Niall J Gannon

Industry Award Winner

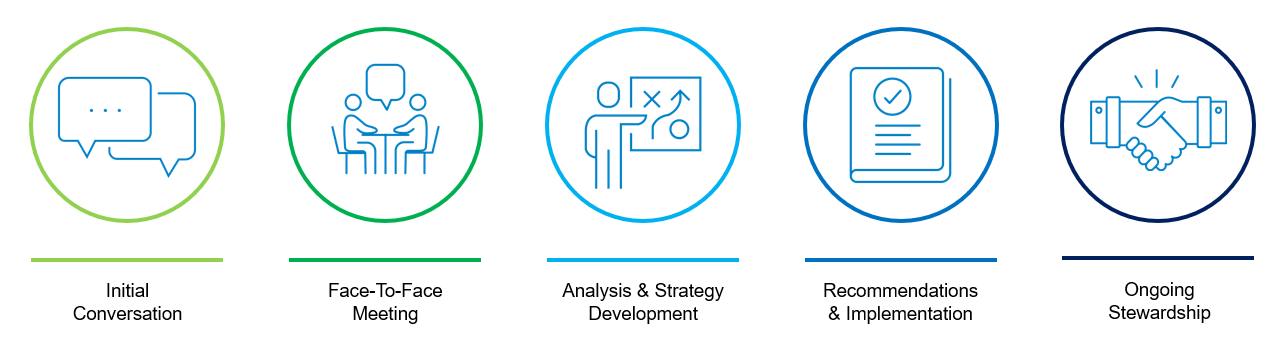

Industry Award WinnerOur process begins and ends with listening. We ask questions about what is important to you, your family and your legacy...and then we listen. Through each step, we provide objective advice and investment insights to construct a wealth management plan that is uniquely yours.

While each client has a unique set of goals and circumstances, they all have one thing in common: They need help simplifying their finances and developing a comprehensive and cohesive wealth strategy. The Clayton Group's objective is to serve as your personal CFO, simplify your life, and help you effectively manage and protect your assets, so you may enjoy your wealth and leave the legacy you desire.

We begin with an informal discussion to understand your financial concerns and determine how we can add value. This is your opportunity to interview us, as we get to know you. If we agree to move forward, we'll schedule our next meeting and request important financial information.

We continue the dialogue by fostering an in-depth conversation where we learn about the values that shape your decisions and identify any unique circumstances. We also review the documents you've prepared and begin to define your priorities.

Here, we utilize proprietary financial planning tools to develop a personalized and detailed strategy with recommendations to help you grow, preserve and transfer your wealth. This serves as the foundation for building your initial plan, as well as future investment decisions.

In this step, we present appropriate investment options that, once executed, are designed to work together to achieve your goals. Upon your approval, we execute the investment recommendations and begin to implement the additional wealth management strategies we've discussed. These often encompass risk management, as well as estate, trust and philanthropic planning.

Committed to premium service, we focus on developing a relationship that provides special value to you and your family. As we begin to execute each strategy, we'll set up tools so you have immediate access to your account information. And because markets and personal needs evolve over time, we set up ongoing meetings to help ensure your plan remains designed to achieve your goals.