Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Services

At The Copilot Group, we're here to help you make sense of wealth when life gets more complex. Think of us as your financial co-pilot: here to guide executives, families, and founders through important decisions.

Clients often turn to us during big transitions - after selling a business, taking on a new role, or planning for the future.

We keep things clear and focused. Instead of overwhelming reports, you get straightforward strategies that bring together your finances, taxes, legal, and estate planning - always aligned with your goals.

Whether you're preparing for a major event, managing stock options, or building a legacy, we provide personalized guidance our clients trust.

Boutique in feel. Institutional in capability.

- Professional Portfolio ManagementFootnote1

- Financial PlanningFootnote2

- Retirement PlanningFootnote3

- Estate Planning StrategiesFootnote4

- Planning for Education FundingFootnote5

- Cash Management and Lending ProductsFootnote6

- Alternative InvestmentsFootnote7

- Philanthropic ManagementFootnote8

- Donor Advised Funds

- Equity Compensation

How We Work

Precision Planning. Concierge Execution.

You don't need more noise - you want clarity. We provide sound advice to help you make confident decisions.

- Map Your Whole Picture

We build your personal balance sheet: assets, liabilities, income, cash flow, equity exposure, and risk. This becomes our shared dashboard. - Set Priorities & Timing

Together, we identify what's ahead (liquidity events, concentrated stock, retirement, or family goals) and align the plan to your timeline. - Design Your Plan

We turn priorities into a clear strategy across investments, taxes, income, wealth transfer, and philanthropy. - Coordinate & Execute

We handle the details - moving assets, executing tax steps, and coordinating with your legal and tax team to provide a confident and seamless experience. - Monitor & Adjust

Life changes. Markets move. We keep tabs, review results, and fine tune as your goals evolve.

- Small Office Feel

A limited client list means more time and depth on your family's needs. - Clarity Over Clutter

Curated insights, timely action, and only what's relevant without the fluff. - Built for Complexity

From equity comp to trusts and private investments we help you save time, lower friction, and gain clarity across every financial choice.

Strategic Solutions for Complex Wealth

Liquidity & Equity Planning

- Pre- and post-liquidity planning

- Equity compensation strategies

- Diversification of concentrated equity

- Structured lending

- QSBS and tax mitigation planning

Long-Term Wealth Strategy

- Customized investment strategy built around your liquidity needs, tax profile, and long-term goals

- Portfolio design and risk alignment

- Tax-aware asset location

- Income and retirement planning

- Ongoing performance optimization

Legacy & Generational Planning

- Wealth transfer and estate coordination

- Trust design and integration

- Strategic gifting

- Philanthropic structures

- Family education and continuity

Private Access & Alternative Solutions

- Private equity and credit

- Hedge funds and liquid alternatives

- Customized lending

- Insurance-based wealth strategies

What Makes It Different

- Curated, not cluttered

- Access with context

- Executed seamlessly

Families

We help families simplify complexity, preserve wealth, and plan for legacy.

- Wealth preservation and cash flow planning

- Trust and estate coordination

- Charitable giving and donor-advised funds

- Strategic gifting and legacy planning

- Family education and financial continuity

Public Company Executives

We bring clarity to complex compensation and long-term planning decisions.

- Equity compensation strategy (RSUs, ISOs, NSOs, ESPPs)

- 10b5-1 plans and diversification

- Tax-smart investment planning

- Liquidity and income structuring

- Retirement and legacy planning

Founders & Entrepreneurs

From startup to exit—and everything in between—we help founders make critical financial decisions at every stage.

- Pre- and post-liquidity planning

- Exit and succession strategy

- QSBS optimization and tax minimization

- Diversification of concentrated equity

- Lifestyle planning and philanthropic structuring

Location

Meet The Copilot Group

About Ryan J. Seay

He works with a select group of executives, families, and founders — helping them make confident, long-term financial decisions during periods of transition, growth, or complexity.

Named to the Forbes Best-In-State Wealth Advisors list, Ryan is known for his ability to connect personally, ask the right questions, and bring structure to even the most complex financial lives. He helps clients articulate what they truly want, confront what they fear, and move forward with a strategy that’s clear, grounded, and unemotional.

With over 20 years of experience, Ryan’s clients rely on him for direct answers, strategic thinking, and the ability to keep everything aligned—without the noise.

When he’s not working with clients, Ryan is enjoys spending time with his wife and three children, exploring the Bay Area, cooking over open fire, or planning the next family adventure.

NMLS#: 1278955

About Nishant Shailendra

As a co-founder of The Copilot Group at Morgan Stanley, Nishant leads client strategy across investment planning, tax-aware diversification, and pre-liquidity estate design. His experience makes him a valued sounding board for founders and private clients navigating complexity, transition, and legacy planning.

Nishant earned his B.A. from the University of California, Davis, and lives in Walnut Creek with his wife and three daughters. Outside the office, he enjoys cooking, playing ice hockey, and spending time with his family.

NMLS#: 1430992

About Shashi Bhagat

An immigrant who began her career in financial services in 1995 with nothing but determination, Shashi is deeply committed to helping others protect and grow the wealth they’ve worked hard to build. She joined Morgan Stanley in 2001 after starting at Kemper Securities in San Jose.

At The Copilot Group, she plays a central role in developing advanced insurance strategies, family trust coordination, and values-based giving plans for ultra-high-net-worth clients.

Shashi earned her B.A. in Liberal Arts from Ravishankar University in India. She holds FINRA Series 7, 31, and 63 licenses as well as a California Insurance License.

Outside of work, Shashi enjoys meditation, cooking, travel, and time with her five grandchildren.

NMLS#: 1290413

CA Insurance License #: 0C17168

About Nikesh Kadakia

His work focuses on building intelligent, tax-aware strategies—leveraging strategies for income and hedging, overseeing private market opportunities, and customizing investment plans to reflect each client’s unique needs. He’s known for his focus, intensity, and passion for helping clients grow and preserve wealth through disciplined, strategic decisions.

Prior to joining Morgan Stanley, Nikesh was a Portfolio Manager in Merrill Lynch’s Personal Investment Advisory Program. He earned his B.S. in Finance from the University of California, Riverside.

Outside of work, Nikesh lives in the South Bay with his wife Rakhi and their two teenage sons, Keshav and Rohin. As a parent of a child with Autism Spectrum Disorder and ADHD, Nikesh understands firsthand the importance of thoughtful, comprehensive financial planning—especially when life doesn’t follow a simple script.

NMLS#: 557835

About Albert Kim

Albert migrated from South Korea at the age of 2 and has been a resident of San Jose ever since. In his leisure time, he enjoys working out, playing soccer, and socializing with friends. Looking ahead, he aspires to dedicate time to learning golf and creating cooking/food-related video content. Albert's ultimate joy lies in hosting BBQs, bringing together great people with good food.

NMLS#: 2561305

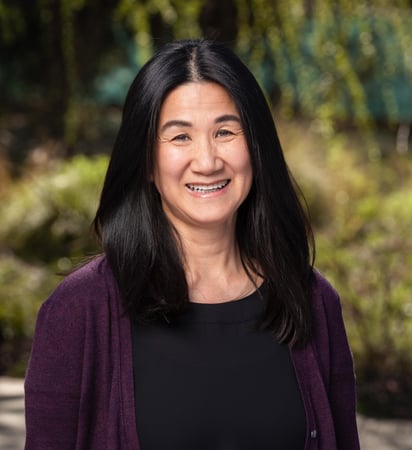

About Annie Tsan Wakayama

From onboarding and documentation to day-to-day account management and money movement, Annie handles the operational details so our clients can stay focused on the bigger picture. Her precision and responsiveness are essential to the high-touch experience The Copilot Group is known for.

Clients value her follow-through. We rely on her consistency. And after nearly two decades in the industry, Annie still brings the same level of care and attention to each relationship.

About Aaron Hannigan

Before joining Morgan Stanley in 2022, Aaron built his career in the fitness and sports marketing industries—first as a personal trainer, then in sales and strategy at a leading sports supplement company. His background gives him a unique perspective on discipline, client service, and the importance of clear goals.

Aaron earned his degree in Kinesiology from California State University, East Bay, where he also played on the baseball team. A lifelong Bay Area native, he now lives in Martinez with his wife, son, and their dog. Outside the office, he enjoys beach volleyball, hiking, and family time in the outdoors.

Contact Ryan J. Seay

Contact Nishant Shailendra

Contact Shashi Bhagat

Contact Nikesh Kadakia

Contact Albert Kim

Awards and Recognition

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

3When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should always check with their tax or legal advisor before engaging in any transaction involving 529 Plans, Education Savings Accounts and other tax-advantaged investments.

6Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

7Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

8Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley