About Matthew Probst

How I can help you:

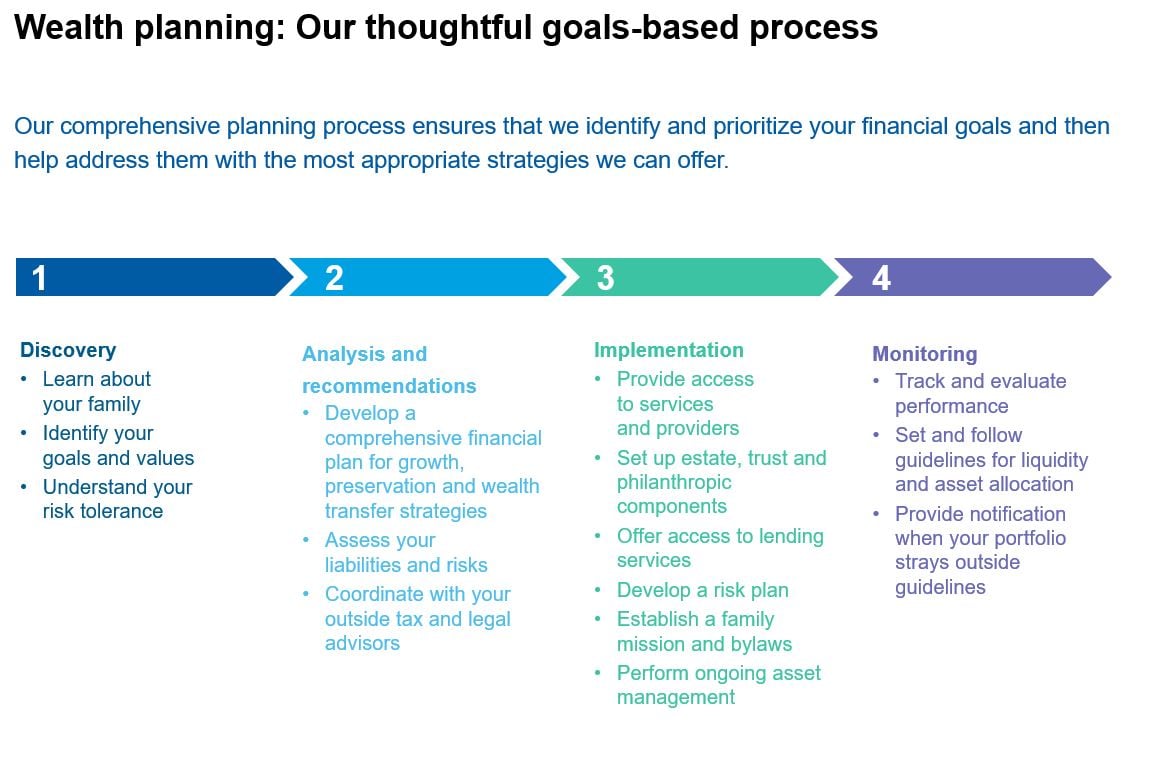

I help my clients create a customized financial plan that serves as a guide for their investment decisions. After defining their long-term objectives, liquidity needs, and time horizons, I leverage the firm’s investment tools and planning software to develop wealth management strategies designed to align with their goals. My consultative process also includes addressing my client’s other needs, such as education savings, retirement income planning, tax management strategies, estate and legacy planning, cash management and lending solutions, and more.

In addition, I provide guidance to nonprofit organizations on financial modeling and analytics while helping to educate around board best practices, and evolving industry trends. I appreciate having access to Morgan Stanley’s broad platform of industry-leading resources. This allows me to identify and implement solutions that I believe are best suited to each client’s unique situation.

What makes me knowledgeable:

I have always had a passion for anything related to finance. At the University of Northern Iowa, I majored in accounting and financial management and subsequently took a position with IBM, where I focused on internal expense forecasting. I was later selected to work in IBM’s treasury department at its corporate headquarters in New York, where I handled diverse responsibilities such as liquidity management and currency hedging. Although these experiences enhanced my professional and personal growth, I realized that Iowa was home, and when Meredith Corporation asked me to serve as Business Manager for Family Circle and Parents magazines, I leaped at the chance. After several years there, I transitioned to Morgan Stanley, where I worked as an analyst and was honored in 2024 with the Association of Professional Investment Consultants’ Pat Nicholson Award for outstanding service and accomplishments as a technical analyst. I then moved into the role of Financial Advisor, and I find it very rewarding to have the opportunity to meet regularly with clients and see the results of the planning work we do together. My years as an analyst have given me extensive knowledge of investment solutions, which I rely on today to help clients design their portfolios, and I have further grown my capabilities by becoming a Chartered Financial Analyst (CFA) charterholder.

Getting to know me:

I live in Clive with my wife, Anna, and our daughter, Olivia, and we enjoy golfing, biking and going to parks together as a family. Over the years, I’ve given back to my community by volunteering with Habitat for Humanity and the Northeast Iowa Food Bank. When I’m not working, I spend time serving on the Programming Committee for the CFA Society of Iowa.

Securities Agent: AR, IA, OK, NV, MT, DC, CO, MI, MD, WI, VT, VA, TX, PA, OR, MA, GA, NJ, IN, HI, NH, ND, ID, FL, SC, MN, LA, CA, AZ, NY, NE, KY, NC, MO, KS, IL, DE, AL, WA, AK, SD, OH; General Securities Representative; Investment Advisor Representative

NMLS#: 2681664

Industry Award Winner

Industry Award Winner