The Davis And Smith Group at Morgan Stanley

Direct:

(682) 299-7158(682) 299-7158

Our Mission Statement

Experience, intellectual capital and dedicated personal service to help you meet your life goals

Our Story and Services

The Davis and Smith Group is a distinguished wealth management team at Morgan Stanley. Led by a team of seasoned professionals, our advisors draw from a rich tapestry of experience and an innate understanding of the complexities that govern the financial realm. We believe that true wealth is not measured merely by monetary value, but by the fulfillment of dreams and aspirations. By forging deep and meaningful connections with each client, we embark on a journey together, seeking to unlock the true potential of their financial endeavors.

Our team of investment professionals understands that most individuals possess a unique set of ambitions, challenges, and desires, which is why we tailor our approach to suit their specific needs. It is this personalized touch that that we believe sets us apart, for we understand that truly effective planning lies in the details. Through our collaborative efforts we deliver insightful and forward-thinking strategies to align with each person’s unique set of goals, their values, and work with them to identify opportunities available for their capital.

In our pursuit of excellence, we leverage the full breadth and resources of Morgan Stanley, a global institution renowned for its commitment to quality and innovation. With access to the industry’s leading wealth and investment management firm we harness the collective power of a vast network of specialists, cutting-edge technology, and a wealth of research, helping propel our clients towards unparalleled success.

Our work is not merely about wealth accumulation; it is about crafting legacies and empowering generations to come. With Davis, Smith, and Associates at your side, you can trust that your financial aspirations are in the hands of a team that personifies humility, diligence, and an unwavering dedication to your financial well-being.

Our team of investment professionals understands that most individuals possess a unique set of ambitions, challenges, and desires, which is why we tailor our approach to suit their specific needs. It is this personalized touch that that we believe sets us apart, for we understand that truly effective planning lies in the details. Through our collaborative efforts we deliver insightful and forward-thinking strategies to align with each person’s unique set of goals, their values, and work with them to identify opportunities available for their capital.

In our pursuit of excellence, we leverage the full breadth and resources of Morgan Stanley, a global institution renowned for its commitment to quality and innovation. With access to the industry’s leading wealth and investment management firm we harness the collective power of a vast network of specialists, cutting-edge technology, and a wealth of research, helping propel our clients towards unparalleled success.

Our work is not merely about wealth accumulation; it is about crafting legacies and empowering generations to come. With Davis, Smith, and Associates at your side, you can trust that your financial aspirations are in the hands of a team that personifies humility, diligence, and an unwavering dedication to your financial well-being.

Services Include

- Wealth ManagementFootnote1

- Alternative InvestmentsFootnote2

- Professional Portfolio ManagementFootnote3

- Executive Financial ServicesFootnote4

- Stock Option PlansFootnote5

- Financial PlanningFootnote6

- Trust ServicesFootnote7

- Estate Planning StrategiesFootnote8

- Long-term Care InsuranceFootnote9

- Endowments and FoundationsFootnote10

Check the background of Our Firm and Investment Professionals on FINRA's BrokerCheck.*

Working With You

We believe that identifying financial solutions begins with a solid understanding of each client's situation, goals, objectives and risk tolerance. We follow a disciplined process that enables us to work with you to craft strategies that are designed to help you meet your individual financial needs.

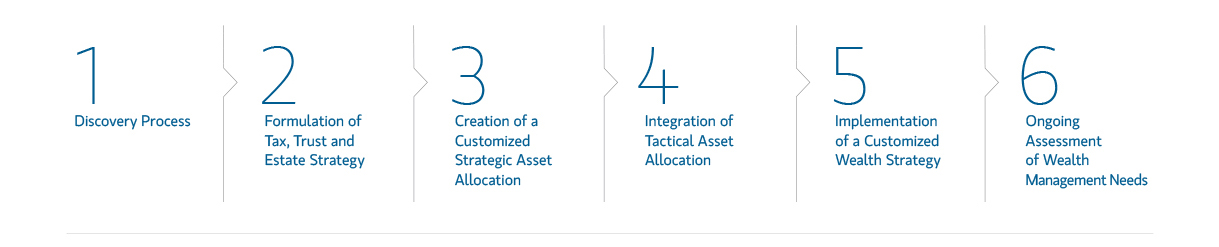

Our Process

- Develop a thorough understanding of your financial goals and objectives

- Review and analyze your current financial situation

- Identify and tailor strategies that can help you meet your individual needs

- Integrate tactical asset allocation to adjust portfolio exposure based on market conditions

- Implement your customized strategy, including personalized services and benefits

- Review your strategy, meeting periodically to discuss your goals and needs

Servicing Overview - Personalized planning and financial education

- Custom investment portfolio design, management and risk monitoring

- Exclusive private equity, credit and real-estate investment strategies

- Trust and estate planning strategies and dedicated services

- High-touch with direct and regular engagement

Location

3230 Camp Bowie Blvd

Ste 625

Fort Worth, TX 76107

US

Direct:

(682) 299-7158(682) 299-7158

Meet The Davis And Smith Group

About Tyler Davis

Tyler began his career in the last Financial Crisis, shaping his investment philosophy of “portfolio construction through financial planning”. After making the move to Merrill Lynch in 2011 from a regional broker-dealer, he had a vision of how he wanted to build his practice and worked for many years shaping what would later be titled as Davis, Smith and Associates. The success and growth of the group is attributed to the emphasis placed on Financial Planning and seeking to provide a financial partnership for the retail client with a “white-glove” service model.

A highly credentialed advisor, Tyler holds both his CRPC® CPWA® designations to ensure the highest level of advice for clients.

In September 2022, Tyler moved his team to Morgan Stanley after seeing the competitive advantage given his team’s clientele. Davis, Smith and Associates work with Executive level clients at publicly traded companies and specialize in comprehensive strategies for these individual’s future retirement. The team also assists in advising clients around trust and estate planning strategies, legacy formation and transfer, education planning, and providing various lending and liquidity options.

Tyler holds his Chartered Retirement Planning Counselor through the College of Financial Planning to ensure myopic focus in the retirement space. He also holds his Portfolio Manager title enabling him to build custom portfolios for each of his client’s unique needs.

Tyler is a Certified Private Wealth Advisor professional, recognized through the Investments & Wealth Institute. Tyler successfully completed his executive course through the Yale School of Management in 2024.

Tyler and his wife Brittany proudly call Fort Worth Texas home. Tyler is actively philanthropic and regularly participates in community events. He serves as a board member for the highly acclaimed community organization titled “Taste Project” that focuses on providing for those who are food insecure.

A highly credentialed advisor, Tyler holds both his CRPC® CPWA® designations to ensure the highest level of advice for clients.

In September 2022, Tyler moved his team to Morgan Stanley after seeing the competitive advantage given his team’s clientele. Davis, Smith and Associates work with Executive level clients at publicly traded companies and specialize in comprehensive strategies for these individual’s future retirement. The team also assists in advising clients around trust and estate planning strategies, legacy formation and transfer, education planning, and providing various lending and liquidity options.

Tyler holds his Chartered Retirement Planning Counselor through the College of Financial Planning to ensure myopic focus in the retirement space. He also holds his Portfolio Manager title enabling him to build custom portfolios for each of his client’s unique needs.

Tyler is a Certified Private Wealth Advisor professional, recognized through the Investments & Wealth Institute. Tyler successfully completed his executive course through the Yale School of Management in 2024.

Tyler and his wife Brittany proudly call Fort Worth Texas home. Tyler is actively philanthropic and regularly participates in community events. He serves as a board member for the highly acclaimed community organization titled “Taste Project” that focuses on providing for those who are food insecure.

NMLS#: 853145

About Miles Smith

Miles Smith is a Vice President of Wealth Management at Morgan Stanley and co-founder of the Davis, Smith & Associates Wealth Management Group. As one of the team’s lead advisors, Miles oversees investor services, portfolio management and strategies for financial planning.

Davis, Smith & Associates serve a select group of families and businesses, working directly with them to navigate the complexities of their financial lives in an evolving economy. Miles understands the unique nature of investor’s goals, needs, preferences, and financial situations, and is why he believes in taking a personalized approach to employing strategies for one’s vision and objectives. Moreover, Miles and his team are not beholden to any one investment product or manager, so clients can rest assured each team member is working with an open mind and a fiduciary perspective.

“I have the pleasure of working with clients directly. Our team’s commitment is to provide personalized guidance, a unique experience, and be a financial partner they can trust so they can focus on what matters most.”

Davis, Smith & Associates serve a select group of families and businesses, working directly with them to navigate the complexities of their financial lives in an evolving economy. Miles understands the unique nature of investor’s goals, needs, preferences, and financial situations, and is why he believes in taking a personalized approach to employing strategies for one’s vision and objectives. Moreover, Miles and his team are not beholden to any one investment product or manager, so clients can rest assured each team member is working with an open mind and a fiduciary perspective.

“I have the pleasure of working with clients directly. Our team’s commitment is to provide personalized guidance, a unique experience, and be a financial partner they can trust so they can focus on what matters most.”

NMLS#: 1580936

About Me

In the year 2000, Tes launched his financial services career in the private banking sector, working as a financial advisor with Edward Jones. Tes then joined Merrill Lynch in 2007 where he helped his clients navigate the last financial crisis as a Senior Financial Advisor and Vice President, until he transitioned to Morgan Stanley in 2022.

Tes and his wife Sarah reside in Grapevine Texas with their two loyal cats. He is passionate about both professional and collegiate sports, with an emphasis on soccer. Tes played soccer during his time in England before moving to the states. He also has a passion for golf and adventurous travel.

Tes feels that getting to know his clients on a personal level is of upmost importance. He works to simplify their financial lives by giving them access to some of the top research in the industry with Morgan Stanley and active phone communication.

Tes and his wife Sarah reside in Grapevine Texas with their two loyal cats. He is passionate about both professional and collegiate sports, with an emphasis on soccer. Tes played soccer during his time in England before moving to the states. He also has a passion for golf and adventurous travel.

Tes feels that getting to know his clients on a personal level is of upmost importance. He works to simplify their financial lives by giving them access to some of the top research in the industry with Morgan Stanley and active phone communication.

Securities Agent: GA, AR, IL, MT, AL, WA, NM, FL, AZ, SC, OR, NV, NH, ID, WY, TX, OH, NY, LA, DE, NC, MD, WI, UT, CO, CA, PA, OK, MS, VA, TN, MI, ME, RI, NJ, KS, IA, MN, MA, KY; General Securities Representative; Investment Advisor Representative

About Fabrice Onomo

Fabrice is a registered client associate on The Davis and Smith Group. He has spent most of his career in the wealth management industry, providing clients with custom advice and personalized solutions. Fabrice holds his Series 7 and Series 66 licenses and earned his bachelor’s degree from the University of Texas at Arlington.

What sets Fabrice apart is his integrity, work ethic, and dedication to our clients. He understands that every client is unique and has their own set of financial objectives and challenges. He takes the time to listen carefully and collaborates with his team to design strategies to meet their goals. Fabrice’s commitment to client’s is unwavering – he has a genuine passion for helping clients succeed with an exceptional level of quality service.

Outside of the office, Fabrice is an avid Real Madrid fan, enjoys drawing, cooking, and has been to every continent except Antarctica. Fabrice believes the best things in life are the people we love and those memories that keeps us smiling.

What sets Fabrice apart is his integrity, work ethic, and dedication to our clients. He understands that every client is unique and has their own set of financial objectives and challenges. He takes the time to listen carefully and collaborates with his team to design strategies to meet their goals. Fabrice’s commitment to client’s is unwavering – he has a genuine passion for helping clients succeed with an exceptional level of quality service.

Outside of the office, Fabrice is an avid Real Madrid fan, enjoys drawing, cooking, and has been to every continent except Antarctica. Fabrice believes the best things in life are the people we love and those memories that keeps us smiling.

Contact Tyler Davis

Contact Miles Smith

Contact Tes Somji

Contact Austin Montgomery

Wealth Management

Global Investment Office

Portfolio Insights

Retirement

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

A Simple Six-Step Retirement Checkup

Article Image

Investing

Working closely with you to guide your wealth and investments through the most challenging market cycles.

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Rational Investing in an Age of Uncertainty

Article Image

Family

Creating customized financial strategies for the challenges that today’s families face.

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

529 Plans: A Powerful Tool to Save for Education

Article Image

Business Planning

Helping you on key aspects of your business such as ownership, liquidity and developing opportunities.

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Planning for Life After Selling a Business

Article Image

Philanthropy

Making sure your philanthropic dollars are managed with the same high quality service as the rest of your wealth.

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Ready to start a conversation? Contact The Davis And Smith Group today.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

3Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

7Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

CRC 4665150 (8/2025)