The Island Legacy Group at Morgan Stanley

Our Mission Statement

Planning your legacy for the years to come.

About Us

The Island Legacy Group at Morgan Stanley is a Hawaii-based wealth and institutional consulting practice serving a select number of individuals, families, businesses, and fiduciaries. Our mission is to serve as a trusted advisor by bringing our passion, experience and resources to the table while helping you define and achieve your goals.

Services Include

- 401(k) Rollovers

- 529 PlansFootnote1

- Asset Management

- Business Succession PlanningFootnote2

- Corporate Retirement PlansFootnote3

- Defined Contribution PlansFootnote4

- Endowments and FoundationsFootnote5

- Estate Planning StrategiesFootnote6

- Financial PlanningFootnote7

- Professional Portfolio ManagementFootnote8

- Retirement PlanningFootnote9

- Trust AccountsFootnote10

- Wealth Consulting

- Wealth ManagementFootnote11

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

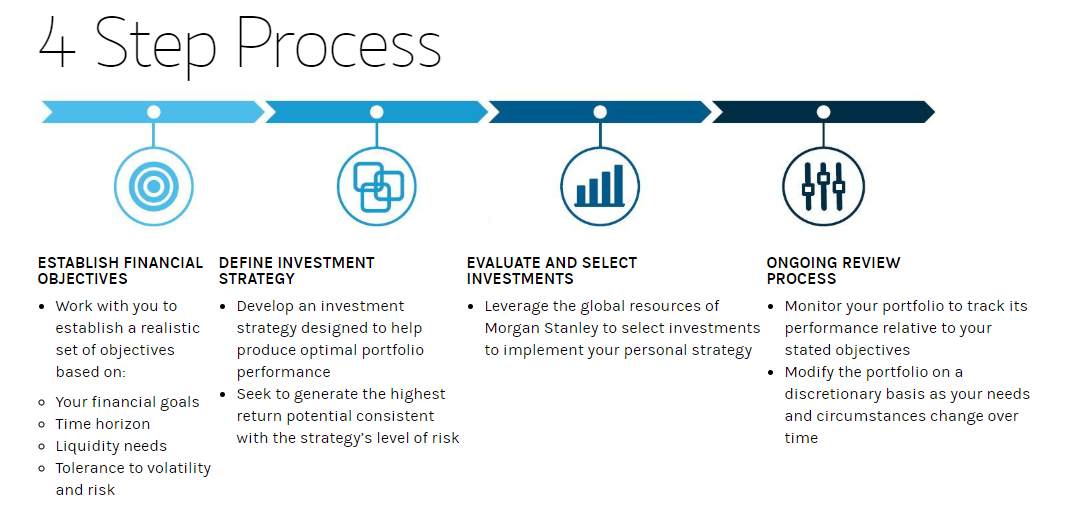

Working With You

At Morgan Stanley, we believe that identifying financial solutions begins with a solid understanding of each client’s situation, goals, objectives and risk tolerance. We follow a disciplined process that enables us to work with you to craft a solution that helps to meet your individual financial needs.

Whatever your financial goal—whether to grow your wealth, preserve it or pass it on to others, you can count on us to help you with a strategy that is:

- Personal

- Highly individualized and committed to helping you achieve financial success

- Flexible

- Responsive to changes in your life and in your priorities over time

- Comprehensive

- Covering a broad array of investment products and services, with preferred benefits tied to your valued status with us

- Highly individualized and committed to helping you achieve financial success

- Flexible

- Responsive to changes in your life and in your priorities over time

- Comprehensive

- Covering a broad array of investment products and services, with preferred benefits tied to your valued status with us

Seminars and Events

The Island Legacy Group, and Morgan Stanley, host numerous seminars and events throughout the year. Please check this page for all past and upcoming events.

Lessons in Leadership With General (Ret.) Stanley McChrystal

Date: Friday, November 17, 2023

Time: 8:00 a.m.

Location: Webcast

In recognition of Veterans Appreciation Month and in honor of the brave service members who dedicate their lives to ensuring national security and defending freedom worldwide, Morgan Stanley Wealth Management is proud to invite you to join us on Friday, November 17 for an exclusive conversation with Four-Star General (Ret.) Stanley McChrystal, U.S. Army.

The discussion will be moderated by Jeff McMillan, Chief Analytics, Data & Innovation Officer, Morgan Stanley Wealth Management and Executive Sponsor of the Morgan Stanley Veterans Employee Network.

Time: 8:00 a.m.

Location: Webcast

In recognition of Veterans Appreciation Month and in honor of the brave service members who dedicate their lives to ensuring national security and defending freedom worldwide, Morgan Stanley Wealth Management is proud to invite you to join us on Friday, November 17 for an exclusive conversation with Four-Star General (Ret.) Stanley McChrystal, U.S. Army.

The discussion will be moderated by Jeff McMillan, Chief Analytics, Data & Innovation Officer, Morgan Stanley Wealth Management and Executive Sponsor of the Morgan Stanley Veterans Employee Network.

A Washington Update with Morgan Stanley’s Global Head of Government Relations, Michael Stein

Date: Wednesday, November 15, 2023

Time: 11:15 a.m.

Location: Webcast

Join us on Wednesday, November 15 at 4:15 PM ET for an exclusive webcast featuring Michael Stein, Morgan Stanley’s Global Head of Government Relations, who will provide us with insight and perspective on the complex events currently unfolding in Washington.

Michael will walk us through the challenging legislative, regulatory and political landscape as the country heads toward the November 2024 presidential and congressional elections.

Time: 11:15 a.m.

Location: Webcast

Join us on Wednesday, November 15 at 4:15 PM ET for an exclusive webcast featuring Michael Stein, Morgan Stanley’s Global Head of Government Relations, who will provide us with insight and perspective on the complex events currently unfolding in Washington.

Michael will walk us through the challenging legislative, regulatory and political landscape as the country heads toward the November 2024 presidential and congressional elections.

Geopolitical Perspectives with Condoleezza Rice

Date: Thursday, November 2, 2023

Time: 11:00 a.m.

Location: Webcast

Join Morgan Stanley on Thursday, November 2 at 5:00 PM ET for a conversation with Condoleezza Rice, 66th Secretary of State. Secretary Rice will share her insights on the rising geopolitical pressures in the Middle East, Eastern Europe and Asia.

The conversation will be moderated by Andy Saperstein, Co-President and Head of Wealth Management at Morgan Stanley.

Time: 11:00 a.m.

Location: Webcast

Join Morgan Stanley on Thursday, November 2 at 5:00 PM ET for a conversation with Condoleezza Rice, 66th Secretary of State. Secretary Rice will share her insights on the rising geopolitical pressures in the Middle East, Eastern Europe and Asia.

The conversation will be moderated by Andy Saperstein, Co-President and Head of Wealth Management at Morgan Stanley.

How to Navigate Emerging Cyber Risks

Date: Thursday, October 26, 2023

Time: 8:00 a.m.

Location: Webcast

In 2023, the rapid pace of technological development has ushered in a new era of cybercrime — from ransomware gangs, to supply chain attacks, to AI-inspired lures. To mark Cybersecurity Awareness Month, Morgan Stanley expert Rachel Wilson will review how the threat landscape has evolved over the past year and unpack new trends and terminology. Tune in and arm yourself with the knowledge you need to help protect your data and assets.

Time: 8:00 a.m.

Location: Webcast

In 2023, the rapid pace of technological development has ushered in a new era of cybercrime — from ransomware gangs, to supply chain attacks, to AI-inspired lures. To mark Cybersecurity Awareness Month, Morgan Stanley expert Rachel Wilson will review how the threat landscape has evolved over the past year and unpack new trends and terminology. Tune in and arm yourself with the knowledge you need to help protect your data and assets.

At Home and Abroad with Samantha Brown, Travel Expert and Host of Samantha Brown’s Places to Love on PBS

Date: September 23, 2021

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

Morgan Stanley Online

Date: September 14, 2021

Time: 11:00am-11:30am

Location: Zoom

Time: 11:00am-11:30am

Location: Zoom

Playing the Long Game with Carli Lloyd, Soccer Superstar, 3x Olympic Medalist and FIFA World Cup Champion

Date: Tuesday August 21, 2021

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

Up Front with Ally Love, CEO/Founder of Love Squad, Peloton Instructor and Host of the Brooklyn Nets

Date: Tuesday July 13, 2021

Time: 11:30pm-12:30pm

Location: Webcast

Time: 11:30pm-12:30pm

Location: Webcast

In the Spotlight with Tan France, Style Icon and Co-Host of Netflix’s Queer Eye

Date: Tuesday June 22, 2021

Time: 11:30pm-12:30pm

Location: Webcast

Time: 11:30pm-12:30pm

Location: Webcast

Washington Update

Date: Wednesday May 19, 2021

Time: 12:00pm-12:30pm

Location: Zoom

Time: 12:00pm-12:30pm

Location: Zoom

Market Outlook

Date: Wednesday April 21, 2021

Time: 12:00pm-12:30pm

Location: Zoom

Time: 12:00pm-12:30pm

Location: Zoom

From the Frontline to Combatant Command: A Conversation with General Lori Robinson

Date: Tuesday March 9, 2021

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

Education Planning and Funding

Date: Wednesday March 24, 2021

Time: 12:00pm-12:30pm

Location: Zoom

Time: 12:00pm-12:30pm

Location: Zoom

From the Frontline to Combatant Command: A Conversation with General Lori Robinson

Date: Tuesday March 9, 2021

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

Under the Stars With Wynton Marsalis, Acclaimed Jazz Musician, Bandleader & Composer

Date: Tuesday February 23, 2021

Time: 3:30pm-4:30pm

Location: Webcast

Time: 3:30pm-4:30pm

Location: Webcast

Identity Theft and Cyber Security

Date: Thursday February 18, 2021

Time: 12:00pm-12:30pm

Location: Zoom

Time: 12:00pm-12:30pm

Location: Zoom

Market & Economic Perspectives - Climate of Change

Date: Wednesday January 13, 2021

Time: 12:00pm-12:30pm

Location: Zoom

Time: 12:00pm-12:30pm

Location: Zoom

From the Court to the Owner’s Box with Grant Hill

Date: Tuesday December 15, 2020

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

From the Laboratory to the Cabinet with Dr. Steven Chu

Date: Tuesday December 8, 2020

Time: 12:30pm-1:30pm

Location: Webcast

Time: 12:30pm-1:30pm

Location: Webcast

Fireside Chat with Justin Rose

Date: Monday November 30, 2020

Time: 11:30am-12:15pm

Location: Zoom

Time: 11:30am-12:15pm

Location: Zoom

2020 U.S. Presidential Elections

Date: Tuesday October 6, 2020

Time: 10:00am-10:30am

Location: Zoom Conference Call

Time: 10:00am-10:30am

Location: Zoom Conference Call

Equity Market Update with Andrew Slimmon

Date: Wednesday July 15, 2020

Time: 10:00am-10:30am

Location: Conference Call

Time: 10:00am-10:30am

Location: Conference Call

Navigating Financial Markets with J.P. Morgan and Touchstone Investments

Date: Thursday February 13, 2020

Time: 6:00pm-8:00pm

Location: 3660 On the Rise, 3660 Waialae Avenue, Honolulu, HI 96816

Time: 6:00pm-8:00pm

Location: 3660 On the Rise, 3660 Waialae Avenue, Honolulu, HI 96816

Magic of Polynesia Dinner Show

Date: Saturday October 26, 2019

Time: 6:00 – 8:30pm

Location: Waikiki Beachcomber Hotel 2300 Kalakaua Ave, Honolulu, HI 96815

Time: 6:00 – 8:30pm

Location: Waikiki Beachcomber Hotel 2300 Kalakaua Ave, Honolulu, HI 96815

The 4th Industrial Revolution with Alkeon Capital Management

Date: Wednesday September 25, 2019

Time: 6:00pm-8:00pm

Location: Morton’s Steakhouse Ala Moana Blvd, Honolulu, HI 96814

Time: 6:00pm-8:00pm

Location: Morton’s Steakhouse Ala Moana Blvd, Honolulu, HI 96814

Tax-Free Investing with Aquila Hawaiian Tax-Free Trust

Date: Wednesday August 14, 2019

Time: 6:00pm-8:00pm

Location: 4370 Kukui Grove St., Ste 111 Lihue, HI 96766

Time: 6:00pm-8:00pm

Location: 4370 Kukui Grove St., Ste 111 Lihue, HI 96766

Market Update with ProShares

Date: Thursday June 6, 2019

Time: 6:00pm-8:00pm

Location: Stripsteak Waikiki 2330 Kalakaua Ave #330, Honolulu, HI 96815

Time: 6:00pm-8:00pm

Location: Stripsteak Waikiki 2330 Kalakaua Ave #330, Honolulu, HI 96815

Helping You Manage Your Wealth to Achieve Your Goals: Morgan Stanley and You

Date: Tuesday April 23, 2019

Time: 6:00pm-8:00pm

Location: 3660 On the Rise, 3660 Waialae Avenue, Honolulu, HI 96816

Time: 6:00pm-8:00pm

Location: 3660 On the Rise, 3660 Waialae Avenue, Honolulu, HI 96816

College Savings 529 Plans with Columbia Threadneedle Investments

Date: Tuesday January 29, 2019

Time: 6:00pm-8:00pm

Location: Ruth’s Chris Steak House Waterfront Plaza 500 Ala Moana Blvd. Honolulu, HI 96813

Time: 6:00pm-8:00pm

Location: Ruth’s Chris Steak House Waterfront Plaza 500 Ala Moana Blvd. Honolulu, HI 96813

Location

733 Bishop Street

Suite 2800

Honolulu, HI 96813

US

Direct:

(808) 525-6992(808) 525-6992

Fax:

(808) 495-0516(808) 495-0516

4370 Kukui Grove St

Suite 111

Lihue, HI 96766

US

Direct:

(808) 245-6927(808) 245-6927

Meet The Island Legacy Group

About Gregg Takara

The Island Legacy Group at Morgan Stanley is a Hawaii-based wealth and institutional consulting practice serving a select number of individuals, families, businesses, and fiduciaries. Our mission is to serve as a trusted advisor by bringing our passion, experience and resources to the table while helping you define and achieve your goals.

Gregg Takara is an Executive Director and Financial Advisor; he also holds the firm and industry recognized designations of Senior Portfolio Manager, Senior Investment Management Consultant, Alternative Investments Director, and Certified Investment Management Analyst®. Gregg has been a key member of The Island Legacy Group at Morgan Stanley and its predecessor teams since 1999, and handles the team’s estate planning, insurance, alternative investments, and philanthropy planning strategies.

Prior to joining Morgan Stanley, Gregg served as Vice President and Manager with one of the largest trust companies in Hawaii. He has been in the financial services industry since 1985, and held previous positions as an institutional futures and options analyst in Chicago, as well as the Research and Portfolio Manager for a Honolulu investment management firm. He holds a BBA in Finance with an emphasis in investments from the University of Hawaii at Manoa. He also graduated from the ABA National Trust School held at Northwestern University; the Cannon’s Financial Institute’s Personal Trust School and attended the CIMA and other executive education programs at the Haas School of Business, University of California, Berkeley and The Wharton School, University of Pennsylvania and the University of Chicago Booth School of Business.

Gregg has served as an advisor or board member for various local, national and global non-profit organizations, including the Hawaii Community Foundation, The Trust for Public Land, and the Worldwide Unchinanchu Business Group/Okinawa Chamber of Commerce. In his spare time, he enjoys landscaping his yard and fishing and hiking throughout the Hawaiian Islands.

Gregg Takara is an Executive Director and Financial Advisor; he also holds the firm and industry recognized designations of Senior Portfolio Manager, Senior Investment Management Consultant, Alternative Investments Director, and Certified Investment Management Analyst®. Gregg has been a key member of The Island Legacy Group at Morgan Stanley and its predecessor teams since 1999, and handles the team’s estate planning, insurance, alternative investments, and philanthropy planning strategies.

Prior to joining Morgan Stanley, Gregg served as Vice President and Manager with one of the largest trust companies in Hawaii. He has been in the financial services industry since 1985, and held previous positions as an institutional futures and options analyst in Chicago, as well as the Research and Portfolio Manager for a Honolulu investment management firm. He holds a BBA in Finance with an emphasis in investments from the University of Hawaii at Manoa. He also graduated from the ABA National Trust School held at Northwestern University; the Cannon’s Financial Institute’s Personal Trust School and attended the CIMA and other executive education programs at the Haas School of Business, University of California, Berkeley and The Wharton School, University of Pennsylvania and the University of Chicago Booth School of Business.

Gregg has served as an advisor or board member for various local, national and global non-profit organizations, including the Hawaii Community Foundation, The Trust for Public Land, and the Worldwide Unchinanchu Business Group/Okinawa Chamber of Commerce. In his spare time, he enjoys landscaping his yard and fishing and hiking throughout the Hawaiian Islands.

Securities Agent: NM, NC, AZ, MI, MD, PA, ID, HI, WA, NV, DE, NH, ME, NY, MS, CA, WY, UT, OR, FL, VA, TX, OK, IL, AL, MA, CT, CO; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1274525

CA Insurance License #: 0I42997

NMLS#: 1274525

CA Insurance License #: 0I42997

About Derek Wickes

Derek Wickes is a CERTIFIED FINANCIAL PLANNER®, Executive Director, and Financial Advisor on The Island Legacy Group. He focuses on financial planning and investment management. Derek designs complex financial plans and retirement models which include cash flow analysis, long term care needs, and estate planning strategies. He then assists clients in implementing these plans in a meaningful way designed to help them pursue their financial goals. Derek also works closely with corporate clients assisting them with cash management, retirement plans, and business transitions.

Derek joined The Island Legacy Group at Morgan Stanley in 2004 and has been in the financial services industry since 2000. Derek is an active member of the Hawaii Estate Planning Council as well as the Financial Planning Association and Hawaii Financial Planning Association. He holds a BSBA in Business Management (Cum Laude Honors) and a MBA with a concentration in Finance (With Distinction Honors) from Hawaii Pacific University.

Derek is originally from Denver Colorado where he previously worked on both retail and institutional trading desks for Charles Schwab. Derek is happily married with two children. He is an active volunteer in his church and in the local community. He enjoys activities such as kayaking, scuba diving, and golf.

Derek joined The Island Legacy Group at Morgan Stanley in 2004 and has been in the financial services industry since 2000. Derek is an active member of the Hawaii Estate Planning Council as well as the Financial Planning Association and Hawaii Financial Planning Association. He holds a BSBA in Business Management (Cum Laude Honors) and a MBA with a concentration in Finance (With Distinction Honors) from Hawaii Pacific University.

Derek is originally from Denver Colorado where he previously worked on both retail and institutional trading desks for Charles Schwab. Derek is happily married with two children. He is an active volunteer in his church and in the local community. He enjoys activities such as kayaking, scuba diving, and golf.

Securities Agent: OR, MD, IN, AZ, DC, CA, UT, PA, NY, NH, WY, WA, TX, NM, NC, MN, CT, IL, ID, CO, VT, NV, DE, HI, VA, FL, MS, OK, ME, MA; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1272963

NMLS#: 1272963

About Donn Ariyoshi

Donn Ariyoshi is a Financial Advisor, Senior Vice President and serves as the Marketing Director for the Island Legacy Group. He assists corporate and Taft Hartley clients in preparing retirement plans including 401(k), profit sharing, defined benefit and non-qualified plans.

Donn started his career in the financial services industry in 1999. Prior to joining Morgan Stanley, Donn was, and still is, a small business owner opening his first business in 1986. His businesses included Munchies, the first Li Hing snack shop, ARI Group Inc, an environmental distributor, and Grandma’s Saimin restaurant. His current family business is Mushrooms Hawai`i, opened in 1996. His small business experience helps him understand the financial challenges business owners and their families face. His first-hand experience helps him create strategies and plans tailored to the needs of business owners.

As an entrepreneur in the 1990’s and supporting the small business community, Donn was appointed to the White House Conference on Small Business, co-coordinated the Hawaii Congress on Small Business, and served on the Bank of America Business Banking Council in 1996. Donn graduated from Chaminade University with a Bachelor of Arts in Business Administration.

Donn started his career in the financial services industry in 1999. Prior to joining Morgan Stanley, Donn was, and still is, a small business owner opening his first business in 1986. His businesses included Munchies, the first Li Hing snack shop, ARI Group Inc, an environmental distributor, and Grandma’s Saimin restaurant. His current family business is Mushrooms Hawai`i, opened in 1996. His small business experience helps him understand the financial challenges business owners and their families face. His first-hand experience helps him create strategies and plans tailored to the needs of business owners.

As an entrepreneur in the 1990’s and supporting the small business community, Donn was appointed to the White House Conference on Small Business, co-coordinated the Hawaii Congress on Small Business, and served on the Bank of America Business Banking Council in 1996. Donn graduated from Chaminade University with a Bachelor of Arts in Business Administration.

Securities Agent: CO, TX, MS, OR, NY, HI, NV, IL, CA, WY, VA, UT, NH, NC, ME, FL, DE, MD, MA, CT, WA, SC, ID, AZ, PA, OK; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1285018

NMLS#: 1285018

About Me

After 35 years of working with families and business owners, one thing’s for sure – no two plans are alike. Managing your wealth is more than just choosing investments. We take the time to understand your dreams and wishes so that we can design a plan that helps you live your best life throughout your lifetime and create the legacy you want to leave.

As a business owner, planning for the continuation of your life’s work can be both daunting and rewarding. Do you want to leave it to your children? Do you have a management team in place that can continue to grow your business? Do you prefer to sell your business? We will work with your team to explore the potential consequences of your many options, so that your final choice is both rewarding and fun!

Geal is a Certified Financial Planner, Certified Exit Planning Advisor, Chartered Life Underwriter, is Series 7 and 63 licensed, a real estate investor and teacher. She enjoys finding strategies to help manage taxes and simplify technical issues to understandable morsels.

Geal offers a planning-based perspective built around clients' goals, dreams and wishes. She takes the time to understand who and what is most important to you, and builds comprehensive, meticulous financial plans while integrating exit and succession strategies. She works with your other advisors to best support your goals prior to and long after any transitional events.

As a business owner, planning for the continuation of your life’s work can be both daunting and rewarding. Do you want to leave it to your children? Do you have a management team in place that can continue to grow your business? Do you prefer to sell your business? We will work with your team to explore the potential consequences of your many options, so that your final choice is both rewarding and fun!

Geal is a Certified Financial Planner, Certified Exit Planning Advisor, Chartered Life Underwriter, is Series 7 and 63 licensed, a real estate investor and teacher. She enjoys finding strategies to help manage taxes and simplify technical issues to understandable morsels.

Geal offers a planning-based perspective built around clients' goals, dreams and wishes. She takes the time to understand who and what is most important to you, and builds comprehensive, meticulous financial plans while integrating exit and succession strategies. She works with your other advisors to best support your goals prior to and long after any transitional events.

Securities Agent: WY, AZ, VA, UT, OR, NC, ID, IA, GA, NV, ME, LA, FL, DC, SC, PA, OH, NJ, MT, WA, TN, OK, IL, DE, MI, CA, TX, NY, MS, MD, MO, IN, HI, CT, AK, NH, CO; General Securities Principal; General Securities Representative; Investment Advisor Representative

NMLS#: 2451938

NMLS#: 2451938

About Keoni Lee

Keoni Lee is a CERTIFIED FINANCIAL PLANNER®, Senior Vice President, Corporate Retirement Director, Financial Advisor, and Managing Partner of The Island Legacy Group at Morgan Stanley. Keoni began his career in the financial services industry in 2010 and utilizes his extensive product knowledge to construct portfolios and conduct investment analysis. He educates families on managing income, expenses, and risk in an ever-changing economic environment. As the Managing Partner, Keoni oversees the day-to-day operations, maintains investment models, and helps identify products and services that may be appropriate to each family's unique needs.

Keoni started with The Island Legacy Group in 2010 while working towards his undergraduate degree at Hawaii Pacific University. He earned his BSBA in Finance and Business Economics (Cum Laude Honors) on an academic scholarship. Keoni continued his education at Hawaii Pacific University by obtaining an MBA with a concentration in Finance (with Distinction Honors). He represented his class as the valedictory speaker of the graduate program.

Keoni spends his time fishing, golfing, and reading. Outside of his leisurely activities, you could find Keoni working to establish and grow a scholarship fund to lessen the financial burden of higher education.

Keoni started with The Island Legacy Group in 2010 while working towards his undergraduate degree at Hawaii Pacific University. He earned his BSBA in Finance and Business Economics (Cum Laude Honors) on an academic scholarship. Keoni continued his education at Hawaii Pacific University by obtaining an MBA with a concentration in Finance (with Distinction Honors). He represented his class as the valedictory speaker of the graduate program.

Keoni spends his time fishing, golfing, and reading. Outside of his leisurely activities, you could find Keoni working to establish and grow a scholarship fund to lessen the financial burden of higher education.

Securities Agent: ME, MA, OR, ID, WA, NC, OK, MS, WY, PA, IL, CA, AZ, UT, TX, MD, HI, CT, NH, WI, NV, FL, IN, DE, CO, VA, NY; General Securities Representative; Investment Advisor Representative

NMLS#: 1663889

CA Insurance License #: 4368314

NMLS#: 1663889

CA Insurance License #: 4368314

Contact Gregg Takara

Contact Derek Wickes

Contact Donn Ariyoshi

Contact Geal Talbert

Contact Keoni Lee

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Retirement for Plan Sponsors

End-to-End Services, Made Simple:

We can provide the tools and guidance to help you manage a retirement plan.

We can provide the tools and guidance to help you manage a retirement plan.

- Plan Evaluation

- Investment Management

- Plan Management Support

- Plan Participant Education

Small Business Retirement Plans

Article Image

Ready to start a conversation? Contact The Island Legacy Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

1Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

11Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

1Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

8Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

11Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)