The Banyan Group at Morgan Stanley

Industry Award Winner

Industry Award WinnerOur Mission Statement

Our Story and Services

At the Banyan Group we take inspiration from the strong and resilient banyan tree, which represents growth, stability, and longevity. With over 100 years of combined experience in the financial services industry, our team is provides individuals and families with comprehensive and personalized financial planning, investment management, wealth advisory, banking, insurance, alternative investments, and trust services.

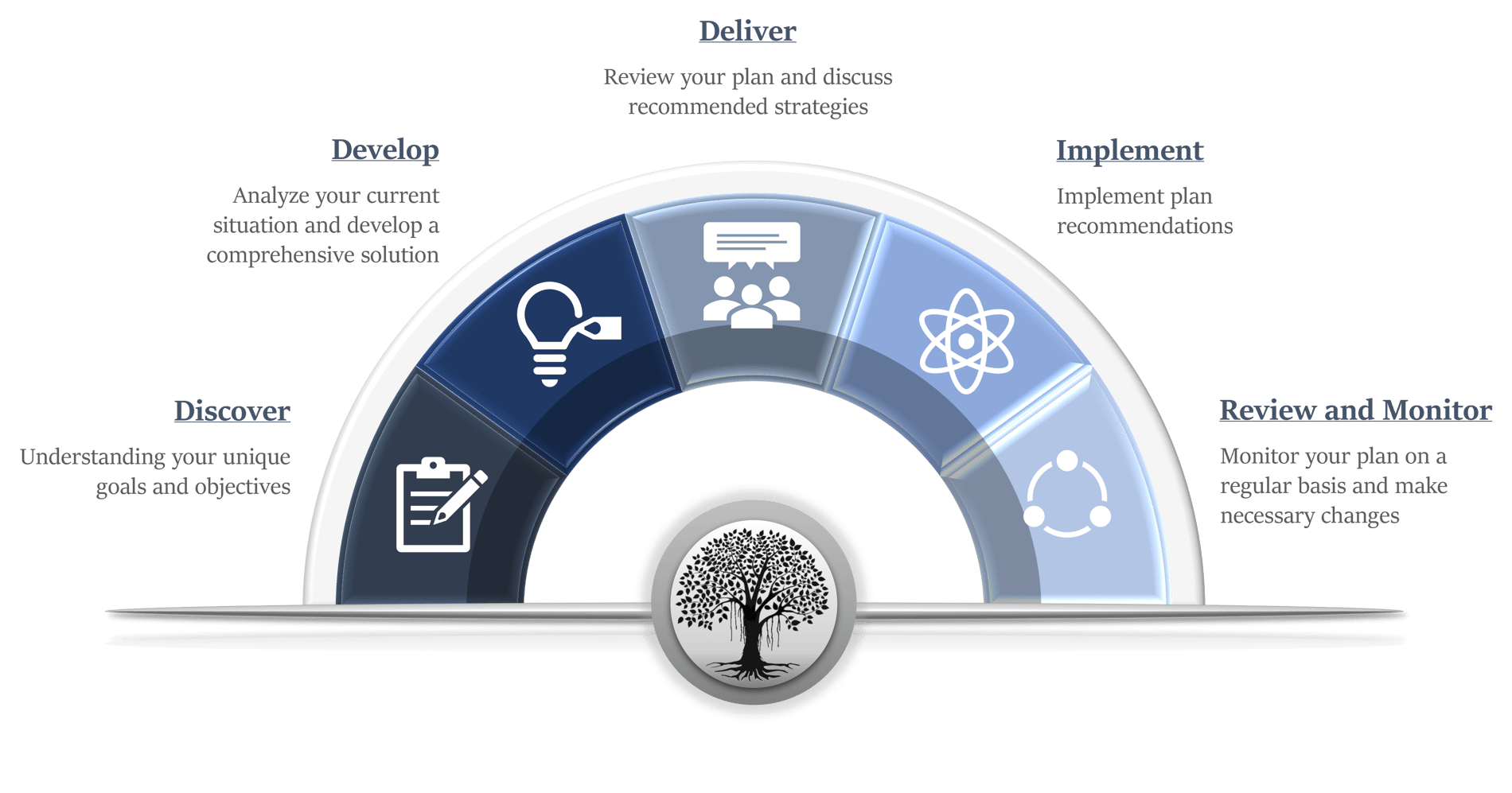

Our process starts with you. We actively listen and help formulate a financial plan and solutions that are customized to each client. We take a holistic approach to financial planning, considering all aspects of our clients' financial lives. We work closely with our clients to develop a comprehensive plan that is tailored to their specific needs and goals. Our mission is to help our clients achieve their financial goals and build lasting wealth, supported by our expertise and experience.

- Wealth ManagementFootnote1

- Estate Planning StrategiesFootnote2

- Portfolio Management

- Financial PlanningFootnote3

- Retirement PlanningFootnote4

- Business PlanningFootnote5

- Alternative InvestmentsFootnote6

- Stock Plan ServicesFootnote7

- Trust ServicesFootnote8

- 401(k) Rollovers

- Life InsuranceFootnote9

- Corporate Pension Plans

- Stock Option PlansFootnote10

- Cash ManagementFootnote11

The Banyan Group at Morgan Stanley is a distinguished team of financial advisors dedicated to providing comprehensive financial planning, wealth preservation, and wealth transfer services. With a combined experience of over 100 years, this elite group brings a wealth of knowledge and expertise to their clients.

Financial Planning Excellence:

At the core of The Banyan Group's philosophy is a commitment to meticulous financial planning. The team works closely with clients to understand their unique financial goals, risk tolerance, and aspirations. By conducting in-depth analyses, they tailor personalized financial plans that encompass investment strategies, retirement planning, and tax-efficient wealth management.

- Wealth Preservation Strategies: Safeguarding Prosperity Amidst Market Dynamics

Recognizing the importance of safeguarding wealth, The Banyan Group employs sophisticated wealth preservation strategies. Through diversification, risk management, and a keen understanding of market trends, they aim to protect and grow their clients' assets. The team remains vigilant in adapting strategies to navigate the ever-changing financial landscape, ensuring that clients' wealth is resilient against market fluctuations. - Diversification as a Shield:

The Banyan Group employs a multi-faceted approach to wealth preservation, with diversification at its core. By strategically allocating assets across various investment vehicles, the team minimizes risk exposure and shields clients' portfolios from the impact of fluctuations in any single market sector. This prudent strategy not only safeguards against potential losses but also positions clients to capitalize on opportunities in diverse market conditions. - Risk Management Expertise:

Navigating the intricate landscape of financial markets demands a keen understanding of risk. The financial advisors at The Banyan Group are adept at assessing risk tolerance levels for each client. Through meticulous risk management, they tailor investment strategies that align with clients' individual preferences and financial goals. This personalized approach ensures that clients can achieve a balance between risk and reward that suits their unique circumstances. - Adaptability in Dynamic Markets:

Markets are dynamic and subject to rapid changes. The Banyan Group excels in adapting wealth preservation strategies to evolving economic landscapes. Regular market analyses, continuous monitoring of global trends, and a proactive stance enable the team to make timely adjustments to client portfolios. This adaptability ensures that clients' wealth not only endures market fluctuations but also thrives in changing conditions. - Educating Clients on Preservation Strategies:

Beyond implementing wealth preservation strategies, The Banyan Group is committed to educating clients on the principles behind these approaches. Transparent communication is key, and the team empowers clients with the knowledge to understand the rationale behind specific investment decisions. This educational aspect fosters a sense of confidence and trust, as clients are actively involved in the preservation of their financial well-being.

Wealth Transfer Expertise:

The Banyan Group understands that wealth transfer is a critical aspect of financial planning. With a focus on legacy planning, they assist clients in structuring estate plans and inheritance strategies. The team aims to optimize wealth transfer efficiency, minimizing tax implications and facilitating a seamless transition of assets to the next generation.

- Wealth Transfer Expertise: Paving the Way for a Lasting Legacy

In the realm of comprehensive financial services, The Banyan Group at Morgan Stanley stands out for its nuanced approach to wealth transfer. Recognizing that the journey to financial well-being extends beyond an individual's lifetime, the team places a significant emphasis on legacy planning and efficient wealth transfer strategies. - Structuring Estate Plans for Generational Success:

The Banyan Group understands that effective wealth transfer starts with meticulous estate planning. The financial advisors work closely with clients to structure estate plans that align with their values and long-term objectives. This involves a careful examination of family dynamics, asset distribution preferences, and tax implications. By tailoring estate plans to each client's unique circumstances, The Banyan Group ensures a seamless and tax-efficient transfer of assets to the next generation. - Inheritance Strategies for Optimal Impact:

Wealth transfer isn't merely about the physical transfer of assets; it's about ensuring that the intended impact is preserved. The Banyan Group develops inheritance strategies that go beyond the transactional aspects. They assist clients in imparting financial wisdom, values, and a sense of responsibility to heirs. By fostering a holistic understanding of wealth transfer, the team contributes to the creation of a lasting legacy that transcends monetary assets. - Optimizing Wealth Transfer Efficiency:

Minimizing tax implications is a central focus of The Banyan Group's wealth transfer expertise. Leveraging their deep understanding of tax laws and regulations, the financial advisors strategically structure wealth transfer plans to optimize tax efficiency. This not only preserves a larger portion of the estate but also ensures that heirs receive their inheritances with minimal encumbrances. - Facilitating Seamless Asset Transition:

The Banyan Group excels in orchestrating the seamless transition of assets from one generation to the next. This involves comprehensive coordination with legal and financial professionals to navigate legal complexities and streamline the transfer process. By providing clients with a roadmap for the efficient transfer of wealth, the team contributes to a smooth transition that honors the intentions of the benefactor.

Collaborative Approach:

One of the key strengths of The Banyan Group is its collaborative approach. The four financial advisors work synergistically, leveraging each other's strengths to deliver holistic solutions. This collaborative spirit extends to their relationships with clients, fostering open communication and trust. Clients benefit from a team that is not only knowledgeable but also responsive to their evolving needs.

Client-Centric Philosophy:

Putting clients at the center of their practice, The Banyan Group prioritizes transparency and integrity. They strive to educate clients on financial matters, empowering them to make informed decisions. Regular communication and reviews ensure that financial plans stay aligned with clients' goals and adapt to changes in their lives.

Commitment to Professional Development:

In an ever-evolving financial landscape, The Banyan Group stays ahead through a commitment to continuous professional development. The team regularly engages in training, stays abreast of industry trends, and refines their strategies to offer cutting-edge financial solutions.

In conclusion, The Banyan Group at Morgan Stanley stands as a beacon of excellence in the financial advisory landscape. With a steadfast commitment to financial planning, wealth preservation, and wealth transfer, this team of seasoned advisors brings unparalleled expertise to their clients. As they continue to evolve with the dynamic nature of finance, The Banyan Group remains dedicated to helping clients achieve and sustain financial success.

Location

Meet The Banyan Group

About Joseph Paiva

Joe’s focus is advising on the development, education, and the implementation of investment strategies to help clients meet their immediate and future goals. He follows a disciplined process of assessing a client’s financial situation, determining risk tolerance, forming and executing an appropriate investment plan, as well as regular portfolio rebalancing in order to obtain measurable results. He also consults on risk management, retirement planning, estate planning, and other critical financial strategies.

Originally from Philadelphia, Pa, Joe made the transition to Florida in 1999. He attended Florida State University where he competed in Track and Field. He and his wife, Kristin, have 2 boys Joey and James. Outside of work he enjoys spending time with his family, golfing, and traveling.

NMLS#: 2421799

About Joseph Compitello

Joe and his team deliver customized solutions to individuals, families, business owners and corporate executives. He addresses the full spectrum of wealth management needs, including investment management, retirement and business succession planning, liability management, trust and estate planning, tax management and philanthropic strategies. He holds a B.S. from Roberts Wesleyan University and attended the Yale School of Management where he completed the Wealth Management Theory and Practice executive education program.

Joe is a current member of the Collier County Community Board for Big Brothers, Big Sisters of the Sun Coast and is a previous member of the Judy Sullivan Center Committee for Catholic Charities in Naples, Fl. Joe and his family relocated from Rochester, NY to Naples, FL in 2013. In his free time, he enjoys playing golf and spending time and travelling with his wife Kathy and their two sons.

NMLS#: 532106

About Mireille Zappulla

Recognizing that each client’s wealth journey is uniquely personal, Mireille takes the time to deeply understand their most cherished goals, philanthropic passions, and long-term legacy aspirations. Her experience is particularly valuable during periods of significant transition, where she guides clients through pivotal events, helping them transform the results of their hard work into lasting legacies. By leveraging Morgan Stanley’s vast financial resources, intellectual capital, and global network, Mireille tailors strategies to fit each client’s specific needs. She also assembles experienced teams to deliver skilled advice and well-informed recommendations.

With over 30 years of experience in banking, Mireille began her career in New York City at Gulf International Bank, where she adeptly managed a diverse portfolio through prudent credit risk management. More than 20 years ago, she moved to the Naples market, spending many years as a Corporate Banker at Wells Fargo, serving institutional clients. In 2018, Mireille joined J.P. Morgan before transitioning to Morgan Stanley, where she continues to make a profound impact in wealth management.

Originally from Paris, Mireille holds a B.A. in International Business Administration from the American University of Paris and an M.B.A. in Finance from Ecole des Ponts Paris Tech. She also completed an advanced graduate program in Negotiation and Dispute Resolution at Harvard Law School and earned a Diplôme d'Etudes Françaises from the Université Paris-Sorbonne. Additionally, she maintains her Series 7, Series 63, Series 65, and SIE licenses, demonstrating her ongoing commitment to maintaining the highest professional standards in the financial industry.

Outside of her professional career, Mireille is a devoted mother to two children, raising them in the vibrant community of Southern Florida. She believes that children are the cornerstone of society and actively participates in initiatives aimed at their development and success. Mireille serves as a judge and mentor with First Inspires, an organization that encourages innovation and leadership in young people. She is also an active member of the local community board for Big Brothers Big Sisters and sits on the Leadership Board of the American Cancer Society, reflecting her strong commitment to philanthropy and community service.

NMLS#: 2626229

About Prinya Sommala

Prinya’s focus is advising on the education, development and the implementation of investment strategies to help clients meet their short and long term goals. He utilizes a disciplined process in assessing a client’s financial situation to determining risk tolerance, forming and executing an appropriate investment plan, as well as regular portfolio rebalancing in order to obtain measurable results. He also consults on risk management, retirement planning, tax harvesting, estate planning, and other critical financial strategies.

Prinya relocated to Naples, FL from Massachusetts in 2015. He attended the University of Arkansas where he completed a Bachelors degree and later attended the Massachusetts School of Law attaining a Doctorate of Jurisprudence in 2010. Prinya was sworn into the Massachusetts Bar in December of 2010. Outside of work Prinya and his wife Ariane enjoy spending time with their families, going to the local beaches, traveling abroad and are passionate sports fans. Prinya is an active member of the Bonita-Naples Rotary club and enjoys giving back to his community.

NMLS#: 2430136

About Eric Benson

He was born and raised in Chicago, IL and graduated from DePaul University.

Eric began his career with Harris Bank and Trust and has worked as a bond trader on the floor of the Chicago Board of Trade,

Trust and Portfolio Management at Northern Trust and previously as an Advisor with J.P. Morgan.

Eric lives in Naples, FL with his daughter who is in her senior year of High School at Barron Collier.

He enjoys golf and tennis in his spare time and traveling with family/friends.

NMLS#: 2434247

About Kathy Compitello

Kathy brings more than 20 years of experience in financial services, sales and event planning to the team and to our clients. She was previously a Paraplanner for an independent financial advisory firm in Naples, Florida. Before relocating from Rochester, New York to Naples in 2013, Kathy managed the operations and client service for a financial services practice.

Kathy attended college in Upstate New York and graduated with a degree in Anthropology, with a concentration in Archeology. She spent several summers doing field work in Central America and in Upstate New York. Kathy is married to Joe Compitello, a financial advisor with the Banyan Group, and has two sons, Joseph and Jack. Outside of the office Kathy enjoys spending time with her family, playing tennis and traveling.

Contact Joseph Paiva

Contact Joseph Compitello

Contact Mireille Zappulla

Contact Prinya Sommala

Contact Eric Benson

Hear From Our Clients

Testimonial(s) are solicited by Morgan Stanley Wealth Management Canada and provided by current client(s) at the time of publication. No compensation of any kind was provided in exchange for the client testimonial(s) presented. Client testimonials may not be representative of the experience of other clients and are not a guarantee of future performance or success.

3846129 9/24

Awards and Recognition

The Power of Partnerships

About Stacey Herring

Private Bankers partner with Financial Advisors to develop a specialized approach for managing clients’ cash flow, liquidity and financing needs, leveraging our comprehensive suite of cash management and lending solutions.

Stacey began her career in financial services in 1994, and joined Morgan Stanley in 2014. Prior to joining the firm, she was a Mortgage Sales Manager at SunTrust Bank and a Senior Mortgage Loan Officer for over 17 years at Fifth Third Bank. Stacey is a graduate of Florida State University, where she received a Bachelor of Science in Business Marketing and a Minor in Communications.

Stacey currently serves on the Women’s Foundation of Collier County Board of Directors, as well as Junior Achievement of SWFL’s Advisory Board. In addition, Stacey has chaired many community endeavors, serving Naples Community Hospital, PACE Center for Girls of Collier County, and Youth Haven. She is a graduate of the Naples Chamber of Commerce’s Leadership Collier program, awarded Gulfshore Business Magazine’s “40 Under 40 Award”, and in 2013 was awarded the Glass Slipper Award by The Education Foundation, Champions for Learning. In 2014, Stacey was named a Woman of Initiative by the Community Foundation of Collier County for her philanthropy, dedication, and commitment to children’s causes.

About Hannah Sledd

Hannah began her career in financial services in 2012 and we are happy that she is rejoining Morgan Stanley. Hannah began her work as an independent advisor in Atlanta, working with top financial firms including E*TRADE and JP Morgan before joining Morgan Stanley. She has a vast array of experiences, including working on an elite trading desk, assisting advisors in the development and implementation of financial plans for their high-net-worth clientele, leading an international mergers and acquisitions team and working as a financial advisor.

Hannah is a graduate of the University of Alabama where she earned a bachelor’s degree in finance with a concentration in investment management, and currently holds the CERTIFIED FINANCIAL PLANNER™ designation. Hannah currently lives in Nashville, TN. When not in the office, Hannah enjoys pilates, travelling, and teaching yoga.

DISCLOSURE:

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

About Mark Jansen

Most recently, Mark worked with New York Life in their Advanced Planning Group working with agents and their UHNW clients advising them on estate and legacy planning, business buy sell planning, and succession planning. Prior to New York Life, Mark held similar Advanced Planning Consulting roles in several National financial organizations. He originally started his career in the financial services industry in the tax department of the public accounting firm Grant Thornton. He is known for taking complex ideas and making them easy to understand. Frequently speaking to groups and individuals on estate and business planning, he brings a conversational style that helps to clarify the complex nature of these topics.

Mark received a Bachelor of Science degree from St. John’s University in Collegeville MN, received his JD degree Cum Laude from the University of Minnesota and his CPA license while working at Grant Thornton. He holds a Series 7, 24 and 63 securities licenses. He currently lives in Richmond Virginia with his wife and occasionally one of their 6 children.

Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Important information about your relationship with your Financial Advisor and Morgan Stanley Smith Barney LLC when using a Financial Planning tool. When your Financial Advisor prepares a Financial Plan, they will act in an investment advisory capacity for thirty (30) days after the delivery of your Financial Plan. To understand the differences between brokerage and advisory relationships, you should consult your Financial Advisor, or review our “Understanding Your Brokerage and Investment Advisory Relationships,” brochure available at https://www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

You have sole responsibility for making all investment decisions with respect to the implementation of a Financial Plan. You may implement the Financial Plan at Morgan Stanley or at another firm. If you engage or have engaged Morgan Stanley, it will act as your broker, unless you ask it, in writing, to act as your investment adviser on any particular account.

Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Five Reasons DIY Investors Choose Morgan Stanley Financial Advisors

Portfolio Insights

Retirement

- 401(k) Rollovers

- IRA Plans

- Retirement income strategies

- Retirement plan participants

- Annuities

Investing

- Asset Management

- Wealth Planning

- Traditional Investments

- Alternative Investments

- Impact Investing

Family

- Estate Planning Strategies

- 529 Plans / Education Savings Planning

- Long Term Care Insurance

- Special Needs Planning

- Trust Services

Business Planning

- Succession Planning

- Business Planning

- Qualified Retirement Plans

Philanthropy

- Endowments

- Foundations

- Donor Advised Funds

- Impact Investing

Financial Wellness

- Reduce employee stress,

- Improve retention and engagement, and

- Set themselves apart by offering comprehensive financial wellness benefits.

1Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

For more information, please see the Morgan Stanley Smith Barney LLC Client Relationship Summary.

2Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

3Morgan Stanley offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Financial Advisor to understand these differences or review our Understanding Your Brokerage and Investment Advisory Relationships brochure available at www.morganstanley.com/wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

4When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

5Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

6Alternative Investments are speculative and include a high degree of risk. An investor could lose all or a substantial amount of his/her investment. Alternative investments are appropriate only for qualified, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time.

7Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

8Morgan Stanley Smith Barney LLC does not accept appointments nor will it act as a trustee but it will provide access to trust services through an appropriate third-party corporate trustee.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

9Insurance products are offered in conjunction with Morgan Stanley Smith Barney LLC’s licensed insurance agency affiliates.

10Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

11Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Check the background of our Firm and Investment Professionals on FINRA's BrokerCheck*.

The information, products and services described here are intended only for individuals residing in states where this Financial Advisor is properly registered as described in this site.

Morgan Stanley reserves the right, to the extent permitted under applicable law, to retain and monitor all electronic communications. Morgan Stanley will not accept purchase or sale orders via any Internet site, social media site and/or its messaging systems. Morgan Stanley does not endorse and is not responsible and assumes no liability for content, products or services posted by third-parties on any Internet site, social media site and/or its messaging systems. All electronic communications are subject to terms available at the following link:

https://www.morganstanley.com/disclaimers/mswm-email.html. Any profiles and associated content are for U.S. residents only.

The securities/instruments, services, investments and investment strategies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment, investment strategy or service will depend on an investor's individual circumstances and objectives. Morgan Stanley Smith Barney LLC recommends that investors independently evaluate particular investments, strategies and services, and encourages investors to seek the advice of a Financial Advisor or Private Wealth Advisor. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Morgan Stanley of any information contained within the website. Morgan Stanley is not responsible for the information contained on the third-party website or the use of or inability to use such site. Nor do we guarantee their accuracy or completeness.

The views, opinions or advice contained within third party websites or materials are solely those of the author, who is not a Morgan Stanley employee, and do not necessarily reflect those of Morgan Stanley Smith Barney LLC, or its affiliates. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

*References to length of service at Morgan Stanley include years at Morgan Stanley and predecessor firms.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization's initial and ongoing certification requirements to use the certification marks.

The use of the CDFA designation does not permit the rendering of legal advice by Morgan Stanley or its Financial Advisors which may only be done by a licensed attorney. The CDFA designation is not intended to imply that either Morgan Stanley or its Financial Advisors are acting as experts in this field.

Awards Disclosures | Morgan Stanley

Verified Client

Verified Client