The Cornell Palilla Group at Morgan Stanley

Our Mission Statement

Our Story and Services

At The Cornell Palilla Group of Morgan Stanley, we bring together decades of experience, institutional knowledge, and a personal commitment to helping clients thrive financially. Our team is built on complementary strengths and a shared dedication to delivering meaningful, lasting value for the individuals and families we serve.

Jeff Cornell, our founding partner, brings over 35 years of industry experience, providing steady leadership, disciplined insight, and a client-first philosophy that has defined our practice from the beginning.

Geoffrey Palilla, as a partner with 5 years of experience, offers a fresh perspective and dynamic approach, helping to bridge innovation with tradition.

Adam Barncard, our Wealth Management Associate, contributes over 25 years of experience, helping to ensure seamless execution, strategic support, and a high-touch service model that keeps our clients informed and empowered.

From that starting point, we design a personalized financial plan—uniquely tailored to reflect your family’s specific goals and values. This roadmap isn’t static; it evolves with you and and your family as your lives change. Together, we navigate your financial journey with intention, adjusting course when needed to help ensure we always remain on track & stay aligned with your long-term objectives.

Our practice is built around serving a select group of families and individuals who value professional guidance and meaningful relationships. We work closely with physicians, business owners, pre-retirees, retirees, and multigenerational families—people navigating complex financial challenges who benefit from a personalized and strategic approach.

In our initial conversations with newly introduced investors, we explore your financial questions, goals, and family dynamics. This helps us determine whether there's a strong mutual fit for a deeper, consultative relationship. We've found that even small refinements can lead to significant improvements.

We are not trying to be everything to everyone. Our niche is serving people with a level of focus and care that allows for superior service and meaningful, lasting impact. Our priority is always to deliver exceptional value—and we do that best when we understand what matters most to you.

As a client of Morgan Stanley, you have access to the full strength of a global firm paired with the personal attention of a dedicated advisory team. When you refer a friend, family member, or colleague to us, we approach that introduction with care and respect. Our initial focus is not whether they become a client, rather to offer sound advice for their benefit.

Ultimately, our objective is simple: to increase the value of our relationship through collaborative efforts designed to acheive your financial goals.

Taking the first step toward organizing your financial life doesn't have to be overwhelming. Whether you're planning for the future, navigating a big transition, or just looking for a second opinion, we're here to help. Give us a call or send us an email—we're always happy to listen, answer questions, and explore what's possible together.

No pressure. Just a thoughtful conversation about what matters most to you.

Location

Meet The Cornell Palilla Group

About Me

How much do I need & am I on track?

Jeff began his career at Lehman Brothers in 1990, which laid the foundation for all aspects in investment management & client advisory services. He attended Clarion University of Pennsylvania, and graduated from North Park University of Chicago with a bachelor of science degree. He has continued his professional development through business education at Northwestern University.

Over the years, Jeff has built meaningful, long-term relationships with individuals and multi-generational families. Portfolio construction is grounded in disciplined asset allocation, balancing the financial resources of Morgan Stanley with forward-looking market opportunities.

Jeff’s approach combines technical focus with a client-first mindset, delivering financial plans tailored to each family we serve. He takes particular pride in helping clients achieve clarity, confidence & financial independence for one of life’s most important milestones – retirement.

Outside of the office, Jeff is committed to health and fitness and is an avid golfer.

He’s a proud member of Grande Oaks Golf Club and maintains active offices in both Fort Lauderdale, Florida, and Chicago, Illinois.

NMLS#: 2702891

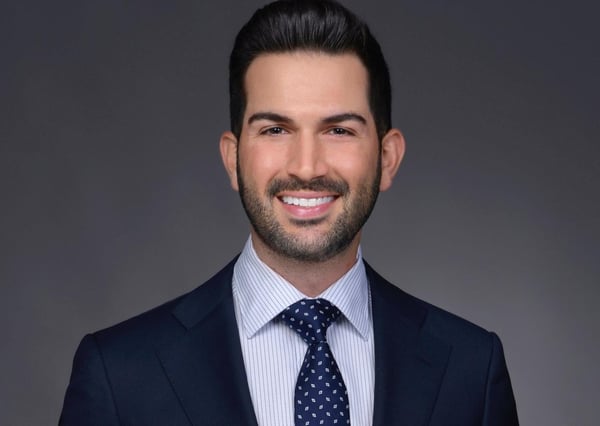

About Me

Geoffrey works closely with Jeff Cornell, embracing a mindset of continuous learning. This commitment to growth fuels his ability to guide clients toward financial confidence—across generations past, present, and future.

A now senior member of the team, Geoffrey brings a strong background in financial leadership. Before joining the team, he served as a director of sales and finance in the home health care industry, where he achieved rapid success. His experience in healthcare finance ultimately led to a transition into wealth management, where he has gained deep expertise in comprehensive financial planning and capital market strategy.

Geoffrey holds an MBA from Florida International University and a BA in Marketing from Florida Atlantic University. He is licensed with both the Series 7 and 66. Outside the office, he enjoys golf, tennis, and fly fishing.

NMLS#: 2702892

About Adam Barncard

Adam's passion for working closely with people, coupled with his interest in finance led him to join the financial industry 1999. Early in his career, Adam joined senior advisor Jeff Cornell and obtained his Series 7 and Series 66 licenses. Seeking a firm to grow and cater to the overall client experience, Adam joined Morgan Stanley in 2025 with Jeff Cornell & Geoff Palilla. Adam now delivers more than twenty five years of experience in the financial industry, providing him with a strong foundation for his work as a Wealth Management Associate.

Adam currently resides in Chicago. Besides being a devoted team member at Morgan Stanley, he shares an even greater passion - being a father to his daughter Grace. When away from the office, you can find him enjoying music or soaking up all mother nature has to offer in the great outdoors.

Contact Jeffrey Cornell

Contact Geoffrey Palilla

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

3Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

4Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley