Daniel E Marting, CFP®, CEPA®

Industry Award Winner

Industry Award WinnerThe Camelback Wealth Management Group at Morgan Stanley is a team of experienced financial professionals who combine their individual talents to help ultra-high net worth families, founders, and business owners simplify the complex challenges of managing significant wealth. We deliver the personnel and resources needed to help you build an effective exit planning team and can offer the services of an outsourced family office.

We look forward to understanding your family's businesses, dreams and aspirations, and presenting meaningful solutions to help you plan for the unplanned, and help you simplify the challenges of managing significant wealth.

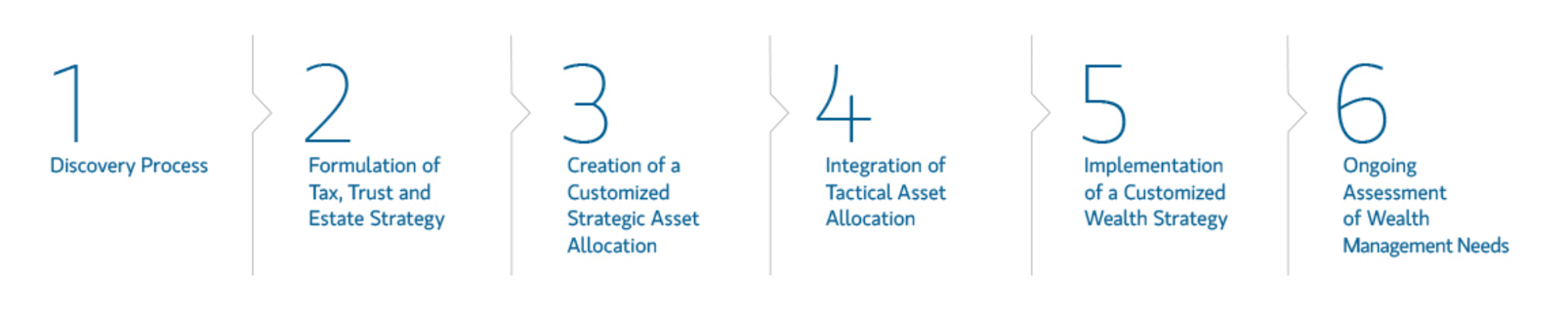

Our comprehensive planning platforms address the complex needs of ultra-high net worth clients, from efficient state strategies and business succession to investment allocation and tax optimization.

How can you integrate philanthropy and family values into your wealth plan? Family Office Resources at Morgan Stanley discusses the approach to articulating and memorializing your family philosophy in your overall plan. Watch for more insights on the importance of addressing the emotional side of planning with your family.

Many of us prefer to combine our support for the causes and people we care about with a desire to save on taxes. Fortunately, there are strategies that may help us accomplish both. Whether you want to donate to charity or invest in a loved-one's future, consider these tax-smart ways to help make your giving go further.

Our team employs a range of sophisticated investment strategies designed to reduce or defer taxes associated with transactions. We excel at simplifying these complex strategies, ensuring they are accessible and understandable. By thoroughly understanding your priorities and those of your family, we can model potential future scenarios to help shape your family legacy.

Creating and growing a successful business is seldom just about money, nor is the decision to exit the business. Whether that exit is through an IPO, merger with another company, private sale, or succession within the family, the process is intense, the details are complex, and the decisions are often an unexpected combination of business, personal, and financial needs. Our team starts by understanding the complexity of your business, personal, and financial goals together before moving forward with helping you simplify the exit planning process.

Events such as death, disability, or retirement of a business owner don't have to mean the end of a successful business. Succession planning can provide for an orderly transition of ownership and business management during lifetime or at death. We will work with you to understand your biggest risks so that your exit plan is never unexpectedly altered due to unforeseen circumstances.

Our team is committed to partnering with you well in advance of any significant events to gain a deep understanding of your priorities and how you envision shaping your family's legacy. We recognize that there are numerous considerations involved, and we take pride in simplifying these complex decisions to make them more manageable and straightforward. By working closely with you, we aim to create a tailored strategy that aligns with your long-term goals and values, ensuring a lasting impact for future generations.