The Calleja Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Family Office Resources.

Get To Know Us

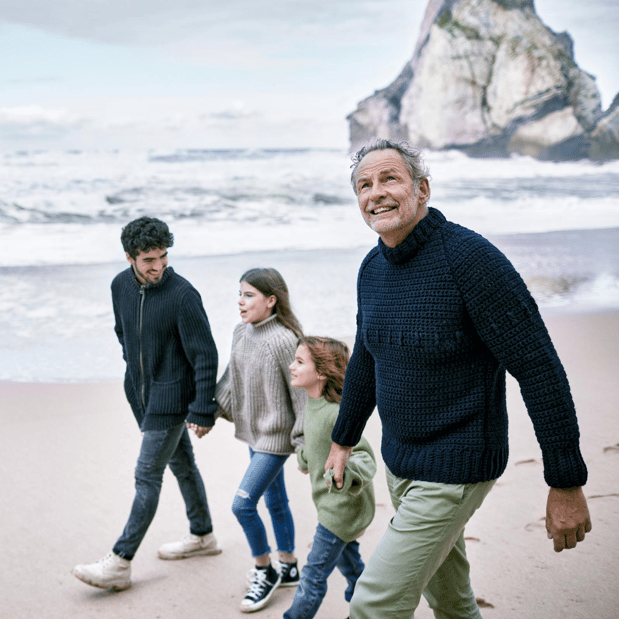

As the world grows increasingly complex, planning with intention is essential.

It begins with translating your values and goals into a cohesive strategy.

We offer you access to family office resources, always placing your best interests above all.

Our team handles the details, so you can focus on what matters most to you.

We collaborate closely with your family and other trusted professionals to provide well-rounded advice.

Together, we help ensure your plan is complete, aligned, and forward-looking.

Our integrated approach brings clarity and confidence - freeing you to create more lasting memories, which we believe are your most valuable asset.

Our roots date back more than 30 years ago and, since then, The Calleja Group has grown into one of Morgan Stanley's most experienced advisory teams.

Today, we are a group of 12 professionals whose combined experience spans over 150 years in the financial industry. This depth of knowledge allows us to address the complexities of modern wealth with perspective, precision and care.

Our Core Values

At the heart of everything we do are our core values, which shape how we serve families across generations.

-

Integrity: Acting with transparency, honesty and accountability.

-

Collaboration: Working seamlessly within our team and alongside your trusted professionals.

-

Excellence: Bringing the highest standards of skilled focus and execution

-

Empathy: Listening actively and tailoring solutions to each family's unique journey.

-

Stewardship: Helping protect and grow wealth for generations, while honoring the legacy you wish to leave.

Who We Serve

Our clients are accomplished individuals and families who have reached a level of success that brings both opportunities and complexities.

Many are entrepreneurs, senior executives, or multigenerational families seeking to align wealth with purpose. They value having dedicated dvisors to simplify decision-making, anticipate challenges, and create clarity across investments, tax planning, estate structures, philanthropy and lifestyle advisory. Above all, our clients want a trusted team that can help unify generations, preserve family harmony and protect their legacy.

Our Presence

Our core group is proudly based in the offices listed below, with an extended team in multiple states across the US and the strength of a global firm behind us. We work seamlessly with families nationwide and in many countries around the world. We welcome a conversation with you if you are seeking a highly selective relationship centered around trust, clarity, and lasting impact - whether you are local, across the country, or international.

A Lasting Relationship

At the Calleja Group, we believe that true wealth is measured by the freedom, security and memories it enables. Our role is to take care of the details and steward your vision forward. Backed by the global resources of Morgan Stanley and driven by our core values, we provide a relationship designed to endure across markets, across generations and across the milestones of your life.

Welcome to The Calleja Group at Morgan Stanley!

Where clarity, confidence and continuity come together to help you focus on what matters most.

The term "Family Office Resources" is being used as a term of art and not to imply that Morgan Stanley and/or its employees are acting as a family office pursuant to Investment Advisers Act of 1940. Lifestyle Advisory Services: Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC ("Morgan Stanley"). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

- Wealth ManagementFootnote1

- Professional Portfolio ManagementFootnote2

- Financial PlanningFootnote3

- Endowments and FoundationsFootnote4

- Estate Planning StrategiesFootnote5

- Trust Services*

- Fixed IncomeFootnote6

- Municipal BondsFootnote7

- SyndicateFootnote8

- Alternative InvestmentsFootnote9

- Asset Management

- Corporate Retirement PlansFootnote10

- Lending Products

Location

Meet The Calleja Group

About Jorge Calleja

Morgan Stanley National Financial Advisory Council – 2023-2025

Morgan Stanley Wealth Management Chairman’s Club – 2022-2025

Five Star Professional Wealth Manager Award – 2016-2025

Morgan Stanley Wealth Management President’s Club – 2010, 2020, 2021

Morgan Stanley Wealth Management Master’s Club – 2013-2019

JORGE CALLEJA’S BIO:

Jorge A. Calleja is a Managing Director, Senior Portfolio Management Director, and Wealth Advisor at Morgan Stanley. Jorge earned a B.S. Degree in finance from the University of Florida’s Warrington School of Business. He is licensed in 38 states and is a 25-year veteran of the firm, having spent his entire professional career at Morgan Stanley.

Since 2008, Jorge has been part of Morgan Stanley’s portfolio management program which allows a select group of Morgan Stanley financial advisors who are qualified by the firm based on training, experience, and commitment, to make independent investment decisions in the management of assets. As a Senior Portfolio Management Director, Jorge studies investment trends and leverages the global resources of the firm to help clients develop a personalized investment strategy.

Jorge is also a Managing Director. An appointment made to a select group of advisers who must not only meet quantitative criteria, but are recognized as exhibiting leadership at the firm, both externally and internally, and is viewed as a role model of Morgan Stanley Wealth Management, and is consistently exemplifying high standards of guardianship.

Jorge and his team are highly experienced with strategies relating to trust and estate planning, as well as working with clients to develop customized investment portfolios and strategies.

Jorge is a member of the firm’s prestigious Chairman's Club. This is an elite group, composed of the firm’s top 2% of financial advisors. It recognizes Jorge’s consistent creativity and excellence in providing a wide range of investment products and wealth management services to his clients. He has served on the firm’s National Financial Advisor Council since 2023. The council acts as liaison between their colleagues and senior management in order to create a two-way communication to discuss and provide feedback and insight on key initiatives within the organization.

Jorge is most proud of his team’s active involvement in local charities. He and his team participate and support more than 20 charities in the community especially those with an emphasis on children and education. He currently serves on the Youth Haven Foundation Board. In his free time Jorge enjoys fishing and spending time with his family. He is married to his high school sweetheart, Gisselle. Jorge and Gisselle have lived in Naples almost 25 years and they are the proud parents of two children.

AWARDS DISCLOSURES:

2016-2025 Five Star Wealth Advisor Award

Source: fivestarprofessional.com (Awarded 2016-2025) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2016 Award - 03/5/2016 - 10/7/2016

2017 Award - 01/20/2017 - 09/8/2017

2018 Award - 02/20/2018 - 09/19/2018

2019 Award - 02/11/2019 - 09/20/2019

2020 Award - 02/10/2020 - 09/11/2020

2021 Award - 01/18/2021 - 09/3/2021

2022 Award - 2/21/2022 - 8/19/2022

2023 Award - 02/13/2023 - 08/31/2023

2024 Award - 03/5/2024 - 09/9/2024

2025 Award - 03/5/2025 - 09/9/2025

NMLS#: 1395600

About Luciane Roessler

Forbes/Shook Magazine America’s Top 100 Women Wealth Advisors 2025

Biography:

With over 25 years of experience in the financial services sector, Luciane Roessler advises clients in meeting lifestyle financial needs, and in portfolio management. With a background in investment banking, Luciane has extensive transaction experience in mergers and acquisitions and corporate finance with industrial companies, as well as with companies in the financial services, electrical distribution, energy, and natural resources industries. Luciane’s clients include both individuals and corporations.

She started her career in investment banking at Smith Barney in 1994, and subsequently worked for Bankers Trust and WestLB, and founded a financial advisory firm, Castle Capital. Previously, she was an Electronics Engineer with Hewlett-Packard.

She has advised on M&A and Corporate Finance transactions in the United States, United Kingdom, Germany, France, Spain, Finland, Sweden, Mexico, Panama, Venezuela, Peru, Chile, Argentina and Brazil. She is fluent in English, Portuguese and Spanish.

Luciane holds an M.B.A. from the Wharton School of the University of Pennsylvania and a B.S. in Electrical Engineering, with high distinction, from the Universidade Federal do Rio Grande do Sul in Brazil. She holds the FINRA Series 7, 63, and 65 licenses.

In her free time, Luciane enjoys traveling, reading, arts & crafts, and fitness.

Awards Disclosures:

Forbes/Shook Magazine America’s Top 100 Women Wealth Advisors 2025

Forbes.com. Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

https://www.morganstanley.com/disclosures/awards-disclosure.html

NMLS#: 1694664

About Juan Ocanas

Forbes America’s Top Next-Gen Wealth Advisors Best-In-State - 2023 & 2024

Five Star Wealth Manager Award – 2020-2021

Morgan Stanley Pacesetter's Club - 2020

JUAN OCANAS' BIO

Juan is a seasoned veteran with a tenure of over 16 years in the dynamic world of finance. As a distinguished Portfolio Management Director, Family Wealth Advisor, Financial Planning Specialist, and Insurance Planning Director through Morgan Stanley, he possesses exceptional expertise that goes beyond traditional boundaries.

With strategic vision, Juan seamlessly integrates his specialized designations into his role as The Calleja Group’s investment strategist. By adeptly leveraging his skill set, Juan cultivates an environment where the convergence of financial management, wealth advisory, insurance planning, and comprehensive estate planning come together harmoniously.

Drawing upon the vast intellectual capital and unparalleled resources of Morgan Stanley, Juan stands resolute as a reliable source of knowledge, fostering intellectual collaborations with Morgan Stanley's renowned analysts. Through his unwavering dedication to excellence, Juan ensures that our client’s portfolios are integrated with the latest insights and cutting-edge thought leadership that defines Morgan Stanley.

Juan’s insight, experience, and ability for innovative thinking uniquely set him apart. Regardless of the economic landscape, Juan's clients are privy to a treasury of inventive ideas that have the power to reshape their financial landscapes, propelling them toward success in achieving their goals.

Beyond his professional achievements, Juan is a devoted husband and loving father of three. He cherishes every moment spent with his family, whether it’s casting a line into the beautiful waters of Southwest Florida during a serene fishing excursion or embarking on joyful outdoor adventures. With Juan’s faith remaining a cornerstone in his life, this allows him to bring a meaningful perspective to every undertaking, supporting a deep appreciation for the many blessings in his life.

Allow our team to help you craft a strategy where expertise and understanding come together in helping you achieve your goals. Experience the power of financial guidance that brings a distinct perspective that recognizes the importance of responsible stewardship, ethical decision-making, and leaving a lasting positive impact on client’s lives.

AWARDS DISCLOSURES:

2023 and 2024 Forbes America’s Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors)

Source: Forbes.com (Awarded 2023 and 2024). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

2020-2021 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2020-2021) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2020 Award: 05/20/2019 - 12/20/2019

2021 Award: 06/01/2020 - 12/18/2020

2023 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State. Source: Forbes.com (2024). Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-In-State ranking awarded in I2024. Each ranking was based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher). This evaluation process concluded in March of the year the award was issued having commenced in March of the previous year. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to SHOOK Research LLC to obtain or use the ratings. These rankings are based on in-person and telephone due diligence meetings to evaluate each advisor qualitatively, a major component of a ranking algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the opinions of SHOOK Research LLC and these rankings may not be representative of any one client’s experience. These rankings are not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with SHOOK Research or Forbes. For more information, see www.SHOOKresearch.com. Morgan Stanley Disclosures: https://lnkd.in/eqMUCKdN

©2024 Morgan Stanley Smith Barney LLC. Member SIPC.

NMLS#: 641775

CA Insurance License #: 4178906

About Ana Munro

Forbes America’s Top Women Wealth Advisors Best-in-State – 2025

Forbes America’s Top Next-Gen Wealth Advisors Best-in-State – 2024, 2025

Five Star Wealth Manager Award by Five Star Professional – 2023, 2024, 2025

Invest in Others Award Finalist - 2025

Invest in Others Award Honoree – 2024

8th Annual International Women's Day Awards - 2024

Gulfshore Business 40 Under 40 Award - 2023

BISA Rising Star Award - 2020

ANA MUNRO'S BIO:

Ana Munro is a dedicated Financial Advisor, Planner and Strategist for ultra-high-net-worth individuals and family offices.

As Senior Vice President, Portfolio Management Director and National Strategic Partner at Morgan Stanley, her mission is to help families navigate the complexities of wealth with clarity, confidence, and purpose.

With nearly two decades of experience, Ana's approach bridges timeless financial principles with forward-thinking creative strategies.

She works with successful individuals to manage financial, personal, and generational intricacies that are often overlooked. Ana integrates her network of world-class specialists in investment management, estate planning, philanthropy, and family governance based on her client's unique vision.

At the heart of what she does is her belief that true wealth is the ability to live fully and intentionally. As such, Ana’s primary goal is to return to clients their most precious asset - time - so they can focus on their life's purpose, their passions, and the people they care about.

Ana is also passionate about building meaningful connections grounded in loyalty, empathy, and respect. She brings the same dedication and care to her clients as she does to her own family.

Her academic achievements include a summa cum laude bachelor’s degree in finance and an MBA in Finance from Florida Gulf Coast University. Ana is a Certified Financial Planner® Professional and has completed Level I of the CFA® Program, demonstrating her passion for investment management and fiduciary responsibility.

Recognized as a keynote speaker, coach, and thought leader, Ana has been featured on platforms including Chief, From Now to Next, and Woman 2 Woman. She is also a mentor for the next generation of financial professionals at Florida Gulf Coast University.

A supporter of women’s leadership and empowerment, Ana serves on the Board of Directors at Women Enabled Enterprises and the Women’s Foundation of Collier County. She is a founding member of Chief, an organization supporting C-level and executive roles. Ana is also committed to philanthropy and financial education, actively supporting organizations like Collier Literacy and providing pro bono financial planning to underserved communities.

On a personal note, Ana has called Southwest Florida home for over 20 years. Alongside her husband, she enjoys staying active in their two sons' little league sports, traveling the world, and embracing new languages. So far, the Munros collectively speak Dutch, German, Spanish, and Portuguese!

AWARDS DISCLOSURES:

2025 Top Women Wealth Advisors Best-In-State

Source: Forbes.com (Awarded Feb 2025) Data compiled by SHOOK Research LLC for the period 9/30/23 - 9/30/24.

2023-2025 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2023-2025) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2023 Award: 06/13/2022 - 12/09/2022

2024 Award: 05/15/2023 - 11/30/2023

2025 Award: 05/15/2024 - 11/30/2024

2024,2025 Forbes America’s Top Next-Gen Wealth Advisors Best-in-State

Source: Forbes.com (Awarded 2024). Source: Forbes.com (Awarded Aug 2024) Data compiled by SHOOK Research LLC for the period 3/31/23 - 3/31/24.

Annual International Women's Day Award - Award by Nicole Shelley Inc. and Haute Living - Wealth (Women, Health and Wealth) Innovation Award (awarded 2024).

Various institutions with a presence in South Florida across 10 industries recommend nominees based on professional achievement, bio, length of service, and community involvement. A review panel consisting of a group of retired professionals in the respective industries for which nominees are being considered reviews each candidate and selects finalists based on professional excellence and community impact. Timeframe is March through November 2023.

Gulfshore Business magazine and their panel of judges identify 40 individuals who have distinguished themselves in their professions and in the community. The honorees' career choices may all be different, but they each share the commonality of making a difference in those careers and also their communities, all before reaching the age of 40.

Website:

https://www.gulfshorebusiness.com/gulfshore-business-40-under-40-class-of-2023/

Invest in Others Award: July 2024. Data compiled by Invest in Others Foundation based on the period between March 29, 2023 – March 29, 2024. For criteria and methodology, go to Invest in Others Awards

Through philanthropic and volunteer efforts for a variety of area nonprofits, each honoree has applied drive and passion to make Southwest Florida and beyond a better place to live and work for everyone.

https://www.investinothers.org/awards/

*2024 Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State. Source: Forbes.com (2024). Forbes America’s Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-In-State ranking awarded in I2024. Each ranking was based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher). This evaluation process concluded in March of the year the award was issued having commenced in March of the previous year. Neither Morgan Stanley Smith Barney LLC nor its Financial Advisors or Private Wealth Advisors paid a fee to SHOOK Research LLC to obtain or use the ratings. These rankings are based on in-person and telephone due diligence meetings to evaluate each advisor qualitatively, a major component of a ranking algorithm that includes client retention, industry experience, review of compliance records, firm nominations, and quantitative criteria, including assets under management and revenue generated for their firms. Investment performance is not a criterion. Rankings are based on the opinions of SHOOK Research LLC and these rankings may not be representative of any one client’s experience. These rankings are not indicative of the Financial Advisor’s future performance. Morgan Stanley Smith Barney LLC is not affiliated with SHOOK Research or Forbes. For more information, see www.SHOOKresearch.com. Morgan Stanley Disclosures: https://lnkd.in/eqMUCKdN

©2024 Morgan Stanley Smith Barney LLC. Member SIPC.

