Stephen Kelliher, QPFC

Industry Award Winner

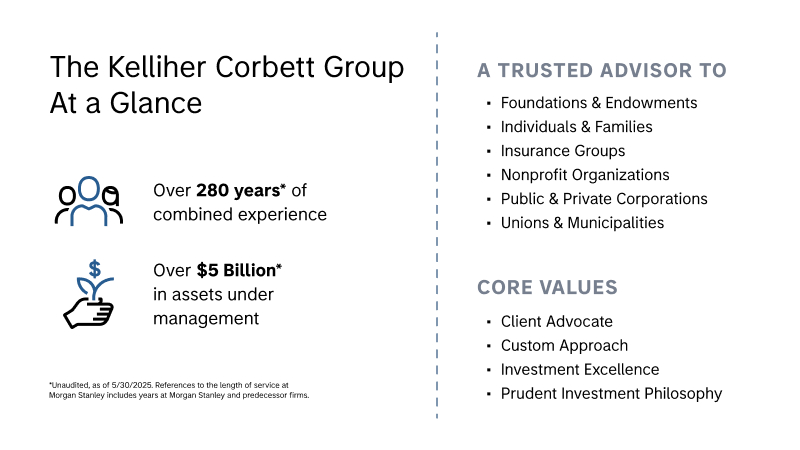

Industry Award WinnerThe Kelliher Corbett Group serves as a dedicated and seasoned advocate, providing thoughtful investment advice and solutions tailored to our clients' unique goals. Founded in 1992, the team of 14 investment professionals manages over $6 billion* in assets, offering a full suite of investment management and advisory services to individuals, families, corporations, and institutions. Clients benefit from the scope, scale, and oversight of a global financial services firm coupled with the independence, objectivity, and individualized service capabilities of a boutique advisory and consulting group. (*as of 12/31/2025)

It is our longstanding philosophy that risk is manageable, and that managing risk all of the time, including before a crisis, is the best way to ride out inevitable and often unpredictable events.

Experience & Resources that Make a Difference:

Independent & Objective Stewards:

Awards

Disclosures:

2022, 2023, 2024, 2025 Barron's Top 100 Institutional Consulting Teams (formerly referred to as Barron's Top 50 Institutional Consulting Teams, Barron's Top 50 Institutional Consultants, Barron's Top 30 Institutional Consultants)). Source: Barrons.com (Awarded April 2022-2025). Data compiled by Barron's based on 12-month period concluding in Dec of the year prior to the issuance of the award.

2004-2014, 2016, 2018, 2022, 2024 PLANADVISER Top Retirement Advisors Source: planadviser.com Awarded May 2004-2014, 2016, 2018, 2022, 2024. Data compiled by ISS Media based on responses to PLANADVISER survey as of Jan/Feb of the year the award was given

2017-2025 NAPA's Top DC Advisor Teams: Source: Source: napa-net.org (2017-2025) Data compiled by NAPA based on self-reported assets under advisement as of Dec 31 of the year prior to year the award was given.

2021–2024 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2014-2019, 2021, 2022, 2023, 2024). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

Experience Resources that Make A Difference

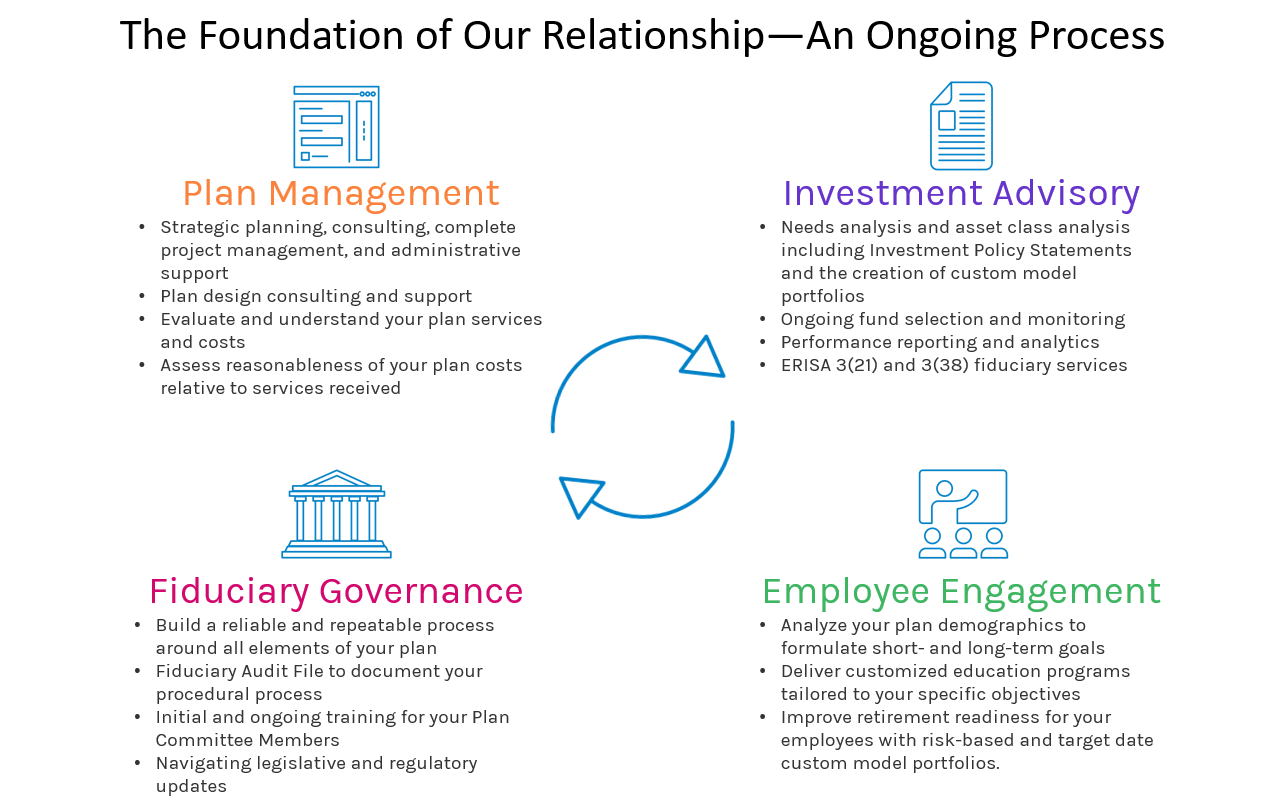

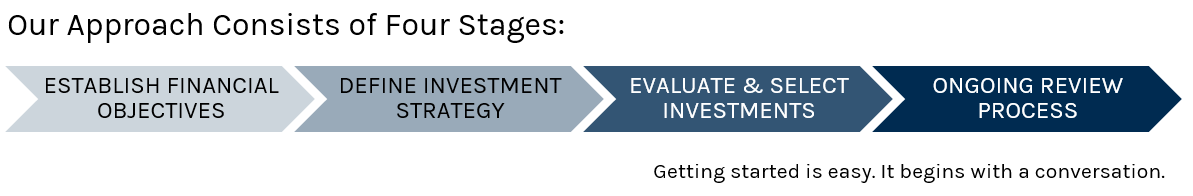

Even elite athletes seek out a coach with the experience and qualifications to offer the training and support required to continually improve their game. The same is true when you're managing a retirement plan and helping your employees plan for their future. For over 30 years, The Kelliher Corbett Group has worked in a collaborative and professional manner with retirement Plan Sponsors to create a reliable process around all critical areas of plan design and oversight. As seasoned professionals with a focus on the retirement plan industry, we know what it takes to achieve measurable results and drive positive outcomes that make a difference to your organization and its employees. We've built our practice around customizing financial solutions for unique organizations just like yours.

We Provide Advisory Consulting Solutions to:

Choose Your Fiduciary Wisely

When hiring a fiduciary advisor to help you fulfill your duties under ERISA, it's important to align yourself with a firm that has the size, strength and resources to meet your needs today and in the future. Fiduciary support is only as meaningful as the organization standing behind it. As a client of the Kelliher Corbett Group, you will benefit from: ERISA fiduciary governance best practices, efficient and cost-effective administration, with improved outcomes for you and your employees.

Retirement Plan Participants: please contact KelliherCorbettGrp@MorganStanley.com with any plan-related inquiries.

What are your financial goals and dreams?

The Kelliher Corbett Group has the experience and resources to translate your goals into a personalized strategy.

Our Core Focus is Risk Management.

Working closely with you and acting as your advocate, Portfolio Manager, and Financial Advisor, we will develop a tailored investment portfolio that is durable through even the most challenging market cycles. We are passionate about developing a long-term relationship with you that fosters trust and delivers the results you desire.

Core Services & Capabilities:

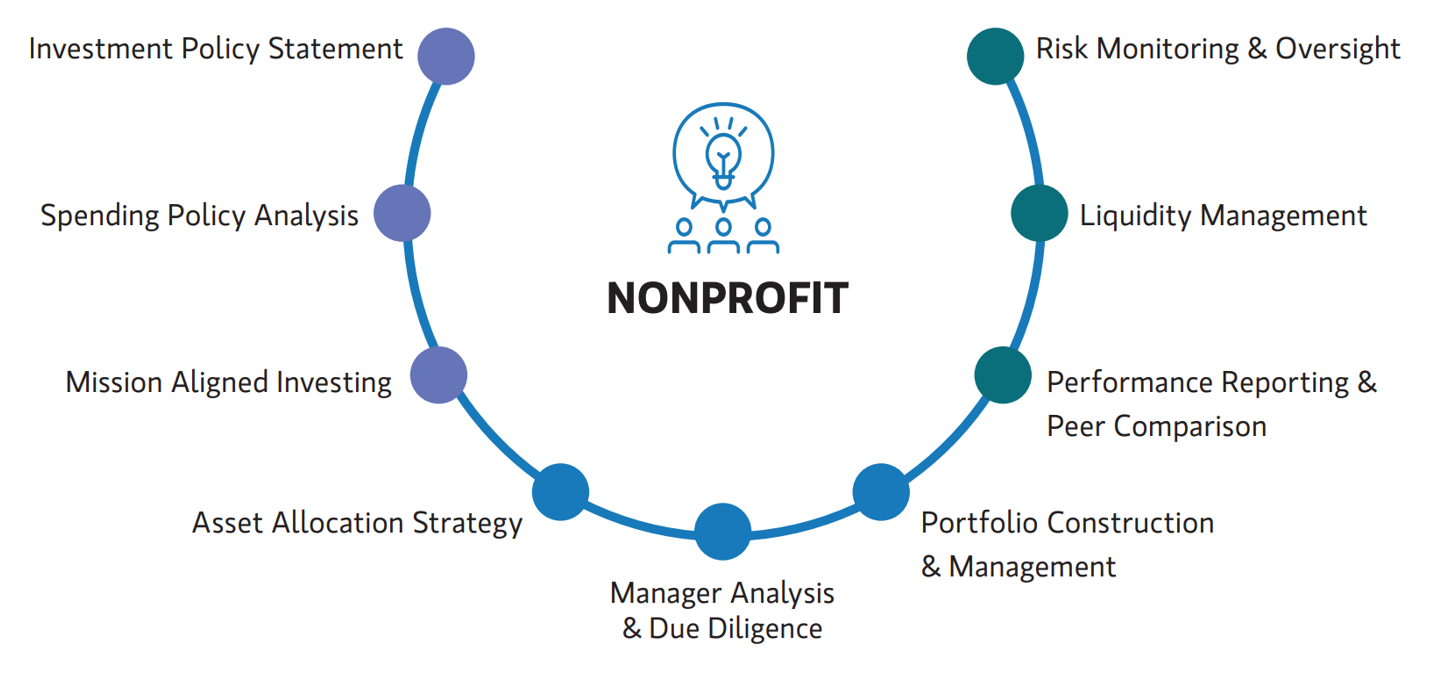

Like many leaders of nonprofit organizations, you face a growing list of challenges such as managing your operating budget and funding sources. For charitable entities, new donations can be hard to nurture year after year and market volatility can take a toll on existing investments.

The management of institutional portfolios has never been a simple matter, and today, investment and fiduciary responsibilities are more demanding than ever before. You need an investment consultant who not only understands these sensitivities but has the knowledge and experience to execute your investment strategy within your risk parameters while supporting the long-term mission and strategic goals of your organization.

For more than 30 years, The Kelliher Corbett Group at Morgan Stanley has provided full-scale, customized solutions for a wide range of institutional clients. We offer a unique client experience: the close relationship you expect from an investment boutique, backed by the industry leading analysis and oversight of a global leader.

The Kelliher Corbett Group personally sponsors or donates to approximately 50 different charitable organizations annually.