The Fleming Kivett & Phillips Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Welcome

At The Fleming Kivett & Phillips Group at Morgan Stanley, we help clients take a fresh look at their financial lives. Our team works with you to build a comprehensive, integrated, goals-based plan that will guide all your financial decisions – including investments, wealth planning, cash management and lending, risk management, wealth transfer, and many other things. In short, anything involving money.

This holistic approach means we work closely with each client, leveraging the vast resources of Morgan Stanley, a global leader that offers expertise in every area of wealth management. We serve as your wealth advisor and manager, providing thoughtful advice and custom solutions.

As a result, our clients get the specialized services they need, combined with personal service and advice offered by a dedicated financial boutique.

With our focus on comprehensive wealth management, it's imperative that we have access to solutions for every financial situation. With a CFP® professional on the team, we provide a wide range of services and recommendations. We are honored to be named to the Forbes Best-In-State Wealth Management Teams list for South Carolina in 2024.

Forbes Best-In-State Wealth Management Teams

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/22-3/31/23.

- Retirement PlanningFootnote1

- Financial PlanningFootnote2

- 401(k) Rollovers

- 529 PlansFootnote3

- Planning for Education FundingFootnote4

- Professional Portfolio ManagementFootnote5

- Wealth ManagementFootnote6

- Alternative InvestmentsFootnote7

- Certificates of DepositFootnote8

- Corporate Cash Management

- Corporate Retirement PlansFootnote9

- Estate Planning StrategiesFootnote10

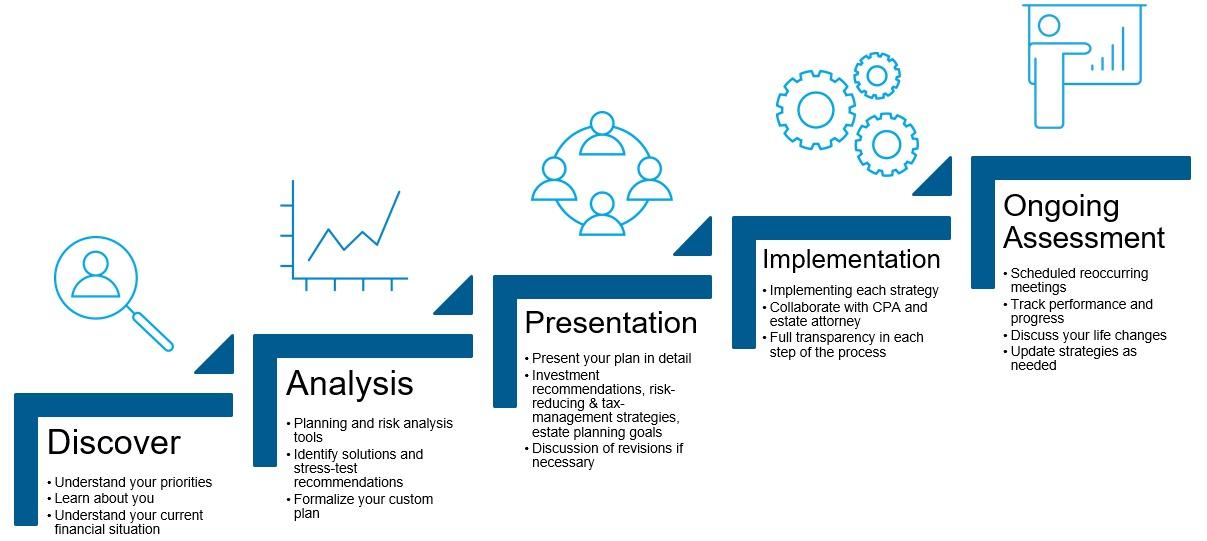

Working With You

Location

Meet The Fleming Kivett & Phillips Group

About H.J. Fleming Jr.

H.J. is a 1996 graduate of Wofford College in Spartanburg, SC with a B.A. in Government. In addition to his studies, H.J. was a 4 year soccer letterman and an active member of Kappa Alpha Order. H.J. was born in New York and raised in Charleston, SC and is proud to call Greenville and the Upstate SC area, his permanent home for his family. He and his wife Kay, a busy mother herself, and their two daughters Annie and Mary Beth, are members of the West Minster Presbyterian Church and the Greenville Country Club. In addition to spending time with his family and raising his daughters, H.J. is a Board Member and Treasurer for Clements Kindness, a non-profit organization dedicated to meeting the medical, emotional and financial needs of Upstate families impacted by pediatric cancer, as well as serving on the Wofford College Terrier Club Board of Directors. Outside the office, H.J. has enjoyed coaching his girls’ soccer team for the past 10 years and playing golf with his lifelong friends.