BISA's Rising Star provides recognition and is designed to foster leadership development for professionals of diverse backgrounds.

Website: https://www.bisanet.org/page/BISARisingStars

Securities Agent: SD, KY, WY, WI, WV, WA, VT, UT, TN, SC, OR, NJ, NV, OK, NY, NH, NE, RI, TX, MO, VA, ME, MD, PA, MA, LA, KS, IN, IA, AZ, CT, CO, CA, FL, GA, AR, MI, MN, DE, MS, MT, NC, AL, AK, ID, OH, IL, DC, NM; General Securities Representative; Investment Advisor Representative

NMLS#: 434224

CA Insurance License #: 0K05620

AR Insurance License #: 15661642

NMLS#: 434224

CA Insurance License #: 0K05620

AR Insurance License #: 15661642

About Hina Sanghvi Cory

With an energetic and positive attitude, Hina empowers clients with financial knowledge to help them achieve new levels of success. Her areas of focus include retirement planning, Tax-Efficient Investing, Alternative Investment Strategies, Insurance Solutions and Estate Planning. For Hina, professional success is measured in terms of client well-being and goal achievement.

Hina has a bachelor’s degree from India with concentration in economics and statistics from St Xavier’s College, India, and an MBA degree from the Florida Gulf Coast University. She has also earned the title of Alternative Investment Director by exhibiting deep knowledge of Alternative Investments that are becoming the new trend in constructing portfolios. She enjoys sharing her knowledge and experience with clients, empowering them to be all they can be and having a meaningful impact on the quality of their lives.

Prior to beginning her financial services career, Hina successfully owned and managed several businesses in Naples for 17 years. Her expertise in business development has proven to be a great asset. She applies her extensive knowledge as an entrepreneur and business owner to provide a more comprehensive and in-depth planning experience for her clients. Hina joined Morgan Stanley in 2015 after working at Fifth Third Bank and Wachovia Bank for eight collective years.

Hina is a strong believer in giving back to her community. Hina enjoys building long-term relationships with clients and serving as the team’s liaison to the community. She has served on the Board of The Books for Collier Kids, an organization that promotes better reading habits with elementary school children and has served as a Treasurer for the Naples Woman’s Club and Naples Newcomer’s Club North. Previous community activities also include Board member for the India Association of Southwest Florida (10 years), committee member for the “Power of the Purse” event at the Collier Country Community Foundation. She has also been instrumental in starting a new chapter of the Bonita-Estero Women’s Club in 2022.

Born and raised in India, Hina is very proud of her Indian culture. She moved to Naples in 1990 and has built a great life here with her husband Jeff. Collectively they have 4 children. She is an ardent Patriots and Tampa Bay Lightning fan. While traveling around the world may be one of her most favorite past times, golf is a close second, a hobby she recently embraced.

NMLS#: 434214

About Joel "JJ" McKoan

Prior to joining Morgan Stanley, JJ held senior investment/portfolio management roles at several investment managers, including Chief Investment Officer at Royal Harbour Capital LLC, CIO and Head of Multi Asset Absolute Return and Tail Hedging Strategies at First Eagle Investment Management, and CIO of Unconstrained and Tail Hedging strategies/ Head of Global Credit Investing at AllianceBernstein.

In these roles, JJ managed the assets of some of the world’s largest and most sophisticated family offices, endowment funds, sovereign wealth funds, pension funds and insurance companies.

Prior to joining AllianceBernstein, JJ held senior trading and management roles on Wall Street, including Managing Director and Head of North American Debt Syndicate for UBS, and Managing Director and co-Head of Global Credit Trading, Research and Syndicate and Head of Global Fixed Income Distribution for UBS predecessor firms PaineWebber and Kidder, Peabody & Co.

JJ is a graduate of Yale and lives in Naples, Florida with his wife Evelyn and their twin daughters.

2023 Pacesetter's Club

Morgan Stanley Wealth Management Pacesetter’s Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance.

NMLS#: 1935344

About Adam Boole, CEPA®

Morgan Stanley Pacesetter's Club 2020-2023

ADAM BOOLE'S BIO:

As a Certified Exit Planning Advisor®, Adam works alongside a select group of business owners, and high net worth individuals to help grow, streamline and eventually exit their business and manage their Wealth.

Adam develops personal wealth plans that align with business, personal, and philanthropic goals to provide guidance during all stages of life. He gives calculated and empowering advice to help achieve the goals of his clients.

He assists his team, the Calleja Group, on Alternative Investments, a unique set of private investments. Alternative Investments in Private Credit, Private Equity, Real Estate and Exchange Funds aid in diversifying client portfolios and provide potential solutions to complex estate and tax problems.

Adam and his family have been fortunate to call Naples home since 1958. He and his wife Julia have been involved in many non-profit organizations throughout the community including the Leadership Collier Foundation, The First Tee, Habitat for Humanity and the Sunshine Kids.

AWARDS DISCLOSURES:

Morgan Stanley Wealth Management Pacesetter’s Club members must meet a number of criteria including performance, conduct and compliance standards, revenue, length of experience and assets under supervision. Club membership is no guarantee of future performance.

NMLS#: 1685001

CA Insurance License #: 4180732

About Cris Lozano

About Andrew Winnick

About Denise Axt

About Kelly Herradon

About Andrew Porath

Contact Jorge Calleja

Contact Luciane Roessler

Contact Juan Ocanas

Contact Ana Munro

Contact Hina Sanghvi Cory

Contact Joel "JJ" McKoan

Contact Adam Boole, CEPA®

Awards and Recognition

Five Star Wealth Advisor Award This award was issued in 2016-2025. The award was determined based on an evaluation process conducted by Five Star Professional based on objective criteria from 2016-2025.

The Power of Partnerships

About Stacey Herring

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Stacey began her career in financial services in 1994, and joined Morgan Stanley in 2014. Prior to joining the firm, she was a Mortgage Sales Manager at SunTrust Bank and a Senior Mortgage Loan Officer for over 17 years at Fifth Third Bank. Stacey is a graduate of Florida State University, where she received a Bachelor of Science in Business Marketing and a Minor in Communications.

Stacey currently serves on the Women’s Foundation of Collier County Board of Directors, as well as Junior Achievement of SWFL’s Advisory Board. In addition, Stacey has chaired many community endeavors, serving Naples Community Hospital, PACE Center for Girls of Collier County, and Youth Haven. She is a graduate of the Naples Chamber of Commerce’s Leadership Collier program, awarded Gulfshore Business Magazine’s “40 Under 40 Award”, and in 2013 was awarded the Glass Slipper Award by The Education Foundation, Champions for Learning. In 2014, Stacey was named a Woman of Initiative by the Community Foundation of Collier County for her philanthropy, dedication, and commitment to children’s causes.

About Hannah Sledd

Hannah began her career in financial services in 2012 and we are happy that she is rejoining Morgan Stanley. Hannah began her work as an independent advisor in Atlanta, working with top financial firms including E*TRADE and JP Morgan before joining Morgan Stanley. She has a vast array of experiences, including working on an elite trading desk, assisting advisors in the development and implementation of financial plans for their high-net-worth clientele, leading an international mergers and acquisitions team and working as a financial advisor.

Hannah is a graduate of the University of Alabama where she earned a bachelor’s degree in finance with a concentration in investment management, and currently holds the CERTIFIED FINANCIAL PLANNER™ designation. Hannah currently lives in Nashville, TN. When not in the office, Hannah enjoys pilates, travelling, and teaching yoga.

DISCLOSURE:

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

About Mark Jansen

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Want to Keep More of Your Investment Returns? Consider These Tax Moves

Portfolio Insights

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley’s investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be appropriate for you. Please see the Morgan Stanley Smith Barney LLC program disclosure brochure (the “Morgan Stanley ADV”) for more information in the investment advisory programs available. The Morgan Stanley ADV is available at www.morganstanley.com/ADV.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

6Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

7Municipal bonds may not be appropriate for all investors. Income generated from an investment in a municipal bond is generally exempt from federal income taxes. Some income may be subject to state and local taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) and its Financial Advisors and Private Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

8Participating in a new issue/syndicate is subject to availability. IPOs are highly speculative and may not be appropriate for all investors because they lack a stock-trading history and usually involve smaller and newer companies that tend to have limited operating histories, less-experienced management teams, and fewer products or customers. Also, the offering price of an IPO reflects a negotiated estimate as to the value of the company, which may bear little relationship to the trading price of the securities, and it is not uncommon for the closing price of the shares shortly after the IPO to be well above or below the offering price.

9Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

10When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley