Bruce Attig, CIMA®

Who We Are

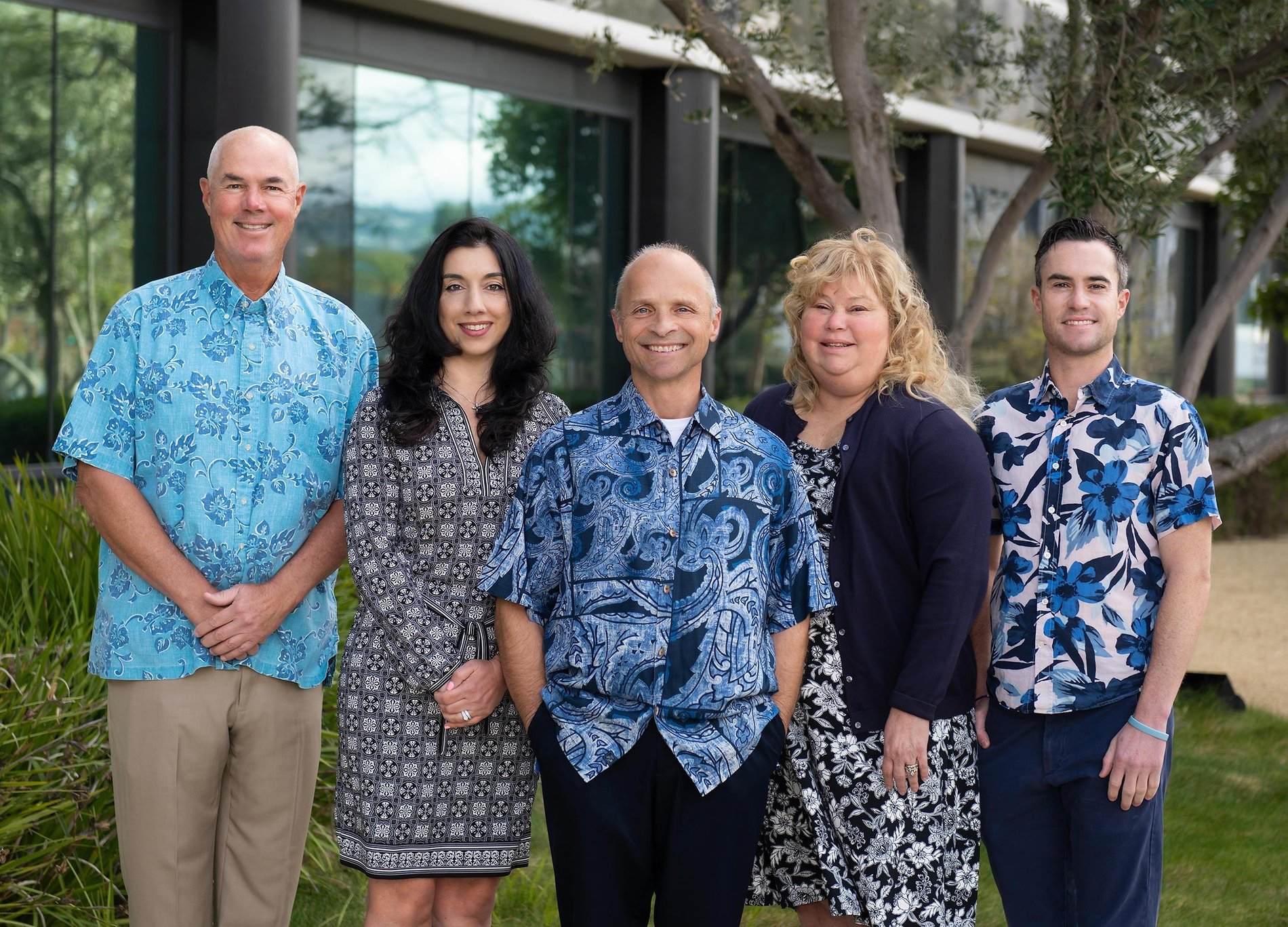

The Equitas Group helps clients in Los Angeles and across the country achieve financial success through careful planning and guidance. We are a team of three advisors and two support staff with over 140 years of combined experience in wealth management. Over time, we have developed close ties to the community and fostered long lasting relationships that span multiple generations.

What We Do

We believe financial planning is not a one-size-fits-all solution. That's why we take the time to understand your individual needs, aspirations, and risk tolerance. Whether you're planning for retirement, savings for your child's education, or just managing your investments, we're here to guide you every step of the way.

We work with clients from multiple industries. Our two senior advisors, Tom and Bruce, work with clients that work in a variety of sectors while, our newest addition to the team, Chris, works primarily with clients in tech. This experience helps us to position the correct solutions and strategies to navigate the unique complexities of each industry.

Our Philosophy

At the core of our business is a foundation of trust, empathy, and communication. We believe that financial success is not just about numbers; it's about people. Our goal is to create meaningful relationships with our clients and truly get to know you and your family. We aim to instill a relationship not based on transaction, but on a shared desire for your overall well-being.

Contact Us

If you're ready to take control of your financial future, reach out to us today to schedule a consultation. We look forward to helping you navigate the complexities of your finances and achieve your goals.

Equity Compensation can be a significant part of your compensation package and understanding how your stock option plan works is the first step. Our clients turn to us with questions about their equity compensation and how it can play a big role in reaching their financial ambitions. We believe in educating our clients and walking them through their options that best align with their goals.

As your career evolves so will your compensation structure. We provide a wide variety of services to help manage your equity compensation and integrate your equity award into your broader financial plan. Whether it is a need for short term liquidity or long-term diversification we work alongside you to leverage your equity compensation to enhance your financial picture.

We work hard to help you navigate the tax and legal considerations associated with your specific equity awards. From RSUs to vested units, we answer client questions about the best approach to implementing their equity awards to better supplement their financial plan.

Taxes Matter. So Does Planning.

Sound investment advice is only the first step in a financial plan. We believe in taking a holistic approach to your finances and taking into consideration the tax implications of your portfolio can help maximize returns.

With the use of Morgan Stanley's Total Tax 365 platform. we implement tax-efficient investing strategies on the foundation of three core ideas - Tax-Loss Harvesting, Tax-Smart Planning, and Tax-Smart Gifting. Implementing a tax efficient strategy can help you keep more of the wealth you worked hard to build.