The BBM Wealth Management Group at Morgan Stanley

Our Mission Statement

About Us

The BBM Group at Morgan Stanley focuses on working with business owners, retirement plans, corporate executives and families with a high net worth seeking the services of an experienced Family Wealth advisory team. We work on their behalf to help solve three critical wealth and investment issues they typically face.

- Managing both cash-flow and risk

- Tax efficiency

- Complex wealth circumstances that requires a team of financial, tax and legal advocates working in concert

As a result of the current economy, you may feel challenged with how to manage both cash-flows and investment risk within your portfolio. We use a system that allows us to identify your portfolio risk, pinpoint deficiencies in cash-flow needs and recommend solutions that seek to fill those gaps to maximize your cash-flow so more of your wealth works on a tax efficient basis and with less risk. In working with you, not only will we serve as your gateway to the intellectual strength and global resources of Morgan Stanley, we will work in concert with your tax and legal professionals to bring together a team of advocates on one goal… yours.

Team Award

Forbes 2024 Best-In-State Wealth Management Teams

Source:Forbes.com (Jan 2024) 2024 Forbes Best-In-State Wealth Management Teams ranking awarded in 2024. This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period from 3/31/22–3/31/23. For criteria & methodology, go to Forbes.com.

Forbes Top Financial Advisors Lists 2024 | Morgan Stanley

- Wealth ManagementFootnote1

- Art AdvisoryFootnote2

- Business PlanningFootnote3

- Corporate Pension FundsFootnote4

- Corporate Retirement PlansFootnote5

- Defined Contribution PlansFootnote6

- Endowments and FoundationsFootnote7

- Corporate Trust Services

- Estate Planning StrategiesFootnote8

- Executive Benefit ServicesFootnote9

- Executive Financial ServicesFootnote10

- Financial PlanningFootnote11

- Philanthropic Services

- Qualified Plans

- Qualified Retirement PlansFootnote12

- Retirement PlanningFootnote13

- Stock Option PlansFootnote14

Awards

Source: Forbes.com (Awarded Jan 2024) Data compiled by SHOOK Research LLC based on time period from 3/31/22 – 3/31/23.

Brian Burns -

Recognized in 2018, 2019, 2020 & 2021 as NAPA's Top DC Advisor Teams

Source: napa-net.org (Awarded 2018, 2019, 2020, & 2021) Data compiled by NAPA based on self-reported assets under advisement as of Dec 31 of the year prior to year the award was given.

Michael Marchiano -

2018 - 2021 NAPA's Top DC Advisor Teams

Source: napa-net.org (Awarded 2018 - 2021) Data compiled by NAPA based on self-reported assets under advisement as of Dec 31 of the year prior to year the award was given.

Awarded 2019 & 2020 Financial Times 401 Top Retirement Advisors

Source: ft.com. Data compiled by the Financial Times based the following time periods:

Awarded 2020 - 12/31/16 - 12/31/19

Awarded 2019 - 12/31/15 - 12/31/18

- Top 401 Retirement Plan Advisors

- NAPA's "Top DC Advisor Firms"

Location

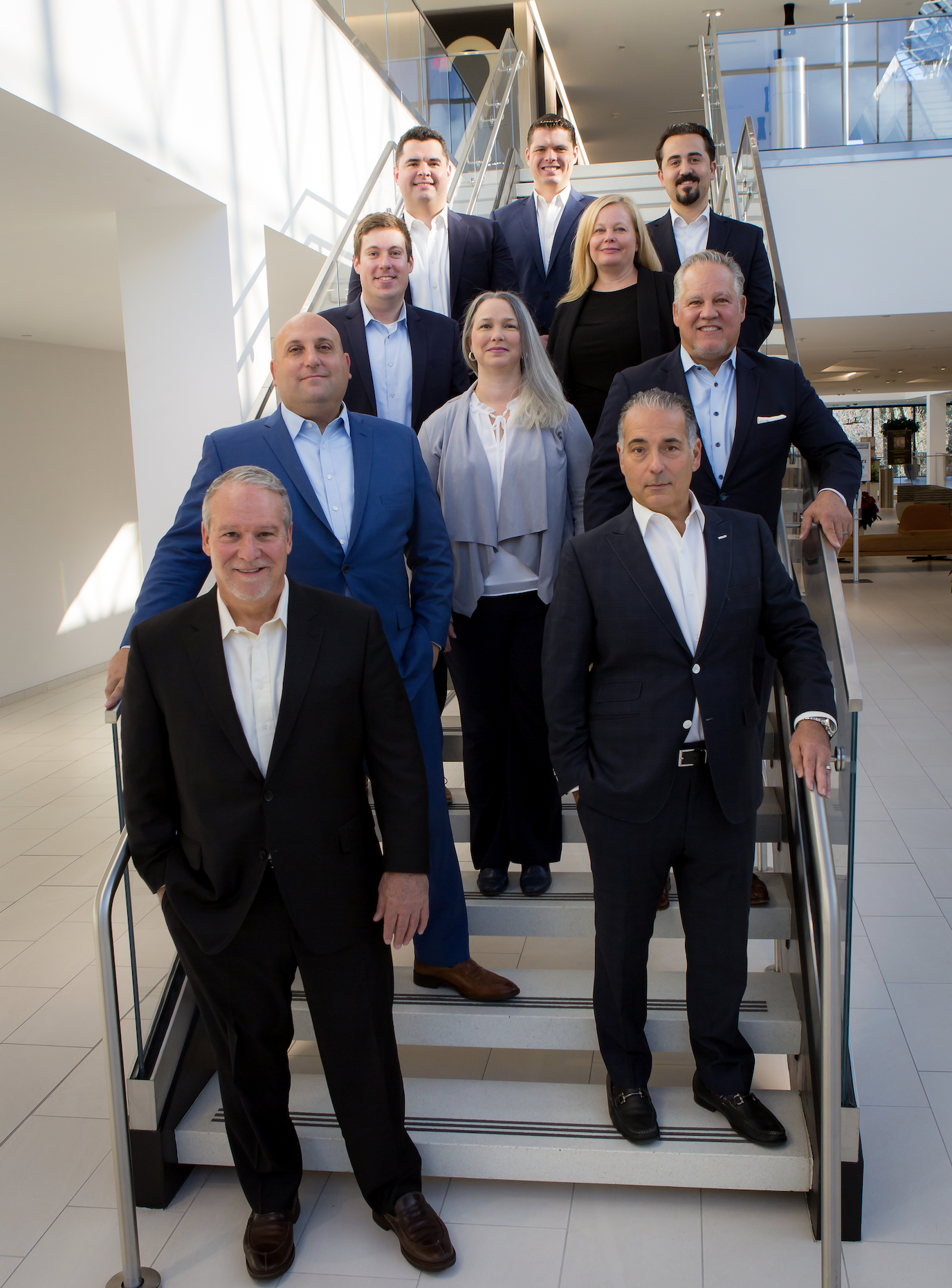

Meet The BBM Wealth Management Group

About Richard M. Beltram

2012-2024 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2012-2024) The award was determined based on an evaluation process conducted by Five-Star Professional based on objective criteria, during the following periods:

2012 Award - 04/15/2011- 10/16/2011

2013 Award - 04/15/2012 - 10/16/2012

2014 Award 04/15/2013 - 10/16/2013

2015 Award - 04/15/2014- 10/16/2014

2016 Award- 04/15/2015- 10/16/2015

2017 Award - 02/25/2016 - 10/7/2016

2018 Award - 02/21/2017 - 10/12/2017

2019 Award - 03/21/2018- 10/12/2018

2020 Award - 03/1/2019 - 10/16/2019

2021 Award - 03/30/2020 - 10/23/2020

2022 Award - 12/20/2021 - 06/17/2022

2023 Award - 03/21/2022 - 10/18/2022

2024 Award - 03/13/2023 - 09/29/2023

2019-2025 Forbes Best-In- State Wealth Advisors

Source: Forbes.com (Awarded 2019-2024). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

NMLS#: 1261978

About Michael Burns

Michael begins his Financial Planning process by speaking with his clients individually and creating a customized plan that is tailored to them and their families based on their specific priorities and long-term goals. He determines risk tolerance, how many years until retirement, and their desires - whether it is a second home, travel or legacy plans. He takes the time to learn about each client and constructs a specific personalized plan and then implements that plan while remaining in continual contact. Michael prides himself on the personal service he offers and his dedication to his clients.

Michael received a B.A. in Business Administration from Western New England College in Springfield, MA. He presently resides in NJ with his three children. Michael enjoys fishing, hiking and camping in his free time.

The BBM Wealth Management Group at Morgan Stanley was named to the Forbes 2024 Best-In-State Wealth Management Teams ranking. Visit our Team Website by clicking below to view the list.

Forbes 2024 Best-In-State Wealth Management Teams

Source:Forbes.com (Jan 2024) 2024 Forbes Best-In-State Wealth Management Teams ranking awarded in 2024. This ranking was determined based on an evaluation process conducted by SHOOK Research LLC (the research company) in partnership with Forbes (the publisher) for the period from 3/31/22–3/31/23. For criteria & methodology, go to Forbes.com.

NMLS#: 1297677

About Brian Burns

2018- 2023 NAPA's Top DC Advisor Teams

Source: napa-net.org (March 2018, 2019,2020,2021,2023, 2024) awarded in 2024. Data compiled by National Association of Plan Advisors based on

self-reported assets under advisement as of Dec 31 of the year prior to the

issuance of the award. For criteria & methodology, go to napa-net.org

NMLS#: 1282564

About Michael Marchiano

Recognized in 2018-2023 as NAPA's Top DC Advisor Teams

Source: napa-net.org (Awarded 2018- 2023) Data compiled by NAPA based on self-reported assets under advisement as of Dec 31 of the year prior to year the award was given.

2013-2019 Five Star Wealth Manager Award

Source: fivestarprofessional.com (Awarded 2021-2023) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods:

2013 Award - 04/15/2012 - 10/16/2012

2014 Award 04/15/2013 - 10/16/2013

2015 Award - 04/15/2014- 10/16/2014

2016 Award- 04/15/2015- 10/16/2015

2017 Award- 02/25/2016 - 10/7/2016

2018 Award- 02/21/2017 - 10/12/2017

2019 Award- 03/21/2018- 10/12/2018

2015-2017 Financial Times 401 Top Retirement Advisors

Source: ft.com. Data compiled by the Financial Times based the following time periods:

Awarded 2017; 12/31/14 - 12/31/16

Awarded 2016; 12/31/13 - 12/31/15

Awarded 2015; 9/30/13 -9/30/14

NMLS#: 1278588

About Sean Stevens

NMLS#: 1744860

About Michael Gannon

Working closely with you, Mike will develop an investment strategy that reflects your lifestyle expectations, cash flow needs, risk tolerance, and aspirations for your family. From there, he and his team will help you build a portfolio using the resources of Morgan Stanley, one of the world’s largest financial services firms. Over time, they will navigate you through the distractions of turbulent markets and focus your attention on achieving your goals.

In Mike’s spare time, he enjoys golfing and spending time with his wife and family boating at the Jersey shore.

NMLS#: 1270207

About Giuseppe Sellitto

After moving back to New Jersey in 2013, he joined FA Michael Burns as a Senior Registered Client Service Associate. Currently a Wealth Management Associate, his primary responsibilities include providing high-net worth clients with exceptional service and delivering complete operational support to his team. His excellent organizational, communication skills, and attention to detail, enable Giuseppe to help deliver the vast resources of Morgan Stanley to his clients.

Giuseppe graduated with a degree in Finance from Fairleigh Dickenson University. He holds series 7, 63, 65, 3, 9, and 10 licenses, He has also obtained his CRPC™ and CRPS® certificates.

Outside of work Giuseppe enjoys playing recreational soccer and spending time with his family. He currently resides in Rockaway, New Jersey where he lives with his spouse and 2 children.

About Dawn Stedronsky

About Nisha Ribardo

Nisha, an Illinois native, received a B.S. in Management from the A. B. Freeman School of Business at Tulane University. After two years teaching in Elizabeth, NJ through Teach for America, she began her financial services career in 1996 at Merrill Lynch. She has her Series 7 and 66 licenses and earned her CFP® designation in 2004.

Outside of work, Nisha's life centers around her husband, Bryan, and their sons, Paul and Edward. She enjoys reading, travelling, volunteering locally, and attending New Jersey Devils games.

*This role cannot solicit or provide investment advice

Contact Richard M. Beltram

Contact Michael Burns

Contact Brian Burns

Contact Michael Marchiano

Contact Sean Stevens

Contact Michael Gannon

Awards and Recognition

Portfolio Insights

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Wealth Management for Athletes and Entertainers

- Investment Management

- Wealth Transfer & Philanthropy

- Private Banking Solutions

- Family Governance & Wealth Education

- Lifestyle Advisory

Retirement for Plan Sponsors

We can provide the tools and guidance to help you manage a retirement plan.

- Plan Evaluation

- Investment Management

- Plan Management Support

- Plan Participant Education

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Products and services are provided by third party service providers, not Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley may not receive a referral fee or have any input concerning such products or services. There may be additional service providers for comparative purposes. Please perform a thorough due diligence and make your own independent decision.

Morgan Stanley does not assist with buying or selling art in any way and merely provides information to clients interested learning more about the different types of art markets at a high level. Any client interested in buying or selling art should consult with their own independent art advisor.

3Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

4Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

5When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

6When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

8Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

11Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

12When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

13When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

14Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley