The HY Group at Morgan Stanley

Direct:

(650) 496-4200(650) 496-4200

Our Mission Statement

A highly credentialed, experienced and compassionate team of Financial Advisors serving the comprehensive financial needs and concerns of affluent individuals and families.

Our Story and Services

Our team works with high net worth individuals, families and entrepreneurs who have trusted us to manage the financial complexities of their lives.

We build comprehensive, customized strategies designed to allow our clients to accumulate, preserve and transfer wealth for their family or business. Over the past two decades, we have prioritized long-term financial planning, while guiding our clients through multiple economic cycles and market conditions. We place a high premium on delivering quality service while building in the flexibility to adapt plans and strategies to help meet the mid- and short-term requirements of life’s unforeseen circumstances.

Many of our clients are first-generation immigrants from China, Taiwan and other countries. As a bilingual team (English and Mandarin), we also work with clients who are non-US citizens living in the US, non-US citizens living outside the US and cross-border families – families whose members have a mix of nationality status and/or whose financial affairs extend across borders.

Morgan Stanley is a top tier US financial institution that offers comprehensive wealth management services to international clients Our clients rely on us to understand the multicultural reasons behind their financial decisions and to help them find the very best solutions, not only for themselves, but for their children and children’s children

Contact us to see how we can make a significant difference in your financial life.

We build comprehensive, customized strategies designed to allow our clients to accumulate, preserve and transfer wealth for their family or business. Over the past two decades, we have prioritized long-term financial planning, while guiding our clients through multiple economic cycles and market conditions. We place a high premium on delivering quality service while building in the flexibility to adapt plans and strategies to help meet the mid- and short-term requirements of life’s unforeseen circumstances.

Many of our clients are first-generation immigrants from China, Taiwan and other countries. As a bilingual team (English and Mandarin), we also work with clients who are non-US citizens living in the US, non-US citizens living outside the US and cross-border families – families whose members have a mix of nationality status and/or whose financial affairs extend across borders.

Morgan Stanley is a top tier US financial institution that offers comprehensive wealth management services to international clients Our clients rely on us to understand the multicultural reasons behind their financial decisions and to help them find the very best solutions, not only for themselves, but for their children and children’s children

Contact us to see how we can make a significant difference in your financial life.

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

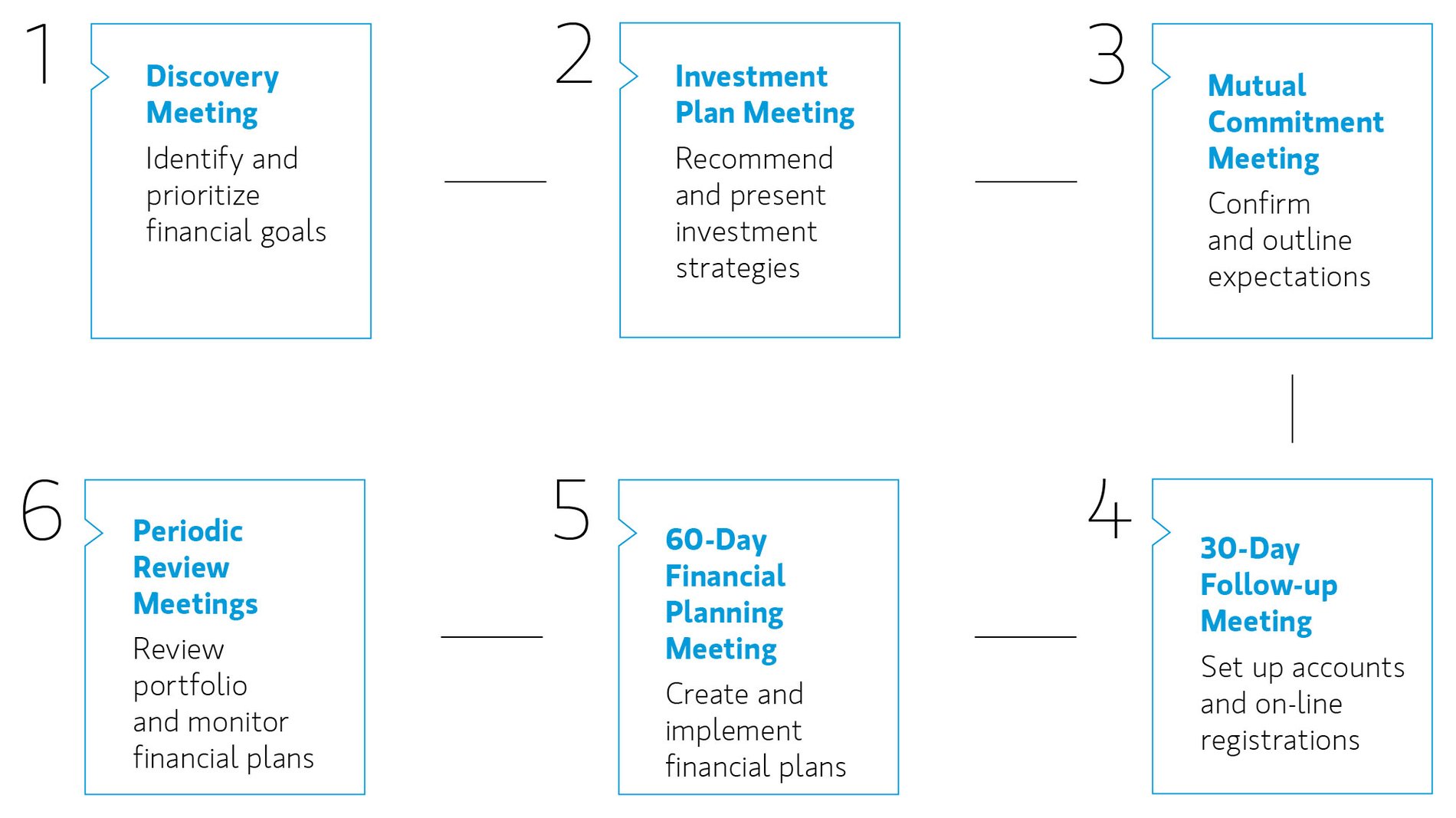

Our Process

We follow a client-focused process that integrates investment decisions with our client's financial needs and their commitments to their family, their community, and their future.

Location

1400 Page Mill Road

Palo Alto, CA 94304

US

Direct:

(650) 496-4200(650) 496-4200

Meet The HY Group

About Sherry (Hsiao-Yun) Yang

Sherry (Hsiao-Yun) Yang, CFP®

Senior Vice President

Financial Advisor

As a Senior Vice President and Certified Financial Planner™ (CFP®), Sherry Yang has more than two decades of experience managing the complex financial needs of high net worth individuals and families. She delivers quality service while implementing strategies that help simplify complicated financial situations and meet multiple financial objectives. Her highly personalized and comprehensive wealth management strategies incorporate estate and trust planning strategies, risk management contingencies, long-term income and retirement solutions, and complex, multi-generational planning, while also allowing for changing life circumstances.

Sherry grew up in Taiwan and graduated with a degree in German literature from Tamkang University in Taipei, Taiwan. She earned a master’s degree in journalism from the University of Wisconsin-Madison and worked as a newspaper reporter for five years before moving to the San Francisco Bay Area and entering the high tech world as a marketing executive.

Sherry became a Financial Advisor in 2002, working for American Express Financial Advisors and then Citi. She became a Vice President with Citi Smith Barney (a Morgan Stanley predecessor firm) in 2006. She joined Wells Fargo Advisors in 2009 and spent more than a decade with the firm, growing her business and earning the Certified Financial Planner™ certification.

Contact:

Tel: (650) 496-4245

sherry.yang@morganstanley.com

Senior Vice President

Financial Advisor

As a Senior Vice President and Certified Financial Planner™ (CFP®), Sherry Yang has more than two decades of experience managing the complex financial needs of high net worth individuals and families. She delivers quality service while implementing strategies that help simplify complicated financial situations and meet multiple financial objectives. Her highly personalized and comprehensive wealth management strategies incorporate estate and trust planning strategies, risk management contingencies, long-term income and retirement solutions, and complex, multi-generational planning, while also allowing for changing life circumstances.

Sherry grew up in Taiwan and graduated with a degree in German literature from Tamkang University in Taipei, Taiwan. She earned a master’s degree in journalism from the University of Wisconsin-Madison and worked as a newspaper reporter for five years before moving to the San Francisco Bay Area and entering the high tech world as a marketing executive.

Sherry became a Financial Advisor in 2002, working for American Express Financial Advisors and then Citi. She became a Vice President with Citi Smith Barney (a Morgan Stanley predecessor firm) in 2006. She joined Wells Fargo Advisors in 2009 and spent more than a decade with the firm, growing her business and earning the Certified Financial Planner™ certification.

Contact:

Tel: (650) 496-4245

sherry.yang@morganstanley.com

Securities Agent: WA, UT, SC, SD, IA, FL, OH, MD, NY, NV, NC, AZ, TX, MN, CA, DE; General Securities Representative; Investment Advisor Representative

NMLS#: 2126079

CA Insurance License #: 0D89178

NMLS#: 2126079

CA Insurance License #: 0D89178

About Jonathan Young

Jonathan Young's fascination with financial planning and investments began in his youth, growing up as part of a first-generation immigrant family. Witnessing his parents' diligent work ethic, prudent savings, and responsible investing decisions laid the groundwork for his own passion for financial planning. He recognized early on the profound impact that sound financial advice can have on shaping one's future.

With eight years of experience in the financial services industry, six of which have been with Morgan Stanley, Jonathan has honed his skills as a financial advisor. His approach to financial planning is organic, fostering dynamic and personalized engagements with his clients. Jonathan prioritizes flexibility, allowing clients to schedule meetings according to their needs and preferences.

Jonathan's dedication to his clients' success is unwavering, driven by his belief that financial prosperity holds different meanings for everyone. By listening attentively to each client's unique story, he tailors financial strategies to align with their specific goals and aspirations.

In recognition of his commitment to providing comprehensive financial services, Jonathan was named to Morgan Stanley's prestigious Pacesetter's Club in 2024. This esteemed group acknowledges the Firm's most successful Financial Advisors, a testament to Jonathan's unwavering dedication to his clients. He appreciates this recognition as a validation of his tireless efforts and looks forward to achieving even greater milestones in the future.

Outside of his professional endeavors, Jonathan finds joy in leading outdoor adventures with his beloved wife Ashley and their delightful daughter Abbie. He remains actively engaged in community involvement, dedicating his time to River of Life Christian Church and various ministries. Additionally, he co-leads The Boring Outdoorsy Group, combining his love for nature with his passion for fostering meaningful connections within his community.

With eight years of experience in the financial services industry, six of which have been with Morgan Stanley, Jonathan has honed his skills as a financial advisor. His approach to financial planning is organic, fostering dynamic and personalized engagements with his clients. Jonathan prioritizes flexibility, allowing clients to schedule meetings according to their needs and preferences.

Jonathan's dedication to his clients' success is unwavering, driven by his belief that financial prosperity holds different meanings for everyone. By listening attentively to each client's unique story, he tailors financial strategies to align with their specific goals and aspirations.

In recognition of his commitment to providing comprehensive financial services, Jonathan was named to Morgan Stanley's prestigious Pacesetter's Club in 2024. This esteemed group acknowledges the Firm's most successful Financial Advisors, a testament to Jonathan's unwavering dedication to his clients. He appreciates this recognition as a validation of his tireless efforts and looks forward to achieving even greater milestones in the future.

Outside of his professional endeavors, Jonathan finds joy in leading outdoor adventures with his beloved wife Ashley and their delightful daughter Abbie. He remains actively engaged in community involvement, dedicating his time to River of Life Christian Church and various ministries. Additionally, he co-leads The Boring Outdoorsy Group, combining his love for nature with his passion for fostering meaningful connections within his community.

Securities Agent: ID, VA, PA, NJ, OR, CO, AZ, SC, MA, TX, NV, NC, IL, SD, OH, NY, MN, MD, FL, DE, WA, CA; General Securities Representative; Investment Advisor Representative

NMLS#: 2334239

CA Insurance License #: 0K51259

NMLS#: 2334239

CA Insurance License #: 0K51259

About Jerrick Lien

As a former financial advisor, Jerrick Lien has always been an integral part of the HY Group. Previously, he provided clients with personalized financial services including financial planning, cash management & lending solutions and advisory and brokerage services.

In his most recent role, Jerrick focuses on maintaining strong and productive relationships with clients. Jerrick assists with the onboarding transition and process a broad range of service requests.

Born and raised in Taipei, Taiwan, Jerrick moved to the U.S. after high school and earned his BS in accounting at San Jose State University. He specialized in tax planning and served as a member and volunteer of Tax-Aid during the tax season.

In his most recent role, Jerrick focuses on maintaining strong and productive relationships with clients. Jerrick assists with the onboarding transition and process a broad range of service requests.

Born and raised in Taipei, Taiwan, Jerrick moved to the U.S. after high school and earned his BS in accounting at San Jose State University. He specialized in tax planning and served as a member and volunteer of Tax-Aid during the tax season.

Contact Sherry (Hsiao-Yun) Yang

Contact Jonathan Young

The Power of Partnerships

By partnering with experienced individuals across wealth disciplines, Morgan Stanley Financial Advisors can align specialized resources with your custom needs and deliver strategic guidance through the familiarity and trust of existing relationships

About Sam Mohebi

Sam Mohebi is an Associate Private Banker serving Morgan Stanley Wealth Management offices in California.

Associate Private Bankers partner with Private Bankers and Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Sam began his career in financial services in 2009 and joined Morgan Stanley in 2022 as an Associate Private Banker. Prior to joining the firm, he was a Licensed Banker at JP Morgan Securities. He also served as a Brokerage Associate at Wells Fargo Advisors.

Sam is a graduate of Azad University, where he received a Bachelors in Civil Engineering. He lives in Campbell, California with his family. Outside of the office, Sam enjoys hiking, as well as playing tennis and golf.

Associate Private Bankers partner with Private Bankers and Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Sam began his career in financial services in 2009 and joined Morgan Stanley in 2022 as an Associate Private Banker. Prior to joining the firm, he was a Licensed Banker at JP Morgan Securities. He also served as a Brokerage Associate at Wells Fargo Advisors.

Sam is a graduate of Azad University, where he received a Bachelors in Civil Engineering. He lives in Campbell, California with his family. Outside of the office, Sam enjoys hiking, as well as playing tennis and golf.

NMLS#: 1616449

Private Banking Group (PBG) Market Managers, Senior Private Bankers, Private Bankers, and Associate Private Bankers are employees of Morgan Stanley Private Bank, National Association.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Wealth Management Financial Advisors can conduct their business in several ways: individually, as a member of a team of Financial Advisors, or through the formation of a Strategic Partnership with another Financial Advisor or team of Financial Advisors. A Strategic Partnership is an arrangement between a Financial Advisor or a team of Financial Advisors with another Financial Advisor or team of Financial Advisors that has a unique focus or knowledge regarding a specific business concentration, product area, and/or client type. If your account is with an individual Financial Advisor, that Financial Advisor services all facets of your account. If your account is with a Financial Advisor who is a member of a team, any Financial Advisor on the team can service your account. If your Financial Advisor is part of a Strategic Partnership, his or her role in that Strategic Partnership may be limited to a specific business and/or product area and may not cover all facets of your account. The use of the terms “Partner” or “Strategic Partner” and/or “Partnership” or “Strategic Partnership” are used as terms of art and not used to imply or connote any legal relationship.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Wealth Management Financial Advisors can conduct their business in several ways: individually, as a member of a team of Financial Advisors, or through the formation of a Strategic Partnership with another Financial Advisor or team of Financial Advisors. A Strategic Partnership is an arrangement between a Financial Advisor or a team of Financial Advisors with another Financial Advisor or team of Financial Advisors that has a unique focus or knowledge regarding a specific business concentration, product area, and/or client type. If your account is with an individual Financial Advisor, that Financial Advisor services all facets of your account. If your account is with a Financial Advisor who is a member of a team, any Financial Advisor on the team can service your account. If your Financial Advisor is part of a Strategic Partnership, his or her role in that Strategic Partnership may be limited to a specific business and/or product area and may not cover all facets of your account. The use of the terms “Partner” or “Strategic Partner” and/or “Partnership” or “Strategic Partnership” are used as terms of art and not used to imply or connote any legal relationship.

Wealth Management

Global Investment Office

Portfolio Insights

This is a video content

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

Enhancing Financial Wellness enables your workforce to do their best work. Companies that invest in financial wellness have an opportunity to:

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

Ready to start a conversation? Contact The HY Group today.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025), 4763067 (9/2025)