Emily Bach

Industry Award Winner

Industry Award WinnerHELPING YOU ACHIEVE YOUR FINANCIAL GOALS

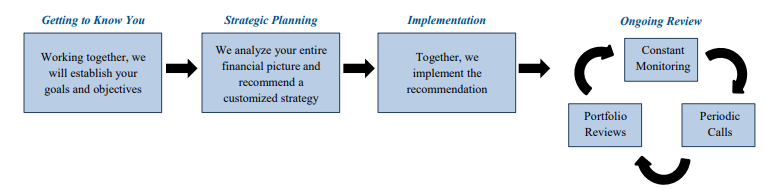

The Bach Group can help you create a personal financial plan and make educated decisions about your investment portfolios. Through a strong planning process and sound investment research, The Bach Group has helped many families clearly define and reach their specific goals and dreams. The Bach Group has grown to include three Investment Professionals and four Support Professionals and manages $1.9 billion for their clients as of December 31, 2025.

TOP TEAM AND ADVISORS

THE BACH GROUP

• Forbes Best-in-State Wealth Management Teams (2023-2026)

EMILY BACH

• Barron's Top 100 Women Advisors (2006-2022, 2025)

• Barron's Top 1200 Financial Advisors (2021-2023)

• Barron's Advisor Hall of Fame (2019)

• Barron's All-Star Women (2015)

• Forbes America's Best-in-State Advisors (2017-2025)

• Forbes Top Women Wealth Advisors (2017-2026)

• Forbes Top Women Wealth Advisors Best-in-State (2022-2026)

• Working Mother's Top Women Financial Advisor Moms (2017-2021)

SEAN PARKS

• Forbes Top 500 Next Generation Wealth Advisors (2017-2018)

• Forbes Best-in-State Next-Gen Advisors (2019)

• Five Star Professional Five Star Wealth Manager (2022-2025)

2006-2022, 2025 Barron's Top 100 Women Financial Advisors Source: Barrons.com (Awarded June 2006-2022 & 2025). Data compiled by Barron's based on 12-month period concluding in Mar of the year the award was issued.

2021-2023 Barron's Top 1,200 Financial Advisors: State-by-State (formerly referred to as Barron's Top 1,000 Financial Advisors: State-by-State) Source: Barrons.com (Awarded 2021-2023). Data compiled by Barron's based on 12-month period concluding in Sept of the year prior to the issuance of the award.

2017-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2017-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.

2017-2026 Forbes America's Top Women Wealth Advisors & Forbes Top Women Wealth Advisors Best-In- State (formerly referred to as Forbes Top Women Wealth Advisors, Forbes America's Top Women Wealth Advisors) Source: Forbes.com (Awarded 2017-2025). Data compiled by SHOOK Research LLC based on 12-month time period concluding in Sept of year prior to the issuance of the award.

2017-2021 Working Mother Magazine & SHOOK Research's Top Wealth Advisor Moms Source: Workingmother.com (Awarded October 2017-2021). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was given.

2017-2019 Forbes America's Top Next-Gen Wealth Advisors & Top Next-Gen Wealth Advisors Best-in-State (formerly referred to as Forbes America's Top Next-Gen Wealth Advisors, Forbes Top 1,000 Next-Gen Wealth Advisors, Forbes Top 500 Next Generation Wealth Advisors) Source: Forbes.com (Awarded 2017-2019). Data compiled by SHOOK Research LLC based on 12-month period concluding in Mar of the year the award was issued.

2015 Barron's All-Star Women 2015 List Source: The Barron's "All-Star Women" list, published in November 2015. Based on Barron's rankings received over the prior 10 years.

2023-2026 Forbes Best-In-State Wealth Management Teams Source: Forbes.com (Awarded Jan 2023, Jan 2024, Jan 2025, Jan 2026) Data compiled by SHOOK Research LLC based on 12-month time period concluding in March of year prior to the issuance of the award.

2019 Barron's Hall Of Fame List

Source: The Barron's "Hall of Fame" list, published throughout 2025. Based on Barron's rankings received over the prior 10 years.

2022-2025 Five Star Wealth Manager Award (Awarded 2022-2025) These awards were determined through an evaluation process conducted by Five Star Professional, based on objective criteria, during the following periods: 2022: 1/17/22 - 7/15/22, 2023: 1/9/23 - 7/31/23, 2024: 1/9/24 - 8/9/24, 2025: 1/8/25 - 8/1/25.

2017-2025 Forbes Best-In- State Wealth Advisors Source: Forbes.com (Awarded 2017-2025). Data compiled by SHOOK Research LLC based 12-month time period concluding in June of year prior to the issuance of the award.