NMLS#: 1282488

About Walter Kivett

Walter is a 1987 graduate of the University of Kentucky with a B.S. in Electrical Engineering and a 1989 graduate of the University of Cincinnati with an M.S. in Electrical Engineering. Walter and his wife Dee Wood Kivett, PhD., an Adjunct Professor at Clemson University International Center for Automotive Research (CUICAR) and a CEO of NextGen Supply Chain Integrators, founded in 2003 a non-profit organization, Operation Bear Hug Inc., to provide stuffed animals to police, emergency responders and children's non-profit agencies.

Since 2014, Walter has been involved in the Boy Scouts of America, serving as a den leader throughout cub scouts and is now the Scoutmaster of Troop 776 where his two children Kyle and Kelli have both achieved their Eagle Scout ranks. During scouting Walter has been the Blue Ridge Council Outdoor Ethics Advocate, a Leave No Trace Master Educator, Tread Lightly Master Trainer, Wilderness First Aid certified and BSA Lifesaving certified.

Walter has served on various non-profit boards and enjoys a variety of sports and outdoor activities. Walter and his family have been members of Brookwood Church in Simpsonville, SC since 2002 and is also a member of the Greenville Rotary Club, Leave No Trace Center for Outdoor Ethics, Conastee Nature Preserve and the Foothills Trail Conservancy. Walter is proud to call Greenville, SC and the Upstate SC area his home for life.

NMLS#: 1279292

About Frederick Phillips

Rick is proud of his service to the Upstate community and charitable organizations, such as United Way of Greenville, United Way of the Piedmont, Healthy Smiles of Spartanburg, Hope Center for Children and Upstate Warrior Solution.

Rick lives in Spartanburg, SC and is a Senior Partner with The Fleming Kivett & Phillips Group.

About Ross Hammond

Prior to joining Morgan Stanley, Ross was an auditor at PWC and the Senior Development Accountant at OTO Development. Ross attended Wofford College and received a BA in Accounting with a Minor in German Studies while playing Division I football on full scholarship. He then received his Master of Professional Accounting at Gardner-Webb university.

Ross grew up and currently resides in Spartanburg, SC. He serves on the Board of directors for the Rotary Club of Spartanburg and the Spartanburg Philharmonic along with being an active member of Westminster Presbyterian Church Spartanburg. In his free time, he enjoys spending time with his wife Katy and son Eli, playing golf with friends and family, and cheering on the Wofford Terriers.

About Hannah Kinney

She has over ten years in the banking industry, supporting clients, the Commercial Relationship Team, and retail branches. In her most recent three years she served as the Executive Assistant to the Greenville, Spartanburg & Cherokee County President of United Community. Prior to that, she worked for several years in the ACH and Wires department, gaining valuable experience in operations and transaction processing.

She is committed to bringing strong communication and interpersonal skills to foster genuine relationships that lead to client satisfaction and a sense of unity within the team.

Outside of the office, Hannah enjoys spending time with her family – including her husband Kyle, their three daughters, and their German Shepherd. She loves playing soccer, baking, and cheering on the Buffalo Bills.

Contact H.J. Fleming Jr.

Contact Walter Kivett

Contact Frederick Phillips

Awards and Recognition

The Power of Partnerships

About Jared M. Bush

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Jared began his career in financial services in 2004, and joined Morgan Stanley in 2016. Prior to joining the firm, he was a Wealth Management Banker at Merrill Lynch. He also served as a Premier Client Manager at Bank of America and as a Licensed Financial Specialist at Wells Fargo.

Jared is a graduate of Slippery Rock University, where he received a Bachelor of Science in Sports Management. He lives in Charlotte, North Carolina with his family. Outside of the office, Jared enjoys playing golf, listening to music, and spending time with family and friends.

About Ty Hardimon

He earned his undergraduate degree from Wake Forest University and received the Financial Planning Specialist® designation from the College for Financial Planning. Ty is originally from Marietta, Georgia and currently resides in Sandy Springs, Georgia.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

1When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan's investment options and the historical investment performance of these options, the Plan's flexibility and features, the reputation and expertise of the Plan's investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state's own Qualified Tuition Program. Investors should determine their home state's tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

5Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

6Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

7Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

8Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley