About Eric A. DiNapoli

Eric is an Executive Director, Financial Advisor, Senior Portfolio Management Director and Chartered Retirement Plans Specialist at The Igel Group at Morgan Stanley. With a comprehensive background in both finance and law, he delivers sophisticated wealth management strategies to a diverse clientele, including individuals, families, corporations, and charitable foundations.

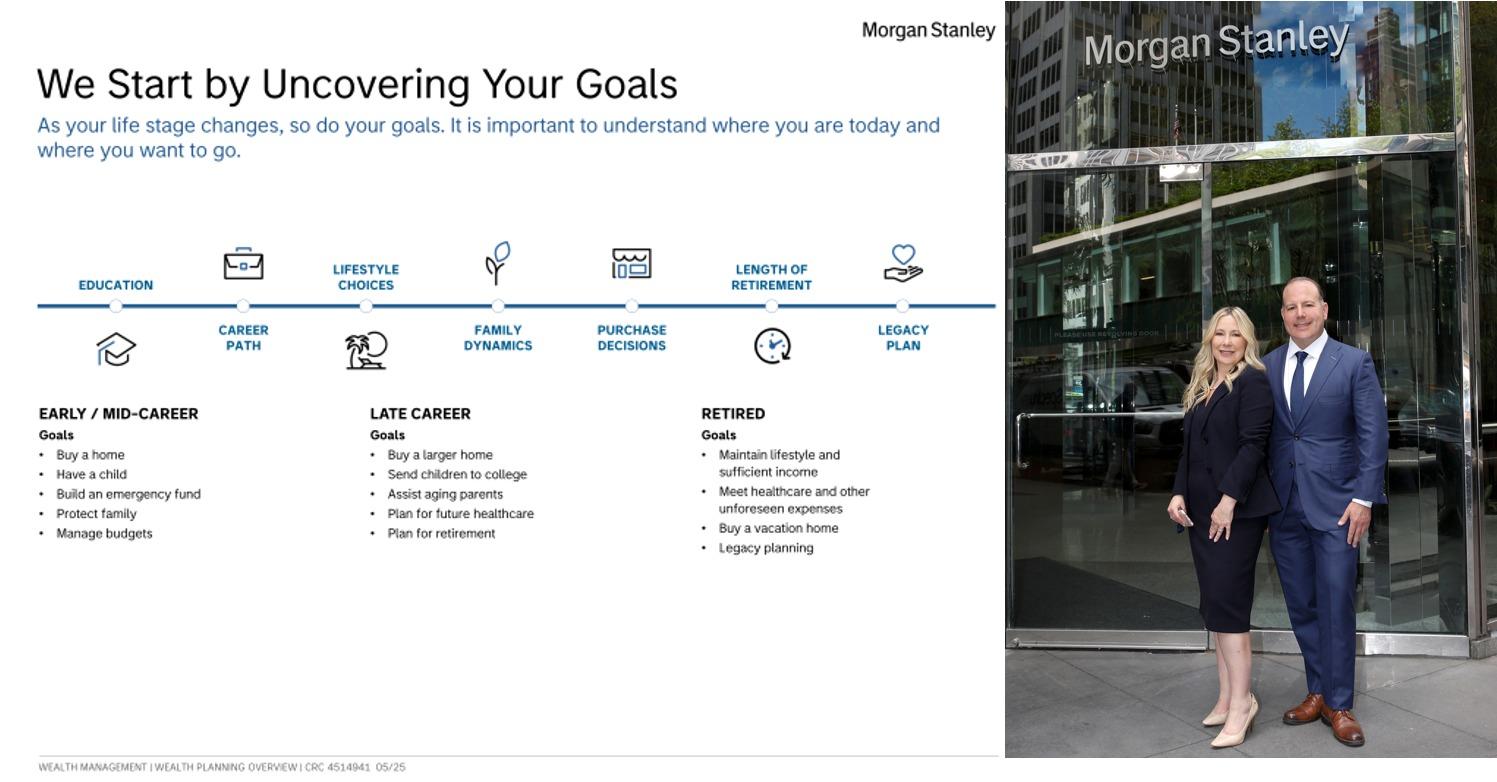

Adopting a holistic, goals-based approach, Eric collaborates closely with clients to craft tailored investment plans that align with their personalized objectives. Recognizing the dynamic nature of financial markets, he consults with his clients to adjust these strategies in response to the evolving economic market, and turbulent geopolitical landscapes.

While Eric does not currently practice law, he is an admitted attorney in both New York and New Jersey. Eric leverages his legal knowledge to assist clients in aligning their legacy and financial strategies by coordinating with clients and their legal team as well as tax advisors. This multidisciplinary approach ensures that estate planning and financial strategies are fully aligned, helping preserve clients' legacies.

Eric earned his Bachelor of Science in Finance from St. John's University and his Juris Doctor from Seton Hall University School of Law. He holds the Chartered Retirement Plans Specialist (CRPS) designation and has achieved the internal Morgan Stanley designation of Senior Portfolio Management Director, awarded to advisors managing significant discretionary assets on behalf of clients.

Beyond his professional pursuits, Eric enjoys skiing, golf, pickleball, weight training, and cherishing time with family and friends.

Securities Agent: MT, MO, HI, FL, TN, CO, AR, OK, LA, CA, TX, MD, IL, AZ, AK, WI, VT, RI, NM, ME, MA, DC, CT, WV, OR, MI, IA, DE, SC, GA, WY, VA, SD, PA, NC, WA, OH, NV, NH, KS, NY, NJ; General Securities Representative; Investment Advisor Representative

NMLS#: 1316526