The Hartman Curio Group at Morgan Stanley

Our Mission Statement

Our Story

The story of The Hartman Curio Group is anything but typical. About thirty years ago Scott Hartman and Jeff Curio met on the very first day of their very first jobs in the financial services industry. It's a testament to what can happen when two like-minded people come together with one common mission—to help clients build wealth, minimize risk and forge a clear path toward achieving their goals.

What sets us apart

When it comes to our clientele, we believe that less is more. We only serve a limited number of clients because it allows us to provide the attention you deserve. Our seasoned team is passionate about helping you and your family live more comfortably today and feel more confident about your future.

Professional. Passionate. Personal

We work with successful individuals, wealthy families, and small business owners, who are committed to following a strategic plan that was created exclusively for their needs. There's nothing cookie cutter about what we provide. When you entrust us to manage your wealth, you'll see how deeply we care about your success. Your milestones become our milestones.

If you're looking for a wealth management firm that delivers phenomenal service, simplifies the complex, and avoids "Wall Street jargon", we're the team for you. Reach out today to see what a difference we can make in your world.

We're in the business of helping you grow and protect your business

Small business is the backbone of America. Our team is highly experienced in helping you throughout every stage—from infancy and expansion to monetization. We have solutions that address the types of challenges that slow down many businesses—from cash flow and tax mitigation to creating plans that attract the right talent.

Whether you own a small business or run a medical practice, we can connect you to a world of new opportunities through Morgan Stanley vast resources, including:

• Strategic Lending – In order to grow, it's important it is to invest in your business. We can create a sophisticated lending solution that can take you to the next level.

• Retirement Savings Plans – We know how important retirement plans and tax benefits are for you and your employees. We can help structure a plan that meets your goals and offers the types of benefits that attract recruits and keep your employees happy.

• Tax Mitigation– We offer strategies to minimize your tax burden and provide tax overlay tools that give you a clearer picture of your challenges—and opportunities.

• Buying or selling a business– We can help you avoid common pitfalls that often come with acquisition and expansion. And when the time comes for you to transition your business, our experience and network can be invaluable.

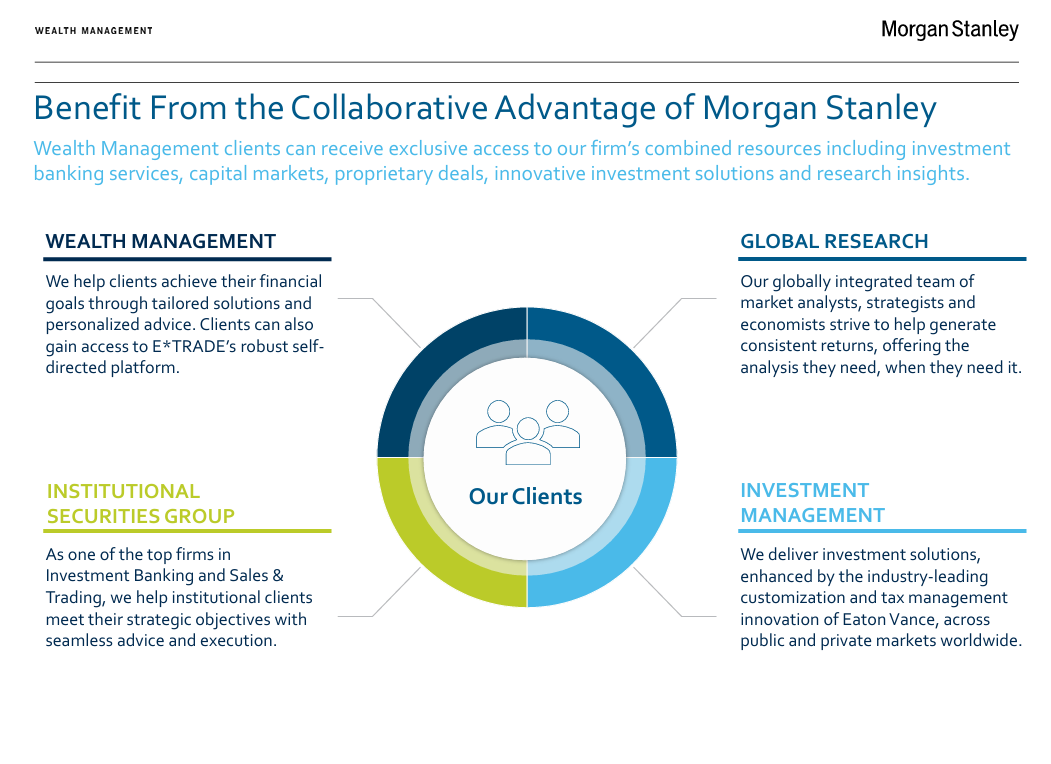

Tap into a global powerhouse.

Morgan Stanley are industry leaders in areas that are critical to your success, including alternative investment opportunities, cybersecurity, and a range of innovative AI platforms.

Location

Meet The Hartman Curio Group

About Me

As a Portfolio Management Director, I’m passionate about making a positive impact on the lives of my clients and their families. It’s very rewarding to get to know a client, earn their trust, and then witness many good things they’ve been able to accomplish throughout the years. I may not have grown up wealthy, but I have tremendous respect for the doors it can open.

With over three decades of working at top firms including UBS, I recently returned to Morgan Stanley because I believe it provides my clients more opportunities to reach their goals. I hold a CPWA designation from the Booth School of Business at the University of Chicago and a CRPS designation. I graduated from the University of Illinois with a degree in Finance.

On a personal note, I love spending family time with my wife, Amy, and our three children. We enjoy staying active and exploring new destinations. I also like playing guitar whenever I get a free moment.

NMLS#: 2447227

About Me

My career in the financial services industry has spanned more than 30 years. While technically I’m a seasoned veteran, I still feel the same drive and passion that got me to where I am. As the co-founder of the Hartman Curio Group, I play a pivotal role in delivering top-tier financial advice that caters to my clients’ individual goals. My commitment to excellence is highlighted by my Certified Private Wealth Advisor (CPWA®) designation, earned through the University of Chicago Booth School of Business.

In my role as a Portfolio Management Director, I’m able to manage wealth, while mitigating risk. I focus on financial planning, employing a holistic approach that encompasses accumulation, distribution, and wealth transfer strategies. One of my main areas of concentration is to craft asset protection strategies and legacy planning solutions, focused on my clients' financial security and the preservation of their legacies.

I’ve been married to my wonderful wife, Melissa, since 2000. Together, we have three active boys, Nicholas, Vincent, and John. It’s been a real pleasure to coach them in football, baseball, and basketball over the years. I’m also deeply committed to my community, and volunteer at St. Patrick High School, Chicago's oldest all-boys Catholic high school.

NMLS#: 2438624

About Era Doce

About Jill Rottman

Jill took a break from her career to focus on her family, raising her two sons until 2020. During this time, she found her way back to the finance world when Hartman Curio welcomed her to UBS Financial as a Client Service Associate. In 2022, she continued her journey alongside Hartman Curio by transitioning to Morgan Stanley in the same role.

Outside of work, Jill finds immense joy in supporting her sons in their various sporting endeavors. She is also deeply committed to volunteering within her school communities and enjoys cooking with her family. She is happily married to her husband Tom and is the proud mother of two sons, Frank and Dean.

Contact Scott Hartman

Contact Jeff Curio

The Power of Partnerships

About Thomas O'Brien

He earned his undergraduate degree from Binghamton University and received the Financial Planning Specialist® designation from the College for Financial Planning. Thomas is originally from Lynbrook, NY and currently resides in Lynbrook, NY.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

5Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

6Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

7Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

8Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

9Annuities are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley