate Private Banker. Prior to joining the firm, he was a Commercial Banker at Wells Fargo. He also served as a Market Consultant at the Hanover Research Council.

Casey is a graduate of George Mason University, where he received a Bachelor of Science in Economics. He lives in Santa Monica, California. Outside of the office, Casey enjoys fishing, hunting, and playing golf.

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Casey began his career in financial services in 2019 and joined Morgan Stanley in 2022 as an Associate Private Banker. Prior to joining the firm, he was a Commercial Banker at Wells Fargo. He also served as a Market Consultant at the Hanover Research Council.

Casey is a graduate of George Mason University, where he received a Bachelor of Science in Economics. He lives in Santa Monica, California. Outside of the office, Casey enjoys fishing, hunting, and playing golf.

NMLS#: 2386859

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Wealth Management for Athletes and Entertainers

Understanding the unique financial challenges of athletes and entertainers and how they differ from one profession to the next, we deliver the experience and resources you need to help create and implement a comprehensive, multigenerational wealth management plan based on your needs, values and aspirations.

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The Lindbrook Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

5Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Participating in a new issue/syndicate is subject to availability. IPOs are highly speculative and may not be appropriate for all investors because they lack a stock-trading history and usually involve smaller and newer companies that tend to have limited operating histories, less-experienced management teams, and fewer products or customers. Also, the offering price of an IPO reflects a negotiated estimate as to the value of the company, which may bear little relationship to the trading price of the securities, and it is not uncommon for the closing price of the shares shortly after the IPO to be well above or below the offering price.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Investing in the market entails the risk of market volatility. The value of all types of investments may increase or decrease over varying time periods. The returns on a portfolio consisting primarily of sustainable or impact investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because sustainability and impact criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

5Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Structured Investments are complex and not appropriate for all investors. An investment in structured investments involves risks. These risks can include but are not limited to: fluctuations in the price, level or yield of underlying asset(s), interest rates, currency values and credit quality, substantial loss of principal, limits on participation in appreciation of underlying asset(s), limited liquidity, credit risk, and/or conflicts of interest. Many structured investments do not pay interest or guarantee a return above principal at maturity. Investors should read the security’s offering documentation prior to making an investment decision.

8Participating in a new issue/syndicate is subject to availability. IPOs are highly speculative and may not be appropriate for all investors because they lack a stock-trading history and usually involve smaller and newer companies that tend to have limited operating histories, less-experienced management teams, and fewer products or customers. Also, the offering price of an IPO reflects a negotiated estimate as to the value of the company, which may bear little relationship to the trading price of the securities, and it is not uncommon for the closing price of the shares shortly after the IPO to be well above or below the offering price.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

11When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)