About David Olson

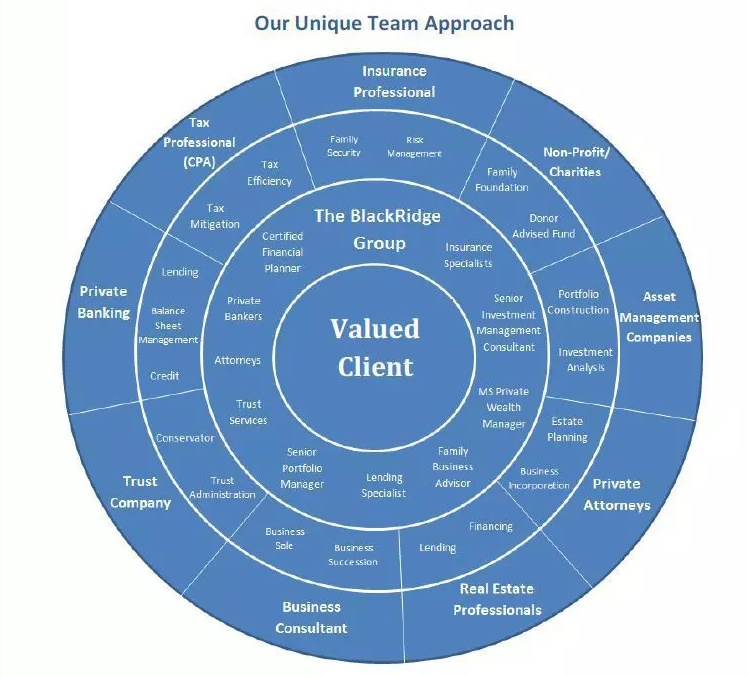

David Olson, Financial Advisor at Morgan Stanley, is a financial services industry veteran with over 35 years of experience in developing strategies intended to meet the goals of business owners, executives, entrepreneurs and physicians. David has been with Morgan Stanley and its predecessor firms since 1985. As founding partner of the BlackRidge Group at Morgan Stanley he coordinates a team of professionals providing consulting and investment management services to a select group of high net-worth families, institutions, endowments, and foundations.

David received his B.A. degrees in Economics and Biology from St. Olaf College. He began his career at E.F. Hutton working on Wall Street prior to joining what is now the Rochester, MN office of Morgan Stanley. He became branch manager in 2000 and had supervisory responsibilities for over $1 billion as of September 2022 when he stepped down from management to focus solely on portfolio management and working with BlackRidge clients.

David has been recognized for excellence in client service and has been named to the President’s Club at Morgan Stanley and its legacy firms from 2004-2020. He has been named to Barron’s America’s Top 1200 Financial Advisors for 2018-2021. He was also named to the select group of Forbes "Best in State Wealth Advisors" in 2018-2021. David was named a Five Star Wealth Manager by Minneapolis/St. Paul Magazine from 2012-2021. He is a Managing Director at Morgan Stanley and holds the designations of Senior Investment Management Consultant, Portfolio Management Director, and Financial Planning Specialist.

2018-2021 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State)

Source: Barrons.com (Awarded 2018-2021). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2018-2021 Forbes Best-In-State Wealth Advisors

Source: Forbes.com (Awarded 2018-2021). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2012-2021 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2012-2021) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2021 Award - 07/13/20 - 01/22/21

2020 Award - 06/01/19 - 02/07/20

2019 Award - 07/19/18 - 02/11/19

2018 Award - 07/21/17 - 02/13/18

2017 Award - 07/25/16 - 02/15/17

2016 Award - 09/16/15 - 02/16/16

2015 Award - 09/16/14 - 02/12/15

2014 Award - 09/16/13 - 02/12/14

2013 Award - 09/16/12 - 02/12/13

2012 Award - 09/16/11 - 02/12/12

Securities Agent: ID, OR, VI, WV, OK, SC, UT, NM, WI, HI, KS, ND, MD, WY, WA, VT, VA, TX, TN, SD, RI, PR, PA, OH, NY, NV, NJ, NH, NE, NC, MT, MS, MO, MN, MI, ME, MA, LA, KY, IN, IL, IA, GA, FL, DE, DC, CT, CO, CA, AZ, AR, AL, AK; BM/Supervisor; General Securities Representative; Investment Advisor Representative; Managed Futures

NMLS#: 1390903

Industry Award Winner

Industry Award Winner